PROP FIRM EA is a Forex robot that works with prop firms such as FTMO, MY FOREX FUNDS and any funding firms of a similar nature. Funding firm challenges are used to ascertain the trader’s ability to maintain the drawdown value at a certain level and keep the profit margin stable. Traders who pass the challenge are eligible to receive a funded account that can have up to $200,000. The proceeds are then divided equally between the trader and the firm.

My EA Academy is the creator of this robot. It is a trade name of SINRY ADVICE WORLDWIDE, a company based in Malaysia that mainly focuses on creating trading systems for Forex. Regrettably, not much is known about My Ea Academy team including whether they have adequate qualifications that would enable them to develop effective trading tools and strategies.

PROP FIRM EA at a glance

| Price | $588 & $388 |

| Trading platforms | MT4 |

| Currency pairs | USDCHF, AUDUSD, GBPCHF, AUDCHF, CADCHF,GBUSD, EURGBP, CADJPY, AUDJPY, NZDJPY, EURUSD, EURAUD, GBPJPY, CHFJPY, NZDUSD, USDJPY, EURCHF, AUDNZD,EURNZD, GBPCAD,USDCAD, EURJPY, AUDCAD,EURCAD, XAUUSD |

| Strategy | Top bottom reverse trading + grid |

| Timeframe | N/A |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | N/A |

PROP FIRM EA functionality

The developer points out the following features of the robot:

- Works on both individual accounts and funding firms accounts

- Fully automated

- A full setup guide is available in PDF format

- No martingale on the board

- Controls spread to prevent trading in an unstable market

- Low drawdown of <5%

- Runs on 2k, 5k, 10k, 50k, 100k and 200k USD accounts

- Does not need a stop loss since the drawdown limit is low

The vendor claims that PROP FIRM EA is easy to set up. Two methods of installation are provided. You can either utilize the PDF guide book or installation videos available on its official website.

PROP FIRM EA trading strategy tests

The robot uses what the vendor calls a top bottom reverse trading approach together with grid. Smart indicator signals are also included to assess the market before a trade is initiated and performed. A news filter is present as well, and it minimizes risks by circumventing big market event days. However, it should be noted that the grid strategy is dangerous and is usually associated with a succession of losses.

Backtesting results are unavailable. We do not know why the vendor has decided to keep this data secret. It is highly likely it did not perform as expected and he is afraid that the statistics will turn off potential traders.

What about PROP FIRM EA live trading results

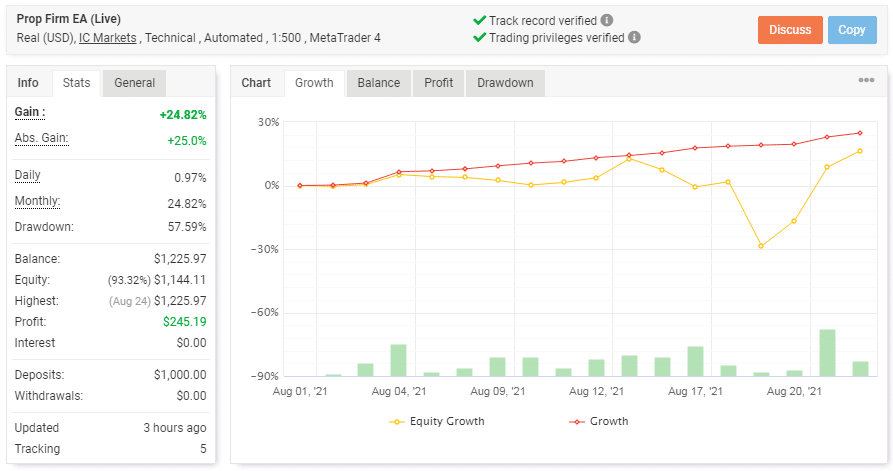

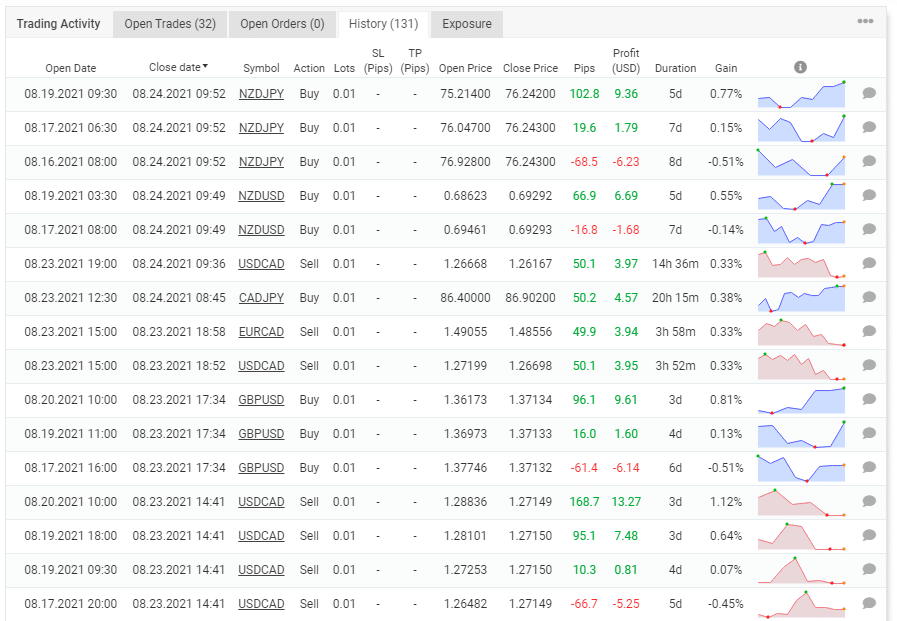

Having been deployed on August 1, 2021, the account has attained a gain of 24.82%. It was initially deposited at $1,000 and has made a profit of $245.19. The account balance is $1,225.97. Daily and monthly profits are made at rates of 0.97% and 24.82% respectively. The drawdown of 57.59% is huge. This value is showing a risky nature of the grid strategy.

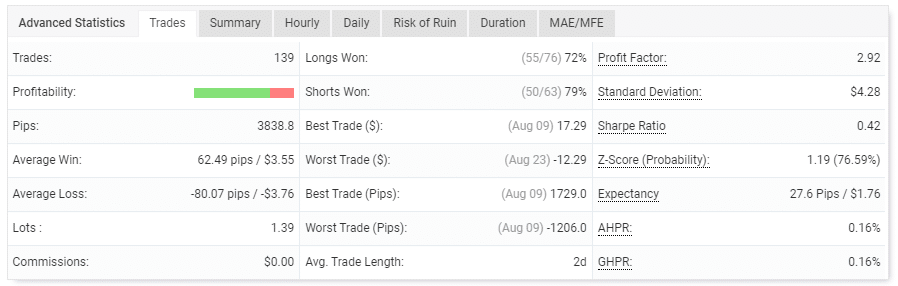

The system has made 139 trades with 3838.8 pips. The average win is 62.49 pips whereas the average loss is -80.07 pips. The winning rate for long and short positions are 72% and 79% respectively. Even though these findings have surpassed the 50% mark, they are still mediocre.

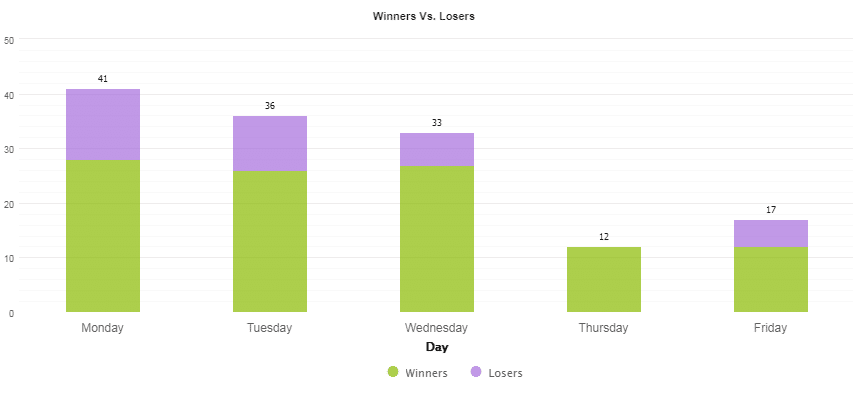

Monday is the most traded day – 41 trades.

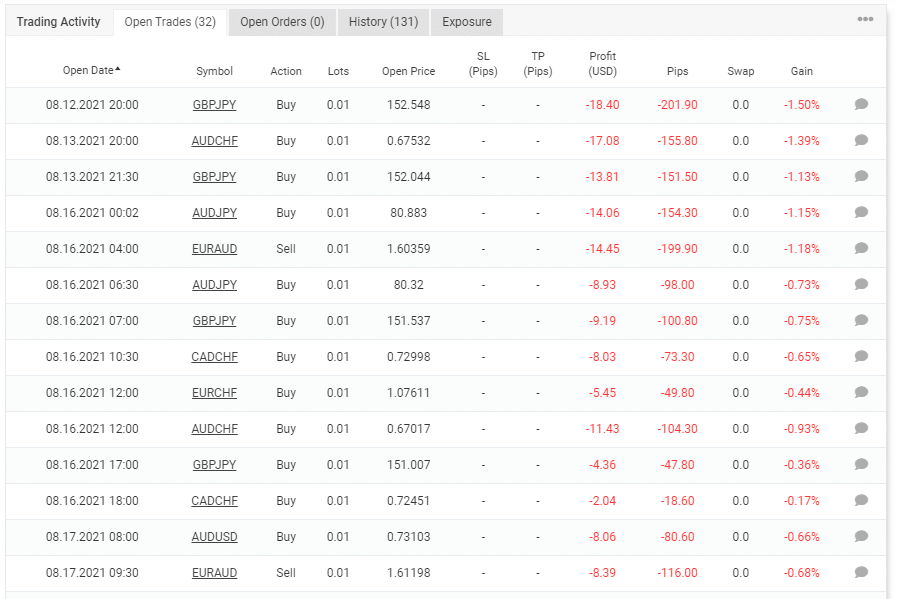

The account’s losing streak is very clear and serious.

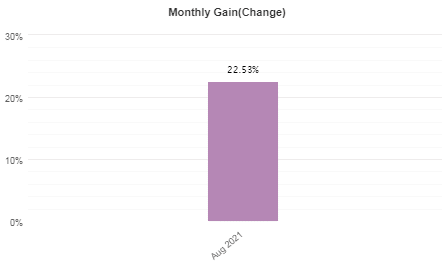

For the 3 weeks the account has been around, 22.53% profits have been made.

Fixed lot sizes and long time frames were used. Grid strategy was present.

Customer reviews

There are several client reviews on the system’s official website. But we doubt if these are even real customers. We suspect that the vendor created the testimonials just to promote their product and interests. User reviews are missing in other sites like Trustpilot and Forex Peace Army. It may be that traders are unaware of the existence of this EA given that it came to the market just a while ago.

PROP FIRM EA Review Summary

PROP FIRM EA-

Functionality3/5 NeutralIs fully automated and can easily be installed.

-

Trading strategy2/5 BadThe approaches used are both ineffective and risky.

-

Live results2/5 BadPerformance is not up to par and the drawdown and losing streaks are worrisome.

-

Customer support3/5 NeutralDifferent contact details are available including email, social media, live chat and physical address.

-

User reviews2/5 BadThe reviews are unreliable and could as well be fake.

The Good

- Live trading results are present

- Fully automated

The Bad

- High drawdown

- Grid on the board

- Unreliable customer feedback