GerFX Density Scalper is an almost year-old robot that executes a scalping strategy. It was released by a company – Exler Consulting GmbH. The system received the final 3.6 update on August 11, 2021.

GerFX Density Scalper at a glance

We have gathered the most important information in the table:

| Price | $140, $370, $700, $1250, and $2000 |

| Trading Platforms | MT5 |

| Currency Pairs | EURUSD, GBPUSD, EURCHF, USDCHF, USDCAD, EURCAD, EURAUD, AUDUSD, AUDNZD, AUDCAD, CHFJPY, (experimental: USDJPY, EURJPY, EURGBP, EURNZD, GBPAUD, NZDUSD, NZDCAD). |

| Strategy | Scalping |

| Timeframe | M5 |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | No |

GerFX Density Scalper functionality

Let’s take a closer look at the robot’s details:

- The system executes orders completely automatically.

- We have to contact the developer after purchasing to get proper settings files.

- We may test the strategy on the H1 time frame or higher.

- We have to trade live on the M5 time frame.

- Next, we see common warnings.

- The system works with SL on every open order.

- “Night scalpers are dependent on good brokerage conditions, like low spread and slippage, which might be worse on large lot sizes.”

- The system is available on both MT4 and MT5 versions.

- The devs say that the system is ‘similar to QuantFlow Scalper but optimized in a few ways to reduce slippage. For example, the entry logic was reduced to make the calculation faster, and the exit is done via take profit orders, which can even lead to positive slippage.’

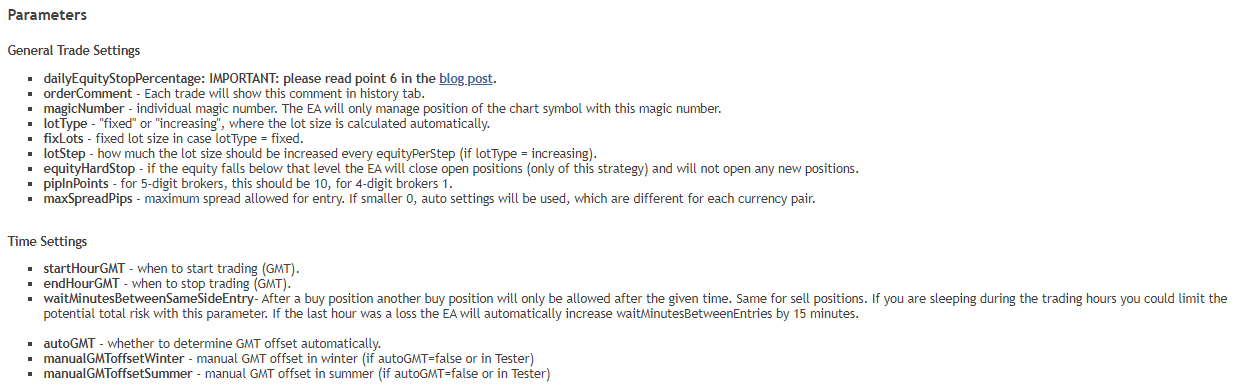

- We can customize many various parameters.

- It doesn’t use Martingale and Grid.

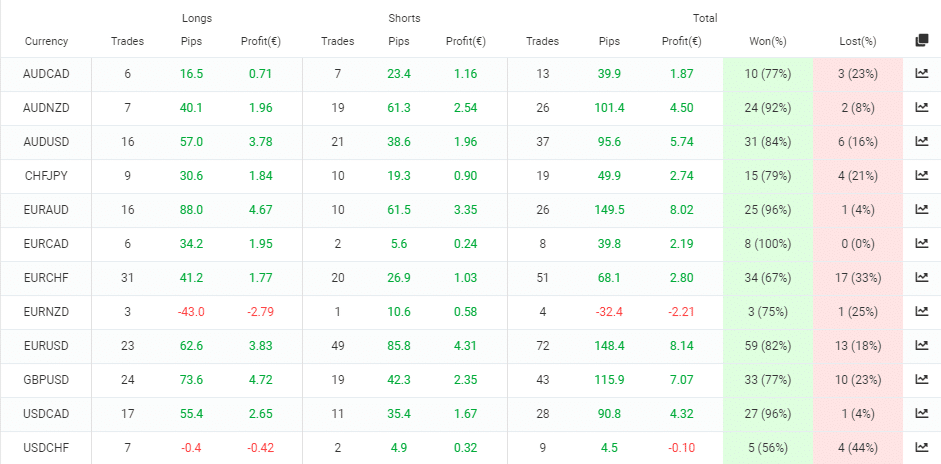

- We can work with EURUSD, GBPUSD, EURCHF, USDCHF, USDCAD, EURCAD, EURAUD, AUDUSD, AUDNZD, AUDCAD, CHFJPY, (experimental: USDJPY, EURJPY, EURGBP, EURNZD, GBPAUD, NZDUSD, NZDCAD).

- There are some instructions in the blog.

- “If GMT auto settings are used, the EA will automatically try to detect the GMT offset.”

- We have to use the system on a VPS service.

- We have to allow our requests for upcoming news.

- We have to test it with real spreads.

- We aren’t allowed to trade during important events.

- We have a list of parameters.

- We should set proper trading hours attentively.

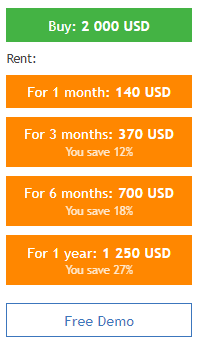

The system costs insane money – $2000. We can rent it for a month for $140. The three-month rent costs $370. The six-month rent costs $700. The annual rent costs $1250. The system can be downloaded for free for demo usage.

GerFX Density Scalper trading strategy tests

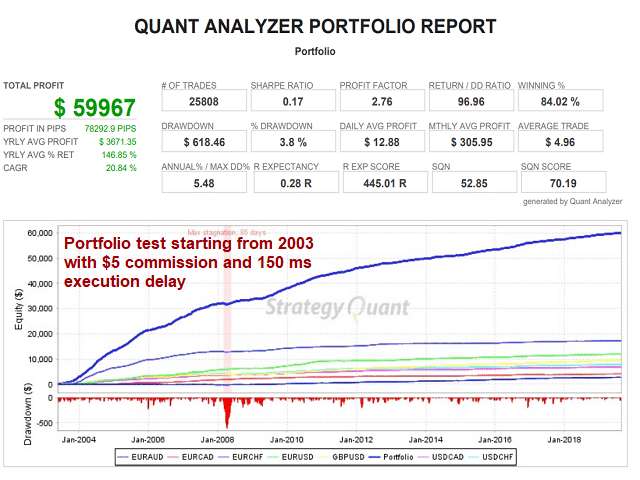

The system was tested on the StrategyQuant platform. The profit factor was 2.76. The win rate was 84.02%. The maximum drawdown was 3.8%. The total profit has amounted to $59,967. The profit in pips was 76,292.

What about GerFX Density Scalper live trading results

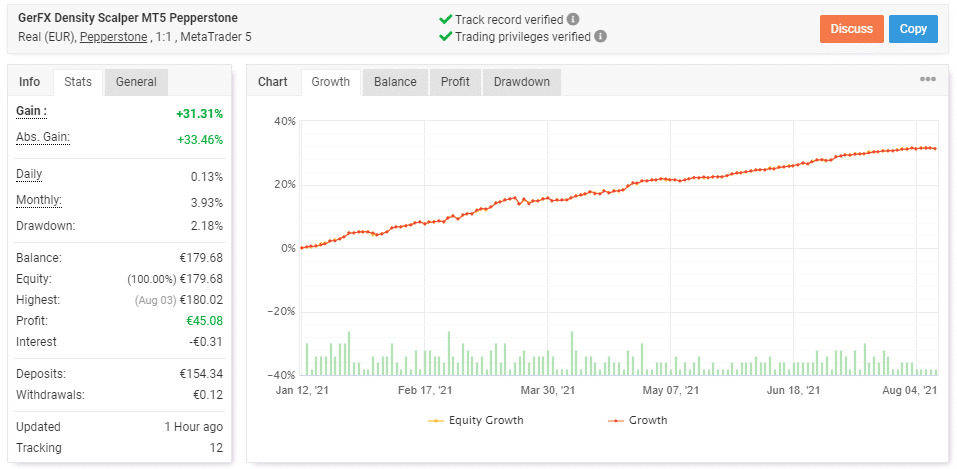

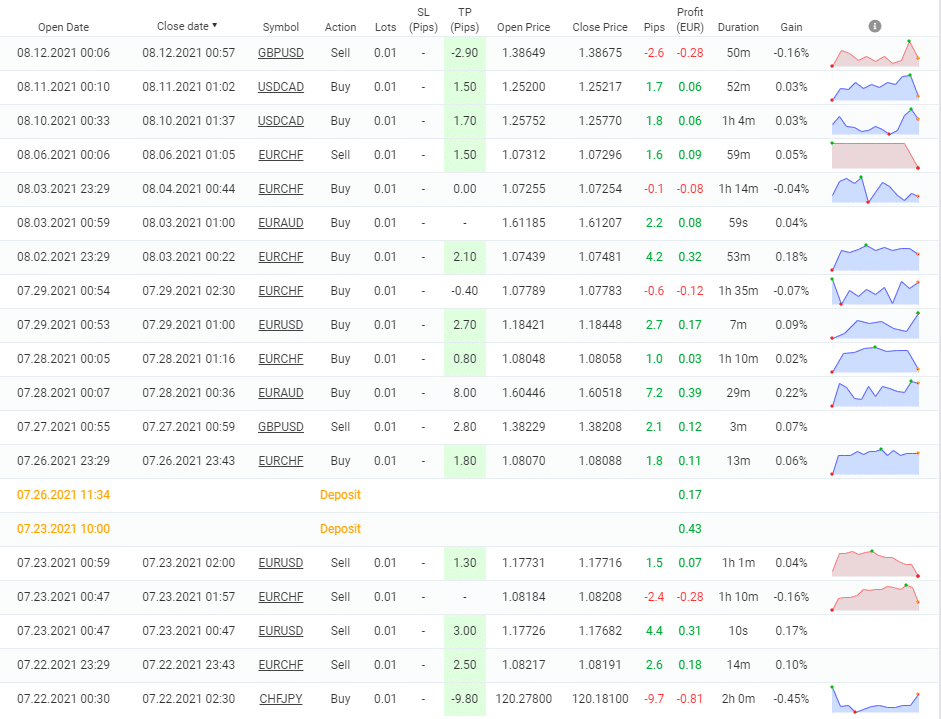

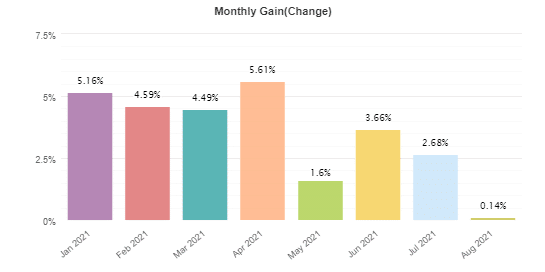

The robot has been running a real EUR account with 1:1 leverage on the Pepperstone broker. The platform is MT5. The account has a verified track record and verified trading privileges. It was created on January 12, 2021, and deposited at €154.34. Since then, the total gain has become 31.31%. An average monthly gain is 3.93%. The maximum drawdown was 2.18%.

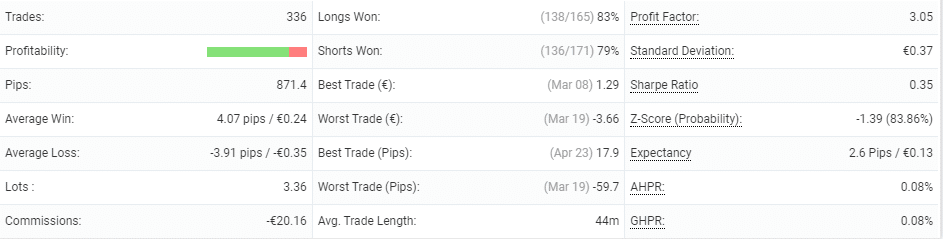

There were 336 orders traded. An average win is 4.07 pips when an average loss is -3.91 pips. The win rate for longs is 83% when for shorts it’s 79%. An average trade length is 44 minutes. The profit factor is 3.05.

The most-traded symbol is EURUSD, with 72 orders. It’s the most profitable as well – €8.14.

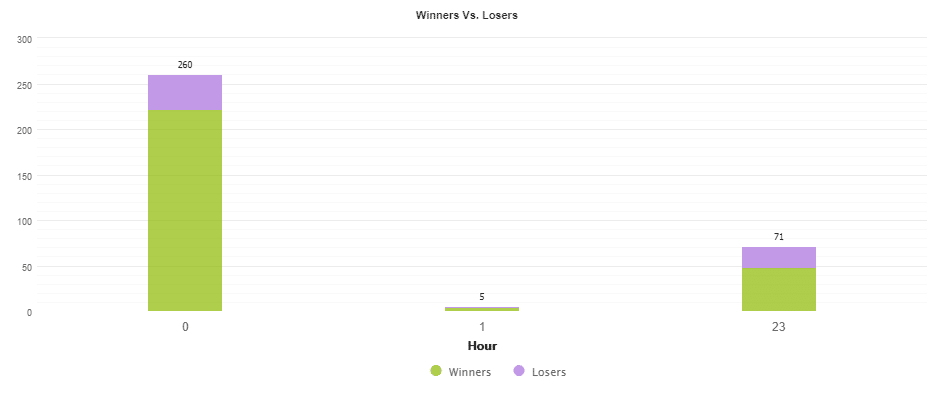

The system works during the night session only.

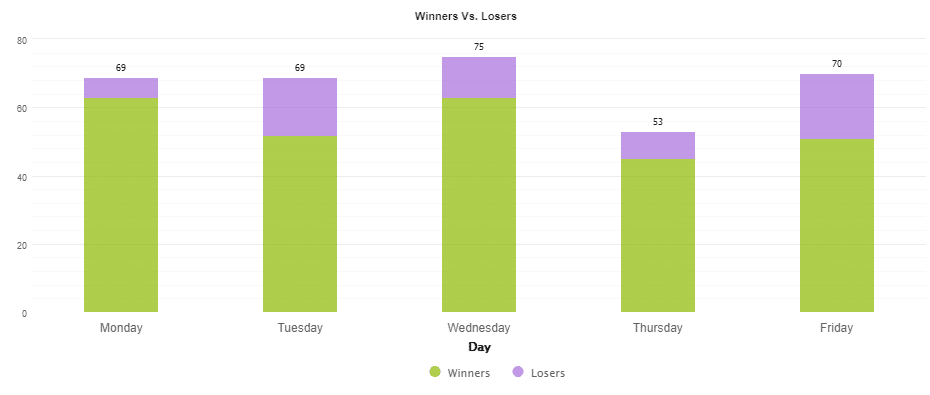

The robot trades little on Thursday – 53 orders.

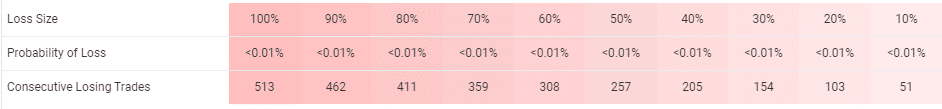

The system works with low risks to the balance.

The robot uses trailing take profit and hides SL levels.

The robot closed all months in 2021 with profits.

We would like to note

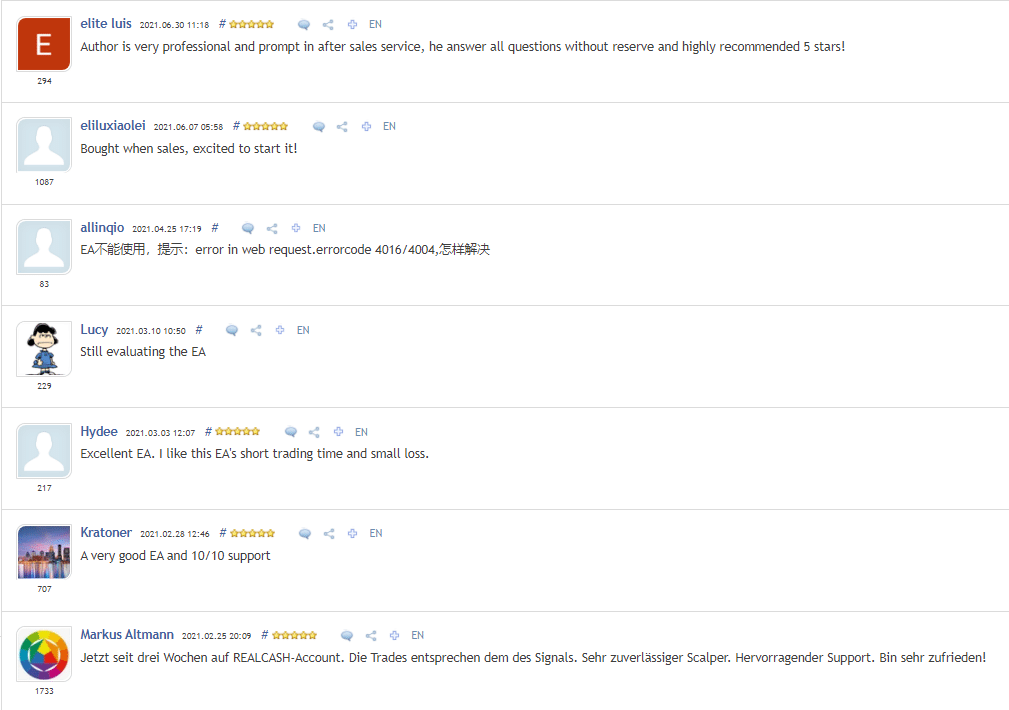

We have only positive testimonials about how the robot works on people’s accounts.

GerFX Density Scalper Review Summary

GerFX Density Scalper-

Functionality4/5 GoodThe robot scalps at night.

-

Trading strategy3/5 NeutralScalping allows making little profits.

-

Live results3/5 NeutralTrading results look good.

-

Customer support3/5 NeutralThe developer is ready to answer all our questions.

-

User reviews2/5 BadThe system has a few people reviews.

The Good

- Backtest reports provided

- Real-account trading results provided

The Bad

- Scalping strategy on the board

- The system is so sensitive to market conditions

- Insane pricing

- Lack of customer testimonials