Pips Alert is a Forex trading signals provider that promises to generate 4500 pips in profit each month. It has a large trading community and employs a team of traders who, according to the vendor, are part of the top 4% elite traders in the world. They have also claimed that this service is suitable for the long-term growth of your account.

This organization was founded by two traders based in the USA and the UK. At this moment, the team consists of individuals from Canada and Tokyo as well. The vision of this company is to build a platform where traders can interact with each other as a community. As per the vendor’s claims, there are 923 students currently enrolled in the courses offered by the website.

Pips Alert at a glance

| Price | $49.99/month |

| Trading Platforms | MT4 |

| Currency Pairs | N/A |

| Strategy | N/A |

| Timeframe | N/A |

| Recommended Deposit | $5000 |

| Recommended Leverage | N/A |

| Money Management | No |

Pips Alert functionality

Before they are considered fit to generate signals, the analysts have to undergo a 9-months long evaluation process. Most of the time, the signals are for the NYC and London trading sessions. The signals are in MT4 format. This means you don’t need to learn new terminologies or complex techniques to trade with them.

The signals include information like the buy and sell prices, instant entry or pending order, stop losses, move to break-evens, take profit targets, and early exits. You can receive the signals via desktop and browser notifications, as well as email and SMS alerts.

You can use the signals on as many accounts and brokers as you wish. For a cent account, you can get started with a small deposit of $50. The vendor recommends using lot size management on the account. On average, customers have a $5000 account size. Bigger investors have accounts as large as $150,000 to $250,000.

Normally, the signals are held for 24-48 hours, but some long-term traders choose to hold them for over a week. The system sends around 3-7 signals daily for each signal group.

Pips Alert trading strategy tests

Unfortunately, we don’t know what strategies the expert analysts use for generating the signals. The vendor has not revealed the details of the trading strategies. Thus, we cannot determine which trading styles they are suitable for. Since this is a signals provider and not an automated trading system, we don’t need to analyze the backtesting data.

What about Pips Alert live trading results

There are verified trading accounts for this signals provider on websites like Myfxbook, FXBlue, and FXStat. As such, we can’t tell whether this service provides a decent ROI or not. Also, it is not possible for us to confirm the monthly average pips claimed by the vendor.

User reviews

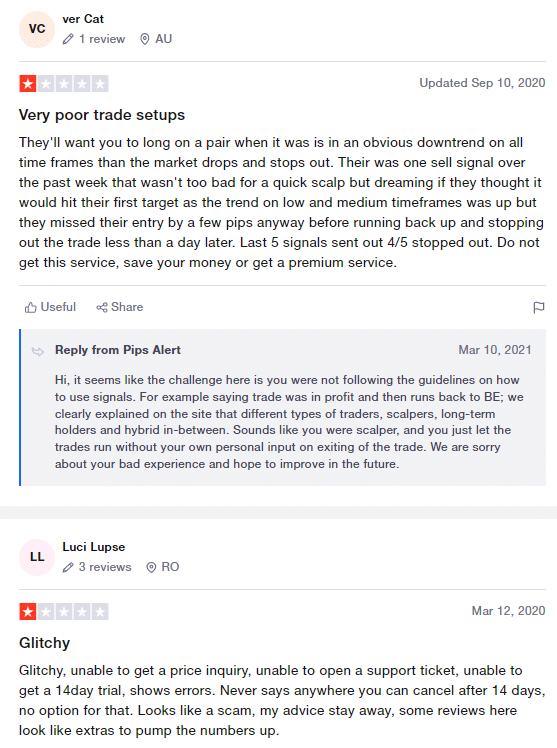

On the Trustpilot website, there are several reviews for this service. One user has complained about the poor trade setups. Another one has stated that they were unable to open a support ticket or get a trial plan.

Price

There are three Forex signals plans for this service. The Jaguar signals group gives you 10-15 signals per week and 1k-2.5k pips/month in exchange for $49.99/month. With the Venture X group, you get 15-20 long-term signals per week and monthly pips of 1.5k-3.5 k. Finally, there is the Investor X Signals plan claiming to provide 1.5l-3k pips per month and 15-20 signals per week. The last two plans both cost $59.95/month. In case you don’t receive a minimum of 500 pips in 30days, your package is extended until the target is reached.

Pips Alert Review Summary

Pips Alert-

Functionality2/5 BadThis platform has no special functionalities that set it apart from other services.

-

Trading Strategy2/5 BadThe vendor has shared no information on the trading strategies the analysts use for generating the signals.

-

Live Results2/5 BadThere are no live results for us to analyze since no verified trading account exists for Pips Alert.

-

Customer Support3/5 NeutralYou can open a support ticket on the official website, but there is no live chat or email support.

-

User reviews2/5 BadSeveral customers have complained about poor trade setups and erroneous entries.

The Good

- Affordable plans

The Bad

- No verified trading statistics

- Undisclosed trading approach

- Lack of vendor transparency