DynaScalp is an FX robot that assures profitable trade opportunities in a hassle-free way. The FX EA claims to have made more than 500% profit in a very short span and with a low drawdown. By installing the software, the vendor claims that you can make triple-digit profits without prior trading experience. This EA is promoted by the LeapFX company.

The company develops and promotes automated trading systems and offers manual trading and managed account services. Unfortunately, we could not find info about the company like its founding year, team members, their experience, address, and phone number. To reach support, the vendor provides an online contact form. The lack of transparency and inadequate support raises doubts regarding the reliability of the EA.

DYNASCALP at a glance

| Price | $397 |

| Trading Platforms | MT4 |

| Currency Pairs | Multiple currency pairs |

| Strategy | Night scalping |

| Timeframe | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

DYNASCALP functionality

Chris Bernell is the developer of this scalping EA. The features of this FX EA include a trading approach that does not use dangerous methods like the Grid or the Martingale system. A news filter is included in the settings and the EA opens and closes its trades on the same day. This fully automated system claims to be beginner-friendly. As per the developer, the main currency pairs this ATS works on are shown in the screenshot below:

Other features the developer mentions concerning this FX Robot include a full plug and play system, a scalping method with a high winning ratio, and SL for all trades with a smart trailing stop.

DynaScalp trading strategy tests

According to the info that the developer provides, this FX EA uses a night scalping approach along with an asset weight management system. The combined methods help the market to control the currency pair weights and the strategy can self-balance based on the prevailing conditions. Consequently, the profitable pairs will be represented more and the non-performing pairs show less participation. We find the explanation is insufficient to assess the efficacy.

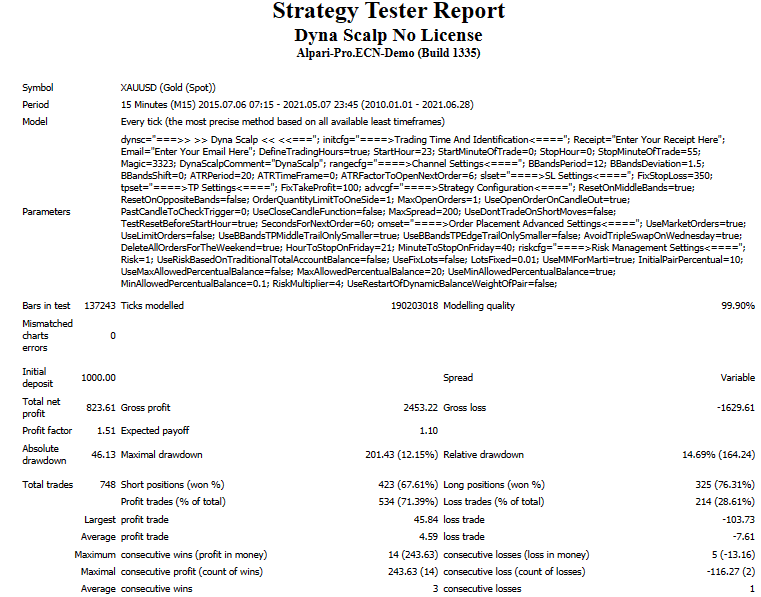

Many backtesting results are present on the official site. Here is a screenshot of one of the strategy tester reports that the vendor provides:

From the above report, we can see the XAUUSD pair revealed a timeframe of 15 minutes and a 99.9% modeling quality. A total net profit of 823.61 was generated for the deposit of $1000. The profit factor value was 1.51 and the maximal drawdown was 12.15% for the account that had executed a total of 748 trades. The profitability was 71.39% and the lot size used was 0.04.

What about DynaScalp real trading results

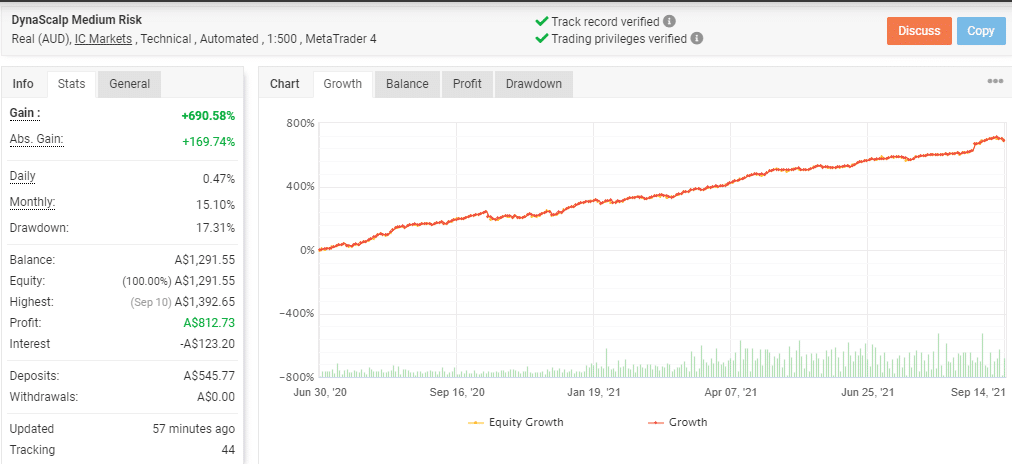

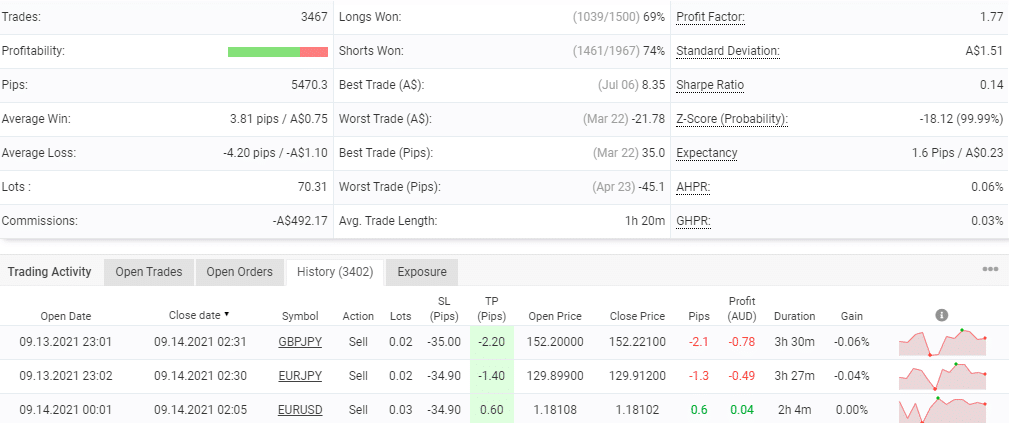

We found a real AUD account for this EA using a medium risk trading style on the IC Markets broker with the leverage of 1:500. The myfxbook verified account is shown in the screenshots below:

From the real live account started in June 2020 with a deposit of AUD 545.77, we can see a total profit of 690.58% is present and the absolute profit is 169.74%. The big difference between the two values indicates a risky trading approach and poor performance. A daily and monthly profit of 0.47% and 15.10% are present for the account. The drawdown value is 17.31 for a total of 3467 trades with a profitability of 72% and a profit factor value of 1.77. From the trading history, we can see varying lot sizes are used ranging from 0.02 up to 0.11. The high lot sizes, the difference in the absolute and total profits, and low profitability indicate the trading approach is ineffective resulting in poor performance.

User reviews

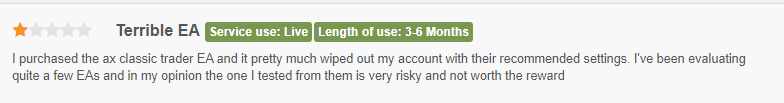

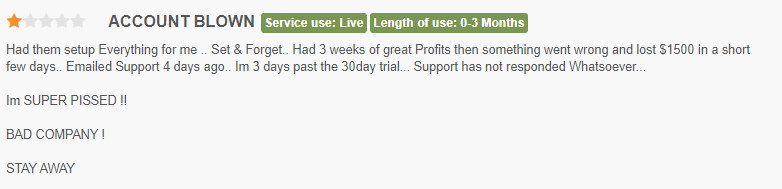

We could not find user reviews for this FX EA. But we found several reviews on forexpeacearmy.com for the LeapFX company. A rating of 3.152 out of 5 stars is present for 16 reviews posted on the site.

From the above reviews, we can see the products are not worth buying as they cause big losses and the customer support is also poor.

DynaScalp Review Summary

DynaScalp-

Functionality2/5 BadVery minimal info is present concerning the features, settings, and recommendations.

-

Trading strategy2/5 BadInsufficient explanation of strategy is present and backtests show low profitability.

-

Live results2/5 BadSeveral discrepancies are present which makes us suspect a risky approach.

-

Customer support2/5 BadThe support methods present are inadequate.

-

User reviews2/5 BadFeedback for the EA is not present but the company has reviews that reveal it Is not a trustworthy system.

The Good

- Fully automated trading

- Verified trading results

The Bad

- Insufficient explanation of the trading approach

- Real trading results show a risky strategy

- Expensive price