Gold Miner is a trading solution that trades Gold and tries to survive on the market and to be profitable. The system is published on the MQL5 market. People show a middle interest in it. NGUYEN NGHIEM DUY is a developer from Viet Nam with no experience on MQL5. His products have a 4.1 rate based on 40 reviews.

Gold Miner at a glance

We have gathered the most important information in the table:

| Price | $30, $49 |

| Trading Platforms | MT4 and MT5 |

| Currency Pairs | XAU/USD, GBP/USD, USD/CAD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, and NZD/USD. |

| Strategy | Grid, Martingale |

| Timeframe | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

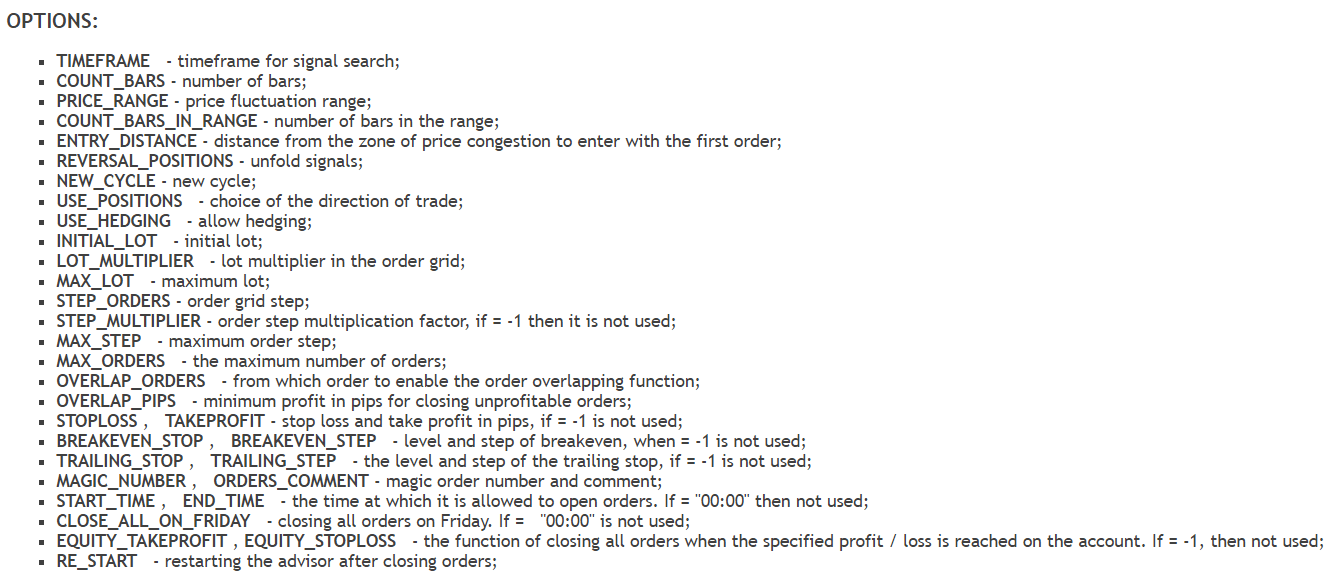

Gold Miner functionality

The presentation is short, and we’d like to say it’s poor. It was hard to gather everything up.

- The system trades automatically for us.

- The strategy is based on “the search for areas of concentration of prices of large buyers and sellers.”

- The system is based on the Grid or orders strategy.

- The advisor can recover after losses.

- It keeps deals open for a short period of time.

- There should be a Martingale feature.

- There are eight pairs allowed to trade where Gold is the main one: XAU/USD, GBP/USD, USD/CAD, EUR/USD, USD/JPY, USD/CHF, AUD/USD, and NZD/USD.

- There’s a Friday exit feature to close deals before Monday’s wild moves.

- It places Take Profit and Stop Loss levels for each open order.

- The developer suggests we use the system with an indicator as well.

- It can be used on MT4 and MT5 platforms.

- The system can be used only on a Hedge account.

- There are Grid and Martingale features.

- The Trailing Stop Loss protects profits from the rough moves.

- The MT4 or MT5 terminal can be automatically restarted.

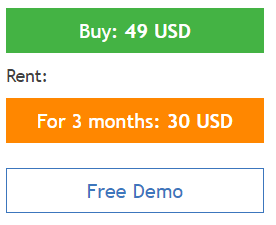

We can purchase a copy of the robot for $49. It’s a cheap offer. So, it cannot be a well-designed trading solution. There’s a 3-month rental option for $30. We may download a demo copy of the system for free.

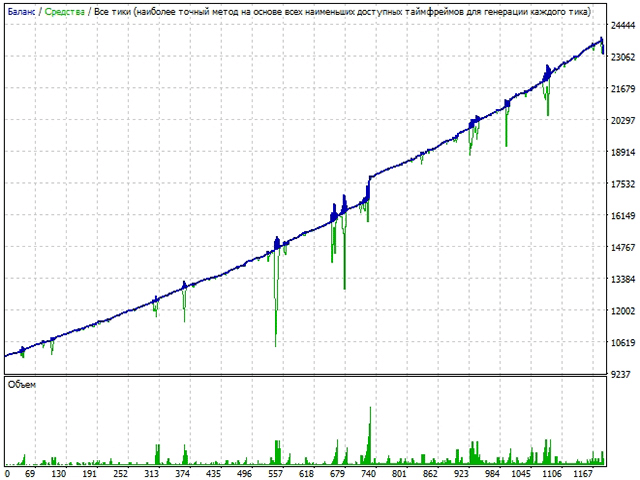

Gold Miner trading strategy tests

We don’t have a backtest report as a final table with the data we can check. It’s not professional because we don’t know what results the system achieved on the past broker data.

What about Gold Miner live trading results

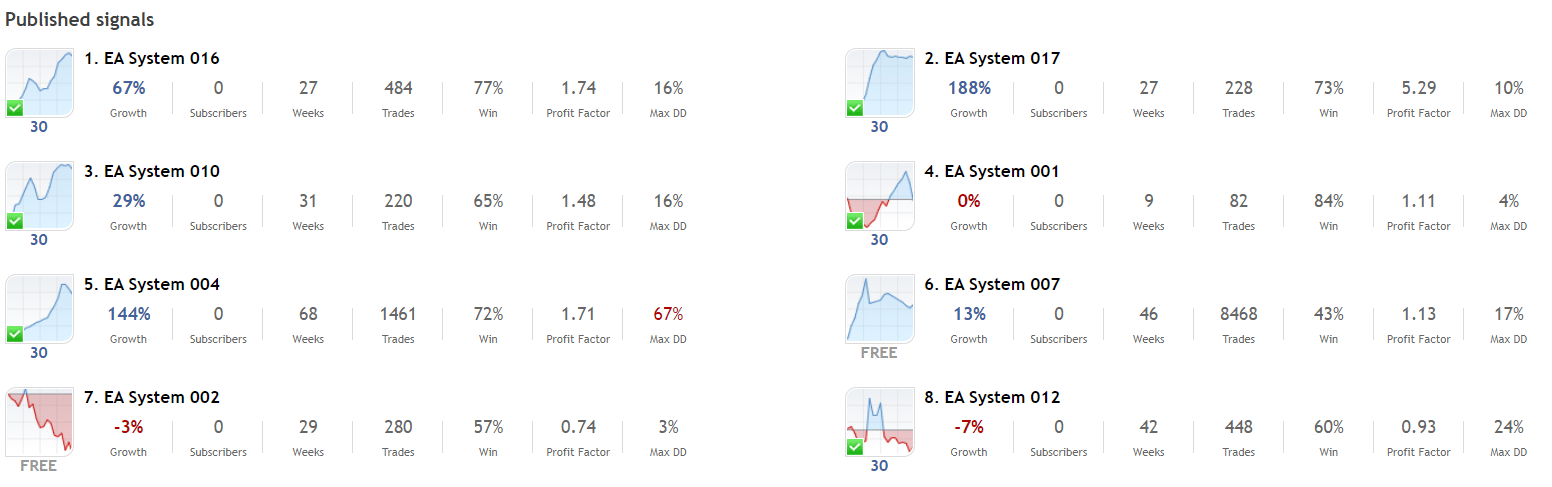

There are many accounts connected. Their numbers decreased three times for several months.

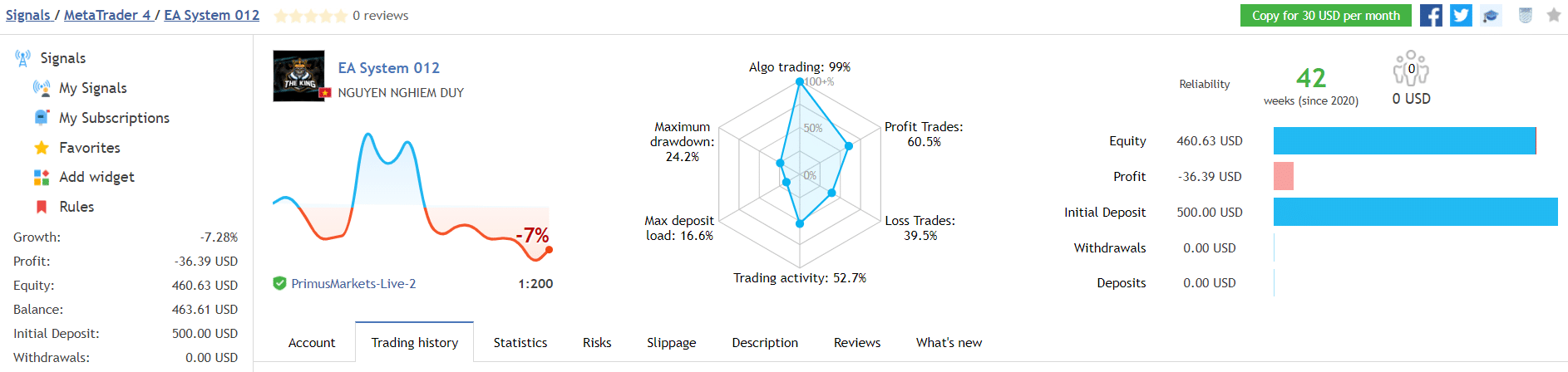

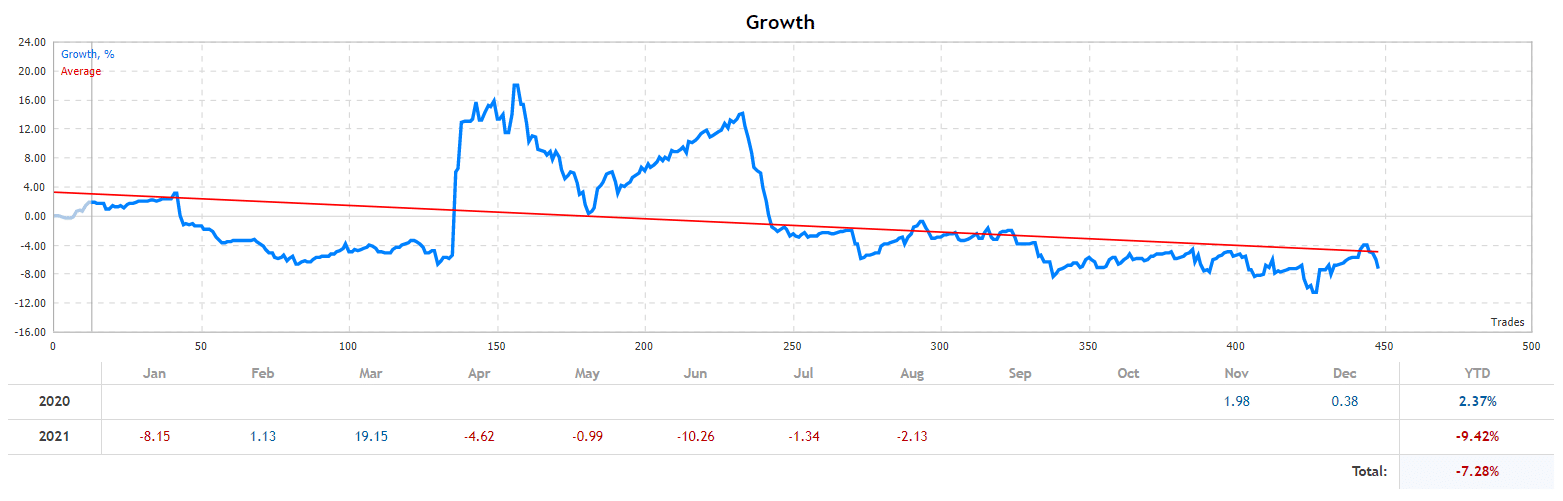

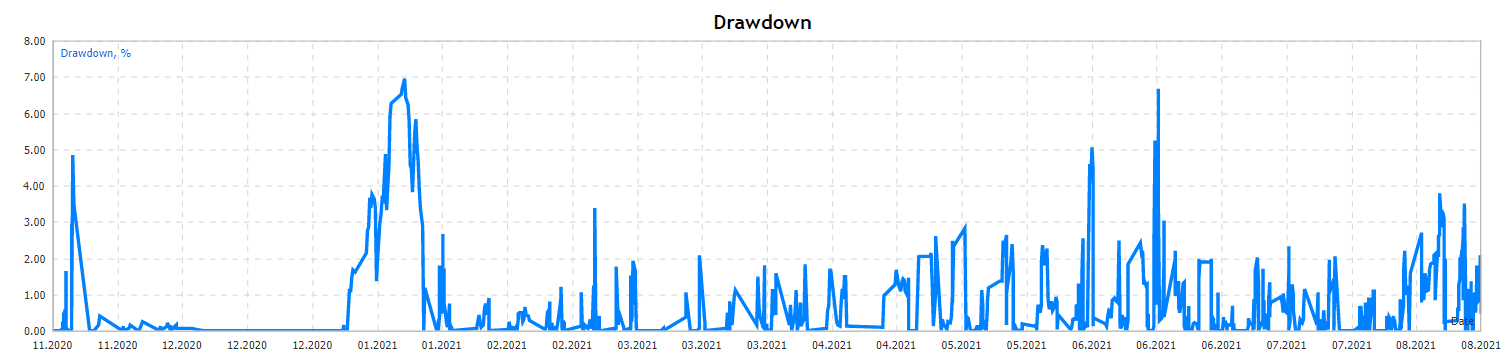

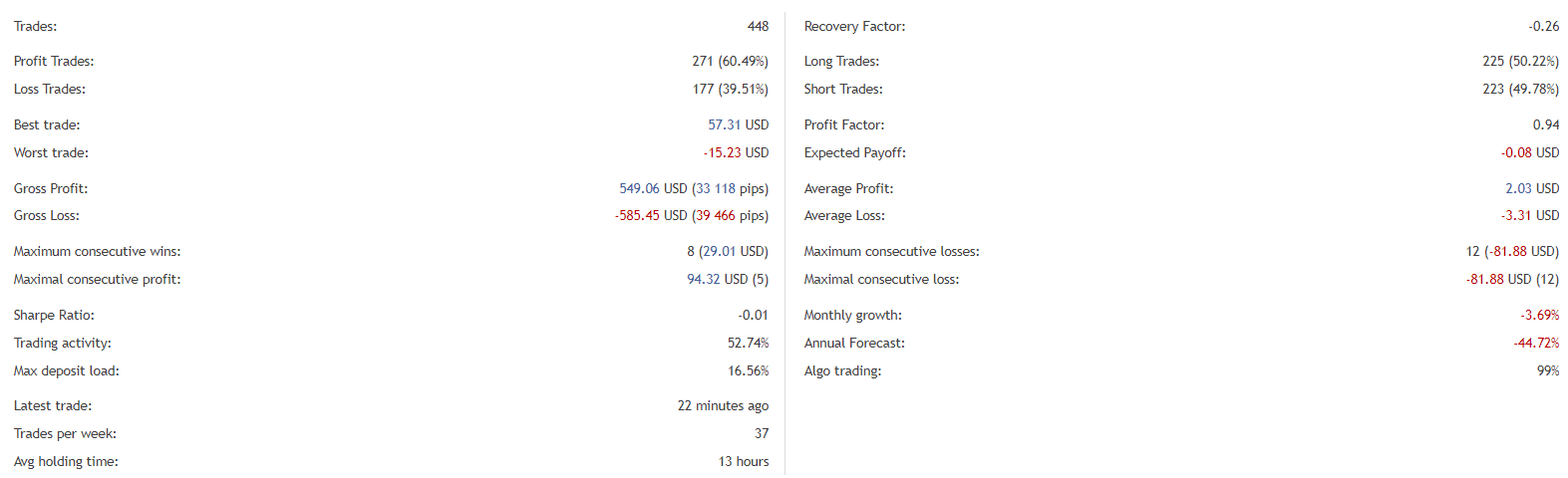

We have a live account on PrimusMarkets where the system works with 1:200 leverage automatically. The maximum drawdown is 24.2%. The maximum deposit load is 16.6%. The accuracy rate is 60.5%. It is impossibly low. The account is live for 42 weeks. The absolute growth is -7.2%.

The system is a scam and doesn’t look like a stable trading solution.

The EA works with low drawdowns.

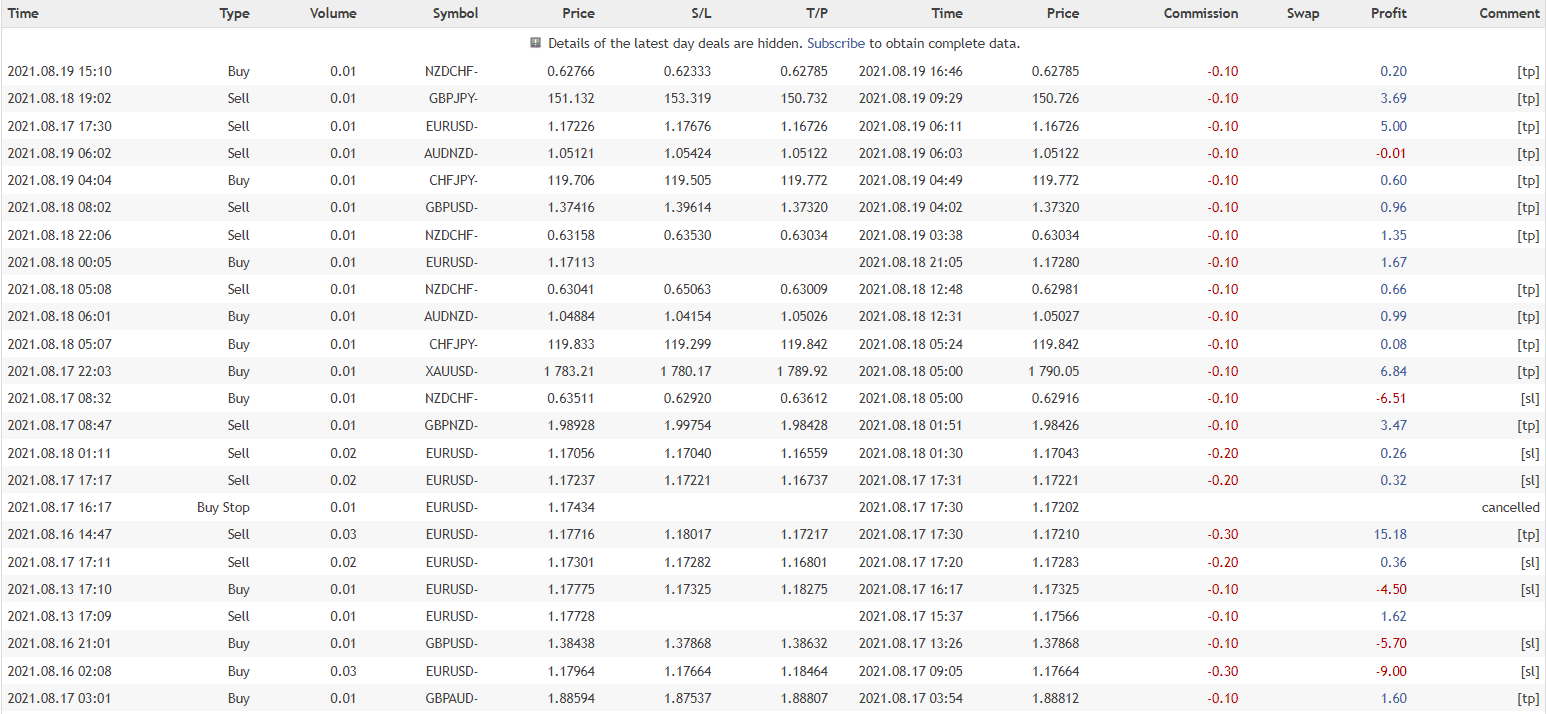

The system uses Martingale on Grids of orders.

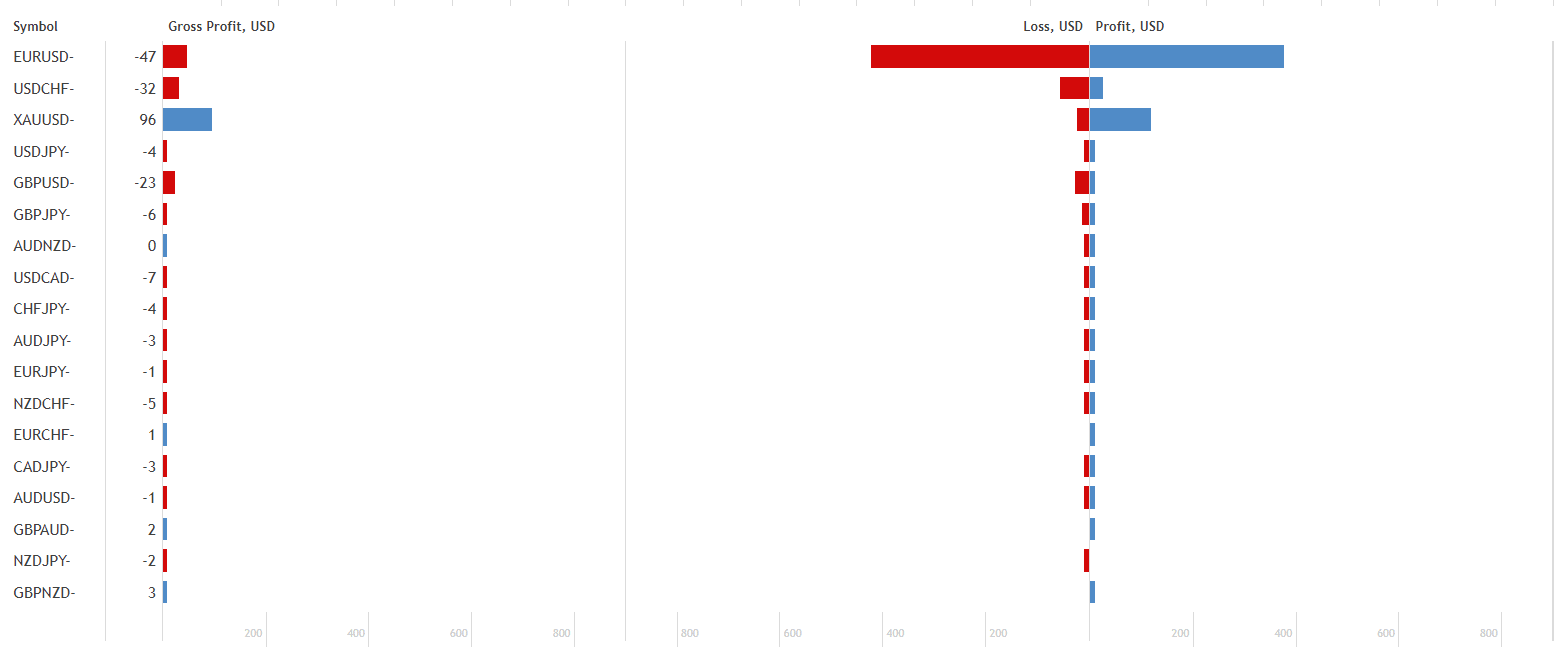

There were 448 deals traded. The best trade is $57.31 when the worst trade is -$15.23. The gross profit is $549.06 when the gross loss is -$585.45. The maximum consecutive wins is eight deals. The system traded 37 deals weekly. An average trade length is 13 hours. The recovery factor is -0.26. The profit factor is only 0.94. An average monthly gain is 0.10% when an expected annual profit is -44.72%.

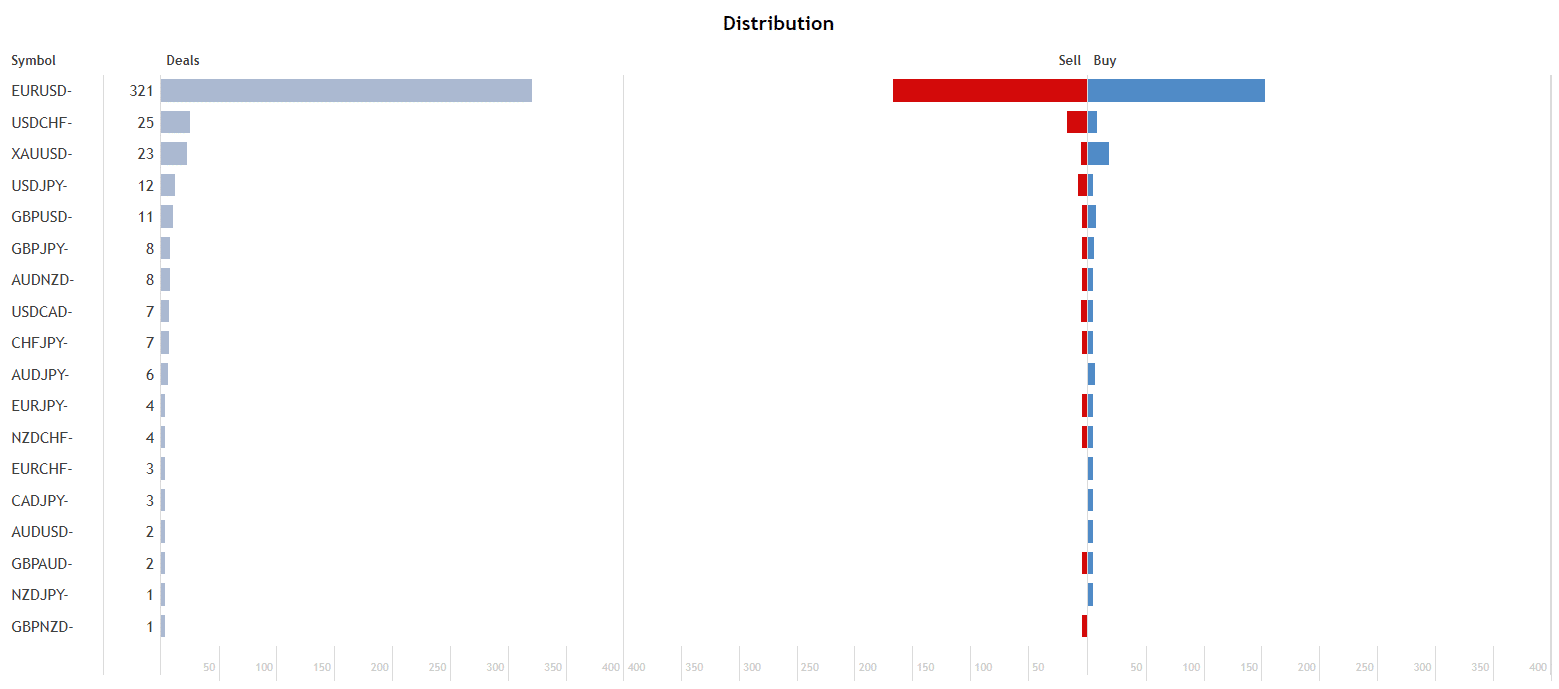

Most orders were closed on EURUSD.

We may note that only the Gold pair is profitable.

The MQL5 bot warms the system periodically because of various reasons.

We would like to note

The system has only one testimonial that is positive. We can’t rely on it because it’s not representative.

Gold Miner Review Summary

Gold Miner-

Functionality2/5 BadThe system has a below-average functionality.

-

Trading strategy2/5 BadThe system trades based on a Grid with Martingale.

-

Live results1/5 AwfullyThe results are horrible.

-

Customer support3/5 NeutralThe support is average.

-

User reviews2/5 BadWe have only 1 review.

The Good

- Affordable pricing

- Trading results provided

The Bad

- No risk or money management advice given

- No backtest reports provided

- Horrible trading results

- No clients’ testimonials published