| Forex EA Robot | Min. deposit | Win rate | Price | Refund | Currency pairs | Learn more |

|---|---|---|---|---|---|---|

| 1. TechBerry | $5000 | 96% | $0-499 | 14 days trial | All |  |

| 2. GPS Forex Robot | $250 | 94% | $149 | 60 days | EUR/USD, EUR/GBP, GBP/USD, USD/CHF |  |

| 3. Wallstreet Forex Robot | $100 | 79% | $267 | 60 days | AUD/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, GBP/USD, EUR/USD |  |

| 4. Forex Fury | $100 | 100% | $229 | 60 days | AUD/CAD, GBP/USD, USD/JPY, EUR/USD, USD/JPY, USD/CHF |  |

| 5. Forex Flex EA | $1000 | 68% | $399 | 30 days | All |  |

| 6. Forex Steam | $300 | – | $117 | – | EUR/USD |  |

| 7. Forex Robotron | $50 | 81% | $299 | – | All |  |

| 8. FX Fortnite | $1000 | 72% | $149 | 30 days | EUR/CHF |  |

| 9. Forex Scalping EA | Any | 87% | $100 | – | AUD/NZD, AUD/USD, CAD/CHF, CHF/JPY, EUR/AUD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/CHF, GBP/USD, USD/CAD, USD/CHF, USD/JPY |  |

| 10. FXStabilizer | – | 65% | $539 | 30 days | EUR/USD, AUD/USD, CHF/JPY, EUR/JPY, USD/CAD, USD/JPY, GBP/CHF, EUR/GBP |  |

The Forex market is a dynamic environment. The conditions keep changing constantly and there are several factors that affect the trading opportunities. To avoid the stress, some individuals opt for Forex expert advisors. Here we shall discuss what is EA in Forex and what are the best products available on the market.

What is a Forex robot?

A Forex robot is a software program capable of conducting trading operations. It notifies you when there is a lucrative trading opportunity. They can scan the market 24*7 analyzing technical patterns. You can program them to place trades automatically. For this, you need to enter some parameters based on which the system will make its decisions. Alternatively, you can use them to know about profitable opportunities and then enter the trade manually.

How does it function?

A trading robot works on a trading platform, usually MT4 or MT5. Programmers use the MQL language to create these systems. They work on the basis of mathematical rules, finding optimum entry points using trading signals. To make informed decisions, they must analyze the market data. What kind of data they analyze depends entirely on the programming. Apart from automating the whole process, they also eliminate emotional bias.

Are Forex EAs legit?

Yes, most Forex EAs are legit. Reliable vendors test their systems using historical data as well as live data. There are systems that allow you to maintain a steady source of passive income. At the same time, there are a few scam services available on the market.

So what are the best forex robots for 2022?

1. TechBerry

TechBerry is an advanced neural trading algorithm that calculates incoming data from over 100k portfolios in a split second. While using the information, it formulates a high win rate strategy that can generate over 10% each month with a low drawdown.

| Min. deposit – $5000 |

| Win rate – 96% win rate based on a verified trading account |

| Price – Membership from $0 to $499 |

| Money refund – 14 trial |

| Currency Pairs – All trading instruments available in MT4/5 |

The trading stats of TechBerry is public on the website, ensuring transparency. The social trading platform supports over 50 regulated brokers and keeps your funds secure through FIDC-insured banks.

Subscribers only need to pay a small annual fee to access one of the best copy trading systems in the financial markets. The service costs can be as low as 15% for the Infinite plan.

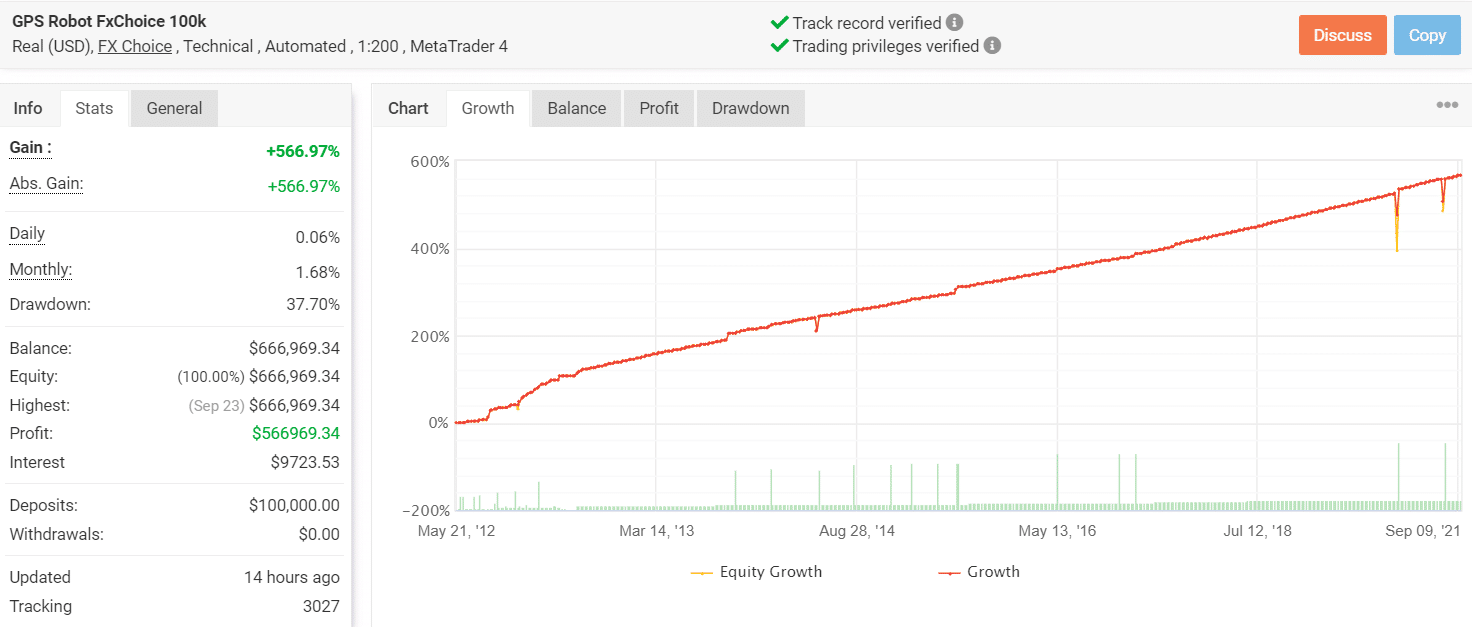

2. GPS Forex Robot

This is a robust system capable of adjusting to different market conditions. It follows a reverse strategy, placing trades in the opposite direction of the trend to make up for losses.

| Min. deposit – $250 |

| Win rate – 94% win rate based on a verified trading account |

| Price – $149 |

| Money refund – 60 days |

| Currency Pairs – EUR/USD, EUR/GBP, GBP/USD, USD/CHF |

After conducting 500 trades, the EA has a win rate of 94% on a verified account. It follows a low-frequency trading approach, only picking the profitable opportunities. This has allowed it to earn a huge profit of $566969.34.

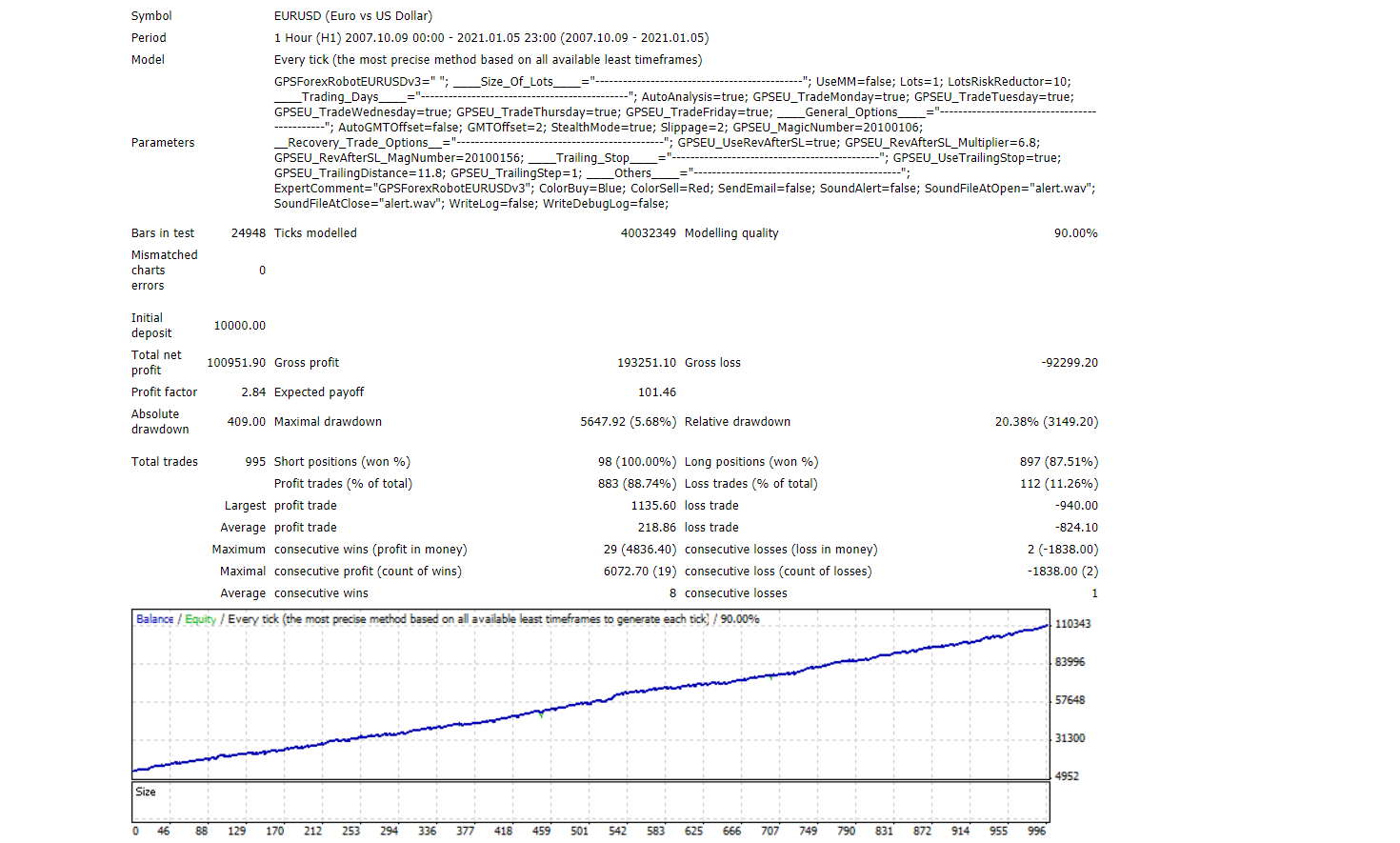

The EA managed 29 maximum consecutive wins for this backtest. Here, we can see a high win rate of 88.74%. The profit factor of 2.84 is higher than the live statistics where it is 2.01.

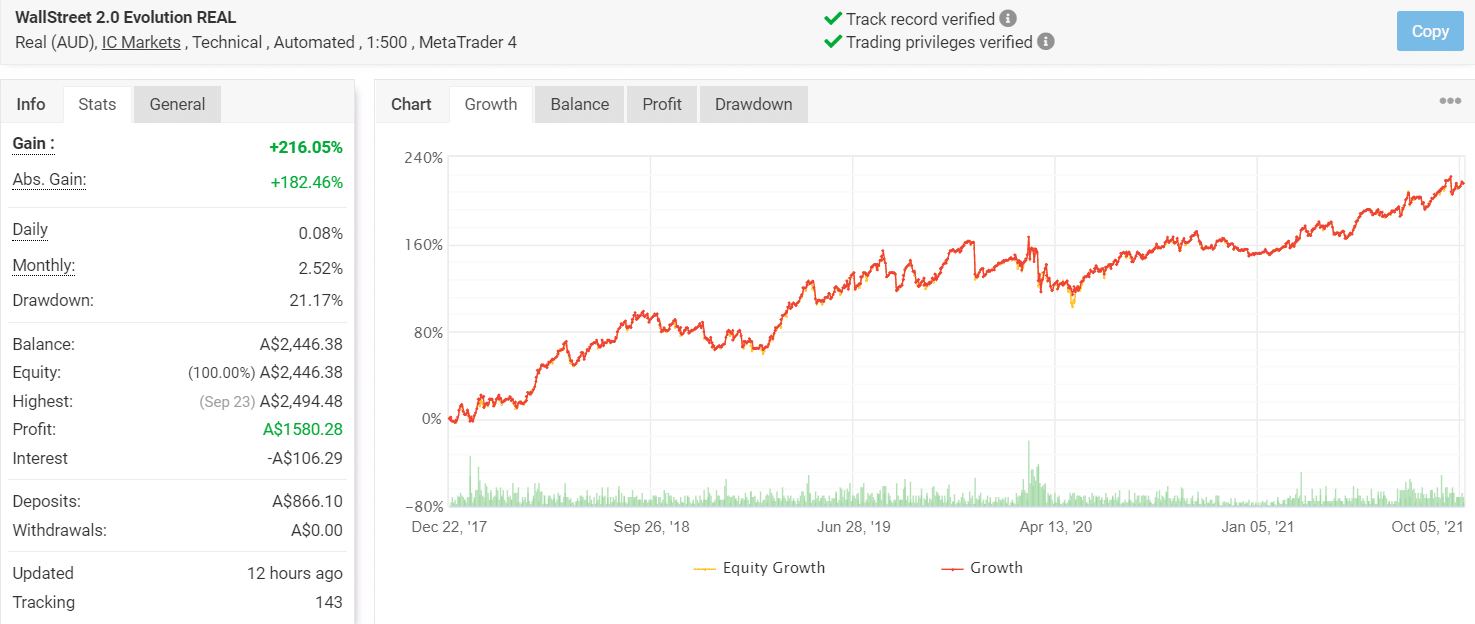

3. Wallstreet Forex Robot

The best feature of this EA is the broker spy module that prevents dishonest brokers from seeing your stop-loss levels. With this system, you can trade with a fixed lot or activate the standard risk management feature. It trades in multiple pairs and works on different account types.

| Min. deposit – $100 |

| Win rate – 79% win rate based on live trading results |

| Price – $267 |

| Money refund – 60 days |

| Currency Pairs – AUD/USD, NZD/USD, USD/CAD, USD/CHF, USD/JPY, GBP/USD, EUR/USD |

For the live trading account, Wallstreet Forex robot has a high win rate of 79%. The account has been active since 2017 and has a decent profit factor of 1.15.

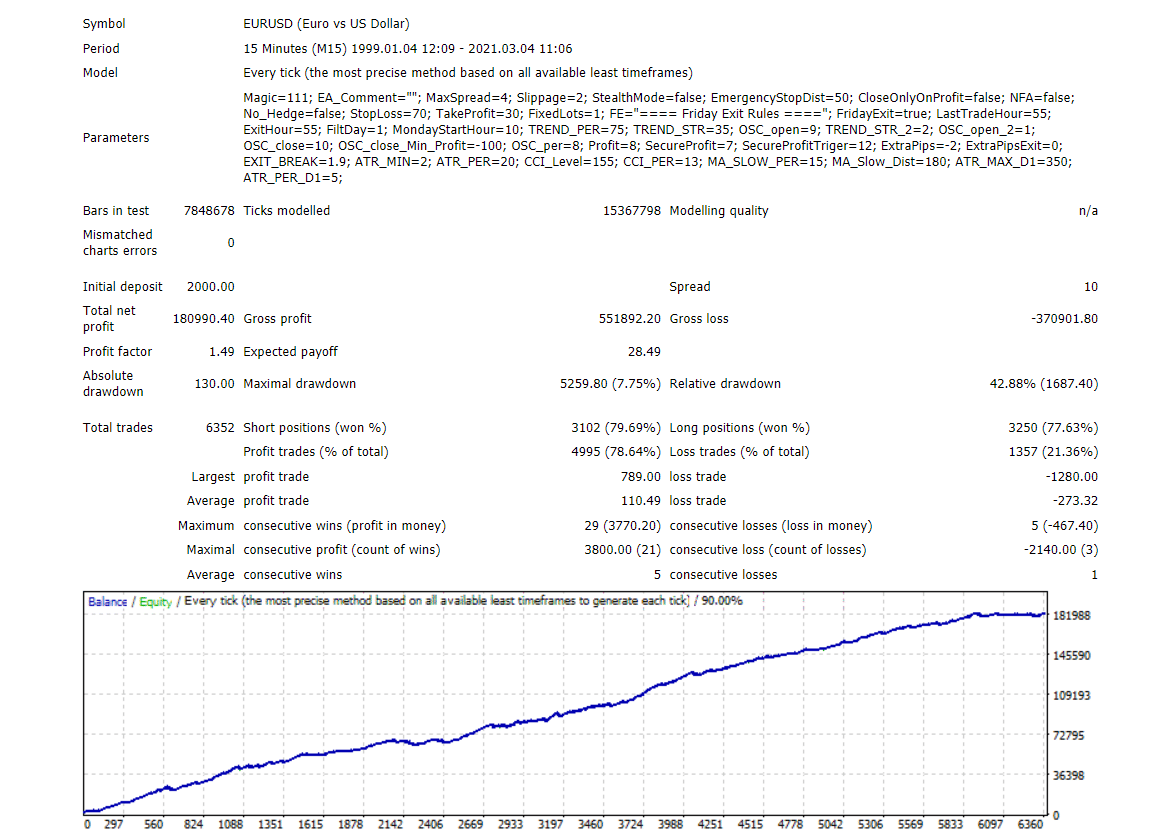

The robot showed decent performance with historical data, managing a win rate of 78.64%. It had 21 consecutive wins during this test and generated a profit of $189990.40.

4. Forex Fury

Forex Fury has a money management feature and three different risk levels. It works with all MT4 and MT5 brokers and employs a range trading scheme.

| Min. deposit – $100 |

| Win rate – 100% win rate based on live trading statistics |

| Price – $229.99 |

| Money refund – 60 days |

| Currency Pairs – AUD/CAD, GBP/USD, USD/JPY, EUR/USD, USD/JPY, USD/CHF |

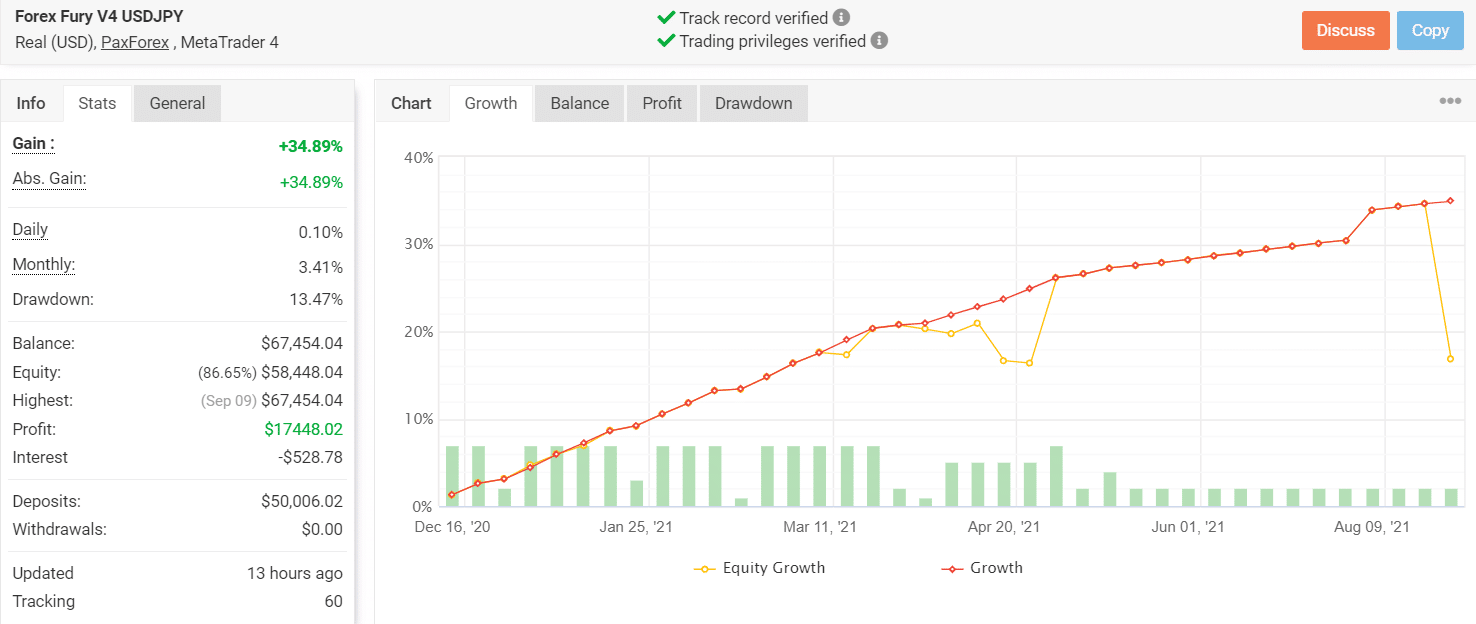

This trading account on Myfxbook has been active since December 14, 2020. The daily and monthly gains are quite satisfactory at 0.10% and 3.41% respectively. Looking at the drawdown of 13.47%, we can tell that the system does not take a high-risk approach.

Forex Fury has placed 150 trades through this account, winning all of them and generating a total profit of $17448.02. The account has an average win of 5.58 pips / $116.32. However, the vendor has revealed no details of the backtest.

5. Forex Flex EA

Forex Flex EA uses 12 different trading schemes to trade the Forex market. It has currency filters, session filters, and time filters. You can also hide your trades from the broker.

| Min. deposit – $1000 |

| Win rate – 68% out of 100% based on live trading statistics |

| Price – $399.96 |

| Money refund – 30 days |

| Currency Pairs – All |

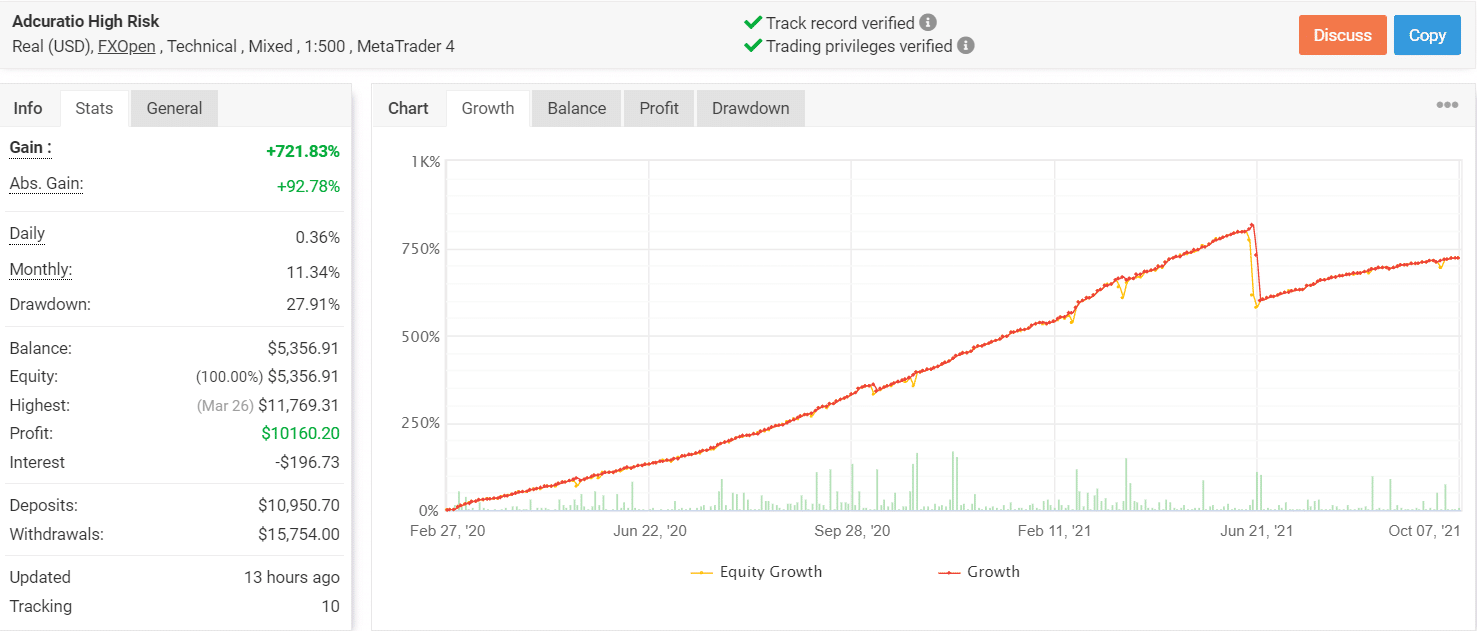

After placing 1122 trades, this account has generated a total profit of $10160.20. It has a 68% win rate and a high monthly gain percentage of 11.34%. We can see the equity growth has been quite stable and the EA has maintained an impressive profit factor of 2.00.

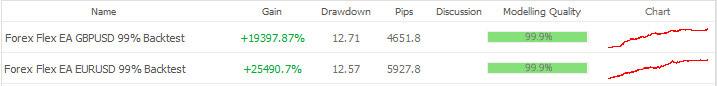

The vendor has presented the backtesting data in a short format. For GBP/USD, the robot made a gain of 19397.87%, while the gain for EUR/USD was 25490.7%.

6. Forex Steam

This automated Forex trading robot uses Steam retrace technology to grow your trading account. It has a holiday filter that lets you avoid drastic market movements. It uses trailing stop losses to manage risks. When you purchase this system, you get access to 4 licenses. Forex Steam is available at a much cheaper rate compared to other systems.

| Min. deposit – $300-500 |

| Win rate – Not available |

| Price – $117.99 |

| Money refund – No |

| Currency Pairs – EUR/USD |

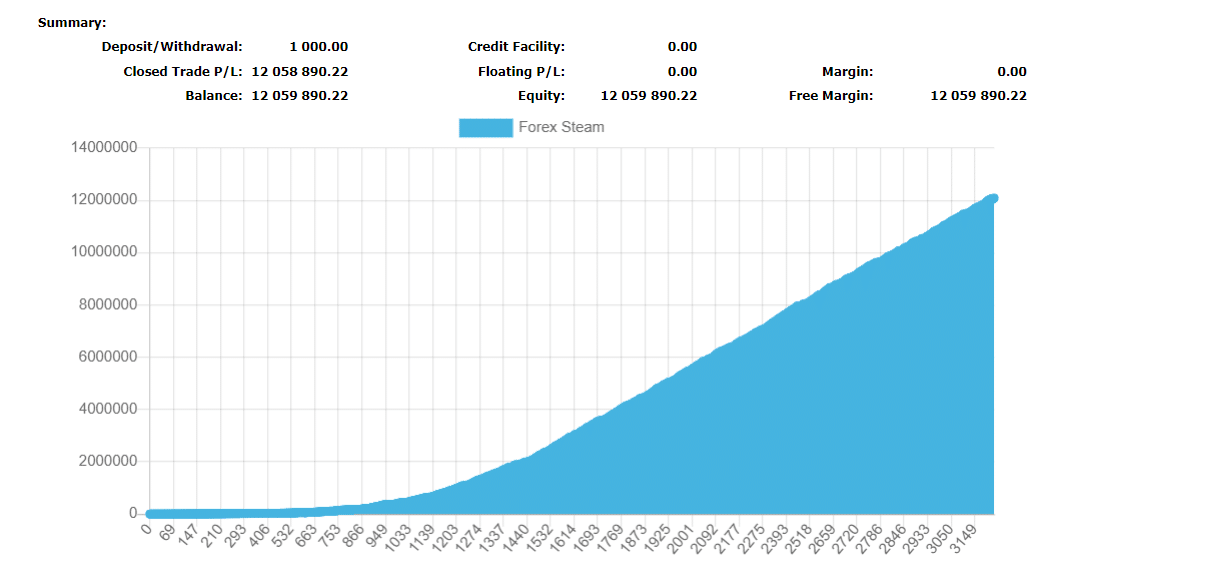

This robot has been trading in the live market since 2012. It started with a $1000 deposit, and today its total profit stands at $12058890.22. Each year, the system improves its profitability by 5-10%. Although the exact win rate is not mentioned, we can see that it closes most trades in profit. Backtesting results are not available for Forex Steam.

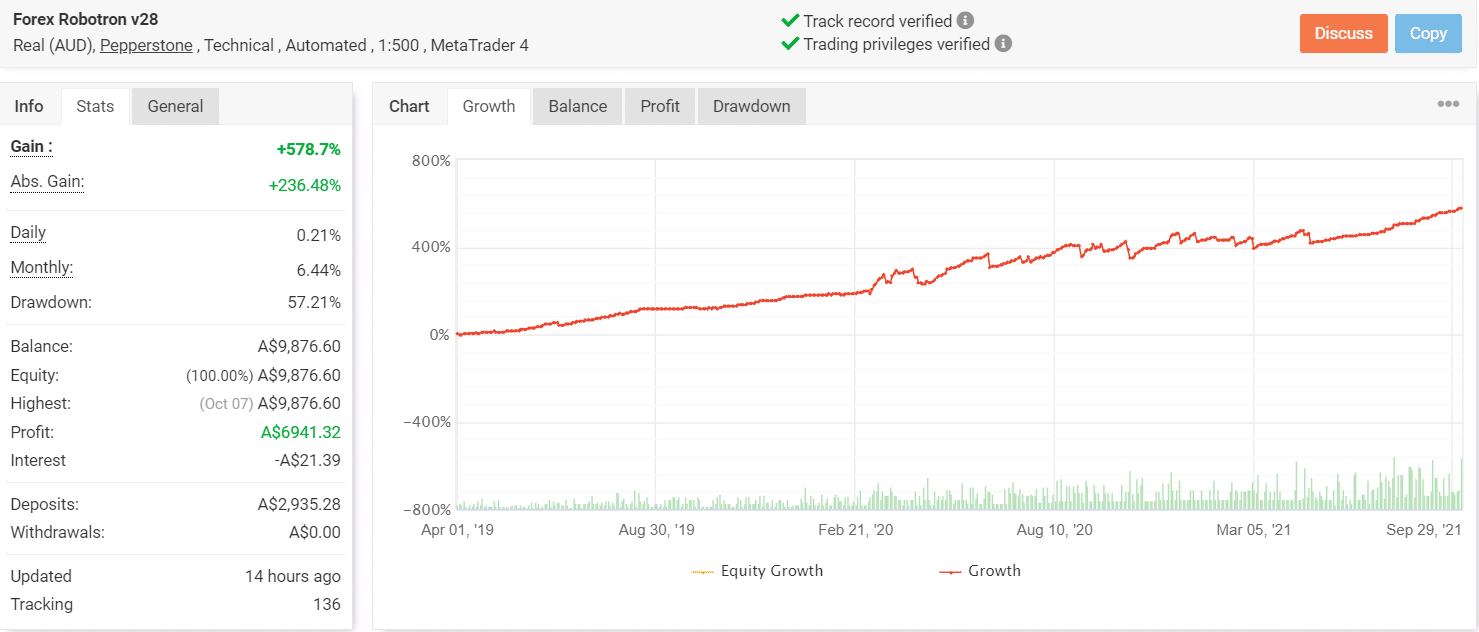

7. Forex Robotron

This system trades in multiple pairs and conducts 600 trades every year on average. It has different risk levels and you can choose the one you are most comfortable with. You can program the EA to not trade during the weekends.

| Min. deposit – $50 |

| Win rate – 81% based on live statistics |

| Price – $299 |

| Money refund – No |

| Currency Pairs – All |

Since 2018, Forex Robotron has conducted 1142 trades through this account, winning 81% of them. It has high monthly gains of 6.44%. Although the drawdown is a bit high at 57.21%, the profit factor of 1.61 tells us that the system is reliable.

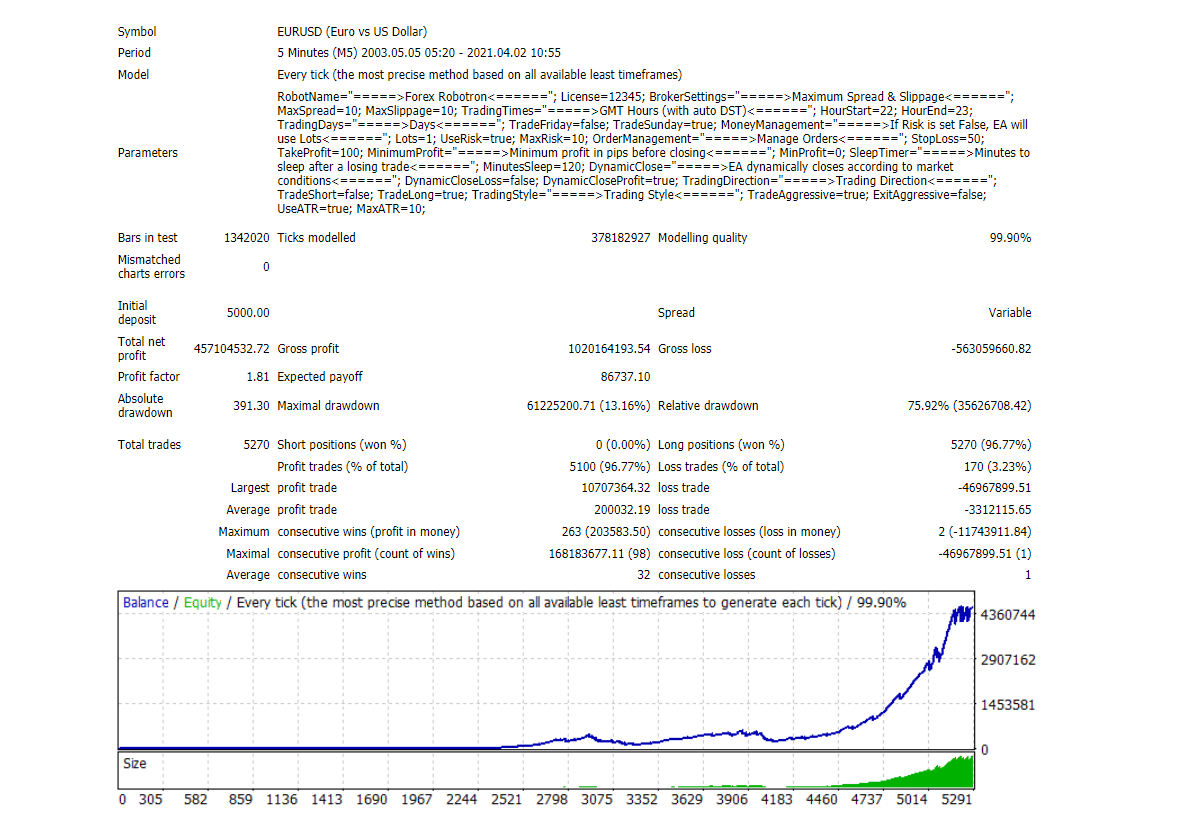

This backtest saw the EA making a huge profit of $457104532.72 between 2003 and 2022. It had a high win rate of 96.77% and managed 98 maximum consecutive profits.

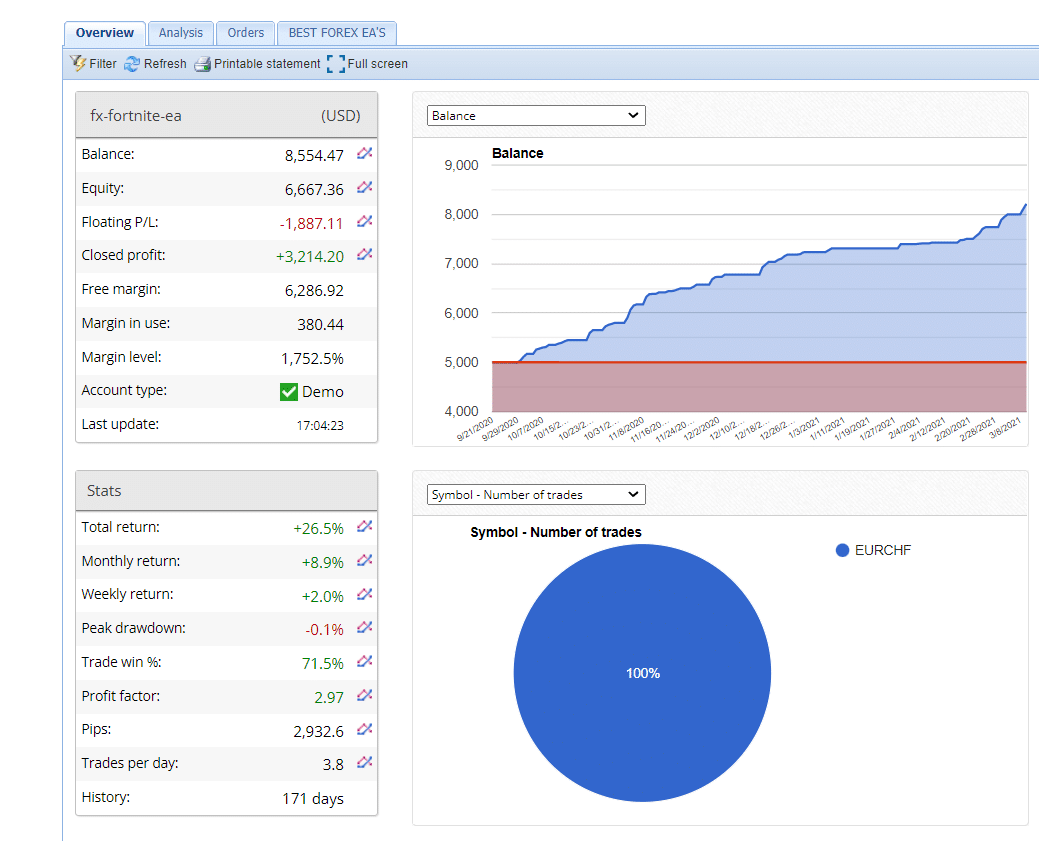

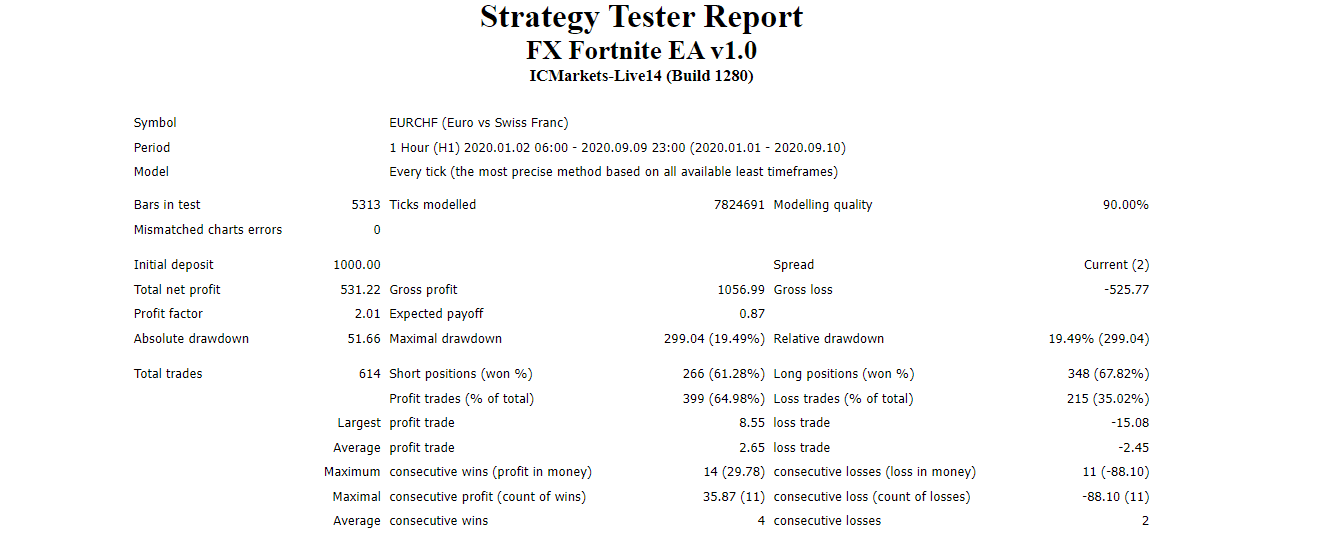

8. FX Fortnite

This Forex trading bot follows trend trading and hedging schemes with variable risk settings. It makes profits by exploiting the high volatility levels in the Forex market. You can also use it with a cent account.

| Min. deposit – $1000 |

| Win rate – 71.5% based on verified statistics |

| Price – $149 |

| Money refund – 30 days |

| Currency Pairs – EUR/CHF |

After 171 days in the live market, the win rate for the live account currently stands at 71.5%. The weekly and monthly returns are quite satisfactory at 2.0% and 8.9% respectively. In this short time period, it has generated a large profit of $3214.20.

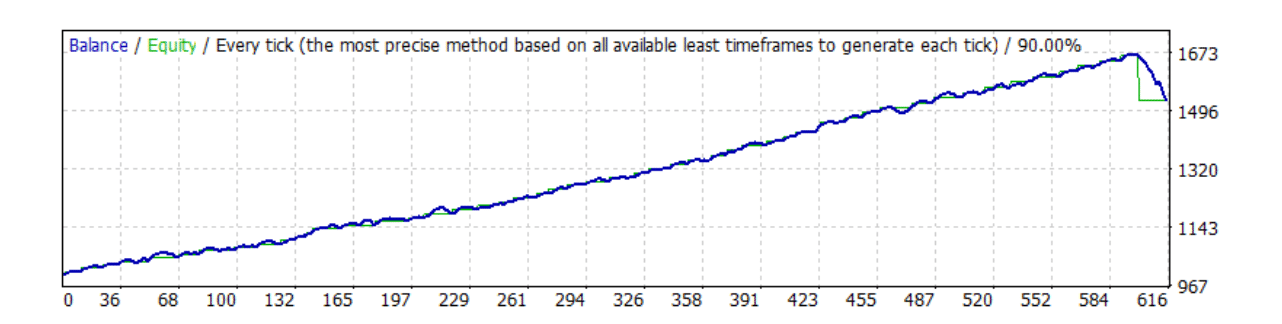

Between January and September 2020, the vendor conducted this backtest, where the robot won 64.98% of its trades. It had a decent profit factor of 2.01 and won 14 trades back to back.

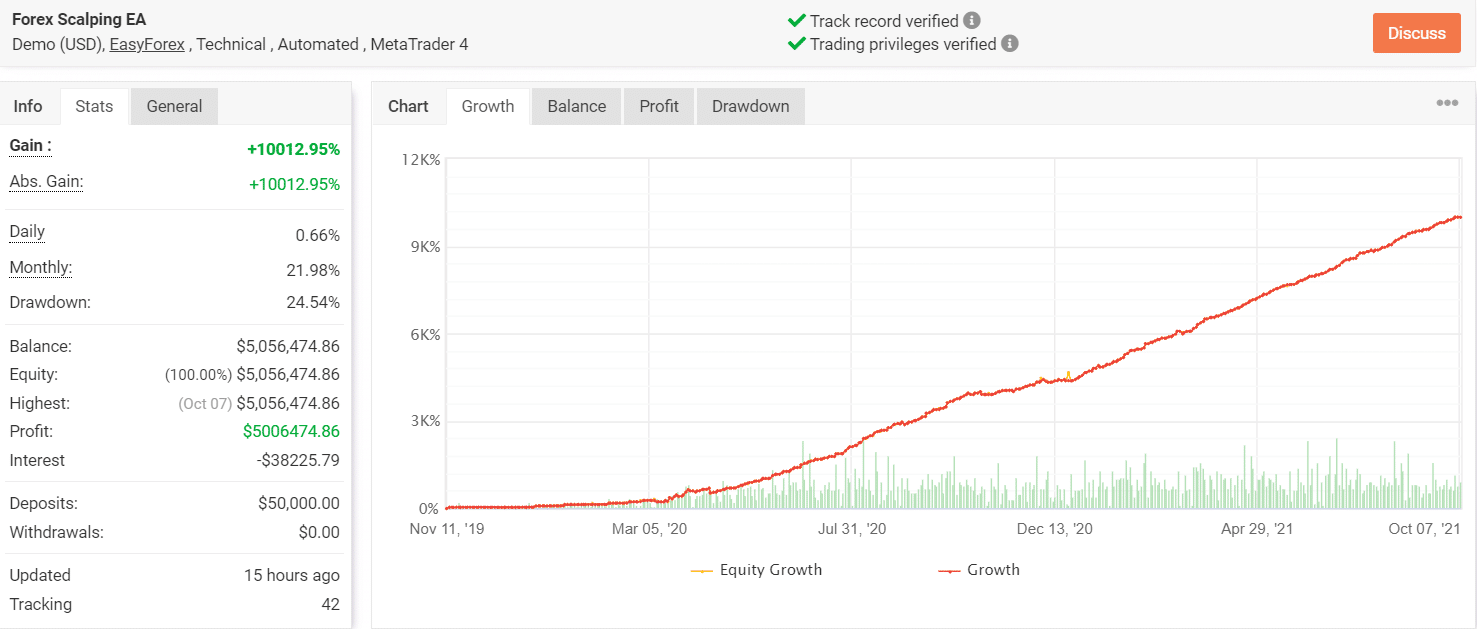

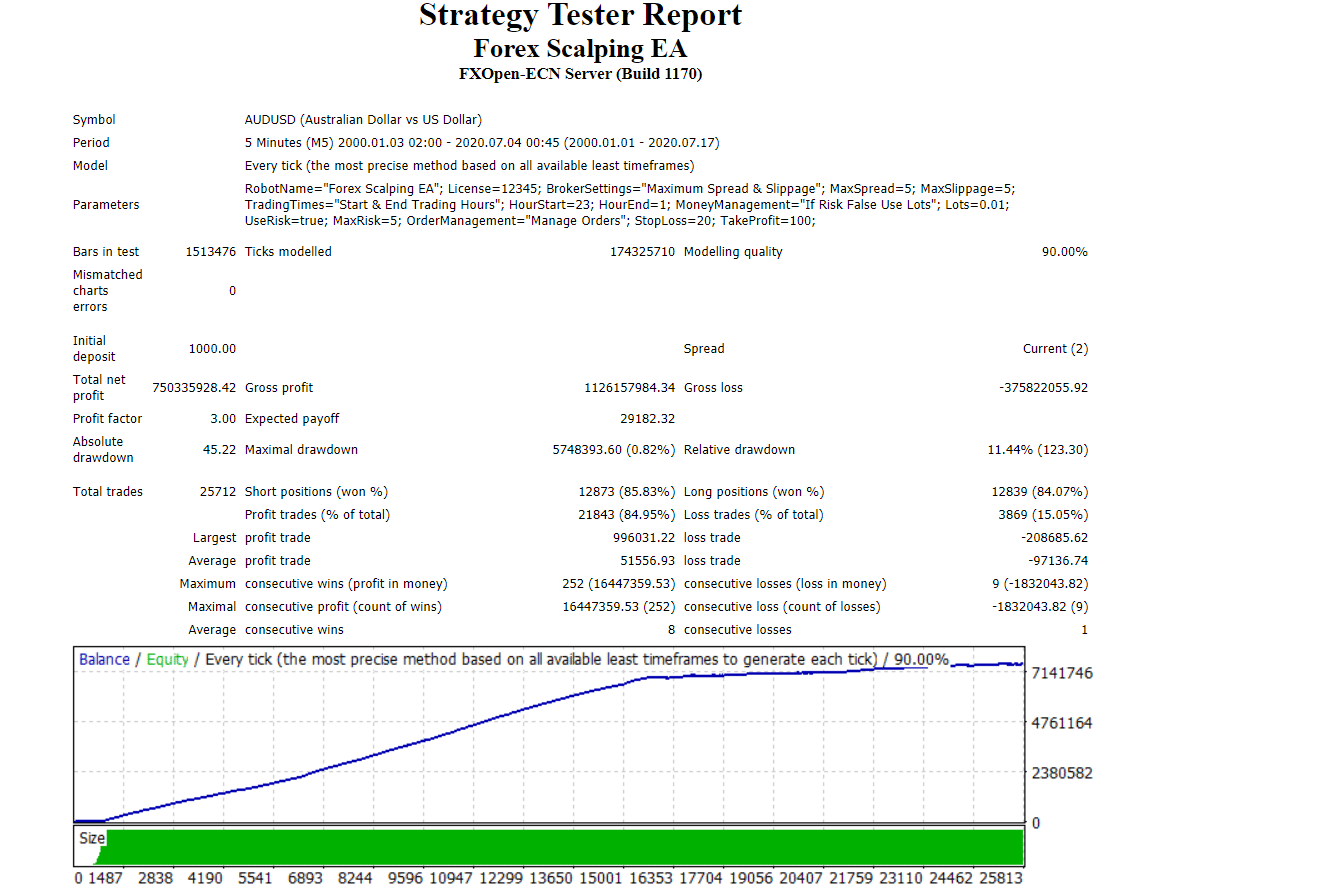

9. Forex Scalping EA

This is a scalping bot that places a large number of trades every day, extracting small profits from each. With this system, you have the freedom to change the EA parameters to suit your profit objective and trading style.

| Min. deposit – Any |

| Win rate – 87% based on verified statistics |

| Price – $100 |

| Money refund – No |

| Currency Pairs – AUD/NZD, AUD/USD, CAD/CHF, CHF/JPY, EUR/AUD, EUR/CHF, EUR/GBP, EUR/JPY, EUR/USD, GBP/JPY, GBP/CHF, GBP/USD, USD/CAD, USD/CHF, USD/JPY |

This trading account was launched on November 11, 2019. After closing 4729 trades, the EA has made a large profit of $5006474.86. It has a win rate of 87% and it is remarkable that it has managed all this while keeping the drawdown relatively low at 24.54%.

For this backtest, this trading robot had a high win rate of 84.95%, which is slightly low compared to the live statistics. It had a low relative drawdown of 11.44% and made a total profit of $750335928.42.

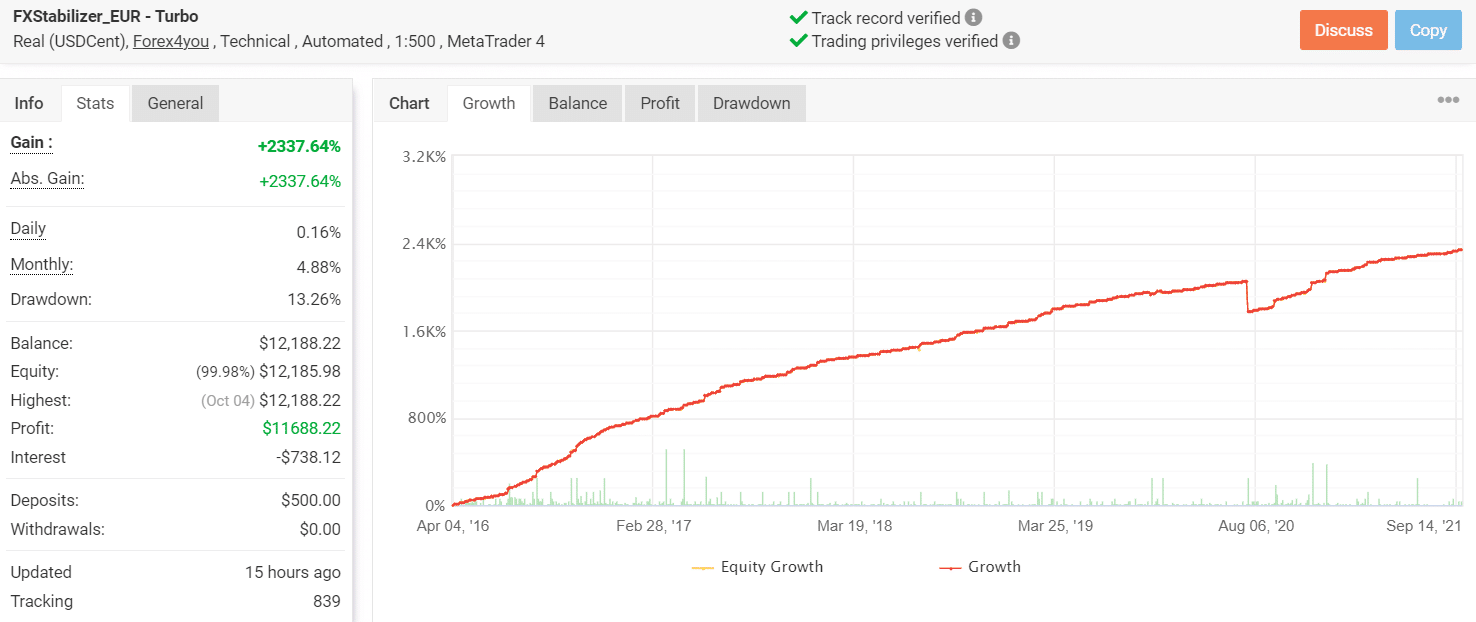

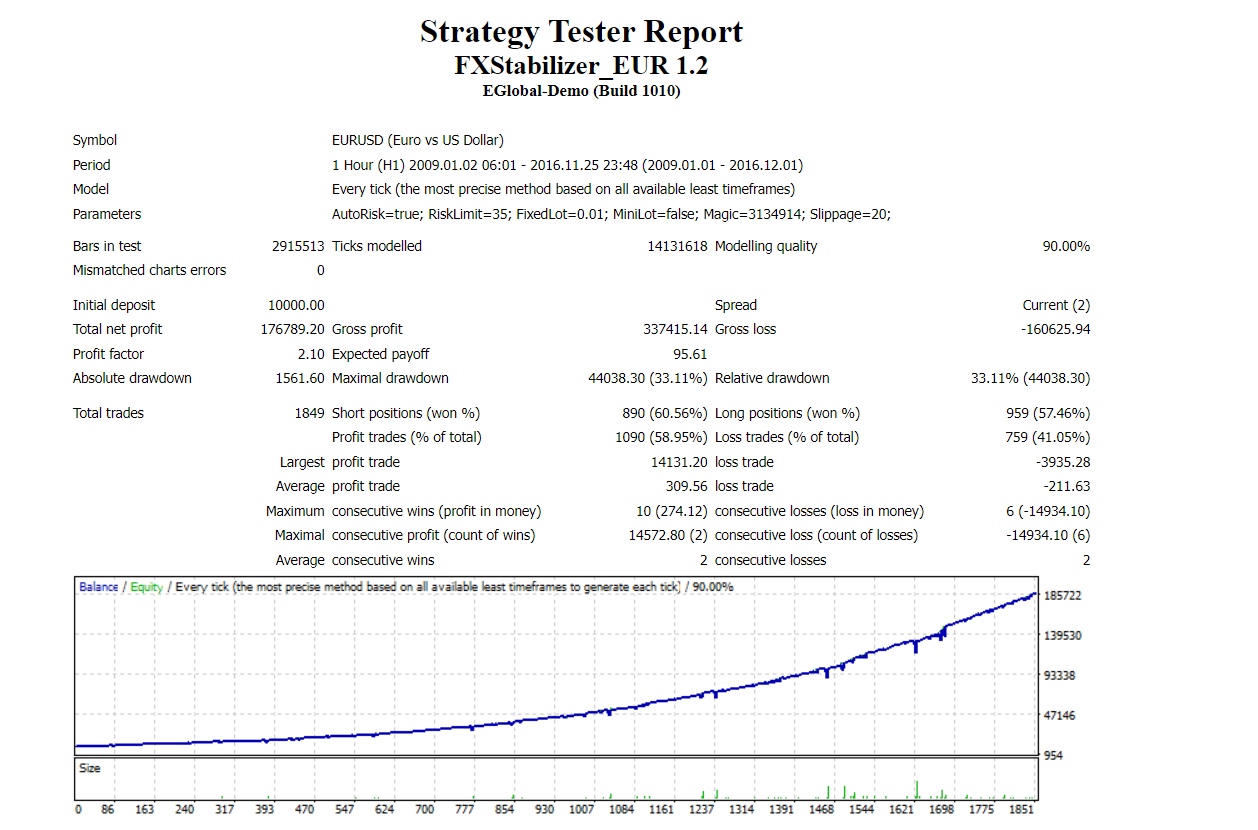

10. FXStabilizer

Compatible with all MT4 and MT5 brokers, FXStabilizer has two modes, namely Durable and Turbo. It gives you the option of specifying the maximum risk in terms of percentage.

| Min. deposit – Not mentioned |

| Win rate – 65% based on a live trading account |

| Price – $539 |

| Money refund – 30 days |

| Currency Pairs – EUR/USD, AUD/USD, CHF/JPY, EUR/JPY, USD/CAD, USD/JPY, GBP/CHF, EUR/GBP |

Since April 2016, FXStabilizer has placed 2288 trades through this account. It has won 65% of them, thus making a huge profit of $11688.22. The account has witnessed stable growth over the years and has a low drawdown of 13.26%. Thus, the robot manages to stay profitable without taking too much risk.

FXStabilizer’s live performance is even better than its historical performance where the win rate was 58.95%. With $10,000, it conducted 1849 trades and generated a profit of $176789.20.

How to avoid scam products?

To avoid scams, you should check user reviews to see what other people are saying about the robot. Forex bots that work based on solid strategies deliver decent results and you can see them reflected on verified live trading accounts on third-party websites. Also, you should look for backtesting data to see whether the system can deal with different market conditions over long time periods.

Is it safe to trade in Forex?

Forex trading is safe if you know what you are doing. If you are following a solid strategy and have proper risk management measures in place, you can earn steady gains. On the other hand, taking too much risk or leaving your trading operations to a scam robot might lead to heavy losses.

What is the average price of a Forex robot?

A reliable Forex robot will cost you anywhere between $50 and $1000. The price range is pretty wide for these systems since they have different functionalities. This makes it difficult to determine the average price. Before investing money into a system, you should always check its performance using a demo account.

How much can you earn with a Forex EA?

The annual profit depends on the Forex trading bot strategy as well as the account balance. With a larger balance, you can make more gains every year. If the average yearly gain percentage is 20%, you can make $200 using a $1000 account. Swing and day traders can win higher annual gains.

Things to remember

Apart from avoiding scams, there are a few things you need to consider before buying an automated trading system. Some of these factors are given below:

1. Choose forex robots with a low drawdown rate

This is one of the most important things to consider while looking for a Forex EA to purchase. This parameter indicates the risk of ruin for a particular system. It depicts the largest loss suffered since the previous peak. It tells you how the performance of the system drops when the market conditions are unfavorable. If the equity curve has several highs and lows, you know the robot trades with high risk.

2. Background check and developer’s history in the industry

Before you download expert advisors, make sure to check the service history of the developer. There are many unscrupulous individuals trying to dupe traders by selling them unprofitable EAs that haven’t been tested properly.

As such, it is important to gather the maximum possible information on the team members. A reliable vendor should share the identities of the people who have worked on the robot. This tells you that it is built by individuals who know what they are doing.

3. Good EAs are well-tested before release

Every EA vendor needs to test their system before making it public. Look for trading bots that are tested using archival as well as live market data. An EA might have a solid trading scheme on paper, but it might fail in a real-time trading scenario. This is why tests are important.

Study the backtesting results and check whether the trade bot performed consistently over a long time period. Remember, historical performance doesn’t always translate into live performance. So you need to pay attention to the latter as well.

4. Use a demo account to test the robot before purchase

Trading in foreign exchange comes with its fair share of risks. Whether you are a beginner or an expert trader looking for a new trading system, you shouldn’t invest real money at first. It is prudent to first test the performance of the bot using virtual money.

Most EA vendors let you test their systems using demo accounts. By doing this, you can check whether the robot’s trading strategy suits your own trading style. You can also see the important performance parameters. If the test results are satisfactory, you can start investing real money.

5. Stay away from FX EAs that use Grid + Martingale combo

If you are a novice trader, you should avoid trading robots that use the grid + martingale combo. Here, the system opens a grid of orders. If there is a loss, it opens all the following trades at larger sizes. While some traders use twice the lot size, others may choose to enhance it by a particular amount.

Due to the increased lot size, the drawdown for your account will reach sky high. Unless the market reverses, you will end up compounding your losses and draining your entire account.

6. Transparent vendors share live trading results

You should never trust a Forex bot that is not supported by verified trading statistics. Live trading results give you a clear idea about the system’s trading approach. It also reveals important performance parameters through which you can gauge the profitability.

You should always look for trading results that are verified by third-party websites. Some vendors share the results on their own websites, but you shouldn’t trust them. These results are usually manipulated to make the EA appear profitable.

7. Efficacy of the system: profit factor and win rate

The profit factor represents the ratio of the profitable transactions to the lost transactions. When the profit factor of a system is more than 1, you know it wins more than it loses. To compute it, you need the winning rate, losing rate, as well as the average gain and loss.

Win rate is the first thing a trader looks for while analyzing the performance of a bot. Ideally, it should be greater than 50%.

8. Analyze customer reviews on reputable third-party websites

When there are a lot of positive reviews for a particular EA, you know it is reliable. Before investing in a system, you should check for user reviews on third-party websites. Look for systems that have several reviews and decent average ratings. A robot without any authentic user reviews is likely to be a scam.

9. Quick response to customers inquiries

Every reliable automated system should have an active customer support team. You should be able to contact the team at any time to solve your issues. You shouldn’t trust vendors that don’t share any contact details on the official website.

10. Affordable pricing and money-back guarantee also matter

No matter what kind of results the seller promises, you shouldn’t invest in an overpriced system. These are usually scam services that promise great things but fail to deliver in live trading scenarios. A reliable robot should be reasonably priced. Moreover, the vendor must offer a money-back guarantee. This will protect your investments in case you are not able to win profits while trading with the EA.

How to optimize a Forex EA?

You can optimize a Forex trading bot using the Metatrader platform. The purpose of this activity is to find the EA settings that can generate the most profit. Open the strategy tester and view the robot properties. You must specify the starting balance, the currency, and the type of position. In the optimizer window, you need to enter the profit factor, average gain, and drawdown. You can tweak the parameters to improve the results. This is much faster compared to manual optimization.

Automated Forex systems also require some supervision

Even the best Forex trading app requires some supervision. From time to time, you need to check your performance. If it’s not up to the mark, you have to change the EA parameters to suit the market conditions.

Best Forex Robots Summary

Pros

- Non-stop trading

- Eliminates human emotions

- Executes complex trading schemes

- Suitable for beginners

Cons

- No ideal for fundamental analysis

- Require strong internet connection

After going through this article, hopefully, you have a better idea regarding which Forex EA to purchase. You shouldn’t just buy a system based on the win rate. Risk management is an important factor that you need to consider. Also, check the trading frequency to see whether you can keep up with it. A decent robot should give you a higher degree of control over your trading operations.

Table of Contents

- What is a Forex robot?

- How does it function?

- Are Forex EAs legit?

- So what are the best forex robots for 2022?

- How to avoid scam products?

- Is it safe to trade in Forex?

- What is the average price of a Forex robot?

- How much can you earn with a Forex EA?

- Things to remember

- How to optimize a Forex EA?

- Automated Forex systems also require some supervision

- Best Forex Robots Summary