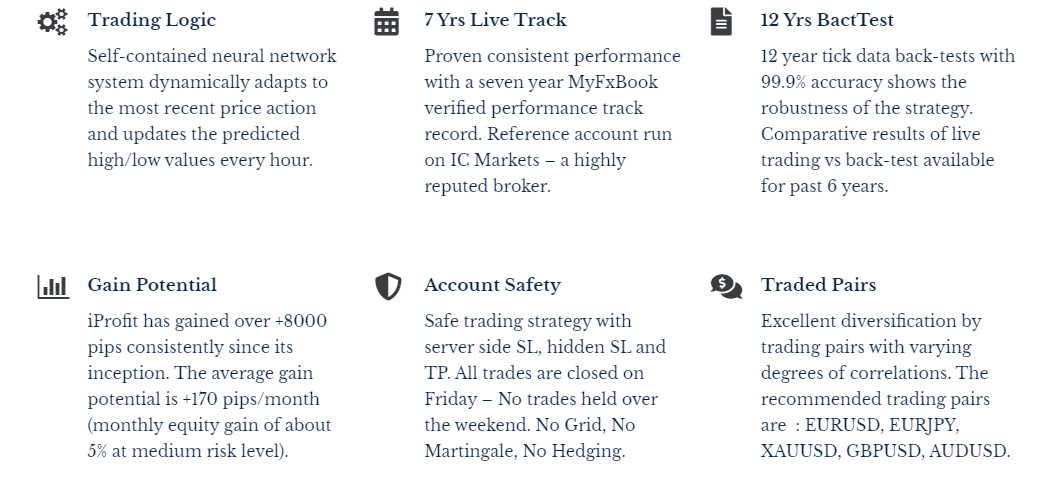

iProfit is a MT4 expert advisor that promises profitable and dependable solutions for fund managers and seasoned traders. This trading tool uses a self-contained neural network process that adapts to market trends dynamically and provides predictions on the upper and lower price limits per hour. This FX Robot is promoted by Phibase technologies. The company claims to provide the best customer support, strategy tests, live results, and more. We could not find info concerning the developer team, their experience, and their expertise. There is no location address or phone number present for contact. The lack of vendor info makes us suspect this is an unreliable system.

iProfit EA at a glance

| Price | $470 |

| Trading Platforms | MT4 |

| Currency Pairs | EURUSD, GBPUSD, EURJPY, AUDUSD, and XAUUSD |

| Strategy | Price action |

| Timeframe | H1 |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

iProfit EA functionality

As per the vendor, this FX EA has gained more than 8000 pips since it started trading in 2013. It has an average monthly profit potential of more than 170 pips. EURUSD, EURJPY, XAUUSD, GBPUSD, and AUDUSD are the recommended trading pairs. The vendor maintains that this FX robot does not use the Hedging, Grid, or Martingale methods. Its money management and trade execution are automated completely. As per the vendor, the robot is profitable in all types of market conditions.

iProfit EA trading strategy tests

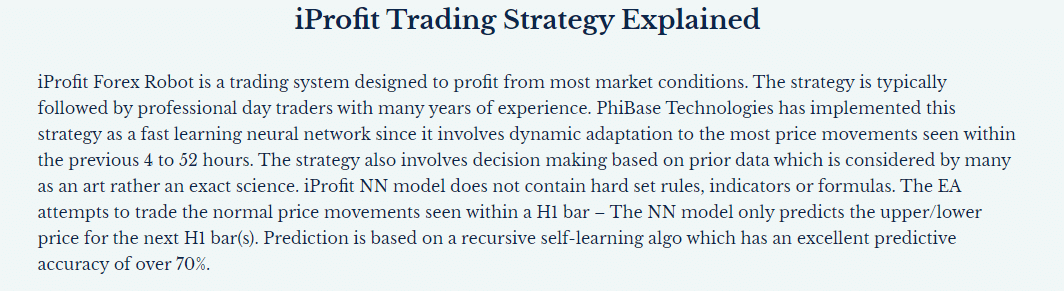

According to the explanation present on the official site, the approach used by this FX robot helps gain returns in a majority of market conditions. While the vendor does not mention the approach used, there is mention of price movement prediction based on a recursive algorithm of self-learning type. A 12-year backtesting report done on the Dukascopy Tick Data using 99% modeling quality is provided by the vendor.

From the above report, we can see a deposit of $10000 had generated a profit of 3306.18 and a maximum drawdown of 6.31%. A total of 1724 trades have been executed with profitability of 56.09% and a profit factor value of 1.16. From the results, it is clear that the profit generated is low indicating an ineffective approach and poor performance.

What about iProfit EA live real trading results

The vendor provides a live real AUD account using the IC Markets broker and the leverage of 1:500 on the MT4 platform. Here are a few screenshots of the trading results:

From the above stats, we can see the EA has generated a total profit of 182.71% and an absolute profit of 97.13%. The daily and monthly profits are 0.03% and 1.05% respectively. A drawdown of 25.47% is present for the account. The vendor has hidden other details like the balance, profit, equity, etc. which raises a red flag. The high drawdown and hidden info make us suspect this is not a reliable expert advisor.

Customer support

For support, the vendor offers an email address and an online contact form. All requests are responded to within 6 hours as per the vendor. We find the support methods are inadequate making us doubt the dependability of the system.

Pricing

To purchase this FX Robot, you need to pay $470 per year. The features provided with the annual package include self-contained trading software, compatibility with MT4 strategy tester, broker compatibility, two real or demo accounts, and the ability to set risk individually for every pair you trade. For the lifetime license, the FX robot costs $899. A 30-day money back guarantee is present for the product. When compared to the price of similar EAs in the market, we find the cost of this FX EA is too expensive.

User reviews

No user reviews are found for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. The lack of feedback reveals this MT4 tool is not a popular product in the market.

iProfit EA Review Summary

iProfit EA-

Functionality2/5 BadThe vendor does not reveal much info on the functionality of the system.

-

Trading strategy2/5 BadA vague explanation is provided for the approach.

-

Live results2/5 BadVerified live results are present but have hidden data which raises a red flag.

-

Customer support2/5 BadInadequate support methods present.

-

User reviews1/5 AwfullyAbsence of user reviews indicates that the EA is not a popular trading tool among traders.

The Good

- Fully automated software

- Verified trading results

The Bad

- Hidden data in real trading raises doubts on the reliability

- High drawdown in real trading

- The price is expensive