True Range promises to deliver a 5-10% monthly profit for users working with the EURUSD currency pair and 20-40% monthly gains for those trading on the GBPUSD symbol. Both MT4 and MT5 versions of the system were published on MQL5 in September 2020.

Aleksei Ostrobodorov is the developer of this EA. He is based in Russia and is the founder of a company called Smart Forex Lab. Mr. Aleksei’s portfolio includes a list of other trading systems, such as Euphoria, Good Morning, Candelabrum, Absolute FX, Traffic Pro, FX Rover, and more.

True Range Pro at a glance

| Price | $495, $45/month |

| Trading platforms | MT4, MT5 |

| Currency pairs | EURUSD, GBPUSD |

| Strategy | Night scalping and grid |

| Timeframe | M1, M5 |

| Recommended deposit | N/A |

| Recommended leverage | 1:100+ |

| Money management | Yes |

True Range Pro functionality

We have highlighted below the other features of the robot:

- It conducts all trades automatically.

- The sustem protects users from high spreads.

- It ataches a hard stop loss for and a dynamic basket take profit on each position.

- The recommended brokers include ForexChiefDirectFx, Weltrade, and ICMarkets.

- The EA works on GMT+3/GMT+2 during summer and winter.

True Range Pro trading strategy tests

The developer describes his robot as an accurate night scalping and smart grid system. This gives us a clue about the kind of strategies it uses. So, it opens and closes trades frequently, all through the night. The EA also places buy and sell stop orders with preset intervals above or below the current market price.

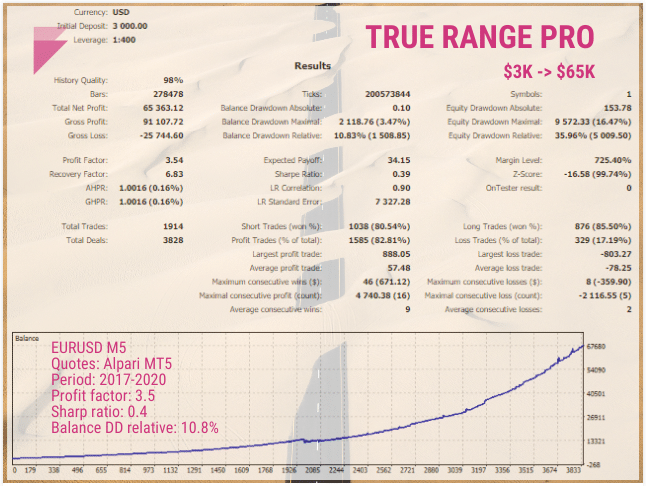

As you can see above, the EA was backtested using 2017-2020 market data on the EURUSD currency pair. All the 1914 trades were conducted on the M5 chart, generating a total net profit of $65363.12 in the process. There was a low drawdown of 10.8%, proving that low-risk trading was employed. The profit factor was 3.54.

What about True Range Pro real trading results

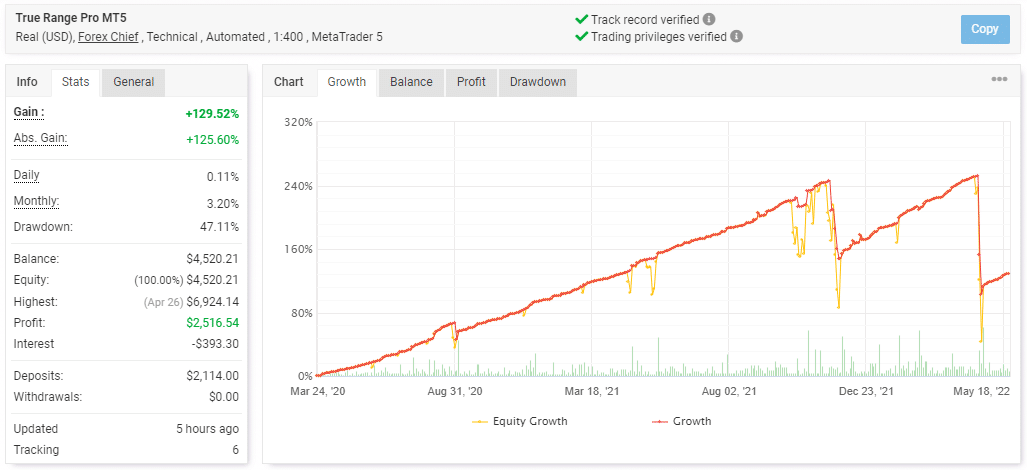

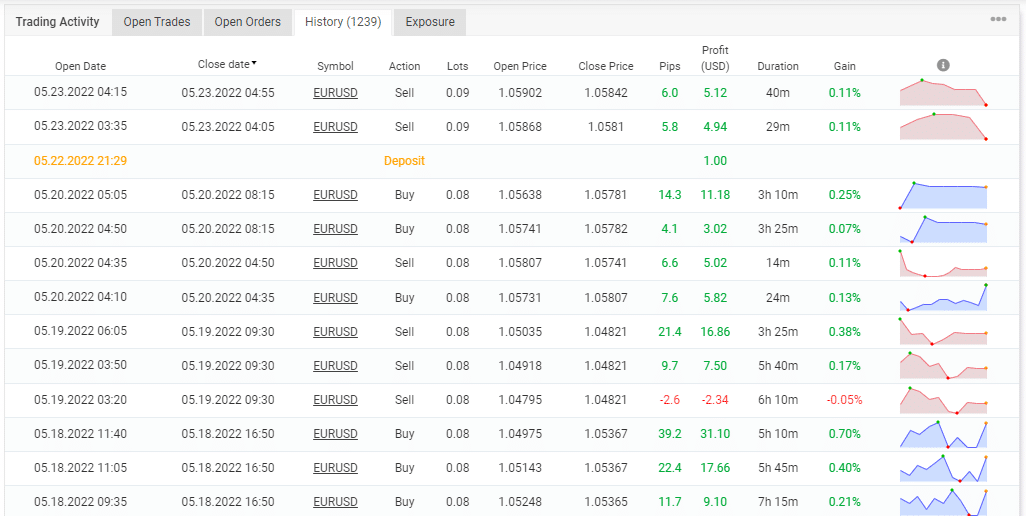

This is a real USD account that was opened more than two years ago, and thanks to the EA’s trading activities, its value has grown by 129.52%. From a deposit of $2114, only a profit of $2516.54 has been generated. As we compare the average monthly rate (3.2%) to the drawdown rate (47.11%), it is evident that the risk/reward ratio, which is 14:1, is unhealthy. This means that the system has a high losing streak.

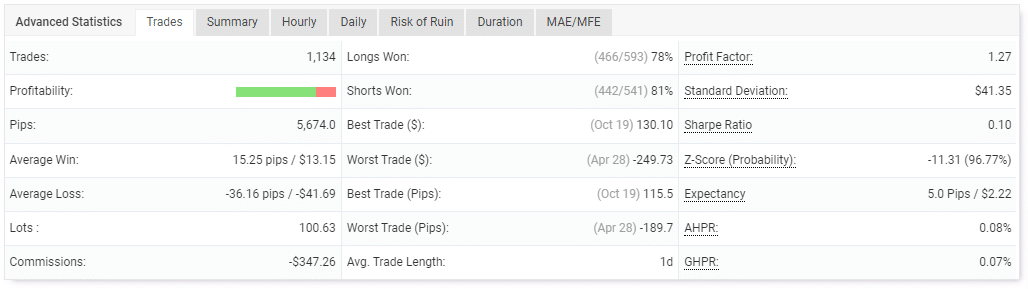

Out of the 1134 completed trades, we have a win rate of 78% for long positions and 81% for short ones. The profit factor value (1.27) tells us that the system isn’t very profitable. To date, the EA has won 5674 pips and traded with 100.63 lots. A total of $347.26 has been paid out in commissions, further reducing the owner’s earnings.

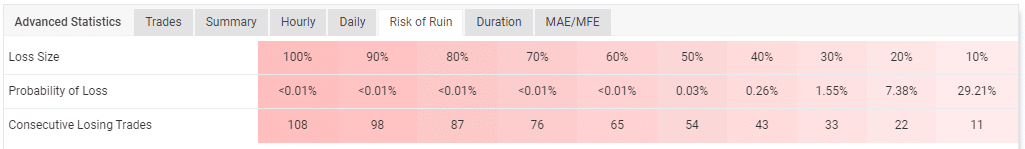

This account’s strength has deteriorated over time, increasing its risk of ruin substantially.

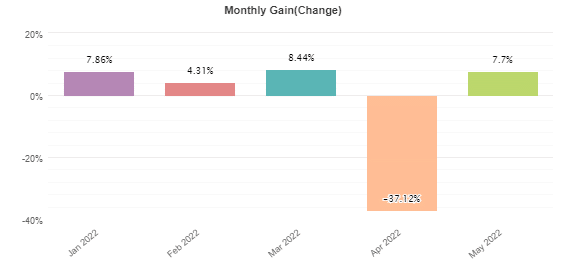

The system made profits throughout this year, except for April, where it incurred a huge loss of -37.12%.

Night scalping and grid strategies are apparent. Large lot sizes are implemented.

Customer reviews

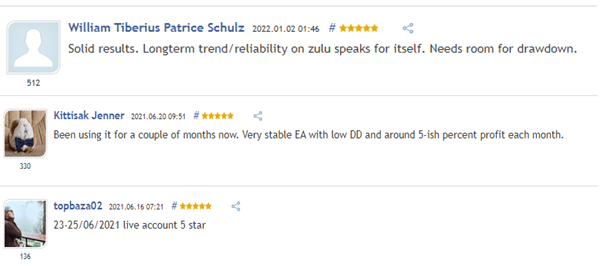

True Ranger Pro has a 5-star rating on MQL5, which indicates that all traders using it are satisfied with its work. For instance, you can see from the comments below that the system produces solid results and a low drawdown every month.

True Range Pro Review Summary

True Range Pro-

Functionality3/5 NeutralThe developer outlines the robot’s features and recommends the settings for you to use to get optimal results.

-

Trading strategy2/5 BadOne of the system’s strategies (grid) is risky and can lead to a large drawdown in the long run.

-

Live Results3/5 NeutralThe EA has run a live account on Myfxbook for 2+ years and produced profits for it.

-

Customer Support2/5 BadCustomer support is provided through the comments section on mql5 only.

-

Customer Reviews4/5 GoodUsers of this robot have confirmed that it is profitable and efficient.

The Good

- Live trading and backtest results are present

- Positive reviews from users

- Built for MT4 and MT5 accounts

The Bad

- Unfavorable risk/reward ratio

- Grid on the board

- Costly

- High risk of ruin