Smart Scalper Pro is said to be the latest edition of the well-known BF Smart Scalper EA with many additional features and enhancements. The vendor also says that the robot will grow your trading account. Furthermore, its low-risk strategy, which comes with logical TP and SL levels plus an ATR based algorithm, will ensure that your drawdown remains low. We will review these claims to ascertain if they are true or not.

FxAutomater is the creator and the promoter of this robot. The company works with a team of Forex traders, investors, and programmers to create trading systems. However, we do not know who the devs really are or their whereabouts. FxAutomater is popular for producing numerous products. Sad to say, most of them are not effective. So, it seems that they are more commercially than results oriented.

Smart Scalper Pro at a glance

| Price | $117 |

| Trading platforms | MT4, MT5 |

| Currency pairs | GBPUSD, EURUSD, USDCHF, USDJPY, and USDCAD |

| Strategy | Scalping |

| Timeframe | M1, M15 |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

Smart Scalper Pro functionality

The EA also comes with the following features:

- Advanced news filter

- Friday exit system

- Email and push notification system

- Advanced time management system

- High spread, slippage, and broker protection

- Customer support

Smart Scalper Pro trading strategy tests

This EA uses the scalping approach. This is a famous strategy in Forex that mainly focuses on attaining small pips from small price changes.

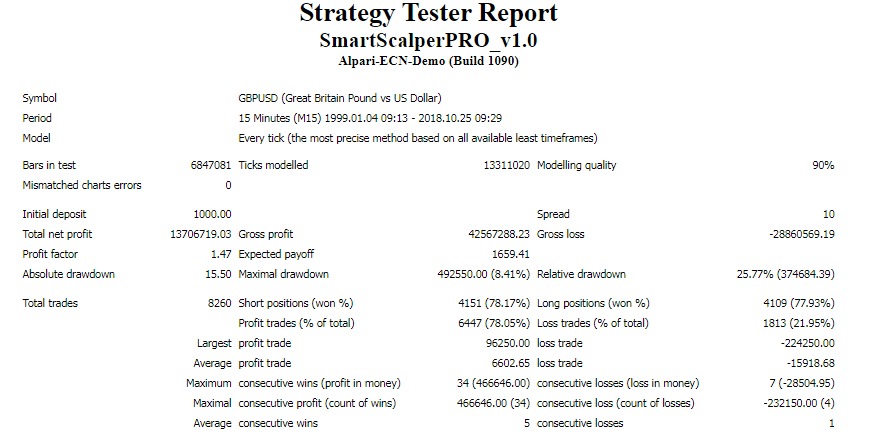

The system was tested on different currency pairs. We have the results for the GBPUSD symbol below:

The robot traded between 1999 and 2018 with a $1000 deposit on the 15 minute chart. The outcome was a total net profit of $13,706,719.03 and a relative drawdown of 25.77%. About 8260 trades were executed, with the win rates of short and long positions being 78.17% and 77.93%, respectively. There was an average loss trade of -$15918.68 that was considerably higher than the average profit trade ($6602.65). This signifies a system that made more losses than wins.

What about Smart Scalper Pro live trading results

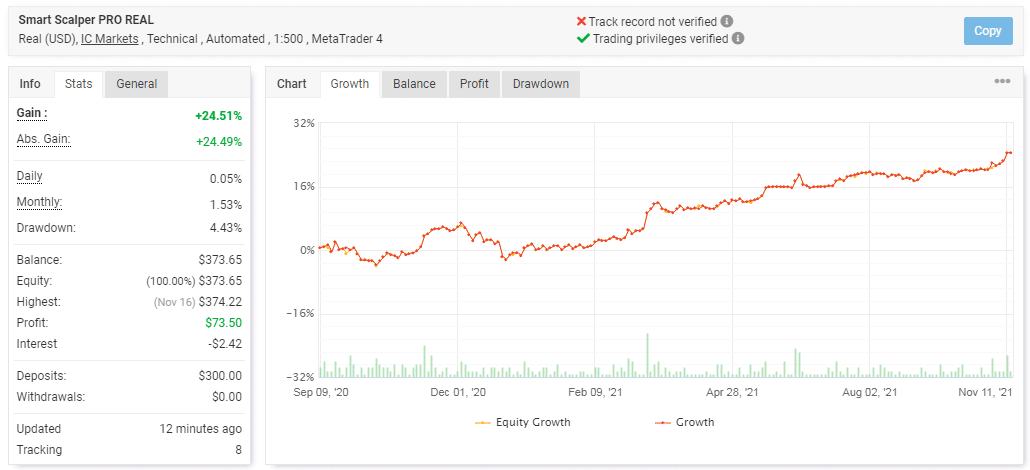

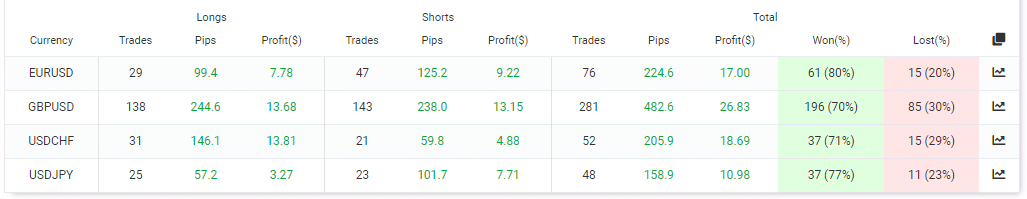

The system is running a real USD account on Myfxbook. But it should be noted that its track record has not been verified.

The statistics above paint a disturbing picture of the system’s performance. It began placing trades over a year ago but has only managed to make $73.50 for the devs. Certainly, nothing much can be expected from an EA that makes an average profit of 1.53% monthly. The drawdown is 4.43%. This provides some relief as it confirms that the strategy used is not risky.

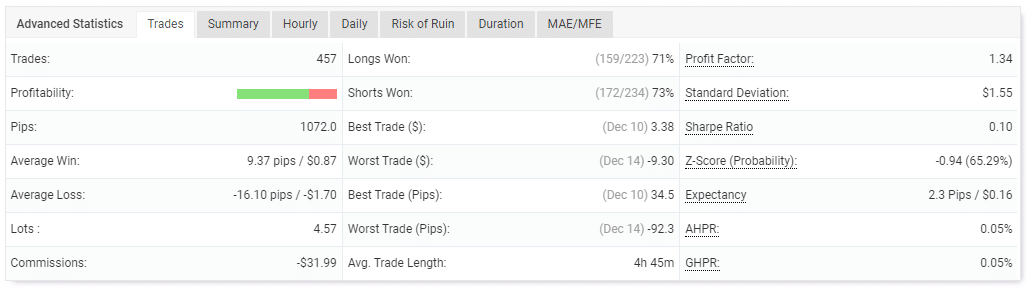

So far, 457 trades have been recorded. The average win and loss are 9.37 pips and -16.10 pips, respectively. There is a low profit factor of 1.34, which shows that the returns generated are nothing to write home about. The win rates for long (71%) and short positions (73%) are not good either.

The GBPUSD was the most traded pair (281 deals), whereas the USDJPY was the least traded one (48 trades).

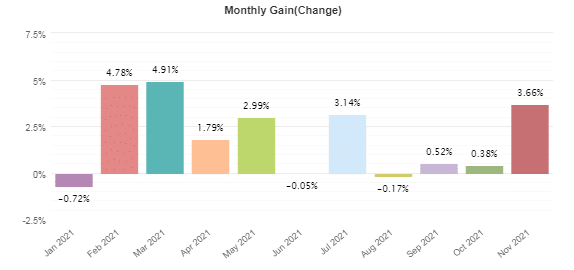

Alt: Monthly profits.

March was the most lucrative month with 4.91% profits. Since the beginning of the year, only the months of January, June, and August have recorded losses.

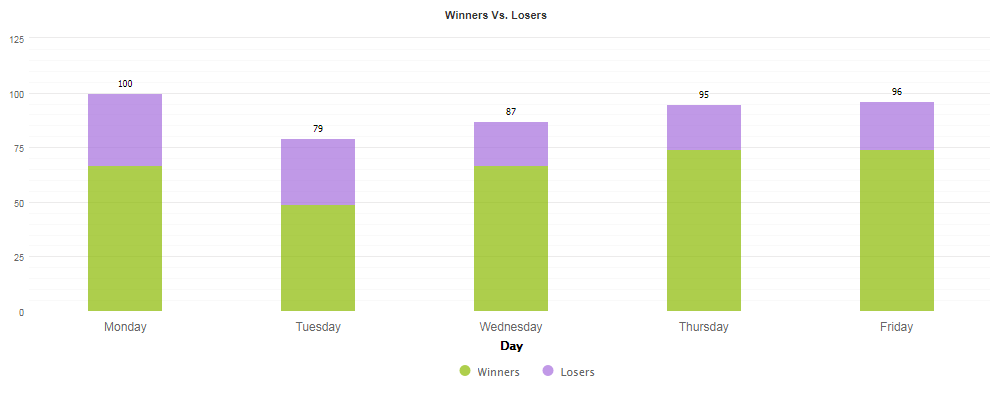

To date, the EA trading activities are mainly concentrated on Monday (100 trades). Friday is the second most active day, closely followed by Thursday.

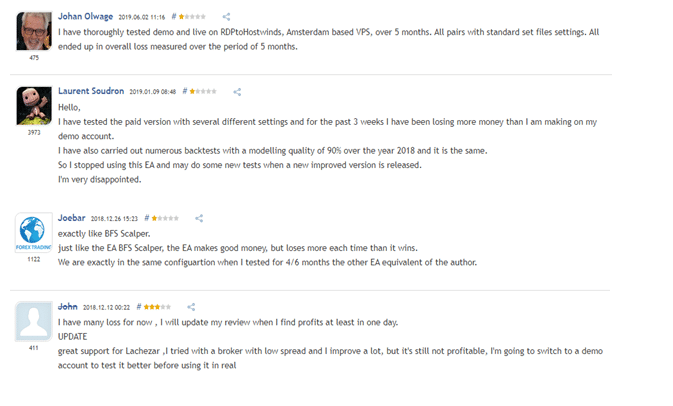

User reviews

We found several mixed customer reviews for this EA on mql5. A significant number of traders are disappointed by its performance. They are saying that the system loses more than wins. These comments coincide with our findings.

Smart Scalper Pro Review Summary

Smart Scalper Pro-

Functionality3/5 NeutralThe system has many additional features that make it more efficient.

-

Trading strategy2/5 BadThe scalping approach used generates very small profits.

-

Live results2/5 BadThe EA’s performance in the live market is poor.

-

Customer support3/5 NeutralThis service is available, and the vendor has provided the contact details traders can use to reach them.

-

User reviews2/5 BadCustomers reveal that the robot is not effective as it loses more trades than it wins them.

The Good

- Money management is present

- A 60-day money-back guarantee is offered

The Bad

- Low return rate

- The profiles of devs are unknown

- High loss rate

- Negative reviews from clients