News Scope EA Pro is an automated trading system that applies a low-risk strategy. It particularly targets traders who like trading during high impact news. The vendor says that the system has a new ATR-based stop loss calculating algorithm. This feature mainly reduces the drawdown and increases the profit factor. Let’s assess the robot to see what more it offers.

The parent company behind this EA is FxAutomater. It claims to have been in the business of developing trading algorithms for 15+ years. So far, the organization has 30+ Forex robots and over 10,000 happy clients. FxAutomater works with programmers, dedicated investors, and active Forex traders who have been trading in this market for many years.

News Scope EA Pro at a glance

| Price | $117 |

| Trading platforms | MT4 |

| Currency pairs | EURUSD, GBPUSD, AUDUSD, USDCAD, and USDJPY |

| Strategy | High impact news trading |

| Timeframe | M1 |

| Recommended deposit | $1000-$5000 |

| Recommended leverage | N/A |

| Money management | Yes |

News Scope EA Pro functionality

We have listed more features of the robot for you below:

- The devs recommend using it only on renowned ECN brokers with a good reputation.

- It has semi-automated and fully automated modes.

- The system includes an advanced news filter as well as precise time and news detecting filters.

- It has a high spread detection filter and a Friday exit system.

- An email and push notification systems are available.

News Scope EA Pro trading strategy tests

As the name suggests, this robot applies high impact news trading. It usually capitalizes on the opportunity presented for short-term scalping when a major news event takes place. During this period, the price has a tendency of spiking in one or both directions, thus creating a trading opportunity.

As per the vendor, a trader might earn 20 pips or even 100 occasionally within a few seconds if the movement of price is strong enough. The main problem is that liquidity issues are inevitable in such scenarios.

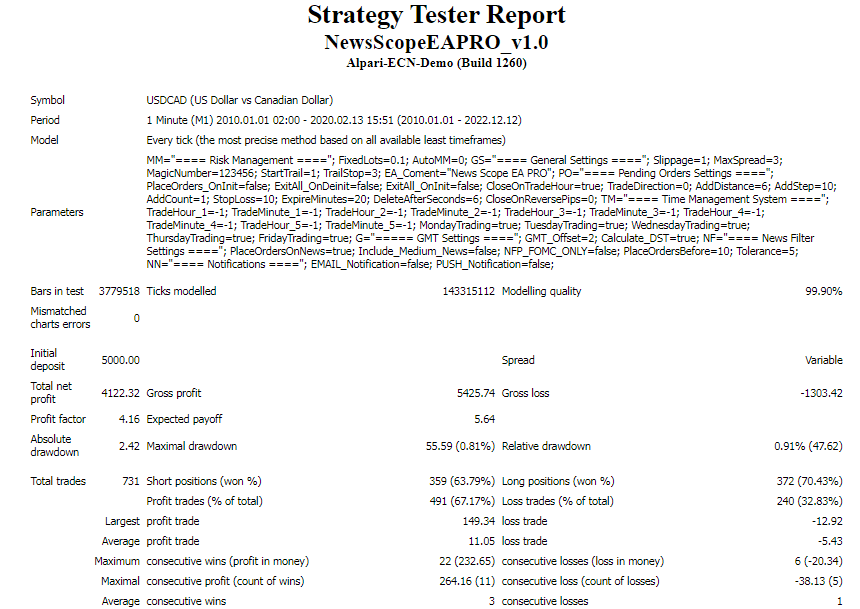

This is a backtest report for the USDCAD currency pair. We can see that the test was conducted on the M1 timeframe using real tick data. It began in January 2010 and ended in February 2020. During this 10-year period, a total of 731 trades were conducted. The resulting profit was rather small — $4122.32. It meant that about $412 was made per year. The robot didn’t even succeed in returning the money invested ($5000) after trading for so long.

There are win rates of 63.79% for the short positions and 70.43% for the long ones. Clearly, the EA faced a difficult time spotting lucrative trades. Fortunately, safe trading was applied as we had a drawdown of 0.81%.

What about News Scope EA Pro real trading results

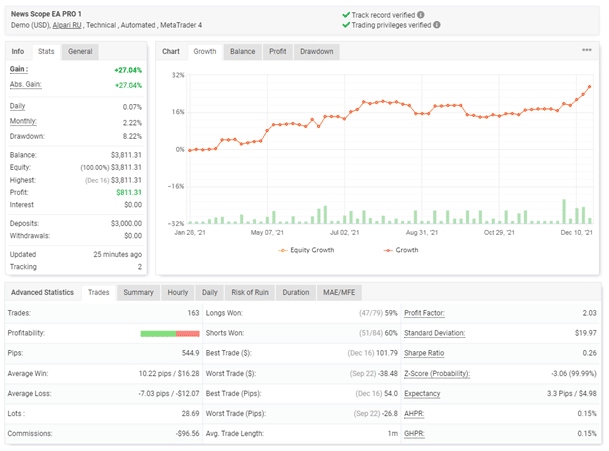

This account was deployed in January 2021 and deposited at $3000. The EA’s low profitability rate is also illustrated in the live market, just like in the backtest period. Only $811.31 has been made till now. It is evident that low-risk trading is involved as well. This is because the drawdown currently stands at 8.22%. The overall gain made is 27.04%.

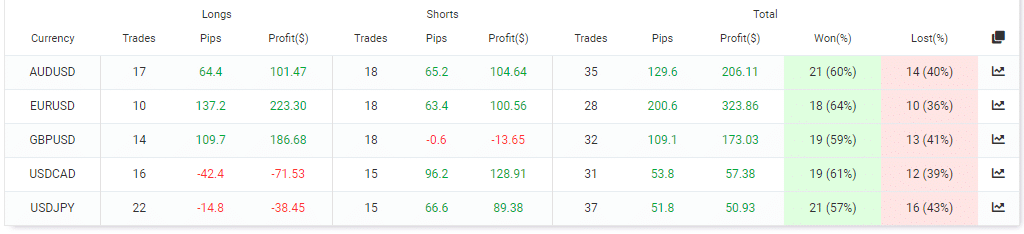

A total of 163 trades have been executed with 28.69 lots. The performance of the long (59%) and short positions (60%) is poorer in the real market compared to the backtest period. There’s a profit factor of 2.03, which means that the robot gets $2 for every $1 it risks.

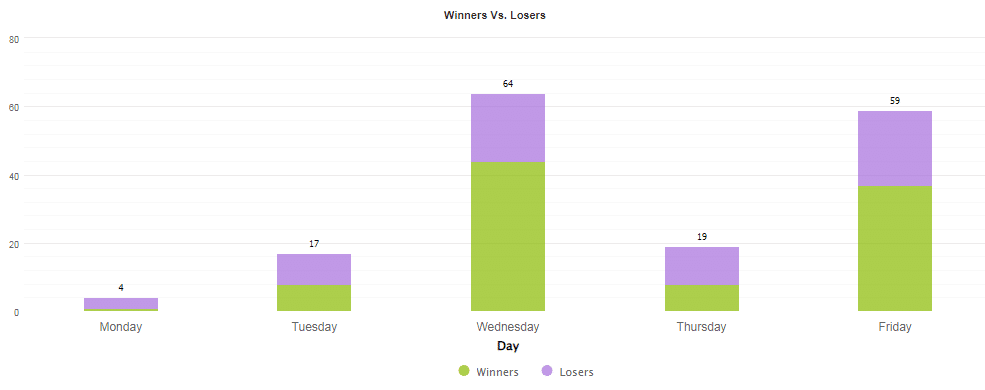

Monday is the least active day, while Wednesday is the busiest.

The USDJPY was the most traded pair. Unfortunately, none of the buy orders placed using this instrument were successful. The USDCAD is the most lucrative symbol to date, with a profit of $128.91.

User reviews

News Scope EA Pro has been reviewed by one customer. We found the testimonial displayed below on mql5. This client says that the EA does not earn.

News Scope EA Pro Review Summary

News Scope EA Pro-

Functionality4/5 GoodThe EA has many helpful features, including different protection systems meant to minimize trading risks.

-

Trading strategy4/5 GoodThe vendor has described the strategy used in a detailed manner enabling the public to fully understand how the system works.

-

Live results3/5 NeutralThe performance of the robot in the live market is mediocre as it is unable to generate significant returns for the user.

-

Customer support2/5 BadThere’s only one customer support option, and it is not known how long the team takes to respond.

-

User reviews2/5 BadOnly a single review is available for this EA. Obviously, this sample size is too small for us to know for sure how customers perceive this tool.

The Good

- Low-risk trading

- Detailed strategy explanation

The Bad

- Inadequate customer feedback

- Low profitability rate

- Poor win rates