Rombus Capital provides Forex managed accounts and social copy trading services. According to the vendor, this system has achieved a gain of 600% from a managed account. They also claim that this service can secure your financial future. However, we simply cannot go by the words of the vendor and need to analyze the various aspects of the system in order to determine its reliability.

On the official website of Rombus Capital, the vendor highlights the main benefits of the system and shares several managed accounts on multiple websites. We can see that they have not elaborated on the features offered by the service, which is a bit odd. The website has a contact form that you can use to get in touch with the service team.

We don’t know much about the parent company, and the vendor has not disclosed the identities of the developers and traders. Thus, Rombus Capital does not offer much in terms of vendor transparency.

Rombus Capital at a glance

| Price | 40% from monthly profits |

| Trading Platforms | All |

| Currency Pairs | All |

| Strategy | N/A |

| Timeframe | N/A |

| Recommended Deposit | 10,000 Euros |

| Recommended Leverage | 1:200 |

| Money Management | No |

Rombus Capital functionality

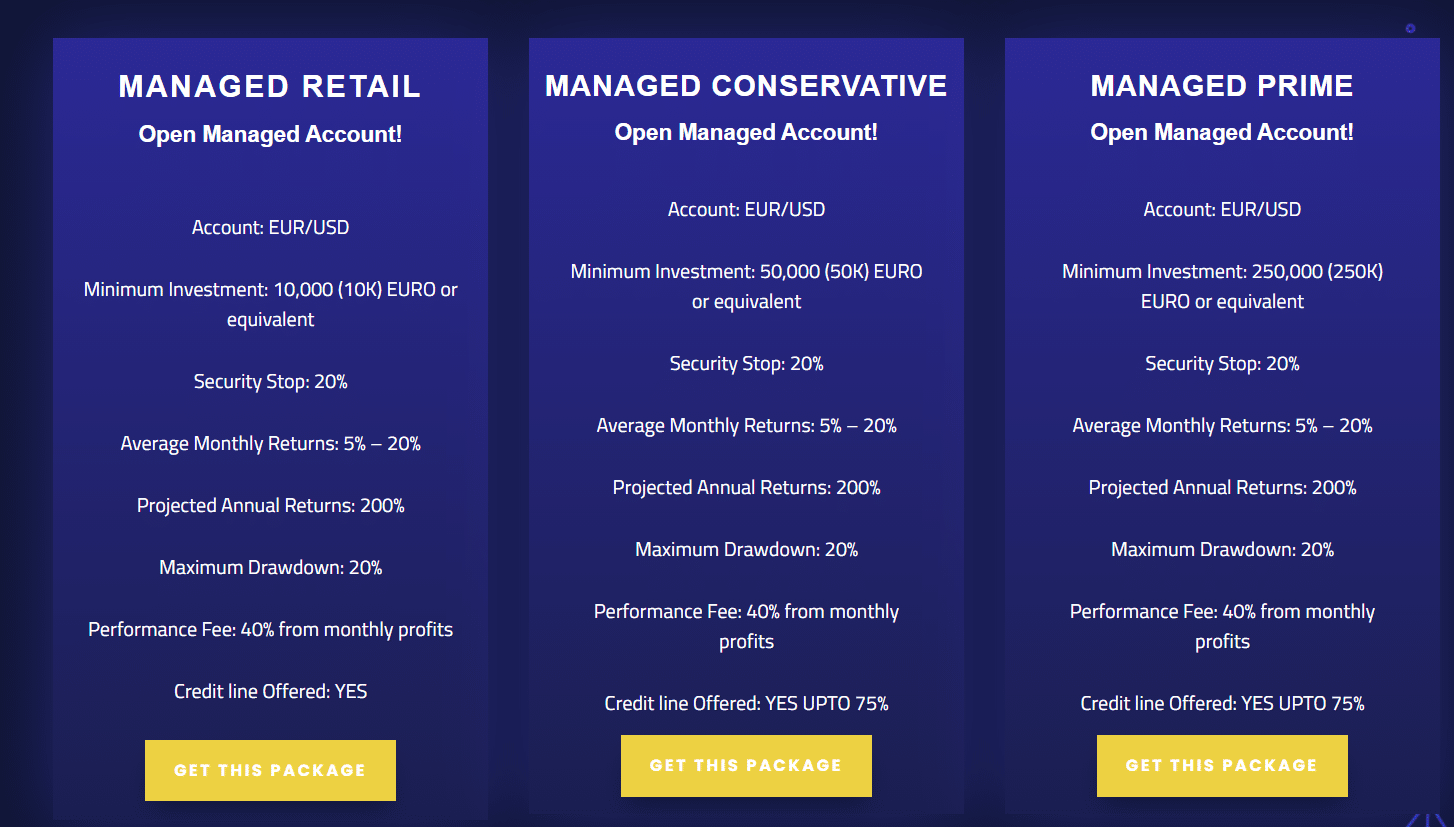

There are three investment plans for Rombus Capital, namely Retail, Conservative, and Prime. All of them are EUR/USD managed accounts. For the Retail plan, you need to make a minimum investment of 10,000 Euros, while the investments for the Conservative and Prime plans are 50,000 Euros and 250,000 Euros, respectively.

All of these plans supposedly have average monthly returns of 5-20% and projected annual returns of 200%. For all of them, you need to pay a 40% performance fee from your profits. We think the initial investment requirements for the plans are too high, especially for novice traders. Also, a 40% monthly performance fee means that traders will not be left with much, in case the profit for that month is low.

At this moment, Rombus Capital is tied to brokerage firms like TradeView, IG Bank, and Hogg Capital. However, the vendor mentions that the trader can use a brokerage of their choice. After you choose one of the packages, you will start receiving signals from traders. Money managers will handle all aspects of your trading account and you can contact customer support at any time for assistance.

Rombus Capital trading strategy tests

We don’t have any information on the trading strategies used by the traders for generating the signals. The vendor should have explained the technical aspects of the strategy, as Forex traders place a lot of emphasis on them. Without strategy insight, it becomes difficult to gauge the profitability of Rombus Capital. Since this is not an automated trading system, the vendor has not shared the backtesting data for this managed account service.

What about Rombus Capital live trading results

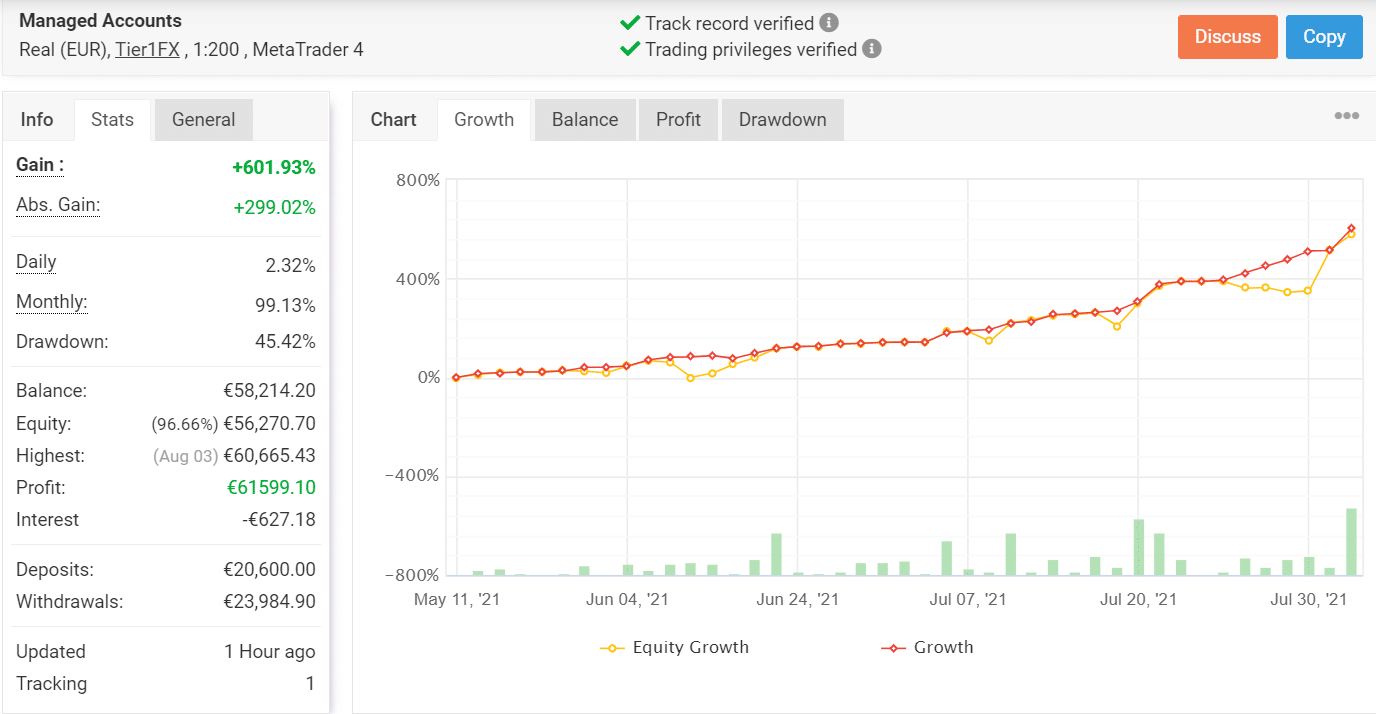

This live trading account on Myfxbook has been active since May 11, 2021, which means the EA has a short trading history. It has placed a total of 346 trades through this account, winning 250 out of them, thus achieving a win rate of 72%. Currently, the daily and monthly gains for this account are 2.32% and 99.13% respectively, while the drawdown is extremely high – 45.42%.

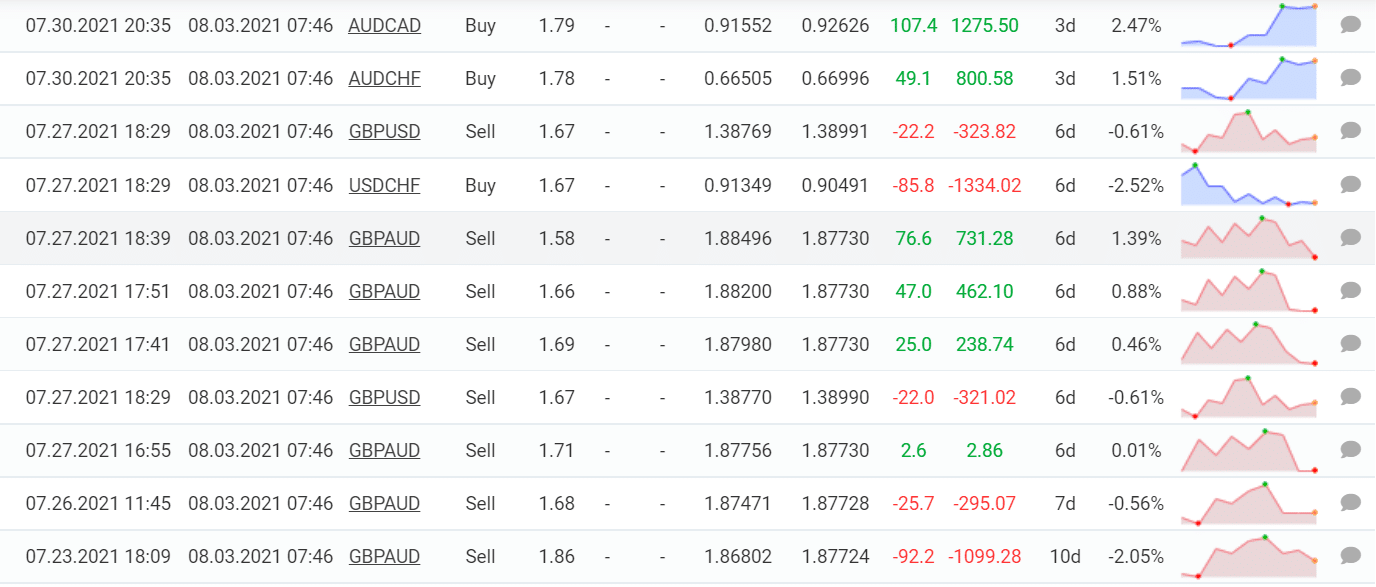

The high drawdown indicates a risky trading strategy and we can confirm this by looking at the trading history. As you can see, the EA has suffered some sizable losses along the way.

User reviews

There are no user reviews for Rombus Capital on the Trustpilot website. On Forexpeacearmy, there is only one review for this managed account service. This tells us that not many people are using this service as of now and it doesn’t have a stellar reputation.

Rombus Capital Review Summary

Rombus Capital-

Functionality1/5 AwfullyThe vendor has not highlighted any particular functionality on the official webpage.

-

Trading strategy1/5 AwfullyWe don’t know what trading strategy Rombus Capital uses.

-

Live results1/5 AwfullyRombus Capital has a short trading history and high drawdown.

-

Customer support1/5 AwfullyWe don’t know through what medium the company offers customer support.

-

User Reviews1/5 AwfullyThere are hardly any user reviews for this system on third-party websites.

The Good

- Verified live trading results available

The Bad

- Lack of strategy insight

- High monthly fees

- Short trading history