FundedNext, a reputable proprietary trading firm, has been making waves in the financial industry with its unique approach to funding and supporting independent traders. Their business model, structured around risk management and talent nurturing, has been proven to yield impressive results, fostering an environment that encourages growth and profitability. This review will delve into the details of FundedNext’s operations, exploring the various facets of their trading strategies, training programs, and success rates.

Features

Here are some key features of FundedNext as a prop trading firm:

- Trading Capital: FundedNext provides traders with access to trading capital, allowing them to trade with larger positions and take advantage of market opportunities.

- Funding Process: FundedNext has a straightforward funding process, where traders can apply for a funded account based on their trading skills and experience. The firm evaluates the trader’s performance and offers funding accordingly.

- Risk Management: FundedNext emphasizes effective risk management strategies to protect both the traders and the firm. They provide risk management tools and guidelines to help traders minimize potential losses.

- Profit Sharing: FundedNext offers a profit-sharing model, allowing traders to earn a share of their profits. This incentivizes traders to perform well and encourages a mutually beneficial partnership between the firm and the traders.

- Advanced Technology: FundedNext provides traders with advanced trading platforms and technology to enhance their trading experience. This includes real-time market data, advanced charting tools, and order execution capabilities.

- Training and Support: FundedNext offers training and educational resources to help traders improve their skills and knowledge. They may provide access to webinars, video tutorials, or mentorship programs to support traders in their journey.

- Competitive Fees: FundedNext aims to offer competitive fee structures for its traders. They may have low or discounted commissions, reducing the cost of trading and improving overall profitability.

- Diverse Markets: FundedNext may provide access to a wide range of markets, including stocks, futures, options, forex, and commodities. This allows traders to diversify their trading strategies and explore different opportunities.

- Scalability: As traders demonstrate consistent profitability and risk management skills, FundedNext may offer opportunities for traders to scale up their trading capital. This allows successful traders to increase their position sizes and potentially earn higher profits.

- Supportive Community: FundedNext fosters a supportive community of traders, where traders can connect, share ideas, and learn from each other. This community aspect can provide valuable networking opportunities and enhance the overall trading experience.

Keep in mind that these features are provided as general information and should be verified with the official FundedNext website or by directly contacting the firm for the most up-to-date information.

Trading Capital and Funding

FundedNext provides a unique opportunity for traders to access substantial trading capital. The firm’s financial backing allows traders to engage in large-scale trades that may not be possible with their funds. FundedNext’s funding process is designed to be both accessible and fair, taking into consideration a trader’s skills, experience, and track record. Traders can apply for a funded account, and upon successful evaluation of their trading performance, the firm provides the necessary funding. This process ensures that only competent and profitable traders are entrusted with the firm’s capital, thereby minimizing risks and increasing the likelihood of successful trading outcomes. It is thus integral that potential traders demonstrate a comprehensive understanding of financial markets and trading strategies, along with a proven ability to manage risk. As always, prospective traders should refer to the official FundedNext website or contact the firm directly for the most accurate and up-to-date information regarding trading capital and funding.

Risk Management and Profit Sharing

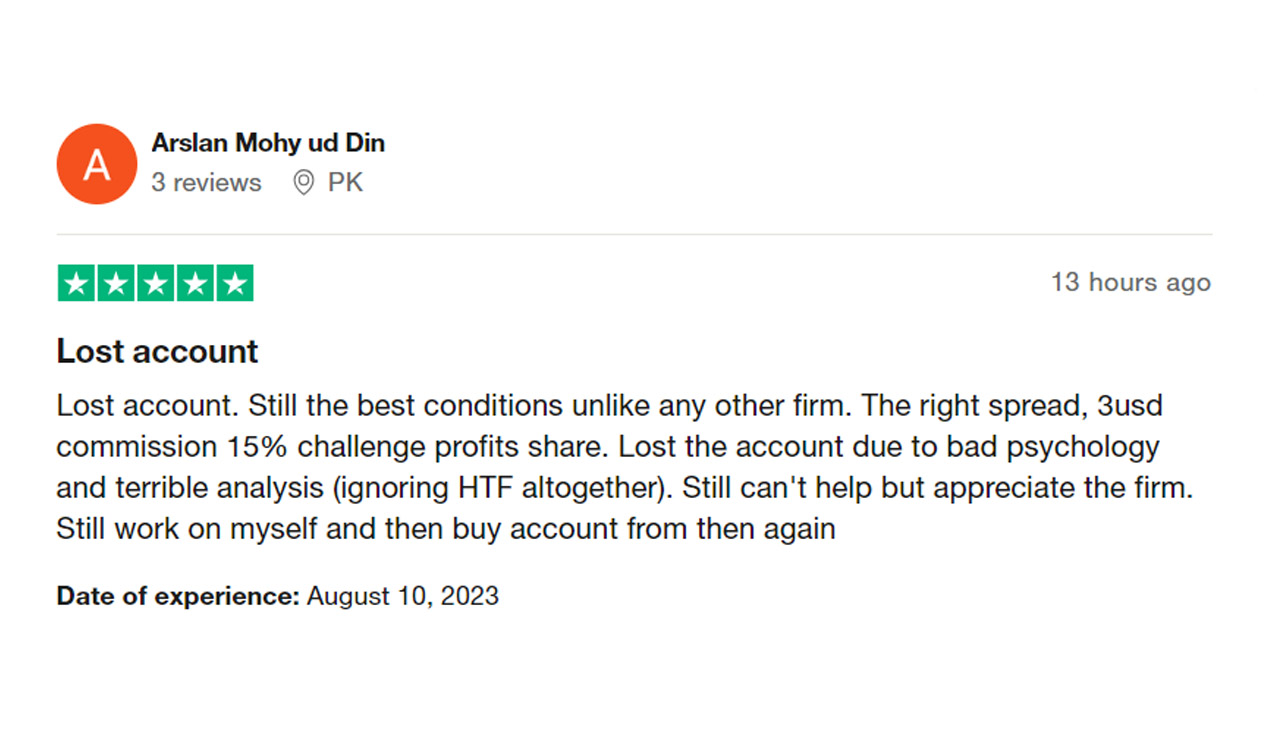

Risk management is a cornerstone of FundedNext’s operations. The firm provides traders with a suite of risk management tools and guidelines to help them navigate market volatility and minimize potential losses. By placing a high emphasis on risk management, FundedNext ensures the sustainability of its operations and the protection of its capital. This approach also encourages traders to adopt prudent trading habits, instilling a discipline that is crucial for trading success. Further, it serves to protect traders from the detrimental effects of substantial losses, helping them to maintain a positive trading mindset.

FundedNext’s profit-sharing model aligns perfectly with their risk management strategy. The firm allows traders to reap a share of the profits generated from their trades. This incentivizes traders to perform well, as their earnings are directly tied to their trading success. The profit-sharing model also fosters a mutually beneficial relationship between FundedNext and its traders, as both parties stand to gain from successful trading outcomes. With this setup, the firm motivates its traders not only to achieve profitability but also to adhere to the disciplined risk management guidelines provided. Prospective traders should note that the exact details of the profit-sharing model, including the percentage of profits shared, may vary and should be verified directly with FundedNext.

Trading Platforms and Technology

FundedNext leverages the power of cutting-edge technology to provide its traders with a superior trading platform. Their platform integrates real-time market data, advanced charting tools, and efficient order execution capabilities, allowing traders to navigate the complexities of the market with ease. The platform’s user-friendly interface ensures a seamless trading experience, whether you are a novice trader or an experienced professional. Furthermore, FundedNext’s platform is characterized by its robust stability and reliability, ensuring uninterrupted trading even during periods of high market volatility. Potential traders should note that the specifics of the trading platforms offered may differ, and it is recommended to check the official FundedNext website or contact the firm directly for accurate information.

Training and Support

FundedNext places a significant emphasis on education and continuous learning. The firm offers extensive training resources and tools to help traders enhance their skills and knowledge. These resources include webinars, video tutorials, e-books, and even one-on-one mentorship programs for those seeking personalized guidance. Beginner traders can greatly benefit from these educational resources, as they offer a deep dive into vital trading concepts, market analysis techniques, and risk management strategies. Experienced traders, too, can leverage these tools to refine their trading strategies and stay up-to-date with evolving market trends. In addition, FundedNext provides dedicated support to its traders, addressing any technical, operational, or trading-related concerns promptly and effectively. This commitment to training and support underscores FundedNext’s dedication to empowering its traders, fostering a conducive environment for growth, and facilitating trading success. However, prospective traders should refer to the official FundedNext website or get in touch with the firm directly to gain precise information about their training resources and support services.

Summary

Summary-

Substantial capital financing4/5 Good

-

Comprehensive risk management tools3/5 Neutral

-

User-friendly trading platforms3/5 Neutral

-

Profit sharing model3/5 Neutral

-

Extensive training resources4/5 Good

-

Dedicated support services4/5 Good

The Good

- Substantial capital financing

- Comprehensive risk management tools

- User-friendly trading platforms

- Profit sharing model

- Extensive training resources

- Dedicated support services

The Bad

- Limited availability of certain trading products and instruments

- Potential fluctuations in profit sharing percentage shared with traders