Robinhood FX EA claims to be a profitable MT4 tool due to the unique trading algorithm it uses. The completely automated system is capable of identifying the right time for closing and opening transactions. As a non-Martingale system, this ATS analyses the market daily and has inbuilt settings that can minimize the losses and allow the trades to generate maximum profits.

We could not find info on the developer or the team responsible for creating this FX robot. The vendor does not provide info on the company like its founding year, location address, etc. For support, the vendor offers an email address and a phone number with technical 24/5 support.

Robinhood FX EA at a glance

| Price | $127 to $167 |

| Trading Platforms | MT4 |

| Currency Pairs | EURUSD |

| Strategy | Technical |

| Timeframe | H1, H4 |

| Recommended Deposit | $100 -$200 |

| Recommended Leverage | N/A |

| Money Management | Yes |

Robinhood FX EA functionality

According to the vendor, this ATS can generate stable monthly profits with minimal losses. Two main factors are used for the functioning of this EA, which are real proper management of the capital and careful and specifically calculated entries and exits for the trades.

The lot sizes used are proportional to the size of the account and the SL level is not revealed to the broker. This EA uses an advanced SL technology as per the vendor where tight stops are placed and move in a small frame to ensure good profits. Bad news events do not deter the functioning of this FX robot.

The main features the vendor focuses on are:

- Risk management is influenced by the automatic lot size, which is proportional to the current balance in the account

- Important news events do not require pausing of the EA

- It works with all types of accounts like cent, micro, STP, and ECN, and all brokers

- The parameters are easy to set up and include an inbuilt magic number

Some of the recommendations for this FX EA include the use of the H1 timeframe on the EURUSD pair which is the only pair this EA is set to work on by default. A lot size of 0.01 for a deposit of $200 is the recommendation by the vendor.

Robinhood FX EA trading strategy tests

The vendor does not reveal the strategy used by the EA. There is no explanation of the trading approach which raises a red flag. Furthermore, there are no backtesting results which confirms our suspicion that this is an unreliable MT4 tool.

What about Robinhood FX EA live trading results

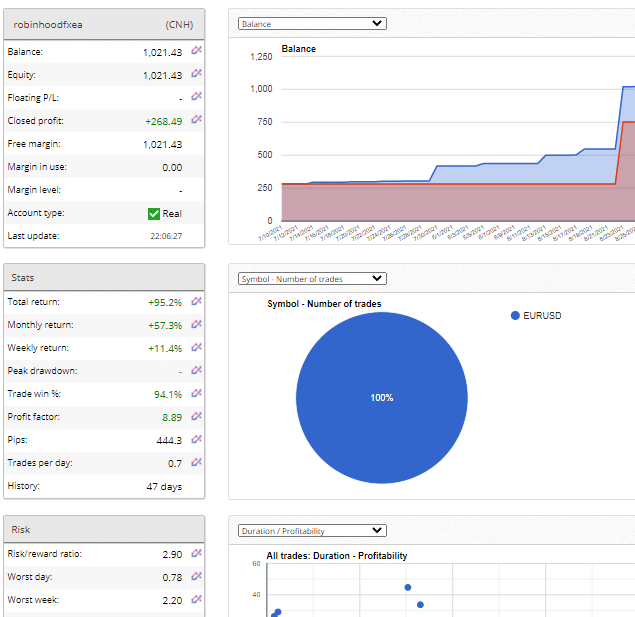

A live real CNH account of this FX robot verified by the FX Blue site is present on the official site. Here is a screenshot of the trading statement.

From the above stats, we can see a total return of 95.2% is generated for the account started in July 2021. A monthly return of 57.3% and a weekly profit of 11.4% are present. The profitability for this account is 94.1% and the profit factor value is 8.89. A risk to reward ratio of 2.90 is present which indicates a high-risk approach. Although the profitability is high the sample size is very small which is insufficient to assess the actual performance of the account.

User reviews

We could not find user reviews for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. The lack of feedback indicates this is not a popular MT4 tool among the trading community. We look for reviews from reputed sites as they reveal important info like the reliability, the support offered for the product, and its performance. The absence of user testimonials raises doubts regarding the dependability of this EA.

Robinhood FX EA Review Summary

Robinhood FX EA-

Functionality3/5 NeutralThe vendor provides adequate info on the features, settings, and recommendations.

-

Trading strategy2/5 BadThe trading approach used is not revealed by the vendor which raises doubts on the reliability of the EA.

-

Live results3/5 NeutralAlthough live real trading results verified by the FX Blue site are present, the sample size is very small.

-

Customer support3/5 NeutralAn email address and phone number are present for customer support.

-

User reviews2/5 BadNo user reviews are present revealing that the product is not popular.

The Good

- Fully automated trading software

- 30-day refund policy

The Bad

- The strategy used is not disclosed

- Small sample size

- Lack of vendor transparency