Vigorous EA is a robot that trades up to 100 times every week and is supported by 21 years’ worth of backtesting data. As per vendor claims, it has a record of consistently generating profits in the live market, however, this is something we need to verify independently.

On the official website of Vigorous EA, we have the link to a live trading account, along with a list of all the main features. The vendor has also shared the backtesting results and has uploaded a video that covers what the EA is about and how it functions. Finally, we have the pricing details and a risk disclosure statement from the vendor.

Vigorous is a product from Ryan Brown and the Responsible Forex Trading team. Brown is an American trader who has developed several EA algorithms over the years. The only contact information available on the website is the email address. Other products from this vendor include RFT EA Bundle and Pinpoint EA.

Vigorous EA at a Glance

| Price | $247 |

| Trading Platforms | MT4 |

| Currency Pairs | EUR/USD |

| Strategy | Scalping |

| Timeframe | N/A |

| Recommended Deposit | $5000 |

| Recommended Leverage | 200:1 |

| Money Management | Yes |

Vigorous EA Functionality

On an average, this EA places 11 trades daily. The average length of each trade is 2 hours, and only 3-8 pips profits are taken from each trade basket. According to the vendor, the EA has completed more than 65,000 trades since 2005.

This is a robot that only uses the longer timeframes for placing its trades. It looks for scalping positions within the dips of the major trend. While the trend is active, the EA uses a flex-grid money management feature.

It is recommended that you start with an account size of $5k while trading with this robot. Every week, the robot places 50-100 scalp trades.

Vigorous EA Trading Strategy Tests

Vigorous EA is a scalping bot that tries to take advantage of the small price differences between currency pairs. Since it only generates small profits from each trade, it needs to conduct several trades before a sizable profit can be made. This trading strategy can be tiresome for some individuals since it requires you to keep the system active 24.7. Also, since there are only a few scalping positions available on the market every day, you need to adhere to a tight schedule.

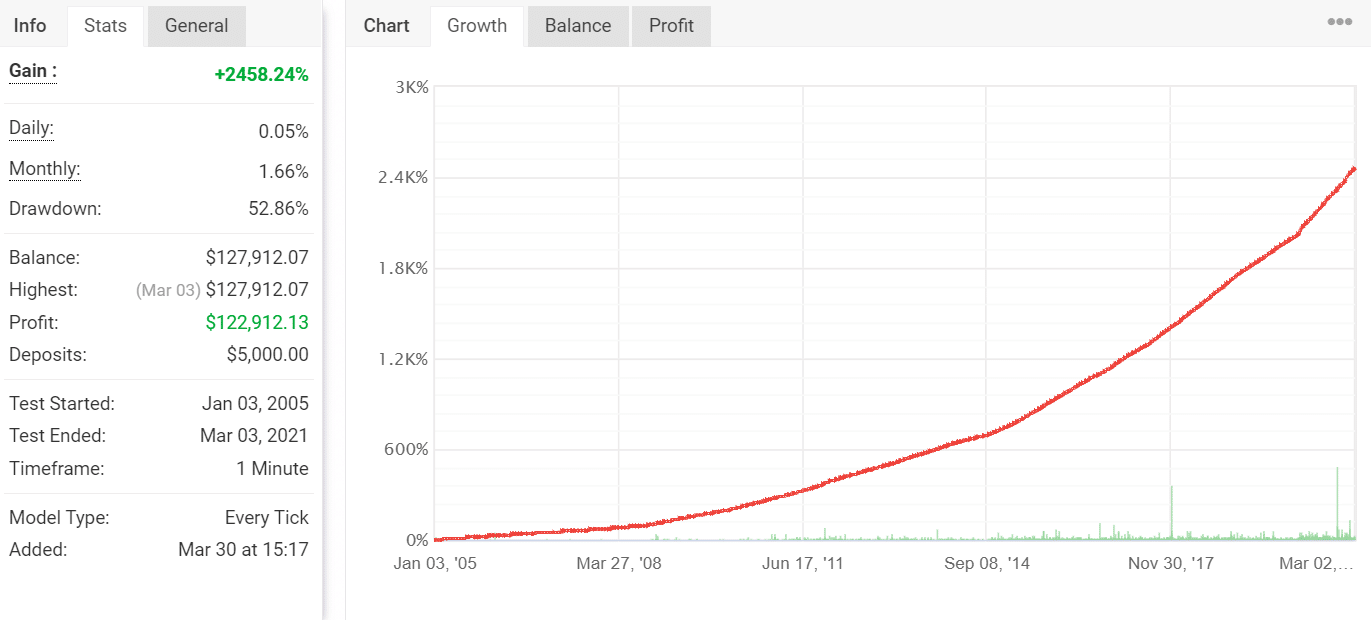

Here we have the results for a backtest that was conducted for Vigorous EA starting from January 03, 2005, to March 03, 2021. The EA used an initial deposit of $5000 for this test, from which it generated a total profit of $122,912.13. It placed a total of 65,733 trades during this time period, winning 75% out of them.

For this backtest, the EA had daily and monthly gains of 0.05% and 1.66% respectively, while the drawdown was 52.86%. Such a high drawdown indicates a dangerous trading scheme that can lead to large losses.

What about Vigorous EA live trading results

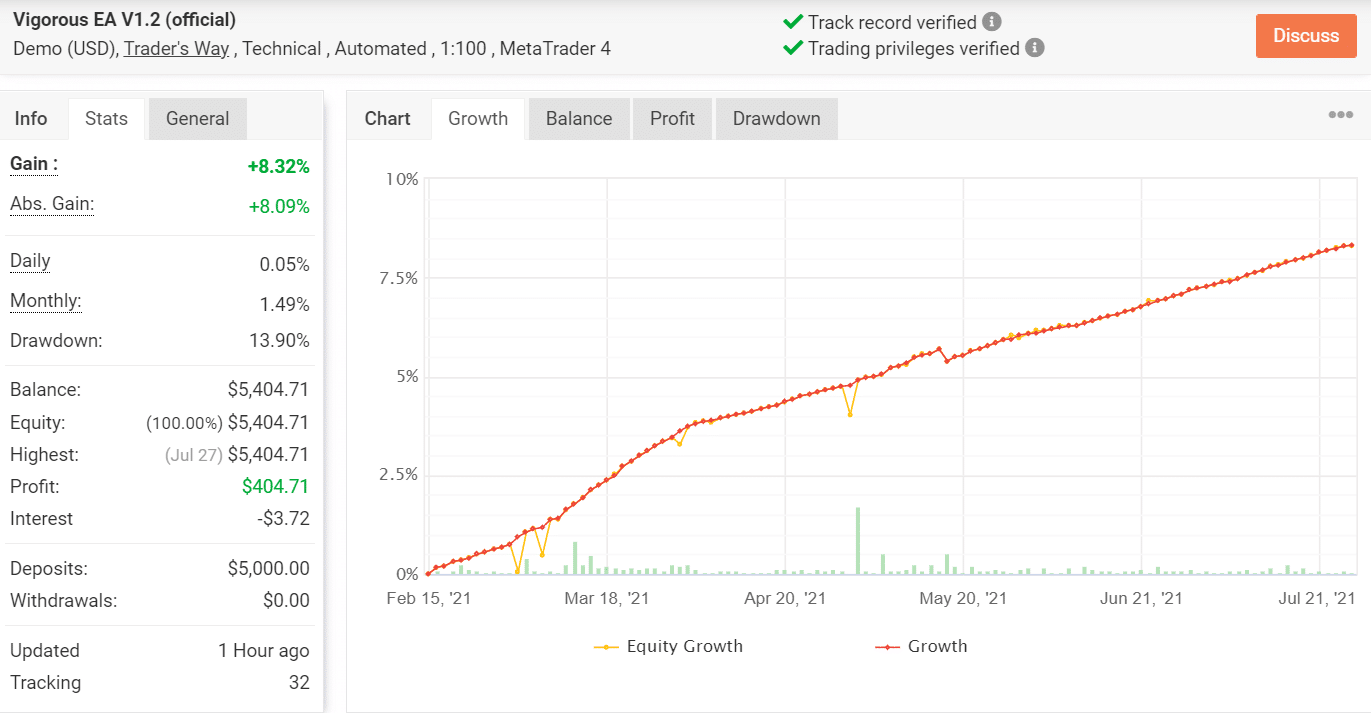

This is a live trading account for Vigorous EA on the Myfxbook website. It was launched on February 15, 2021, so it doesn’t really have a long trading history. On the official website, the vendor claims that the average monthly profit is 1.56%, but here we can see it is only 1.49%. After several months of trading, the EA has generated a small profit of $404.71, so we cannot consider it a profitable system.

User Reviews

We were unable to find any user reviews for Vigorous EA on trusted third-party review websites. Therefore, it is quite evident that not many are using this EA as of now. It seems like the robot suffers from a lack of reputation.

Vigorous EA review summary

Vigorous EA-

Functionality2/5 BadMoney management setting allows for the adjustment of trading lots in an attempt to control the risk.

-

Trading Strategy1/5 AwfullyVigorous EA uses the scalping strategy that is only suitable for winning minor profits.

-

Live Results1/5 AwfullyThe trading history is pretty short, and the profit generated is quite small.

-

Customer Support2/5 BadCustomer support is provided via email and live chat.

-

User Reviews1/5 AwfullyThere are no verified user reviews for this expert advisor.

The Good

- Live trading results available

- Backtesting results available

The Bad

- No money-back guarantee

- Low profits during live trading

- Short trading history