Foreximba desires to help you thrive in the Forex market through automated trading. The vendor asserts that it currently runs several live accounts on Myfxbook, which have shown stable results. We will see how true these claims are in this review.

The developers of the system are anonymous. Nothing on the official website can point us to the creators. That being the case, it becomes impossible to determine their qualifications, competencies, or even their reputation in this market.

Foreximba at a glance

| Price | $194.99 |

| Trading platforms | MT4 |

| Currency pairs | EURUSD, AUDUSD |

| Strategy | Grid |

| Timeframe | N/A |

| Recommended deposit | $60 |

| Recommended leverage | N/A |

| Money management | N/A |

Foreximba functionality

Foreximba is very easy to set up, and any person can use it. A drawdown control system is featured to minimize trading risks. The EA can work with any broker comfortably, so you can choose one that you feel will meet your trading needs. A detailed manual is provided, and in case you have any questions about the service, a friendly support team is available to respond to them.

Foreximba trading strategy tests

The trading strategy used by the EA is not disclosed in the sales pitch. The only available intel is that it works with fixed lot sizes with no martingale. Notwithstanding, we realized later as we assessed the trading data that the grid approach plays a key role in this system’s trading activities.

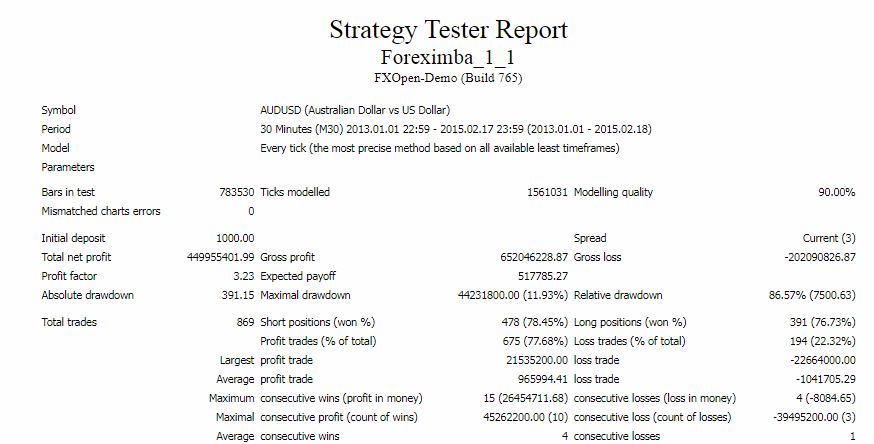

The EA traded from January 2013 to February 2015 on the M30 timeframe. The AUDUSD currency pair was the major currency pair used. Through a deposit of $1000, a whopping profit of $449955401.99 was realized after the robot carried out 869 trades. The profit factor was 3.23, while the success rates for short and long positions were 78.45% and 76.73%, respectively. A huge relative drawdown of 86.57% was recorded, which indicates that a dangerous approach was on board.

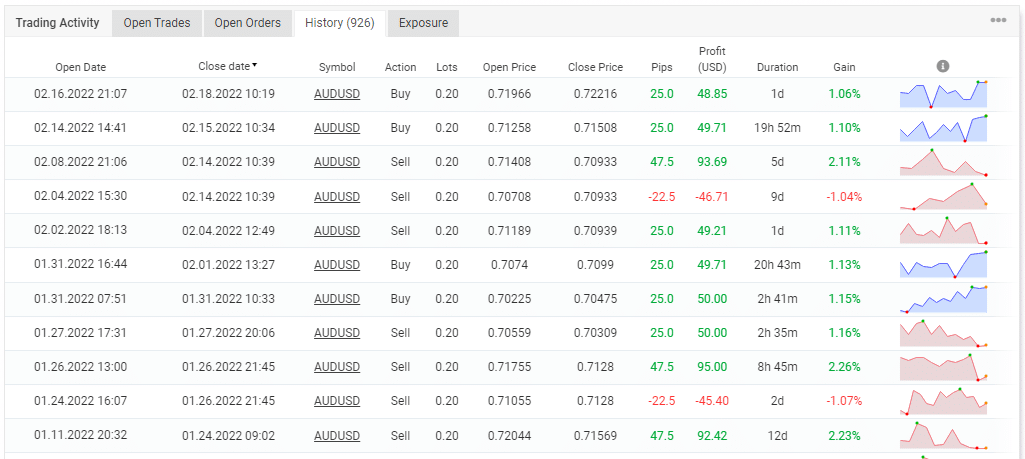

Foreximba real trading results

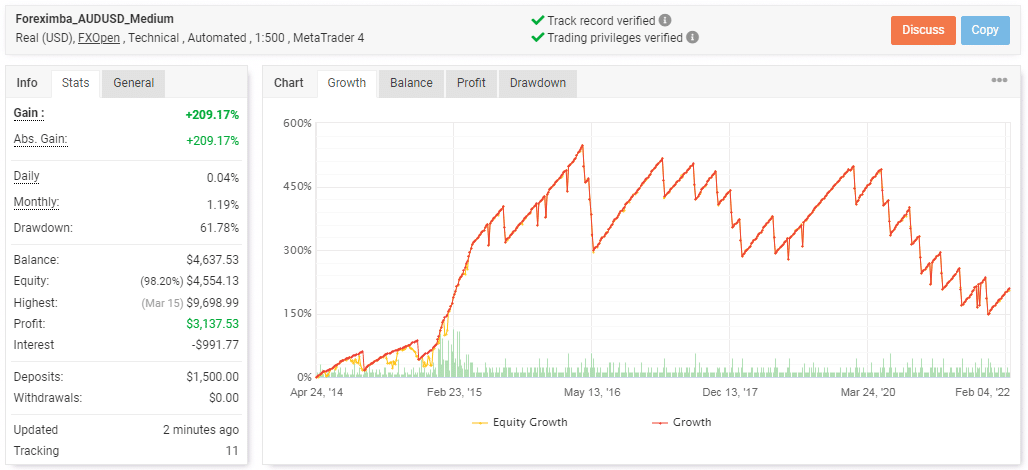

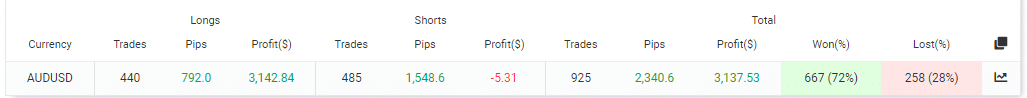

Foreximba has already doubled the investment ($1500) after operating on this account for almost 8 years. So far, we have a profit of $3137.53, but this profitability rate is too low. According to our estimates, the bot might be making about $400 yearly. The drawdown rate (61.78%) has increased exponentially. As such, it threatens to decimate the capital.

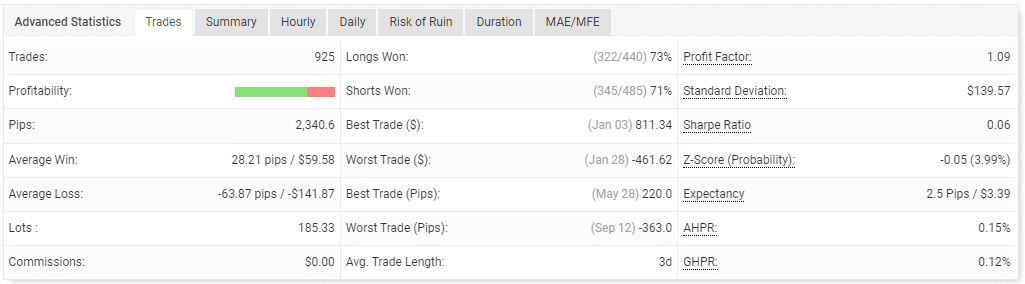

The robot has implemented 925 trades and has won 73% of the long positions and 71% of the short ones. There’s a profit factor of 1.09, which reveals that the system has an average return rate. The owner of this account has suffered more losses than wins, given that the average loss (-63.87 pips) is higher than the average win (28.21 pips).

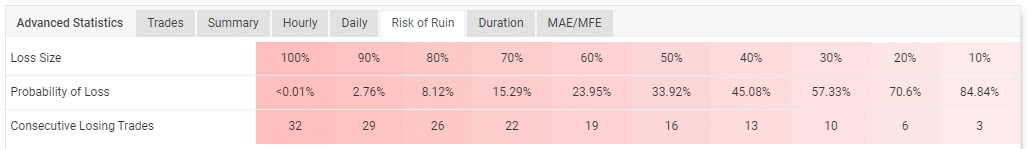

This account can easily be ruined.

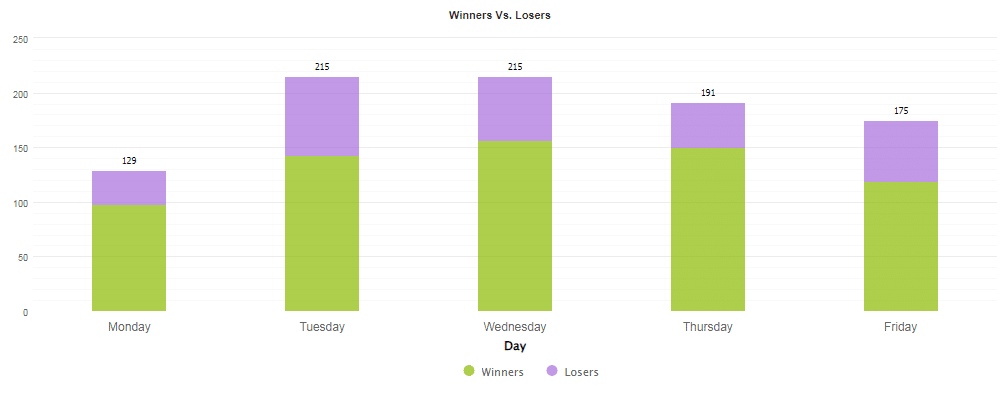

The activities of this bot are very high on Tuesday and Wednesday.

The EA mainly works with short positions, but the long trades are the most lucrative to date.

It is apparent that fixed lot sizes are used with no martingale, just as the authors have said. Some grids of orders were placed.

Customer reviews

We came across Foreximba’s page on Forex Peace Army, but to our disappointment, no reviews have been written about the product yet. So, we cannot tell if the system can work well on traders’ accounts or not.

Foreximba Review Summary

Foreximba-

Functionality3/5 NeutralThe vendor mentions and briefly describes the features of the robot.

-

Trading strategy2/5 BadAlthough the trading strategy is not indicated anywhere in the presentation, we have found out that a dangerous strategy (the grid) is on the board.

-

Live Results2/5 BadThe trading outcomes are not impressive, as evidenced by the low return rate and the large drawdown made.

-

Customer Support3/5 NeutralA friendly customer support is available for anyone who needs help using the service.

-

Customer Reviews2/5 BadNo customers have reviewed the EA yet, a sign that traders might not be using it.

The Good

- Customer support is available

- Reasonable pricing

- Verified live records are present

The Bad

- Grid on the board

- Unhealthy risk/reward ratio

- Low return rate

- No customer feedback