Growex is a copy trading service that promises expert monitored auto trading. The service claims to provide a daily profit of 0.48%. With different investment plans and pricing, this company assures consistent profits and a safety stop for capital protection. This FX trading service works by monitoring the market 24/5 using its proprietary software which it claims ensures precise and profitable entries. Combined management consisting of automated entries and manual input is used by this company.

The company was founded in April 2021 by Val, a trader based in the UK, and Ed, based in Cape Town. Information about the founders is provided on the official site. A WhatsApp number is provided for contact besides a support email and Telegram Group of this company.

Growex at a glance

| Price | $39/month |

| Trading Platforms | MT4 |

| Currency Pairs | Any |

| Strategy | Managed Grid |

| Timeframe | N/A |

| Recommended Deposit | $1000 |

| Recommended Leverage | 1:100 to 1:500 |

| Money Management | Yes |

Growex Functionality

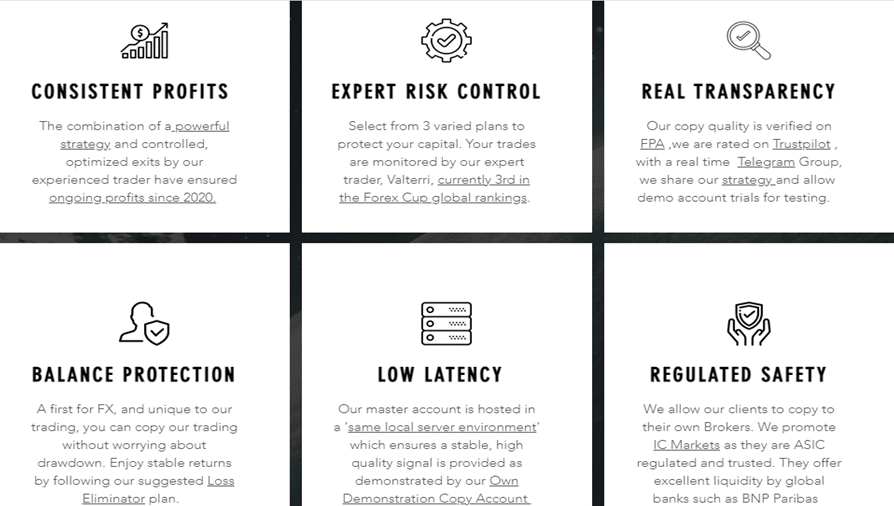

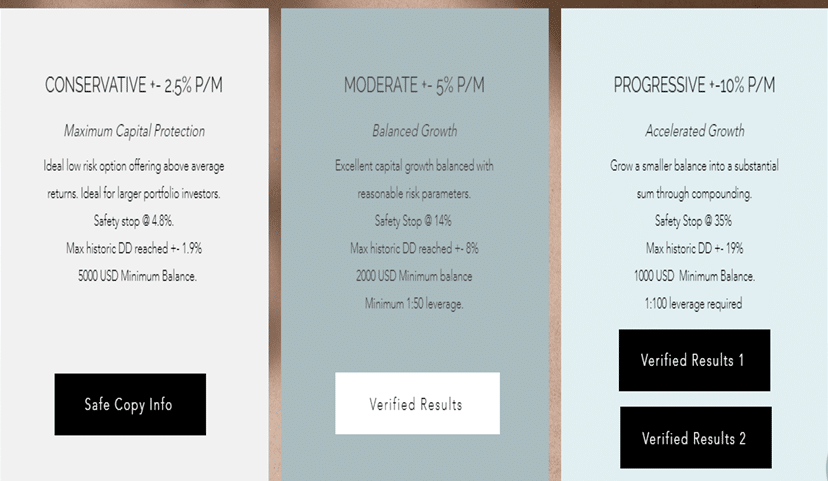

Features this service claims to have include,the use of a trading approach which is combined with optimized exits done by the expert traders at Growex to provide profits. Three different plans based on the risk and recommended deposit are present. The vendor maintains that the copy trades do not have a high drawdown and provide stable returns. Other claims of the vendor include low latency and regulated safety.

According to the company info, the trading atmosphere it provides includes a consistently profitable approach, three investment plans, and a safety stop for capital protection. Each of the plans is explained in detail under the Be Clever section of the site. Free VPS hosting is provided by the vendor.

Pricing plans start from $39 per month and there is no money-back offer present. However, the vendor offers a free trial period of one or two weeks.

Growex Trading Strategy Tests

A separate section is dedicated to the trading approach. Under this section, the developer explains the entries and the approach used. All entries are automated and monitored 24/5 using proprietary software. Entries occur only when there is a stronger than normal movement followed by a probability of a pullback.

On the strategy, the vendor claims that the trading does not involve the Martingale principle. Instead, the system uses a manually controlled grid approach. The lot sizes are increased mildly and Safety hard stops help to control the risk according to the vendor.

No backtests are present as the vendor claims that it is not possible to backtest their trading due to the combined manual and automated approach they use. This is disappointing as we are unable to assess the performance and efficacy of the approach using historical data.

What about Growex Live Trading Results

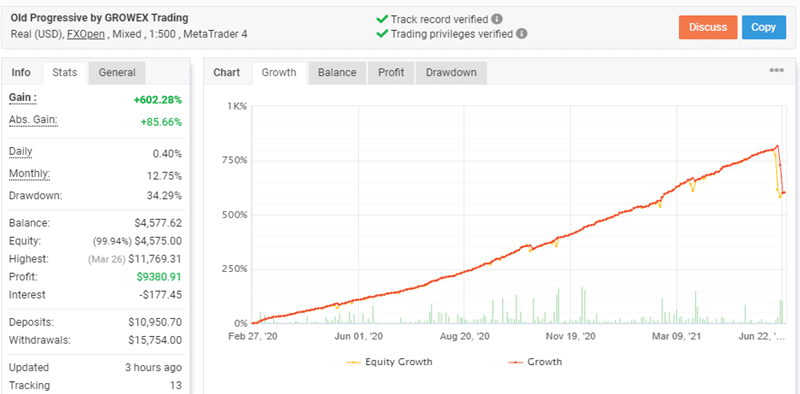

A real USD account using FXOpen broker and Mixed trading with the leverage of 1:500 on the Metatrader 4 platform is provided by the vendor. The account verified by the myfxbook site is shown in the screenshots below.

From the trading stats, we find that the account has a total profit of 602.28% and an absolute gain of 85.66%. There is a huge difference between the two values, which suggests that the strategy used is not effective and also is in the high-risk category. A drawdown value of 34.29% is present for this account that started trading in February 2020.

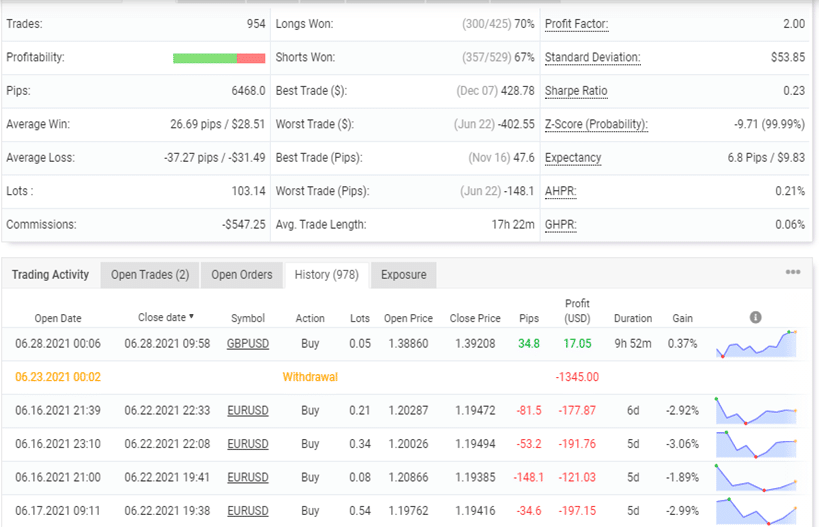

The total number of trades used is 954 with a profitability of 69% and a profit factor of 2.00. From the trading history, we can see lots of varying sizes used ranging from 0.05 up to 0.86. The varying and high lot sizes also confirm our suspicion that the strategy is not a low-risk one.

Customer Reviews

We found feedback for this company on the Trustpilot site. A total of 14 reviews are present with a rating of 4.4/5. Here are a few of the testimonials.

The reviews are positive and mention the transparent service and technical knowledge of the team. But there is no user feedback on the Forexpeacearmy site which makes us suspect that the positive reviews may be manipulated.

Growex Review Summary

Growex-

Functionality3/5 NeutralElaborate explanation of the trading without stress on the specific trading aspect

-

Trading Strategy2/5 BadManage grid is still a high-risk approach as witnessed in the trading results

-

Live Results2/5 BadHigh drawdown, big lot sizes, and a few other discrepancies that show poor performance

-

Customer Support3/5 NeutralPhone contact, live chat, and email options present but the live chat feature is not responsive

-

User Reviews1/5 AwfullyPositive reviews on Trustpilot, but no feedback on the Forex Peace Army site

The Good

- Combined automated and manual trading method

The Bad

- Lack of customer reviews

- Big lot sizes

- High drawdown

- No backtests are present