The vendor of XFXea says that the goal of this robot is to bring constant profits no matter the situation of the market. The devs also want us to believe that the EA doesn’t have loss periods. Even when losses are made, XFXea covers them by utilizing a special algorithm. Unfortunately, the aforementioned statements are misleading. We have learned that the system uses a risky trading style-the grid. So, your account won’t be safe while using it.

XFXea is the product of Forexstore.com. Unfortunately, nothing is known about this company. There’s no information about its physical address, contact details, historical background, or the names and profiles of its development team. You should be wary of vendors like this who lack openness. There’s no way of holding them accountable in case they do not deliver the product or mismanage your investment or even fail to give you a refund.

XFXea at a glance

| Price | $260 |

| Trading platforms | MT4/5 |

| Currency pairs | AUDUSD and EURUSD |

| Strategy | Grid |

| Timeframe | N/A |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | N/A |

XFXea functionality

The EA also comes with the following features:

- User manual

- Free updates

- Around the clock customer support

- A 30-day money-back guarantee.

XFXea trading strategy tests

The devs say that XFXea computes an entry point by assessing in a special way a certain number of bars and then creates an important range. It then determines how and when to begin trading based on this range. In short, the professionals are describing the grid strategy.

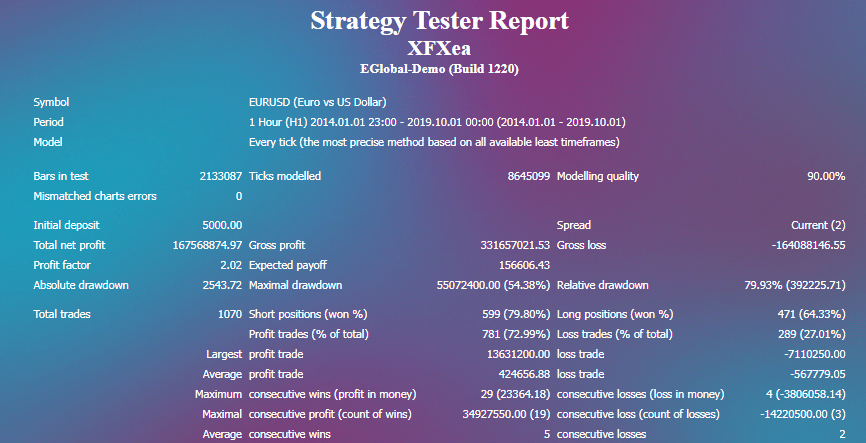

The backtesting results for this robot are available. As you can see below, we have a strategy tester report for the EURUSD currency pair. The EA conducted 1070 trades with it using the 1 hour timeframe. Between January 2014 and October 2019, a profit of $167,568,874.97 was made from a deposit of $5,000. It means that on average, the system generated about 33.5 million profits annually, an amount that is hard to achieve in the real market.

There was a massive drawdown of 54.38%. This could only mean one thing-the strategy in play was very dangerous. The short positions didn’t perform that well — 79.80%. The performance of the long trades was worse — 64.33%.

What about XFXea live trading results

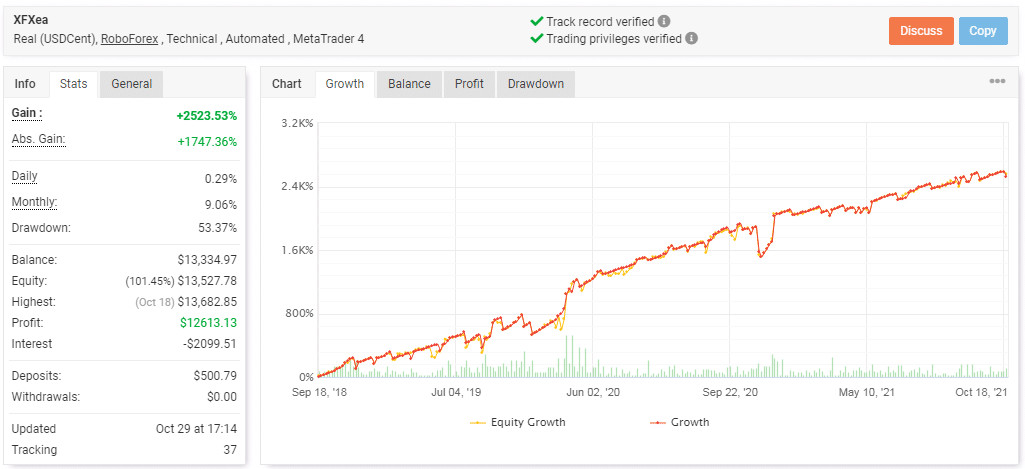

We appreciate that the devs have opened an account on Myfxbook, which allows traders to track how the robot performs in the real world. Now let’s see whether the above past results are reflected in live trading.

As we look at the live data above, the insane profits reported during the backtesting period have not been replicated here. The EA has managed to make a profit of $12,613.13 within 3 years of trading. However, the sky-high drawdown (53.37%) is almost similar to the one in the backtest report. We are afraid that the devs didn’t improve the strategy, and now it has drained more than half of the capital in this account. The risk reward ratio (5:1) is also very poor.

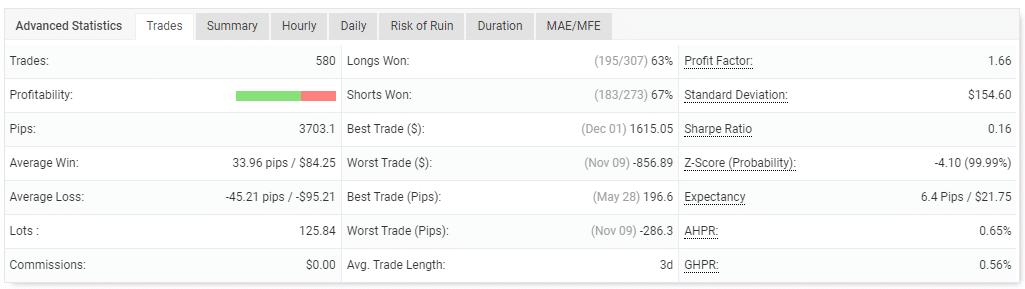

The robot has a low trading frequency. We can see it has an average trade length of 3 days, and so far ,only 580 trades have been implemented. The performance of the long — 63% and short trades — 67% are worse compared to the historical performance data. The same can be said about the profit factor, which is 1.66. We have more loss rates (-45.21 pips) than win rates (33.96 pips).

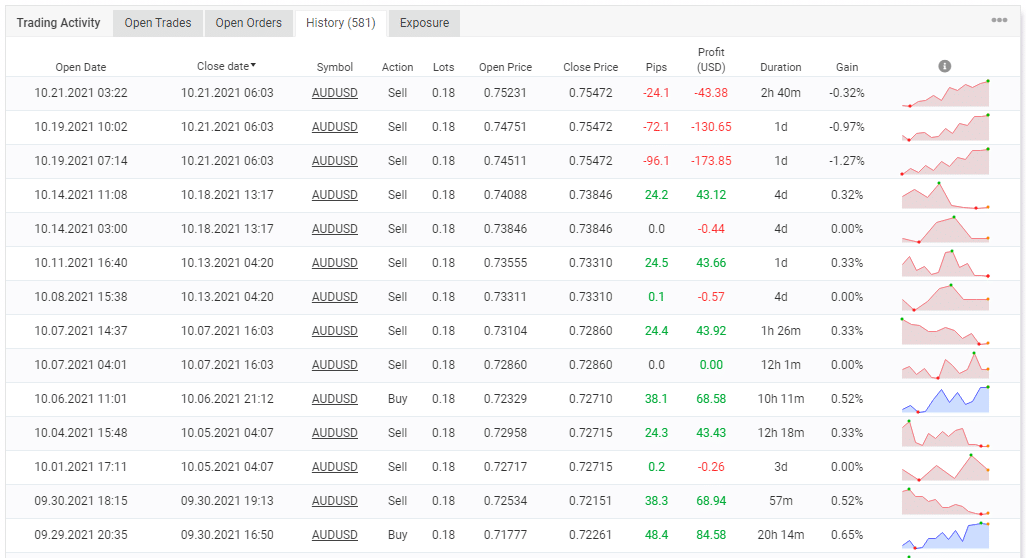

The grid strategy and the big lot sizes used to trade the AUDUSD pair are apparent. Some significant losses have been made.

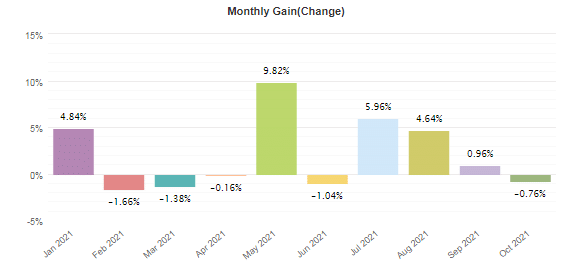

The EA has not generated substantial profits since January.

Customer reviews

Customer reviews for this robot are missing. There are no testimonials on platforms like Trustpilot, Myfxbook, FPA, or Quora. This tells us that few, if any, customers are presently using this EA for their trading purposes. We find this suspicious, considering that XFXea has been trading in the live market since 2018.

XFXea Review Summary

XFXea-

Functionality2/5 BadThe devs fail to disclose some important features of the robot, such as the timeframe, recommended minimum deposit, and leverage.

-

Trading strategy2/5 BadThe approach used generates a high drawdown.

-

Live results2/5 BadThe EA performs badly, as shown by poor win rates and low profitability rate.

-

Customer support4/5 GoodThe vendor offers 24/7 customer support.

-

User reviews2/5 BadNo customers have reviewed this EA.

The Good

- Live trading stats are featured

- Backtest results are available

The Bad

- Vendor transparency is lacking

- Low rate of profitability

- Grid on board

- No customer feedback