FXMath X-Trader is an FX robot that uses the trend approach for identifying profitable trades. It is designed for the MT4 (MetaTrader 4) platform and has a simple installation process.

This MT4 tool is developed by a financial software team that is skilled in creating trading tools for institutional trading and hedge funds. The vendor does not provide further details on the team members, their expertise, and experience in the Forex market. We could not find a location address or phone number and their Google Maps function does not work properly. The absence of vendor info raises suspicion on the reliability of the company.

FXMath X-Trader at a glance

| Price | $99 – $149 |

| Trading Platforms | MT4 |

| Currency Pairs | EURUSD |

| Strategy | Trend |

| Timeframe | H1 |

| Recommended Deposit | N/A |

| Recommended Leverage | From 1:100 |

| Money Management | Yes |

FXMath X-Trader functionality

According to the vendor, the important features of this FX EA are:

- The vendor offers 24/5 support.

- Regular upgrades are done by the development team to ensure the product is competitive.

- Instant activation of the license once you purchase the product and send your MT4 account details to the vendor.

- This FX EA is compatible with any MT4 broker.

Requirements for the system include an MT4 account with the leverage starting from 1:100 up to 1:1000. The ATS works on the EURUSD pair and the account types you can use include the cent, micro, mini, pro, and ECN accounts.

FXMath X-Trader trading strategy tests

The vendor claims that this EA uses profitable mathematical techniques that assure high profits and the lowest drawdown. It identifies the most probable trend direction for opening orders. The ATS uses math for its signal calculations which, the vendor claims, gives more than a 90% winning rate. We find the explanation is vague and does not reveal many details on the approach.

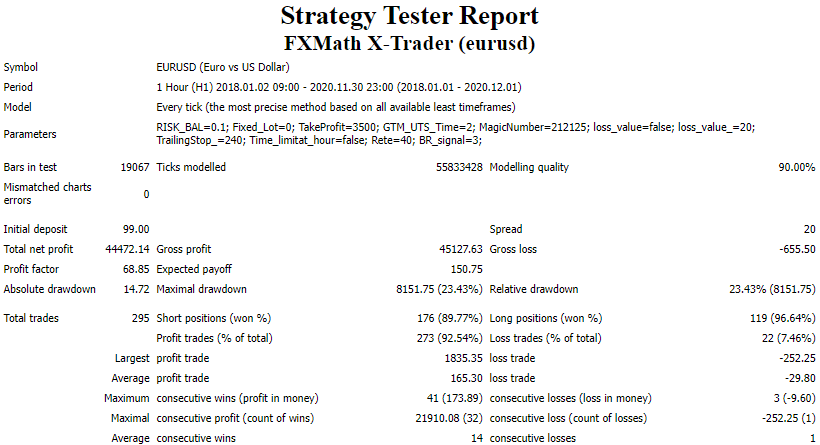

Here is a backtesting report provided by the vendor for the EURUSD pair using the H1 timeframe. The testing done from 2018 up to 2020 is shown below:

From the above report, we can see that a total profit of 44472.14 was generated from an initial deposit of 99.00. A total of 295 trades had been completed with a profitability of 92.54% and a profit factor of 68.85%. The maximum drawdown for the account was 23.43%. From the high drawdown, we find that a risky approach was used.

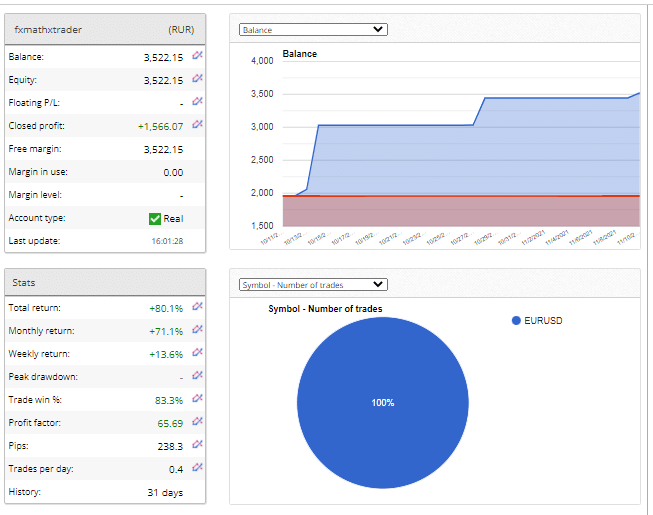

What about FXMath X-Trader real trading results

The vendor provides a real RUR account verified by the FXBlue site. From the above screenshot, we can see the total profits for the account are 80.1%. The monthly and weekly returns for the account are 71.1% and 13.6%. Profitability of 83.3% is present for the account with a profit factor of 65.69. The account shows a trading history of 31 days. We find the monthly profits are too high indicating a high-risk approach. This corroborates the risky approach we found in the backtesting report.

Pricing

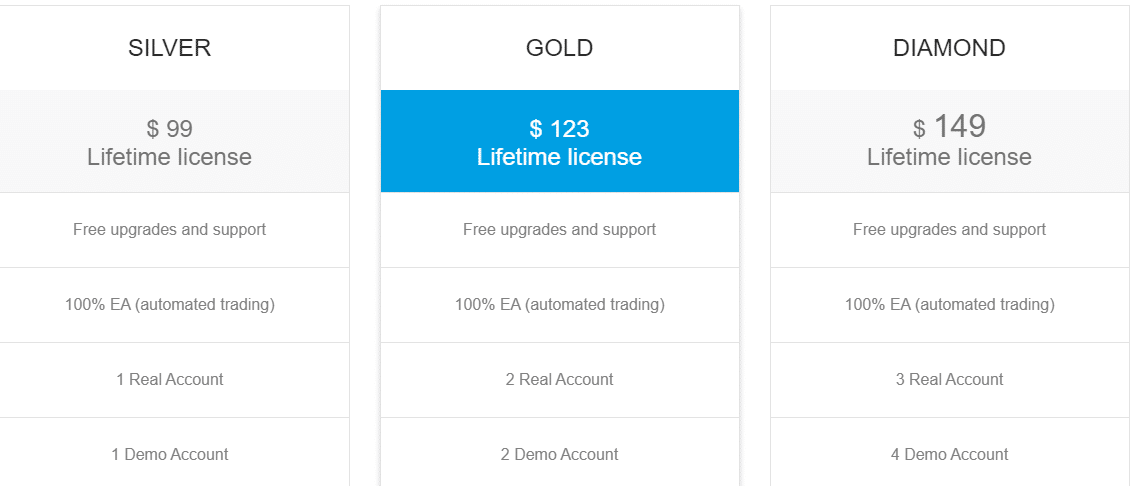

You can choose from the Silver, Gold, and Diamond packages available with the cost ranging from $99 up to $149. Free support and upgrades and fully automated software are offered with the packages. The three packages differ in the number of real and demo accounts they have. We could not find a money-back guarantee which makes us suspect this is an unreliable EA.

User reviews

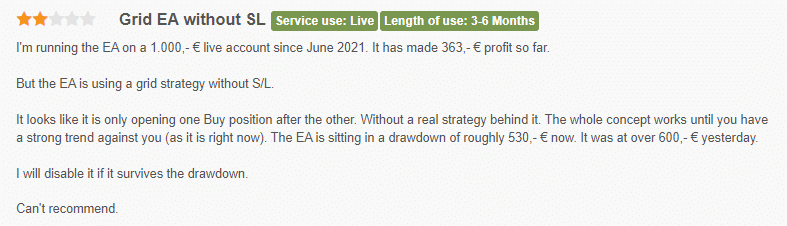

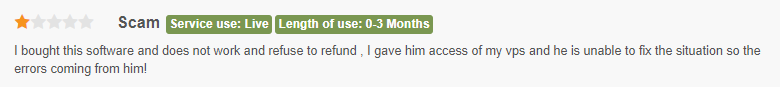

We found 3 user reviews for this FX EA on the FPA site. Here are a couple of the user responses.

From the feedback, we can see that the drawdown is very high and the strategy used is not effective. One reviewer indicates the software is defective and that the company is refusing to refund the money.

FXMath X-Trader Review Summary

FXMath X-Trader-

Functionality1/5 AwfullyThe vendor does reveal info on the working method or other aspects of the EA.

-

Trading strategy2/5 BadVery minimal info present which shows the system lacks a solid strategy.

-

Live results2/5 BadLive trading results show high profits in a very short time indicating a risky approach.

-

Customer support2/5 BadInadequate customer support is present with only a contact form present for contacting the vendor.

-

User reviews3/5 NeutralTwo out three reviews on the FPA reveal this is not a trustworthy EA.

The Good

- Fully automated software

- Verified trading results

The Bad

- Vague explanation of the strategy

- Risky approach seen in real trading

- Negative user reviews