FXZipper is being marketed as a reliable scalper and broker-friendly EA. One of the main messages is that the system’s approach is not toxic. Also, since FXZipper is profitable on demo and real accounts, your broker will not have a problem if you use it. We doubt if these descriptions are enough to get the attention of serious traders.

The identity of the vendor is unknown. The presentation does not include the name of the company or the credentials of the devs who created this EA. This is disturbing, to say the least. Any vendor who produces efficient products would want to be known and appreciated for their good work. Since this is not the case here, we believe that the system presented to us isn’t productive.

FXZipper at a glance

| Price | $345 |

| Trading platforms | MT4, MT5 |

| Currency pairs | AUDUSD, AUDCAD, USDCAD, GBPUSD, GBPCAD, GBPAUD, EURCHF, and EURCAD |

| Strategy | Scalping |

| Timeframe | M15 |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | N/A |

FXZipper functionality

Some other features of the robot include:

- User manual

- Free updates

- Friendly support

- A 30-day money-back guarantee

- Works with minimum spread accounts

- Broker friendly

FXZipper trading strategy tests

FXZipper uses the scalping approach. The devs say that this strategy allows the EA to keep positions open for short periods and close them when they are profitable. As a result, the small pips are earned from every trade.

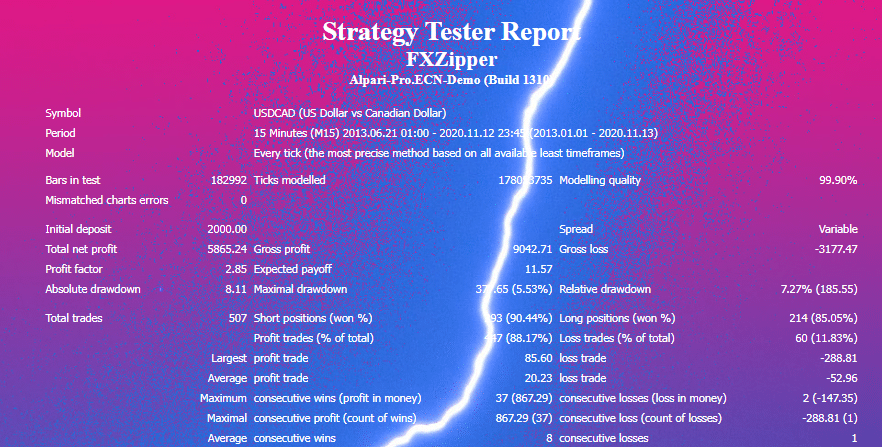

To show us if this strategy is effective, the vendor does not shy away from displaying multiple backtesting results for each currency pair the system trades. In this case, we focus on the USDCAD pair’s test data.

We can see that the team tested the workings of this EA from June 2013 to November 2020 using the 15-minute timeframe. The modeling quality was 99.90%. Within a 7-year period, a profit of $5865.24 was realized from a deposit of $2000. Even then, the system made more losses compared to wins. The stats on the average profit trade ($20.23) and average loss trade (-$52.96) reveal this. There was a maximal drawdown of 5.53%.

What about FXZipper real trading results

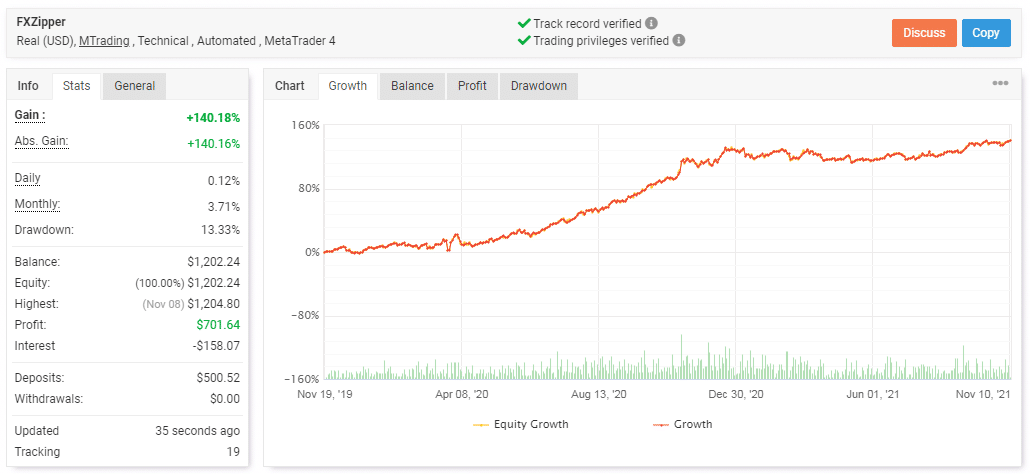

The EA has grown this account by 140.18% since it began its trading activities on November 19, 2019. This means that it has generated a profit of $701.64 from $500.52 after completing 1006 trades. From the daily (0.12%) and monthly profits (3.71%), it is apparent that the robot attains very small revenues from every trade. The losing streak is, however, higher as shown by the drawdown — 13.33%. So, we have a high risk/reward ratio of 3.5:1.

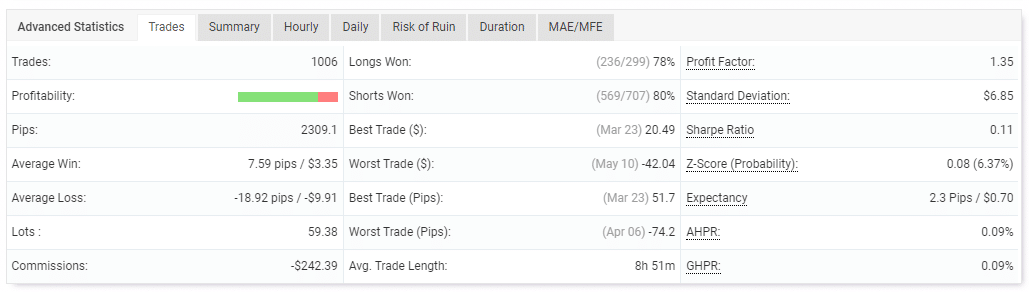

The trades performed aren’t that lucrative as we have a profit factor of 1.35. The best trade had $20.49, while the worst one made a loss of -$42.04. To date, the pips made are 2309.1, with the average win being 7.59 pips. It is disturbing that the average loss (-18.92 pips) is twice higher. This indicates that most of the trades aren’t successful.

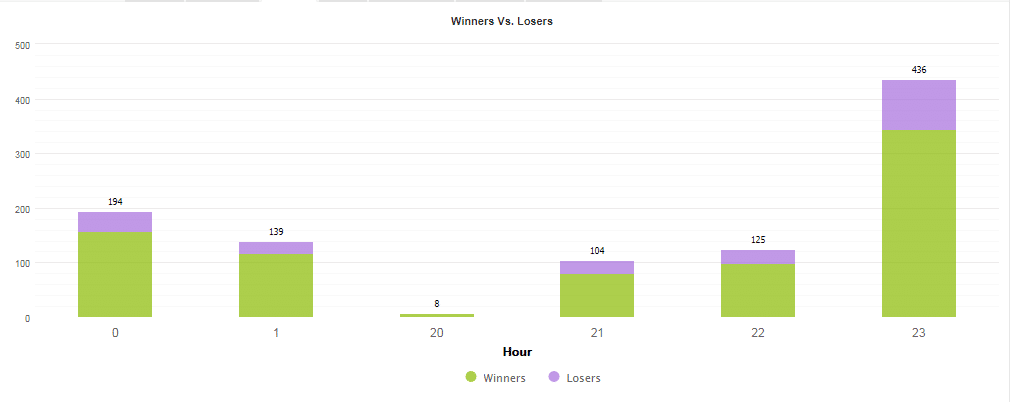

The bar graph above informs us that the EA is very active at night, especially at around 11 pm.

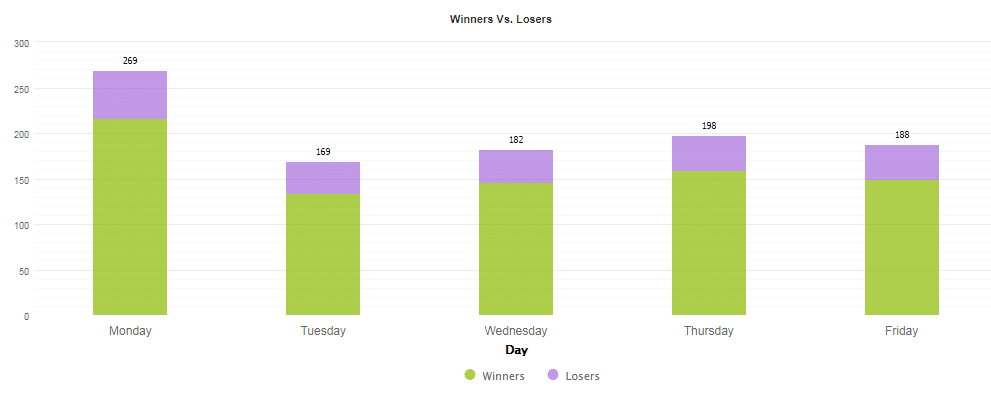

From Tuesday to Friday, the robot conducted numerous trades ranging between 169 and 198. However, it was very active on Monday as the trades completed surpassed the 250 mark.

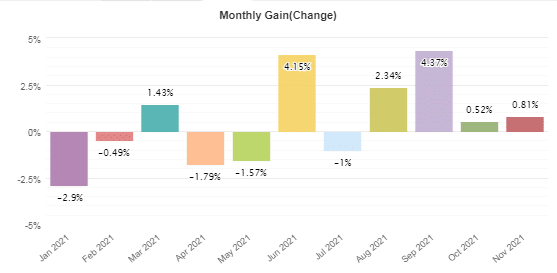

A closer look at the above graph portrays a picture of a system that is incapable of earning a decent income. It makes very small profits. Moreover, January, February, April, May, and July were unproductive.

Customer reviews

FXZipper has a page on FPA, but there are no customer reviews. This is odd considering that the EA has been in the market for a long time now. It could be that traders have not heard about it yet or are reluctant to try it out.

FXZipper Review Summary

FXZipper-

Functionality3/5 NeutralThe features of the robot are outlined.

-

Trading strategy3/5 NeutralThe system uses a not so lucrative trading approach.

-

Live results3/5 NeutralAccording to the live results, the EA is a poor performer as it produces little earnings.

-

Customer support2/5 BadThe vendor claims to offer 24/7 customer support but doesn’t include contact details that can be used to reach them.

-

User reviews2/5 BadThe EA has not received any reviews from customers.

The Good

- Free updates

- Historical and current performance data is available

The Bad

- Zero vendor transparency

- Low rate of profitability

- Lack of customer feedback

- High losing streak