BestFXNetworks is said to be one of the best trading systems around. The EA was created in 2020, and according to the vendor, it has demonstrated good performance since 2021. As such, its profits always exceed the number of losses. We will have to see for ourselves in this review if there is any truth to these assertions or not.

The creator of this MT4 product is anonymous. There’s no info on the official website that could point us to the real identities of the developers who built the EA.

BestFXNetworks at a glance

| Price | $129, $149, and $169 |

| Trading platforms | MT4 |

| Currency pairs | EURJPY |

| Strategy | Neural networks, Grid |

| Timeframe | N/A |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | Yes |

BestFXNetworks functionality

These are the other features you will find in the EA:

- License for both real and demo accounts

- Free upgrades and support are present

- Compatibility with all brokers

- All account types are supported, including STP, ECN, Micro, and Cent accounts

- There is no need to disconnect the system at the time of news release

- 100% automated and easy to set up

BestFXNetworks trading strategy tests

The EA has incorporated the neural networks theory and technology into its trading strategy. It uses neural networks to assess both fundamental and technical data so as to identify patterns in the market. The findings are later used to predict how the market will behave in the future, and consequently, generate buy/sell orders. The system also works with the grid approach, something the devs have failed to mention in their presentation.

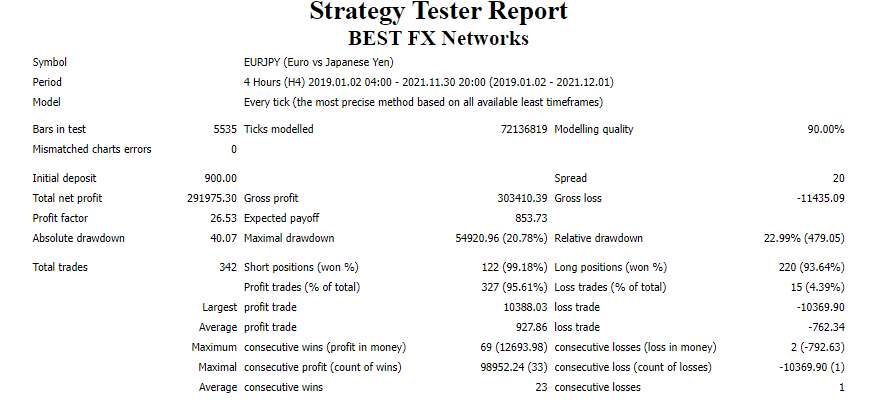

Backtest results for the above strategies are available. So, let’s see what they report below:

This is the backtest report for the EURJPY that was done using 2019-2021 trading data. With an initial deposit of $900, the EA managed to implement 342 trades on the H4 chart. A large profit amount ($291975.30) was realized as a result. The drawdown (20.78%) generated was low and a sign that low-risk trading was employed. There was a profit factor of 26.53 that depicted the system as a very profitable trader. Win rates of 99.18% were attained for short positions and 93.64% for long ones.

What about BestFXNetworks real trading results

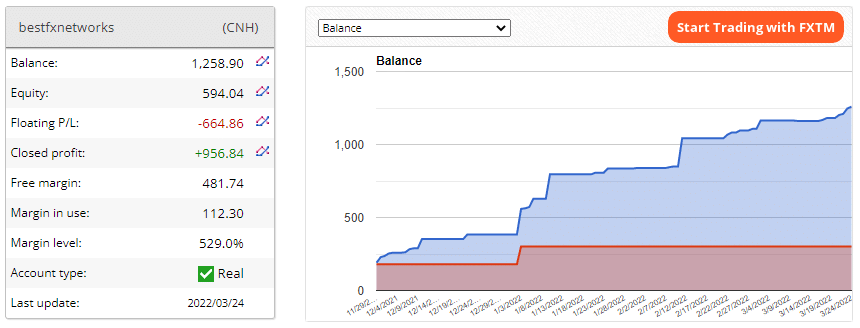

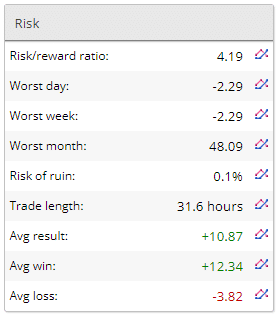

For an account that was opened in November 2021, the profit generated by March 2022 was $956.84. The loss made was somewhat high at -$664.86. The free margin was $481.74, while the closing balance was $1258.90.

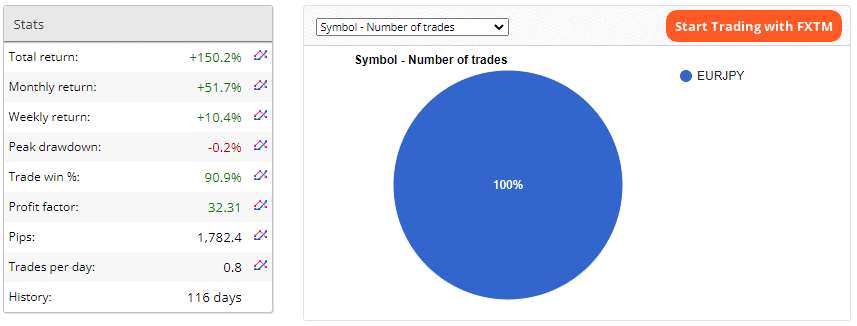

A total return rate of 150.2% was attained within 4 trading months, which was outstanding. On average, the EA made a monthly profit of 51.7% and a weekly profit of 10.4%. The peak drawdown (-0.2%) was low, an indication of low-risk trading. A majority of the completed trades were successful, going by the 90.9% trade win reported. The profit factor (32.31) value also showed that the system was very productive.

The account had a low risk of ruin at 0.1%. Generally, a position was held for 31.6 hours, and by the end of the trading period, a risk/reward ratio of 4.19 was reported.

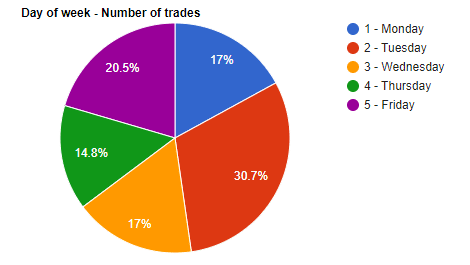

The system mainly placed buy/sell orders on Tuesday, making it the most active period of the week.

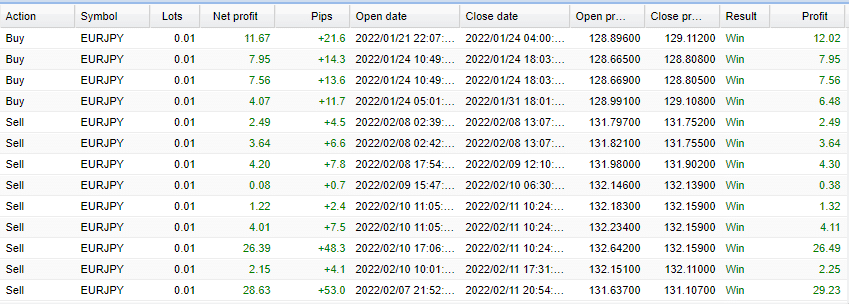

Fixed lot sizes (0.01) were applied during trading, and on some occasions, the system placed a grid of orders. Most trades generated profits.

Customer reviews

The EA still has zero reviews on FPA despite being around for quite a while now. Its performance on FXBlue appears to be good, so it comes as a surprise that no trader has surfaced yet to tell us what their experiences with the bot are.

BestFXNetworks Review Summary

BestFXNetworks-

Functionality4/5 GoodThe vendor highlights the basic features of the tool.

-

Trading strategy3/5 NeutralThe strategy is revealed and its performance on past and live market data is good.

-

Live Results3/5 NeutralThe EA has managed a live account on FXBlue for a few months and demonstrated a desirable performance.

-

Customer Support3/5 NeutralCustomer support is provided in the form of email, but the response time is rather unknown.

-

Customer Reviews2/5 BadThere are no customer reviews to disclose to us the kind of outcomes the system generates on traders’ accounts.

The Good

- Low risk of ruin

- Both backtest and live trading results are available

- Reasonable pricing

- Favorable risk/reward ratio

The Bad

- Only one currency pair is supported

- No feedback from clients

- Zero vendor transparency