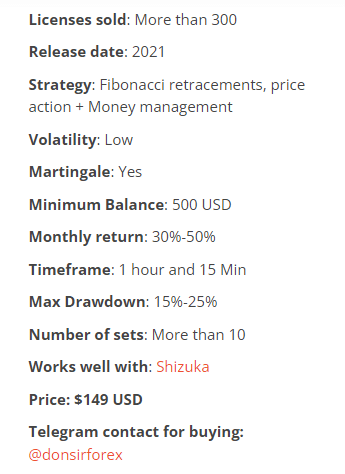

Big Poppa EA uses a highly optimized system for ensuring profitable returns. It is a low volatility FX EA that uses the Martingale method. Developed and promoted by the BenderFX group, this ATS has sold over 300 copies. The team members of the company are skilled in data analytics, development, machine learning, and genetic algorithms. Bender Series and Shizuka are other products of this company. The company boasts 582 clients, 4 EAs, and 1623 hours of code, testing, and improving the software. As per the vendor, the company has been trading for over 5 years and has used automated strategies for the past three years. No location address or phone number is provided for Bender FX.

Big Poppa EA at a glance

| Price | $149 |

| Trading Platforms | MT4 |

| Currency Pairs | N/A |

| Strategy | Fibonacci retracements, price action, and money management |

| Timeframe | H1, M15 |

| Recommended Deposit | $500 |

| Recommended Leverage | N/A |

| Money Management | Yes |

Big Poppa EA functionality

As per the vendor, the key features of this FX robot that make it competitive are:

- It is a low volatility system that uses the Martingale method.

- A minimum balance of $500 is required to use this ATS.

- The vendor assures a monthly profit of 30% to 50%.

- A maximum drawdown of 15% to 25% is present.

- The ATS has the option to enhance the backtesting performance to identify your set files.

- The set files used by the MT4 tool were created using genetic algorithm methods.

- Optimized parameters of the set files ensure high profits and low drawdown.

Big Poppa EA trading strategy tests

This FX EA uses the Fibonacci Golden Zone and the probabilistic zones for capturing retracements and studying their efficacy over time. It looks for crossovers and verifies that they have over 75% winning chances. Money management is also part of the approach that helps secure profit without risking your capital. Equity Stop, Trailing Stop, and Hedging limit are some of the features under the money management feature. No backtesting results are provided by the vendor.

What about Big Poppa EA real trading results?

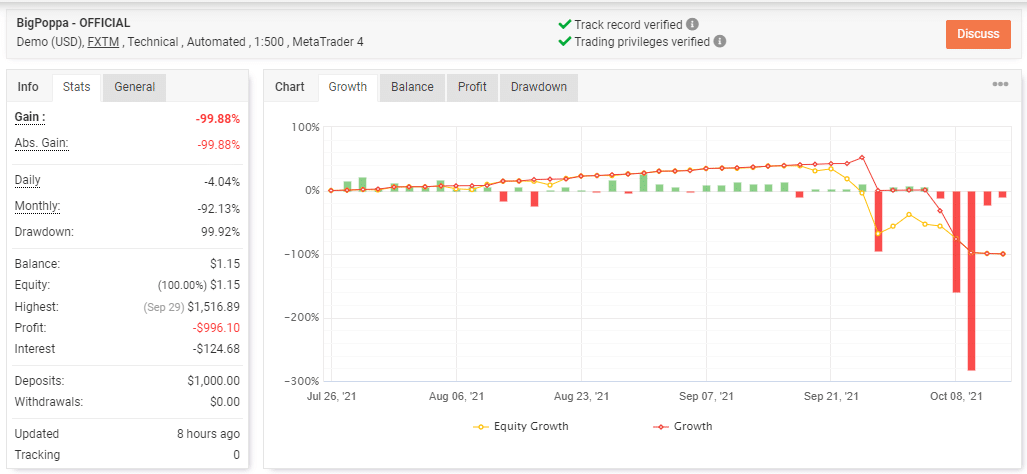

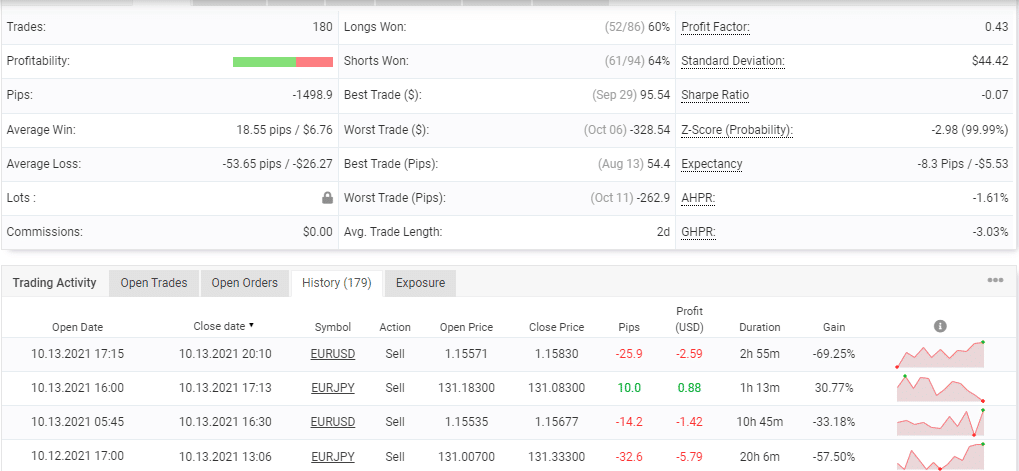

A demo USD account verified by the myfxbook site is present for this FX EA. A couple of screenshots of the demo trading results are shown here.

From the above info, we can see that the account uses the FXTM broker and the leverage of 1:500 on the MT4 platform. A loss of 99.88% and a similar value of absolute loss are present. The daily and monthly losses are 4.04% and 92.13%. For a deposit of $1000, the account that started in July 2021 shows a drawdown of 99.92%. A total of 180 trades have been completed with 63% profitability and a profit factor of 0.43. The vendor does not reveal the information on the lots used. The high drawdown and losses indicate a high-risk approach and poor performance.

Customer support

For support, the vendor provides a Telegram link. An FAQ section is present that answers the commonly asked queries of users. There are no other support methods like live chat, phone number, etc.

User reviews

Unfortunately, we cannot find any user testimonials for this FX robot on reputed third-party sites like FPA, Trustpilot, etc.

Big Poppa EA Review Summary

Big Poppa EA-

Functionality2/5 BadVery minimal info on the working method of the ATS.

-

Trading strategy3/5 NeutralMultiple strategies are used including Fibonacci retracements.

-

Live results2/5 BadOnly demo results are present which show dismal performance and a high drawdown.

-

Customer support2/5 BadA Telegram channel link and an FAQ are the support methods present.

-

User reviews1/5 AwfullyNo user feedback present for this ATS on reputed sites like FPA, Trustpilot, etc.

The Good

- Fully automated software

- Price is not expensive

The Bad

- Uses the Martingale method which is a risky strategy

- Demo results show big drawdown and loss of capital

- No user feedback