TrendSpider is an innovative and robust technical analysis tool designed to meet the needs of modern traders. It’s cutting-edge features and automated approach to charting aim to provide traders with an edge in today’s fast-paced and competitive financial markets. From beginner to seasoned trader, TrendSpider offers a comprehensive suite of resources to help streamline and enhance your trading experience.

Features of Trend Spider

Trend Spider offers a range of powerful features designed to enhance technical analysis and trading strategies. Here are some key features of Trend Spider:

- Automated Trendline Detection: Trend Spider utilizes advanced algorithms to automatically detect and draw trendlines on charts. This saves time and helps traders identify important support and resistance levels.

- Multi-Timeframe Analysis: Trend Spider allows users to analyze multiple timeframes simultaneously, providing a comprehensive view of market trends and patterns. This feature helps traders make informed decisions across different time horizons.

- Fibonacci Retracement Tool: The platform includes a built-in Fibonacci retracement tool, which assists in identifying potential price levels for market reversals or continuation. Traders can easily measure retracement levels and incorporate them into their strategies.

- Volume Analysis and Alerts: Trend Spider provides tools to analyze trading volume patterns, helping traders understand the strength and reliability of price movements. Users can set custom volume alerts to be notified of significant changes in trading activity.

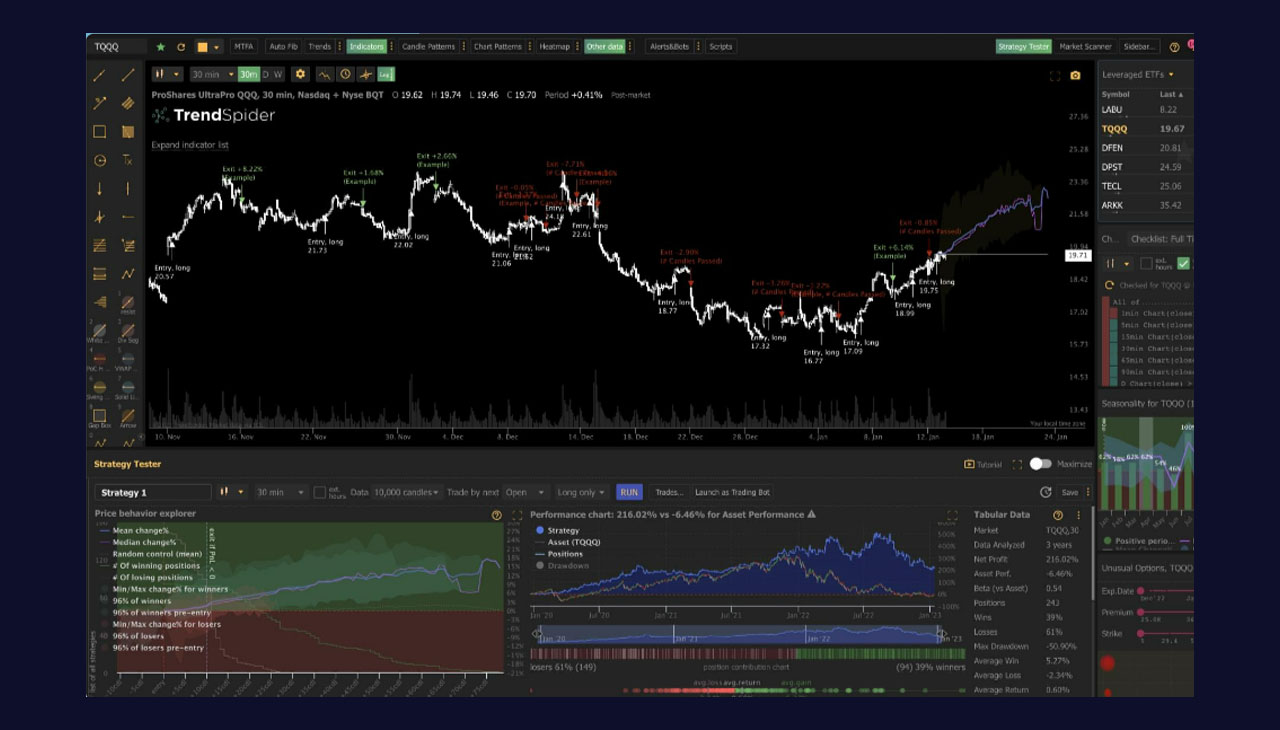

- Backtesting and Strategy Testing: Traders can backtest their strategies using historical data to evaluate performance and optimize trading rules. This feature enables users to refine their strategies based on past market conditions and improve their trading outcomes.

- Smart Trading Assistant: Trend Spider’s smart trading assistant generates trade ideas based on technical patterns and indicators. It scans the markets in real time, identifying potential trading opportunities and providing actionable suggestions.

- Real-time Alerts: Users can set up customizable alerts to receive real-time notifications for specific events, such as trendline breaks, moving average crossovers, or other technical indicators. This helps traders stay informed and take timely action.

- Risk Management Tools: Trend Spider offers risk management features that enable users to set stop-loss and take-profit levels, calculate position sizing, and manage risk effectively. These tools help traders protect their capital and minimize losses.

Overall, Trend Spider provides a comprehensive suite of advanced technical analysis tools and features that can assist traders in making informed decisions and improving their trading performance.

Advanced Technical Analysis Tools

TrendSpider is well-equipped with advanced technical analysis tools that elevate its utility and efficiency for traders. It includes a Heatmap feature, which gives a visual representation of how different technical indicators are behaving across multiple timeframes. This helps traders identify convergences or divergences in the market.

The platform also offers a Seasonality tool, enabling traders to analyze historical patterns based on the time of the year. By understanding these patterns, traders can anticipate future price movements and make strategic decisions accordingly.

Another key tool is the Market Scanner, which scans thousands of markets in real time, filtering them based on user-defined criteria. This helps traders spot potential opportunities faster.

Lastly, the Raindrop Charts tool, a unique feature to TrendSpider, blends price action and volumes into a single visual representation, providing insights into market sentiment during a specific timeframe.

Each of these advanced tools is designed to equip traders with the ability to swiftly interpret and respond to market changes, providing a significant edge in the ever-evolving world of trading.

Backtesting and Strategy Testing

Backtesting and strategy testing are essential components of effective trading and investing. Trend Spider offers robust features in this area to help traders evaluate their strategies and make informed decisions. Here’s how Trend Spider supports backtesting and strategy testing:

- Historical Performance Analysis: Trend Spider allows users to backtest their trading strategies using historical market data. By applying their strategies to past price movements, traders can assess how well their strategies would have performed in different market scenarios.

- Optimization of Trading Strategies: Traders can fine-tune their strategies using Trend Spider’s optimization tools. The platform enables users to test various parameters and indicators to identify the optimal settings for their strategies, maximizing potential returns.

- Simulation and Testing: Trend Spider provides a simulation environment where traders can test their strategies in real-time without risking actual capital. This feature helps users gain confidence in their strategies before implementing them in live trading.

- Strategy Performance Metrics: Trend Spider offers a range of performance metrics to evaluate the effectiveness of trading strategies. Users can assess metrics such as profitability, win rate, drawdowns, and risk-adjusted returns to gauge the performance of their strategies.

- Scenario Analysis: Traders can use Trend Spider to simulate different market scenarios and test the robustness of their strategies. By assessing how their strategies perform under various market conditions, traders can identify strengths and weaknesses and make necessary adjustments.

- Strategy Comparison: Trend Spider allows users to compare multiple strategies side by side. This feature enables traders to assess the performance of different strategies simultaneously and choose the most effective approach.

By offering comprehensive backtesting and strategy testing capabilities, Trend Spider empowers traders to analyze their trading ideas thoroughly. This helps traders refine their strategies, improve decision-making, and potentially increase profitability in the markets.

Smart Trading Assistant

A smart trading assistant can be a valuable tool for traders, providing real-time insights and assistance in making informed trading decisions. Here are some key features and benefits of a smart trading assistant:

- Trading Ideas Generation: A smart trading assistant can analyze market data, technical indicators, and patterns to generate trading ideas. It can identify potential opportunities based on predefined criteria and present them to the trader.

- Real-Time Market Monitoring: A smart trading assistant constantly monitors the markets, tracking price movements, news events, and other relevant factors. It can provide real-time updates and alerts, ensuring that traders stay informed about important market changes.

- Risk Management Tools: Effective risk management is crucial in trading. A smart trading assistant can help traders manage their risk by providing tools for setting stop-loss and take-profit levels, calculating position sizes, and implementing risk management strategies.

- Trade Execution Assistance: Some smart trading assistants offer trade execution capabilities, allowing traders to place trades directly from the assistant’s interface. This streamlines the trading process and helps traders execute their strategies more efficiently.

- Backtesting and Strategy Optimization: Traders can use a smart trading assistant to backtest their trading strategies using historical data. This allows them to evaluate strategy performance, identify strengths and weaknesses, and make necessary adjustments for optimization.

- Performance Tracking and Analytics: A smart trading assistant can track and analyze the performance of executed trades, providing valuable insights into trading outcomes. Traders can review their success rate, profitability, and other key metrics to improve their trading strategies over time.

- Personalization and Customization: Smart trading assistants often offer customization options, allowing traders to tailor the assistant’s recommendations and alerts according to their preferences and trading style.

- Integration with Trading Platforms and APIs: Many smart trading assistants integrate with popular trading platforms, enabling seamless connectivity and data synchronization. They can also integrate with third-party APIs to access additional market data and analysis tools.

Overall, a smart trading assistant can enhance a trader’s decision-making process by providing real-time insights, trading ideas, risk management tools, and trade execution assistance. It can help traders save time, improve their trading strategies, and stay on top of changing market conditions.

Customer Reviews and Testimonials

Trend Spider has garnered positive feedback from traders and investors who have used the platform to enhance their technical analysis and trading strategies. Here are some customer reviews and testimonials:

- John D.: “Trend Spider has been a game-changer for my trading. The automated trendline detection feature saves me so much time, and the multi-time frame analysis has helped me identify key levels of support and resistance. Highly recommend!”

- Sarah T.: “I’ve tried several technical analysis tools, but Trend Spider stands out with its advanced features. The Fibonacci retracement tool and volume analysis features have helped me make more accurate predictions. The real-time alerts and smart trading assistant are a bonus!”

- Mark L.: “Backtesting and strategy testing in Trend Spider has been invaluable in refining my trading strategies. Being able to simulate different scenarios and analyze historical performance has greatly improved my decision-making process. The customer support team is also very responsive.”

- Emma R.: “I’ve been using Trend Spider for a few months now, and I’m impressed with the customization options and user-friendly interface. It integrates seamlessly with my trading platform, and the risk management tools have helped me protect my capital effectively. Recommend giving it a try!”

Please note that these testimonials are based on individual experiences and results may vary. It’s always recommended to conduct thorough research and consider personal trading goals before choosing any trading software.

Summary

Summary-

Automation5/5 Amazing

-

Customization3/5 Neutral

-

Cost4/5 Good

-

Ease of Use5/5 Amazing

-

Accuracy/Reliability4/5 Good

The Good

- Automated trendline detection

- Multi-time frame analysis

- Customizable Fibonacci retracement levels

- Volume analysis feature

- Risk management tools

The Bad

- Limited customization options for some features

- Can be expensive for individual traders

- Relatively new platform with limited customer reviews and testimonials