Omega Trend EA trades on GBPUSD, EURJPY, and EURUSD and comes with a custom indicator that determines trends on the market. Traders can tweak the trading hours and the exit points of the robot to tweak its output. We have both backtesting and live records that we will review in our article to analyze the system’s performance.

FxAutomater claims to have 10 years of market and developing experience. They have 10000 clients and have been dealing with the financial industry for more than 15 years. However, there are no certificates or records that could verify these claims.

Omega Trend EA at a glance

| Price | $117 |

| Trading Platforms | MT 4 |

| Currency Pairs | GBPUSD, EURUSD, and EURJPY |

| Strategy | Trend Spotting, Strategy Diversity, Dynamic Entries & Exits |

| Timeframe | H1 |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

Omega Trend EA functionality

The EA has the following features:

- It has a money management system in place.

- The robot comes with a custom indicator.

- It can stop trading during periods of high spread.

- Traders can adjust the trading hours.

Omega Trend EA trading strategy tests

The developers state that the robot uses a combination of three strategies to trade EURUSD, GBPUSD, and EURJPY.

- The first one is trend spotting. As the name indicates, it determines the market momentum and trades accordingly.

- The second one utilizes two custom trend indicators for trading.

- The third employs a stop loss and a take profit to trades for producing a drawdown control.

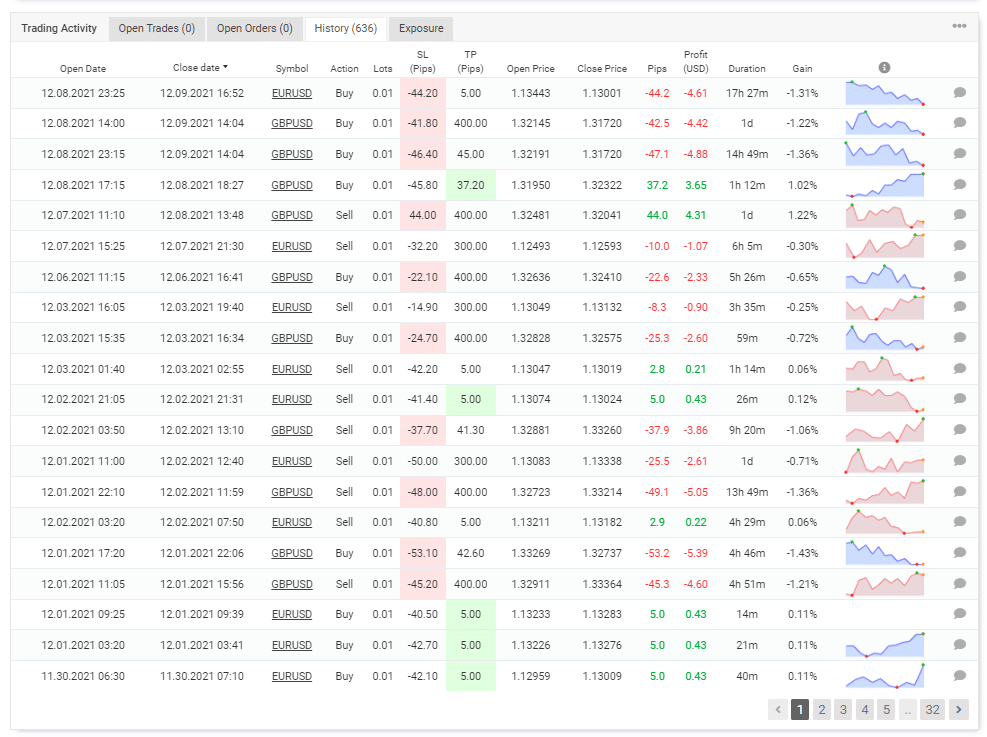

From the history on Myfxbook, we observe that the robot uses a stop loss of 20 pips with a take profit of 400. It closes trades before they reach the designated exit points.

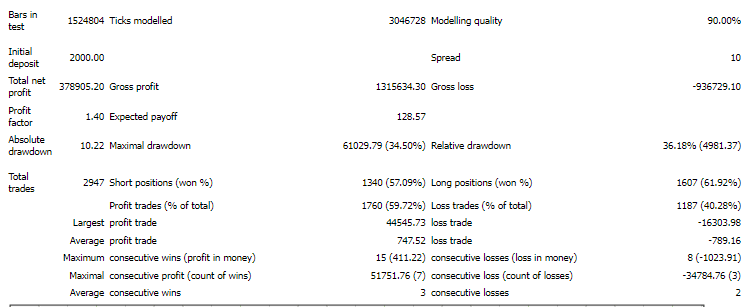

Backtesting results are available for the EURUSD real tick data, which shows the relative drawdown was around 36.18%, and the winning rate was 59.72%, with a profit factor of about 1.4. All the tests were done on the H1 chart with a starting balance of $2000.

The robot tanked an average profit of $378905.2 during this period in a total of 2947 trades. The best trade was $44545.73, while the worst one was -$16303.98. The modeling quality stood at 99.9%.

Omega Trend EA real trading results

Verified trading records on Myfxbook are available. We can see that the current floating gain is 32.86% at an account balance of $348.18. The drawdown value is around 32.86%, with a winning rate of 60% and a profit factor of 1.15.

The best trade was $43.75, while the worst was -$22.40 in a total of 636 trades. The system has made an average monthly output of 3.8% for this period. While comparing the drawdown value with the monthly gain, we get a poor risk-reward of 10:1.

User reviews

There is only one review present on Forex Peace Army for the Omega Trend EA. The customer states that he likes the trend-following methodology as his strategies are designed to follow momentum. He says that he will keep testing the robot and submit another review in the upcoming weeks. There has been no review written since July 27, 2013.

Omega Trend EA Review Summary

Omega Trend EA-

Functionality2/5 BadThe service works only on MT4.

-

Trading strategy4/5 GoodIt uses a stop loss and a take profit.

-

Live Results3/5 NeutralLive results show a high drawdown.

-

Customer support4/5 GoodCustomer support is available 24/7.

-

User reviews2/5 BadOnly a single review is present on Forex Peace Army.

The Good

- Multiple backtesting records

The Bad

- It has a high drawdown

- No transparency of developers

- It only works on MT4