Euro Hedge is another EA that is being sold on the mql5 website. Since its publication on March 29, 2021, it has been activated 20 times. A person named Sugianto from Indonesia created this system. There are a total of 32 other products in his portfolio. Some include Trendline Trader, Net Z, GO Trendline and Green Gold Scalper among others.

There is no data that reveals more about his background. Therefore, it is hard to tell his level of expertise as a developer and if he has enough experience to create effective and beneficial trading tools for Forex.

Euro Hedge at a glance

| Price | $349 |

| Trading platforms | MT5 |

| Currency pairs | GBPUSD, EURUSD, and XAUUSD |

| Strategy | Hedging, averaging, pyramiding, lot martingale and anti-martingale |

| Timeframe | N/A |

| Recommended deposit | $5,000 |

| Recommended leverage | 1:500 |

| Money management | N/A |

Euro Hedge functionality

The other notable features of the robot are as follows:

- Hedging accounts are suggested

- The recommended start lot is 0.01

- A VPS with good internet connection is needed

- Brokers with good requites, slippage, spreads & rebates are required

Euro Hedge trading strategy tests

According to the vendor, Euro Hedge uses a mixture of hedging, averaging, pyramiding, lot martingale and anti-martingale strategies along with the ability to close incomplete losing positions. The objective is to enter and exit the market as soon as possible to prevent trappings by sudden market changes.

The information provided on these strategies is insufficient. The vendor should have at least explained how each one works, and whether they are used individually or simultaneously. We have also noted that a dangerous strategy is on board (lot martingale). Even though this approach increases the robot’s chances of winning trades in the short term, losses will ultimately surpass the profits over a longer period.

Backtest results are not available. It seems that the vendor doesn’t want us to see the historical performance of this product. His actions point to a developer who is not confident about the workings of his creation. How then can traders trust it to deliver profitable results for them?

What about Euro Hedge live trading results

Trading results are present, but they are unverified. Nonetheless, let’s just analyze what we have.

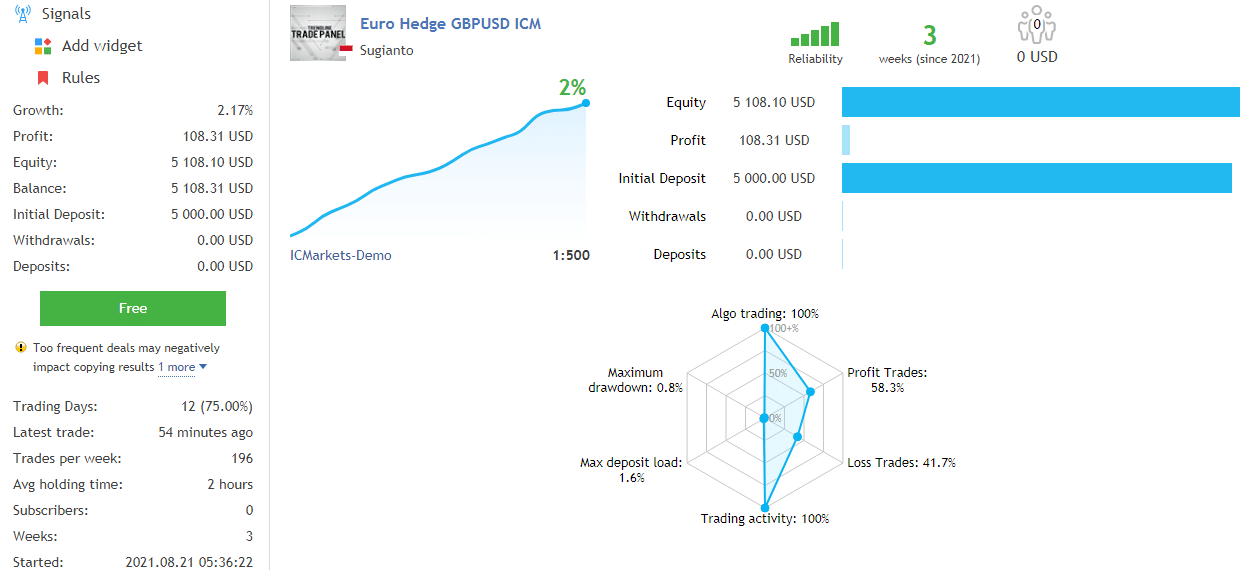

The GBPUSD currency pair is the one being used in this account and the operations are under IC Markets. The account has supposedly been active for 3 weeks and yet it is stated that it began its activities on August 8, 2021. This makes us question the reliability of this data more.

We are told that the account has grown by 2.17%. This is after it made a profit of 108.31 from a deposit of $5,000. The current balance is $5,108.10. Apparently, the EA carries out 196 trades weekly. The profit trades are 58.3% while the loss trades are 41.7%. The maximum drawdown which is 0.8% is small.

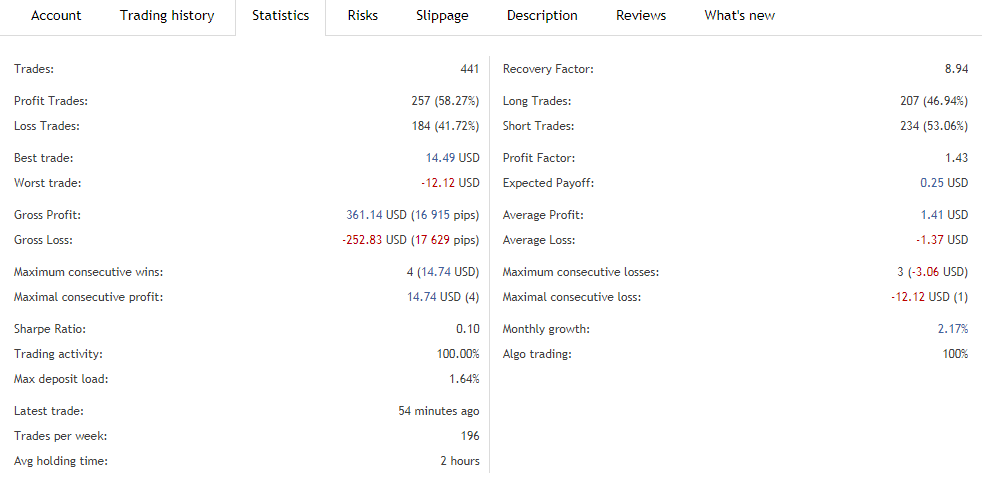

The data here suggests that the system has performed 441 trades. The win rates for long and short trades are 46.94% and 53.06% respectively. These results are clearly very poor and signify that the trading tool is not lucrative. The profit factor of 1.47 is also average and an indication that the EA has a low ROI. The average profit is $1.41 while the average loss is -$1.37.

Customer reviews

Only 2 customers have come forward to narrate their experiences with the robot. We expected to find more feedback given that the EA has been in the market since March and has been activated many times.

It is possible that the developer deleted unfavorable reviews or his product is not popular. These questions create doubts about the reliability of the available customer feedback. Consequently, we cannot fully ascertain if traders are satisfied or dissatisfied with this system.

Euro Hedge Review Summary

Euro Hedge-

Functionality3/5 NeutralThe features of the product are highlighted and clear.

-

Trading strategy2/5 BadThe trading strategies are not explained in detail.

-

Live results2/5 BadThe live trading results available are unverified and hence unreliable.

-

Customer support2/5 BadThe vendor has not provided any information that shows he offers customer support.

-

User reviews2/5 BadCustomer feedback is inadequate and not credible.

The Good

- Fully automated

- Supports multiple currency pairs

The Bad

- Lack of vendor transparency

- Backtest results are missing

- Unverified live trading results