Forex Sugar is an FX robot that promises steady growth of the account and quick profits. This fully automated EA trades 24/5. As per the developer Brian Jones, the FX EA is designed based on your profit goals. Price data analyses and real-time scalping are used for the trading approach. The ‘About Us’ section does not reveal info on the developer or the company. There is no location address or phone number present. For support, the developer provides email addresses and an online contact form. From the minimal info provided on the developer and company, we are suspicious of the reliability of the FX robot.

Forex Sugar at a glance

| Price | $99 – $264 |

| Trading Platforms | MT4 |

| Currency Pairs | EURGBP, XAGUSD(silver), XAUUSD(gold), AUDUSD |

| Strategy | Grid-based scalping |

| Timeframe | M15 |

| Recommended Deposit | $1000 |

| Recommended Leverage | 1:500 |

| Money Management | Yes |

Forex Sugar functionality

As per the developer, the expert advisor is optimized and well-developed ensuring profitable trades. The orders are made based on technical indicators and smart calculations. It is possible to adjust the settings or shift to manual trading in the presence of unusual market conditions. This ATS monitors and trades several instruments 24 hours a day. According to the developer, the working method of this MT4 tool is as follows:

- It uses technical indicators and live news events for generating signals

- On opening positions, it uses indicators for deciding on the TP or SL levels and does not have fixed settings.

- The MT4 tool works best in a stable market. In the case of volatile markets, the EA pauses in its trading activities. You can however change the settings to allow or stop trading.

- You can keep the software turned on or off on any specific weekday.

Forex Sugar trading strategy tests

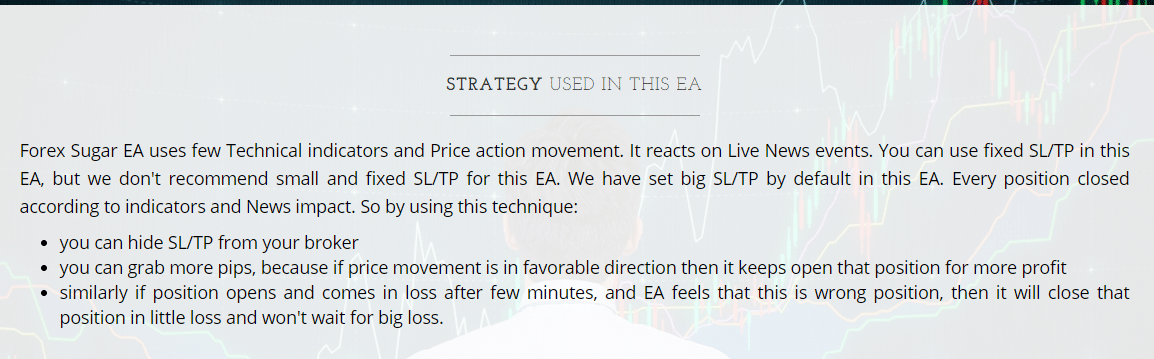

The developer claims that price action and technical indicators are used for the strategy. The EA reacts to live news events. Each position is closed based on the news impact and the indicators. The developer recommends that fixed SL and TP are not appropriate for the EA.

A big SL and TP position is present as default settings. The trading method used allows you to hide the SL and TP levels from your broker. It also enables you to get more pips if the price movement is favorable. Similarly, it can close a trade, even with a small loss, and does not wait until a big loss.

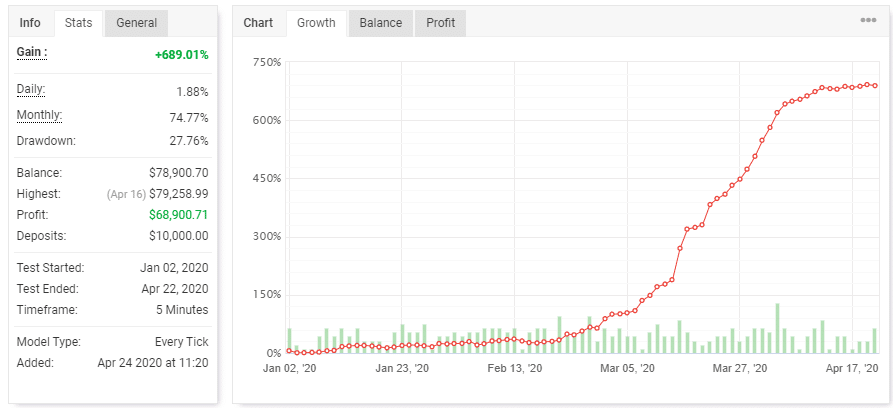

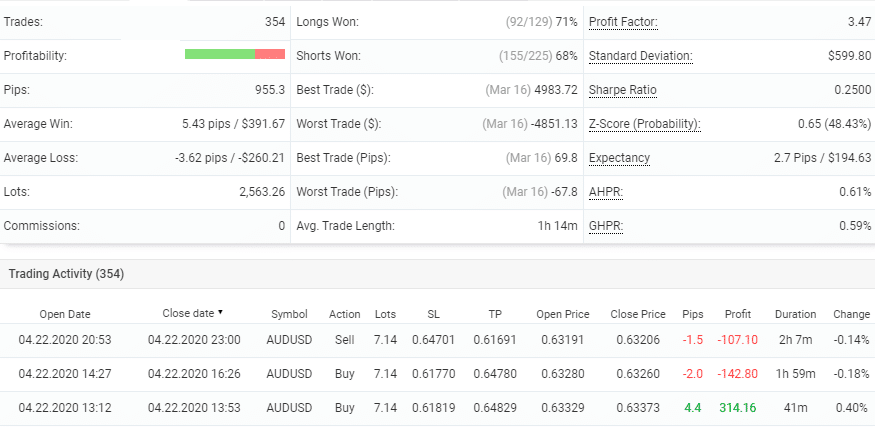

The developer provides a strategy tester report using the ‘Every Tick’ model on the Myfxbook site. From the trading stats, we can see the test occurred from January 2020 up to April 2020 on a timeframe of 5 minutes. For a deposit of $10,000, the total profit generated was 689.01%. A daily and monthly profit of 1.88% and 74.77% are present. The drawdown was 27.76%. A total of 354 trades have been completed with a profitability of 74% and a profit factor of 3.47. The trading history reveals the lot size of 7.14. From the big lot size and high drawdown, we find that the approach used was very risky.

What about Forex Sugar real trading results?

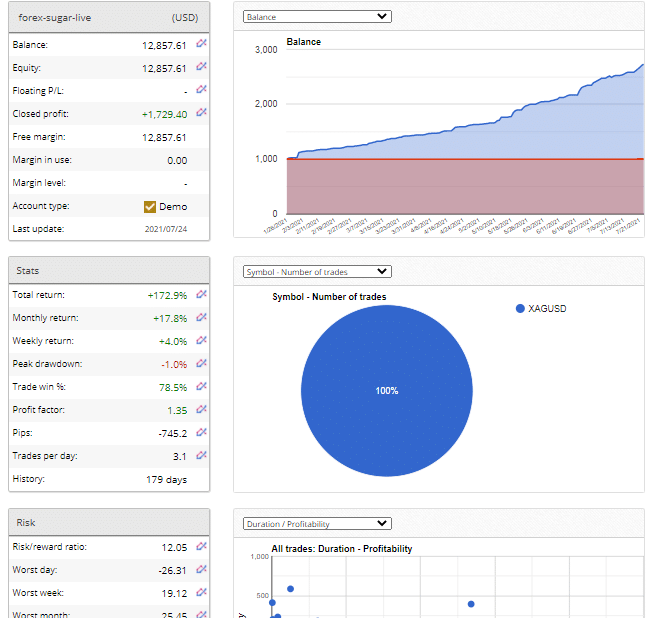

A live demo USD account verified by the FXBlue site is present on the official site. Here is a screenshot of the test results.

From the above trading statement, we can see a balance of 12.857.61 for a deposit of $1000. The total profit is 172.9% and the monthly returns are 17.8%. A peak drawdown of -1% is present in this account with a profit factor value of 1.35 and profitability of 78.5%. The risk to reward ratio is high at 12.05. The risk to reward ratio is 12.05, which indicates a high-risk strategy and poor performance.

User reviews

We could not find feedback from customers for this FX EA on reputed sites like Forexpeacearmy, Trustpilot, etc. The absence of reviews reveals the system is not well-known among the traders’ community.

Forex Sugar Review Summary

Forex Sugar-

Functionality4/5 GoodThe developer provides info on the features, working method, strategy, and other aspects of the website.

-

Trading strategy4/5 GoodThe dev mentions the trading approach the robot uses.

-

Live results2/5 BadOnly a live demo account result is displayed and the result indicates the poor and risky performance.

-

Customer support2/5 BadVery minimal support methods are present which raises a red flag.

-

User reviews1/5 AwfullyNo user reviews present on reputed sites including Forexpeacearmy, Trustpilot, etc.

The Good

- Automated software with manual trading option

- Verified trading results

The Bad

- Backtests and live trading results reveal a risky approach

- No vendor transparency

- Absence of a money-back guarantee