Assuring automated trading with the best expert advisors Forex Robot Trader claims that they have been coded to perfection. The company states that it has seen a profit of more than 42345 pips with its FX robots in a month. FRT promotes several FX robots and each of them uses a different trading approach for the trades.

Founded by Don Steinitz, with the simple goal of providing the best FX robots and indicators for newbie traders as well as professional traders. In the About Us section, Don Steinitz reveals the story of how he started as a computer operator and ended up learning about Forex trading to start the basic design of the Steinitz HAS MTF Robot. Besides Steinitz, the company includes a team of many skilled programmers specializing in MQL code. The developer does not provide location info or phone contact. An online contact form is the only support option available.

Forex Robot Trader at a Glance

| Price | $49 to $129 |

| Trading Platforms | MT4 |

| Currency Pairs | Multiple currency pairs |

| Strategy | Grid, Trend trading, and more |

| Timeframe | H1, H4 |

| Recommended Deposit | Starts from $250 |

| Recommended Leverage | N/A |

| Money Management | Yes |

Forex Robot Trader Functionality

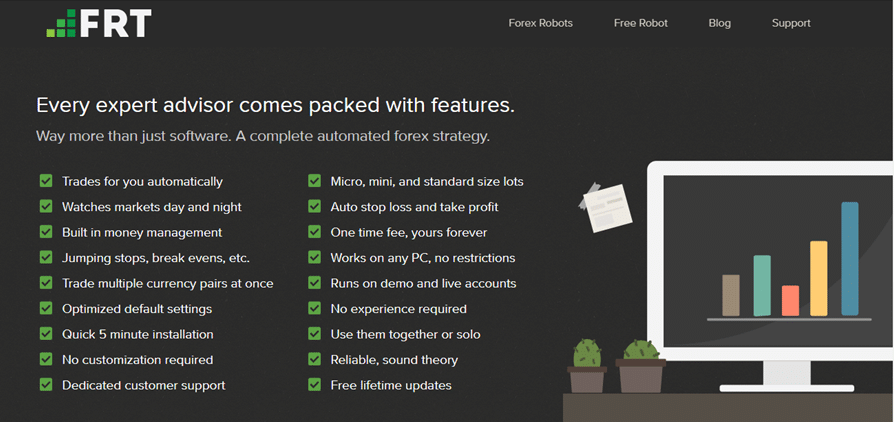

From the info provided on the official site, the FX robots by this company are packed with various features that ensure a full-fledged automated trading approach. Some of the features mentioned include automatic trades, continuous market watch, inbuilt money management, trading of multiple currency pairs simultaneously, dedicated support, and a 5-minute setup. The software does not need any customization as all default settings are optimized.

A one-time fee is charged for use of the EAs and they can be used independently or together. All trading parameters including TP and SL are automated and lots are of micro, mini, and standard sizes.

Forex Robot Trader Trading Strategy Tests

As per the vendor information, the approaches used by the EAs are of the highest quality. The trading approach used is from testing the profitable manual system the developer has had for several years. Strategies such as grid, trend trading, and Fibonacci are used for the different FX EAs of this company.

With the help of the software design, a trader can identify the best trades easily and manage the stops and closure. Although the developer mentions the trading approach used, he does not elaborate on them which is disappointing. Furthermore, no backtests are provided for finding the efficacy of the approach used. This raises a red flag.

What About Forex Robot Trader Live Trading Results?

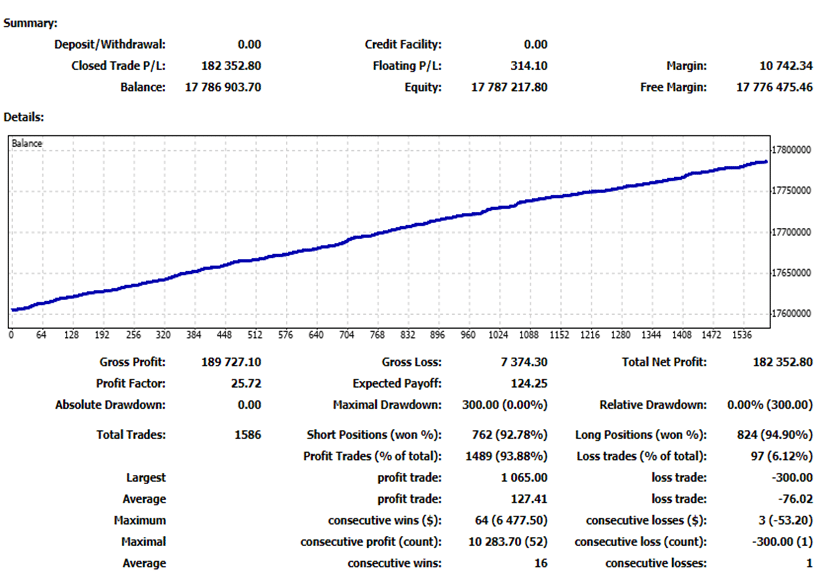

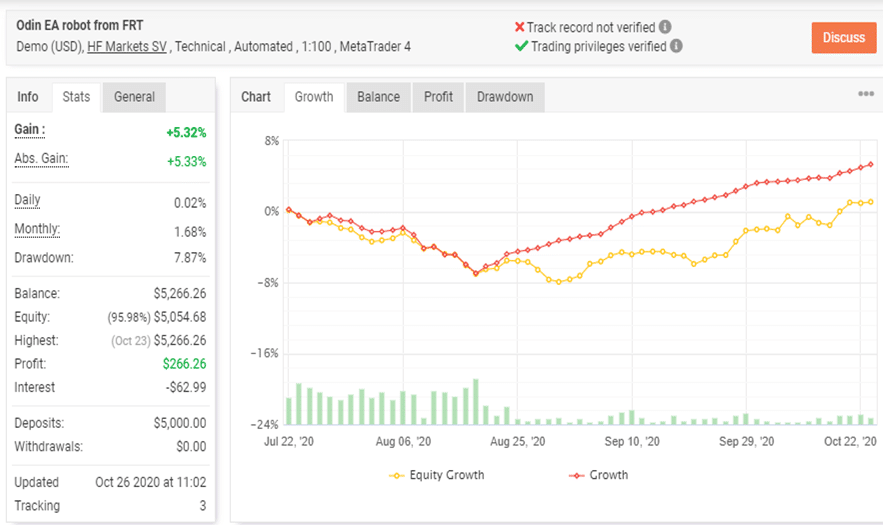

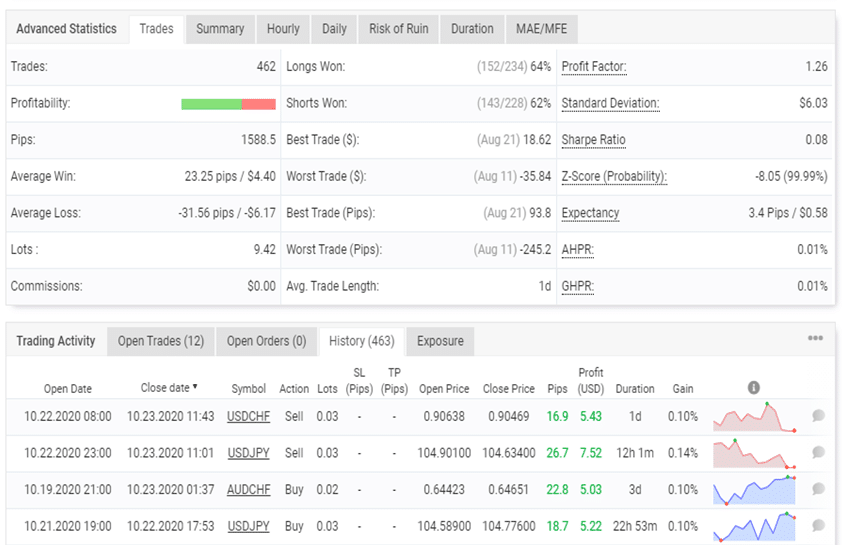

The vendor provides live trade results for all the FX robots. But these are not verified results so we are unable to glean useful info from them. However, we found a demo USD account of Odin EA on the myfxbook site with verified trading privileges and an unverified track record. Here are a couple of screenshots of the trading stats:

From the above stats, we could see the demo USD account uses the leverage of 1:100 on the MT4 platform. For a deposit of $5000, a total profit of 5.32% and an absolute gain of 5.32% are revealed. The drawdown is 7.87% and the daily and monthly gains are 0.02% and 1.68%. A total of 462 trades have been executed for the trading duration from July 22, 2020, up to October 22, 2020. The profit factor value is 1.26 and the trading history reveals lot sizes ranging from 0.02 up to 0.03. It is clear from the stats that the system is not using an effective approach and fails to provide decent profits.

Forex Robot Trader Conclusion

Forex Robot Trader Review Summary-

Functionality:4/10 PassablyInsufficient information provided about the EAs, their working method, and features.

-

Trading strategy:5/10 NeutralLack of proper explanation on the strategy used and its effectiveness.

-

Live results:5/10 NeutralNo verified live results provided for the EAs.

-

Customer support:4/10 PassablyAn online contact form is the only support option present.

-

User reviews:4/10 PassablyNo user reviews found on reputed sites like Forexpeacearmy, Trustpilot, etc.

The Good

- Automated trade settings

- Single upfront fee

The Bad

- Poor Performance

- Vendor transparency is absent

- Insufficient customer support