MyForexPath is a Forex robot that works on four independent sessions, enabling it to have a sufficient number of trading signals. The EA comes with a drawdown control system that works with a stop loss to protect the trader from unnecessary losses. As the name suggests, the system plans to show you the path to success in Forex. In this review, we will find out if you can really benefit from this tool.

The creator of MyForexPath is mysterious. There’s nothing on the official website that could point us to the real identities of the developers, their trading experience, location, professional backgrounds, etc.

MyForexPath at a glance

| Price | $285 |

| Trading platforms | MT4 and MT5 |

| Currency pairs | EURUSD, AUDUSD, and USDCAD |

| Strategy | Trend following, Grid |

| Timeframe | N/A |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | Yes |

MyForexPath functionality

The extra features of the robot can be found here:

- It includes a detailed user manual.

- The devs offer free updates.

- A 30-day money-back guarantee is available.

- The vendor provides best technical support 24/7.

MyForexPath trading strategy tests

The EA focuses on the trend. It is created with unique indicators and algorithms like Parabolic and MA that help it identify a trend and subsequently open orders in the direction of the trend. The robot is also designed to close previously opened trades to recover the small losses it might have incurred when the direction of the trend changed or when it made unsuccessful trades. As per the vendor, this protects the user from large drawdowns.

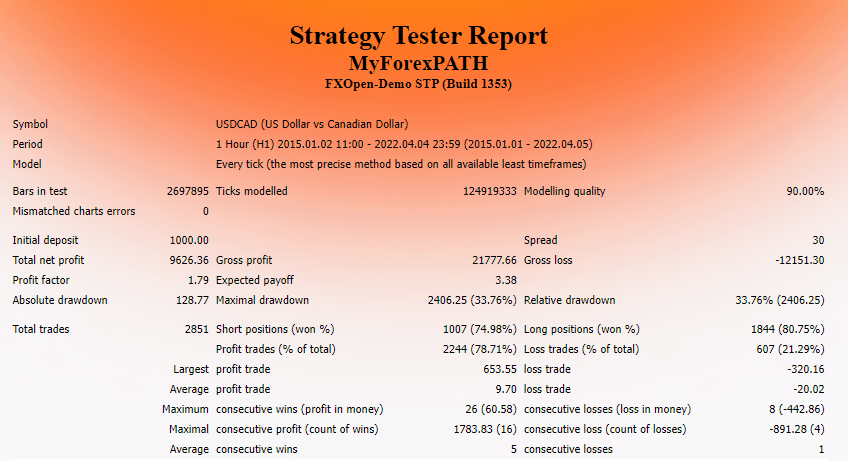

The EA traded on the USDCAD pair on the H1 chart during this 2015-2022 backtest period using a $1000 deposit. As a result, it implemented 2851 orders and attained a profitability rate of 74.98%. The realized profit amount was $9626.36. From the profit factor of 1.79, it is apparent that the system was relatively lucrative. However, a drawdown of 33.76% was reported, indicating that risky trading was involved. The average profit trade was $9.70, while the average loss trade was -$20.02.

What about MyForexPath real trading results

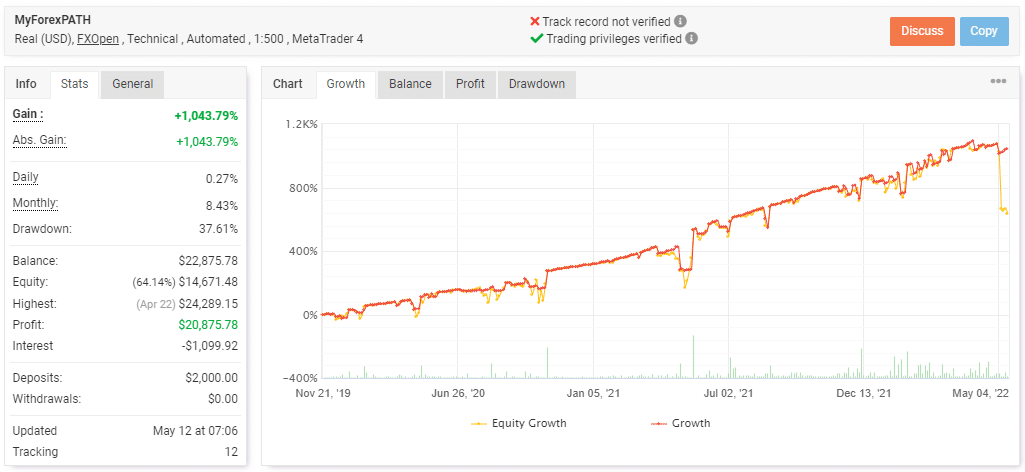

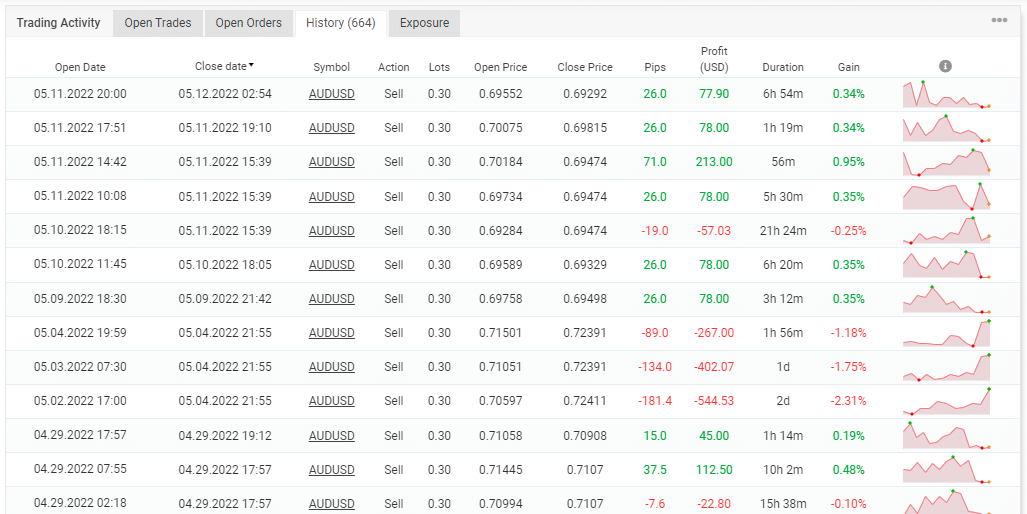

As you can see from the screenshot above, the system has been managing a live account on Myfxbook since November 2019. From a deposit of $2000, a large profit amount of $20875.78 was realized, increasing the balance to $22875.78. The account’s value also increased significantly—1043.79%. A large drawdown was (37.61%) recorded, further highlighting the risky nature of the strategy used.

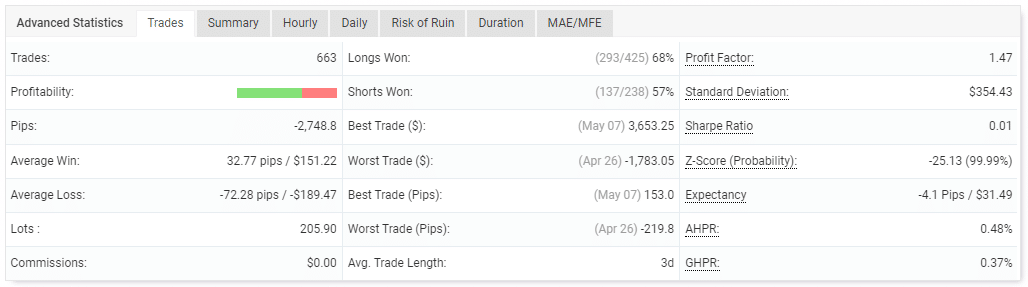

The EA implemented 663 trades, but the higher average loss (-72.28 pips) value against the average win (32.77 pips) shows a high losing streak. The performance of the long (68%) and short (57%) trades was poor, demonstrating the low profitability of the system. On average, a position was held for 3 days, and from the 205.90 traded lots, we can tell that the EA used large lot sizes. Losses amounting to -2748.8 pips were reported.

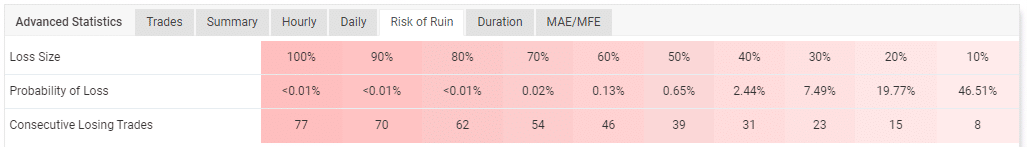

The EA’s risky trading activities substantially increased this account’s risk of ruin.

The system placed grids of orders and made profits and losses in the process. It worked with both short and long time frames.

Customer reviews

Customers have not commented about this system, including the viability of its strategy, efficiency, performance, etc. Therefore, you will be hugely disappointed if you are that trader that relies on other people’s opinions to make a purchase decision.

MyForexPath Review Summary

MyForexPath-

Functionality4/5 GoodThe system includes simple-to-use features.

-

Trading strategy3/5 NeutralTwo strategies are integrated into the bot, but one of them (the grid) is relatively risky.

-

Live Results3/5 NeutralThe performance of the EA is average because it is still able to make consistent profits even if it trades dangerously.

-

Customer Support4/5 GoodCustomer support is provided round the clock.

-

Customer Reviews2/5 BadUser testimonials are missing, so customers' experiences with the product remain a mystery.

The Good

- Provides a 30-day refund policy

- Backtest and live trading results are present

- Offers a user manual

- Cost-friendly

The Bad

- Large drawdown

- Grid on the board

- Poor risk/reward ratio

- Lack of vendor transparency