Stealth Trader implements a low-risk scalping system and uses tight stop loss on its trades. It comes with a detailed setup guide and includes the best recommendations to maximize its outcome. To give more information to our readers, we will discuss the profitability, history record, strategy effectiveness, and key features of the robot.

Greg James is the robot developer who presents multiple backtesting and live records to verify its performance., LeapFX is the parent company that owns numerous bots for auto and manual trading, such as Stealth Trader, DynaScalp, etc. The vendor keeps its users blind to vital company information such as company foundation year and residing place.

Stealth Trader at a glance

| Price | $347 (yearly), $597 (lifetime) |

| Trading Platforms | MT4 |

| Currency Pairs | GBP/JPY |

| Strategy | Grid |

| Timeframe | M5 |

| Recommended Deposit | N/A |

| Recommended Leverage | 1:100 |

| Money Management | Yes |

Stealth Trader functionality

Users must follow the following steps to get started with the system:

- Click on the purchase option available on the website

- Sign in to MetaTrader 4 platform

- Bring the bot to the expert directory and reload the page

- Link the robot with the chart, and be ready to go

The algorithm comes with the following key features:

- Multiple purchasing options are present.

- A free demo is available.

- It works on the MetaTrader 4 platform.

- The algorithm has free updates and customer support

- The product comes with a 30-day money-back guarantee

Stealth Trader trading strategy tests

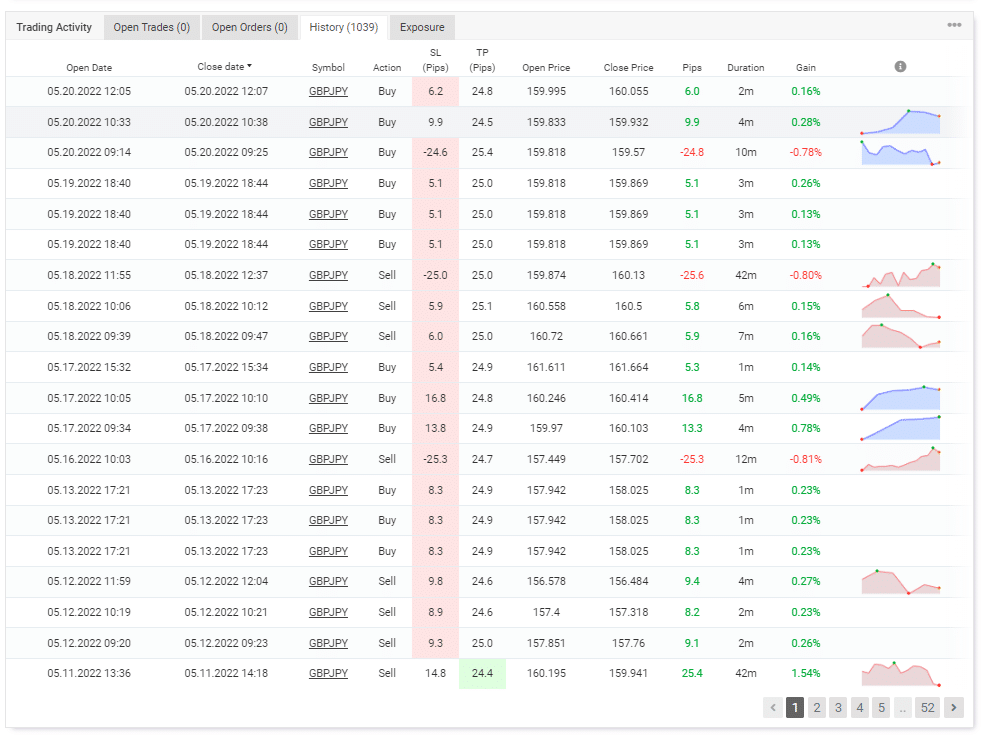

The robot does not use grid or martingale and trades on the GBPJPY currency pair. It prefers the following instrument due to its volatility and wide ranges. The history on Myfxbook shows us that the robot uses a fixed take profit of around 25 pips. It has a trailing stop loss feature to secure profits once the trade becomes positive.

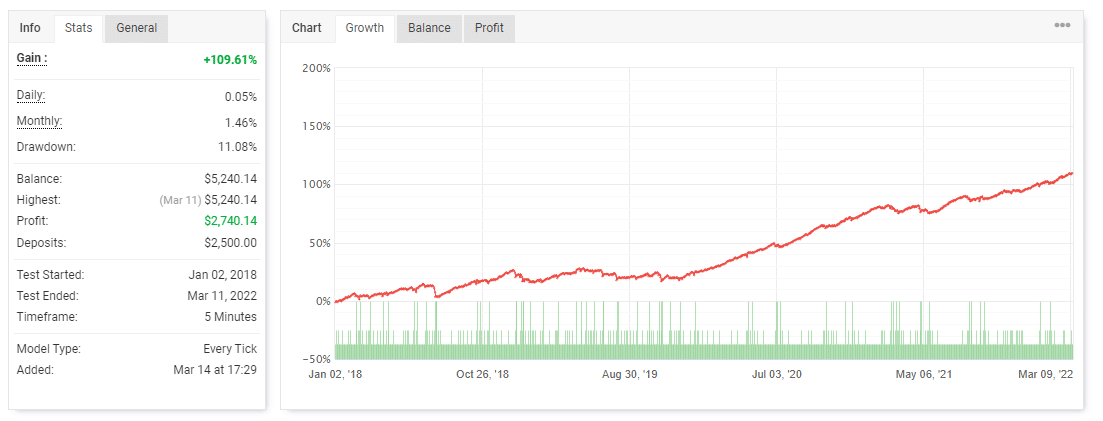

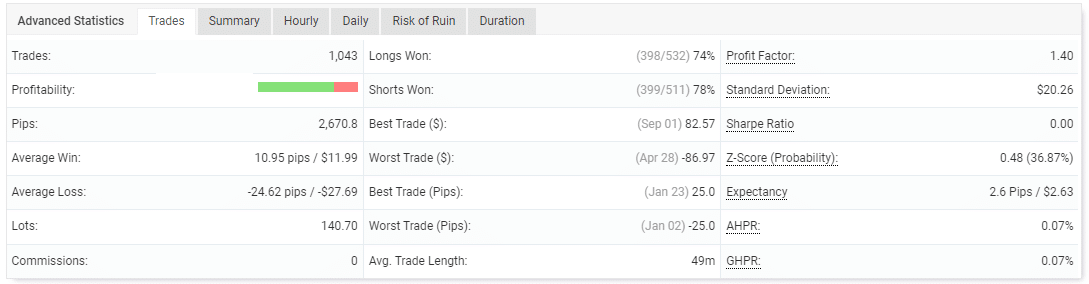

Backtesting records

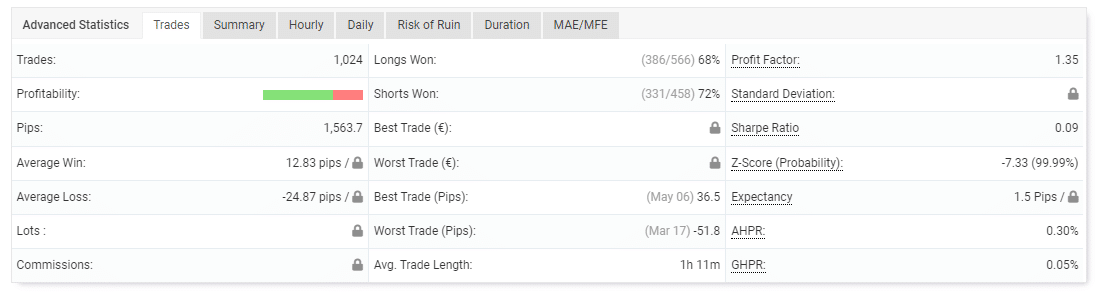

The account backtest is available from Jan 2018 till Mar 2022, where the robot had a win rate of 76%. From the statistics, we observed that the algorithm conducted 1043 trades and earned $2,740.14. It had the best trade of $82.57 with a profit factor of 1.40. The initial deposited amount was $2500, resulting in an average win of $11.99.

What about Stealth Trader live trading results

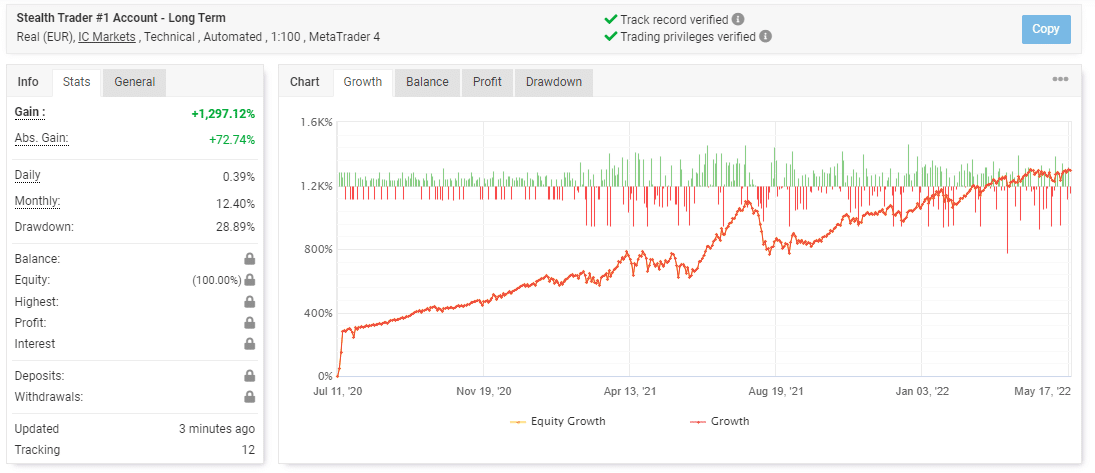

The trading account on Myfxbook has been active since July 11, 2020, till the current date. The robot has had a gain percentage of +1,297.12%, with a daily gain rate of 0.39% and a noted drawdown value of 28.89%

After placing 1024 trades, the portfolio has a 70% win rate and a monthly gain percentage of 12.40%. The vendor has locked the details such as deposit, profit, current balance, etc. the noted approach raises trust issues for its users.

Customer reviews

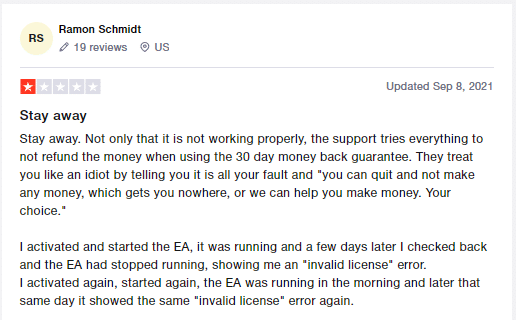

The company has a rating of 4.1 based on 14 reviews on Trustpilot. One of the traders says that the EA does not only work correctly, and the company does not take the money-back guarantee seriously.

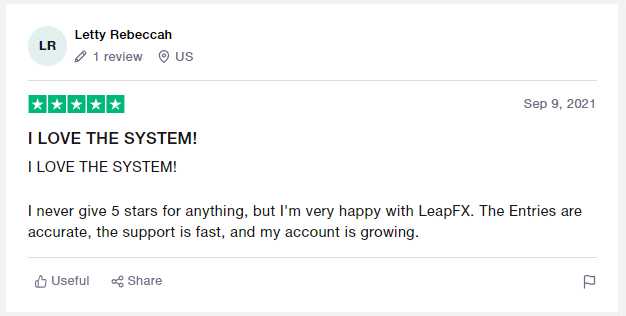

Another user finds the robot has accurate entries and states that the customer support is very fast.

Stealth Trader Review Summary

Stealth Trader-

Functionality4/5 GoodFree updates, demos, and multiple purchasing offers.

-

Trading Strategy2/5 BadUses grid trading strategy.

-

Live results3/5 NeutralThe drawdown value of 28.89% makes it more open to risk and losing investments.

-

Customer support2/5 BadThe customer service team is present for trader's inquires. The drawdown can be seen at 99%, showing complete liquidation of the account.

-

User reviews3/5 NeutralAbove average feedback on Trustpilot.

The Good

- 30 days money-back guarantee

The Bad

- Lack of information on company profile

- Below average live performance

- Poor customer support