Stenvall Mark III is an automated trading system that uses a combination of trend and counter-trend approaches. The developer claims that this is an appropriate system for long-term private investment and managed accounts.

Gennady Sergienko is the developer of this FX EA. He has more than five years of experience in the field and has developed 7 products and 10 signals. North Star and Alexis Stenvall are some of the other products of this developer.

As per the developer info, the initial version of this FX EA was formed in 2016 and the first public version was published in 2019 on the MQL5 site. The MT5 version was published in June 2021 and is in version 3.0 now with the recent update done in August 2021. To contact support, the developer provides a telegram link, an email address, and messaging via the MQL5 site.

Stenvall Mark III at a glance

| Price | $980 |

| Trading Platforms | MT5 |

| Currency Pairs | EURUSD |

| Strategy | Trend and Counter-trend |

| Timeframe | M5 |

| Recommended Deposit | $2000 |

| Recommended Leverage | From 1:100 |

| Money Management | Yes |

Stenvall Mark III functionality

As per the developer, the EA works mainly on the EURUSD pair. It does not trade in the transitions and rollovers occurring at 00:00 because the spread is wider during the time. This FX EA is not influenced by broker requotes and spreads. Some of the important features of the ATS include the use of 76 functions, SL for every position, and 24 hours algo trading with long holding position and complex wave analysis. As per the developer, the average TP is 150 points and 5% is the average load placed on the deposit. This system is safe and reliable and uses a clean and direct trading approach that does not use dangerous methods like the Martingale or grid.

Stenvall Mark IIItrading strategy tests

This FX EA uses a hybrid of the counter-trend and trend approaches. The developer mentions that the EA used the night scalping approach in its initial version and with regular updates and added functions, the trading approach has been enhanced with signal accuracy increasing up to 70%.

As per the developer, the strategy is stable and precise and will not lose its importance even with changing positions of the EURUSD. We could not find backtesting results for this FX EA. The lack of backtests and insufficient explanation of the strategy makes us suspect the reliability of this MT5 tool.

What about Stenvall Mark III real trading results

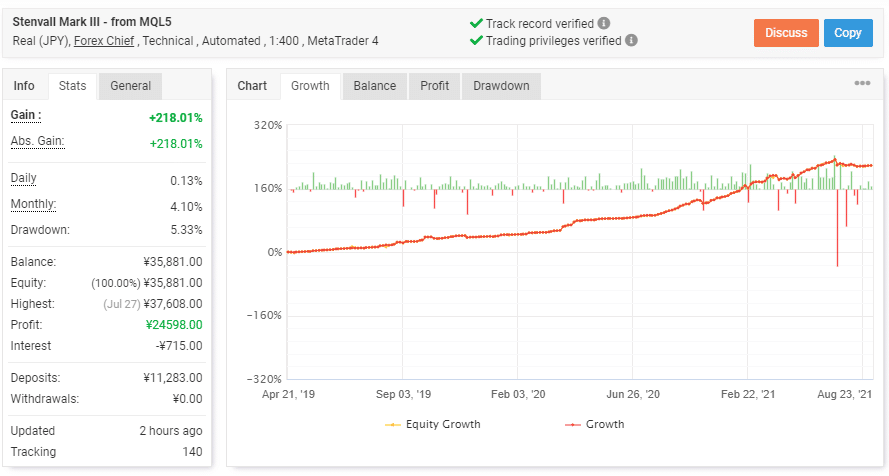

A real JPY account using the Forex Chief broker and the leverage of 1:400 on the Metatrader 4 platform verified by the Myfxbook site is shown here.

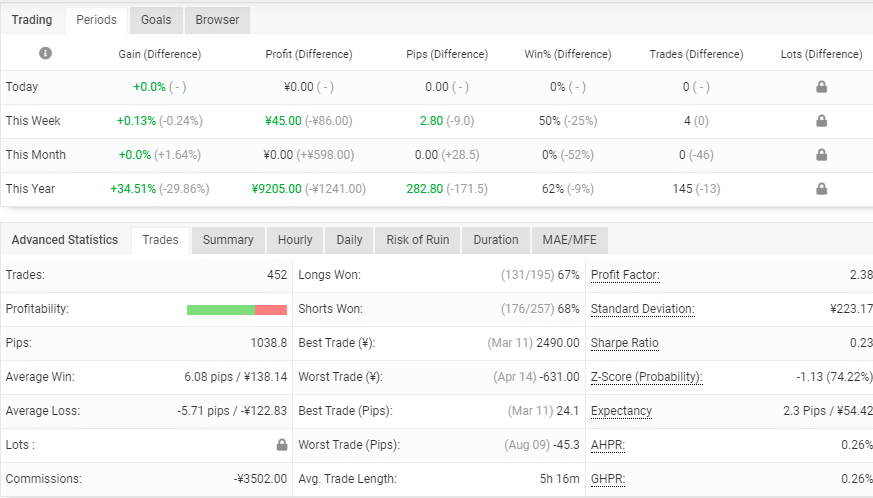

From the above screenshots, we can see the EA has generated a total profit of 218.01% and an absolute profit of similar value. A daily profit of 0.13% and a monthly profit of 4.10% are present and the drawdown is 5.33%. The total number of trades executed for the account started in April 2019 is 452 with a 68% profitability and a profit factor of 2.38. We find the information on the lots used is hidden which raises doubts on the reliability of the system.

User reviews

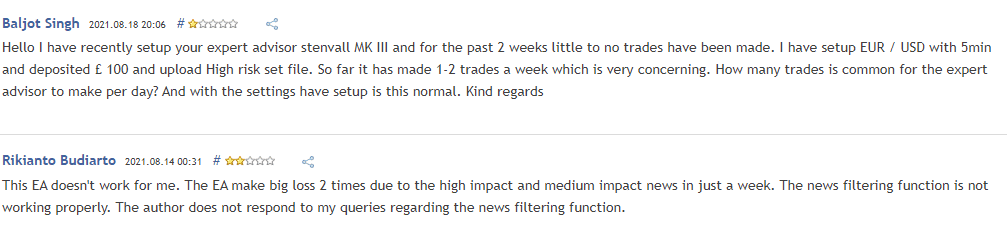

We found 10 user reviews for this MT5 tool on the MQL5 site. Here are the recent user testimonials:

From the above feedback, we can see that the frequency of trades is very low with just one or two trades per week. Another user mentions that the EA has made huge losses due to the medium and high impact news events within a week. He claims that the news filtering setting of the EA is not working.

Stenvall Mark III Review Summary

Stenvall Mark III-

Functionality2/5 BadLack of info provided on the working mechanism, features, and settings of the system.

-

Trading strategy3/5 NeutralThe strategy used is not explained properly and there are no backtesting results.

-

Live results2/5 BadVerified results are present but have hidden data that raises a red flag.

-

Customer support2/5 BadEmail and messaging via Telegram and the MQL5 site are the methods present.

-

User reviews2/5 BadNegative user reviews indicate the EA causes big losses and is not reliable.

The Good

- Fully automated trading

- Verified trading results

The Bad

- Inadequate explanation of the strategy

- Hidden data in real trading results

- Expensive price