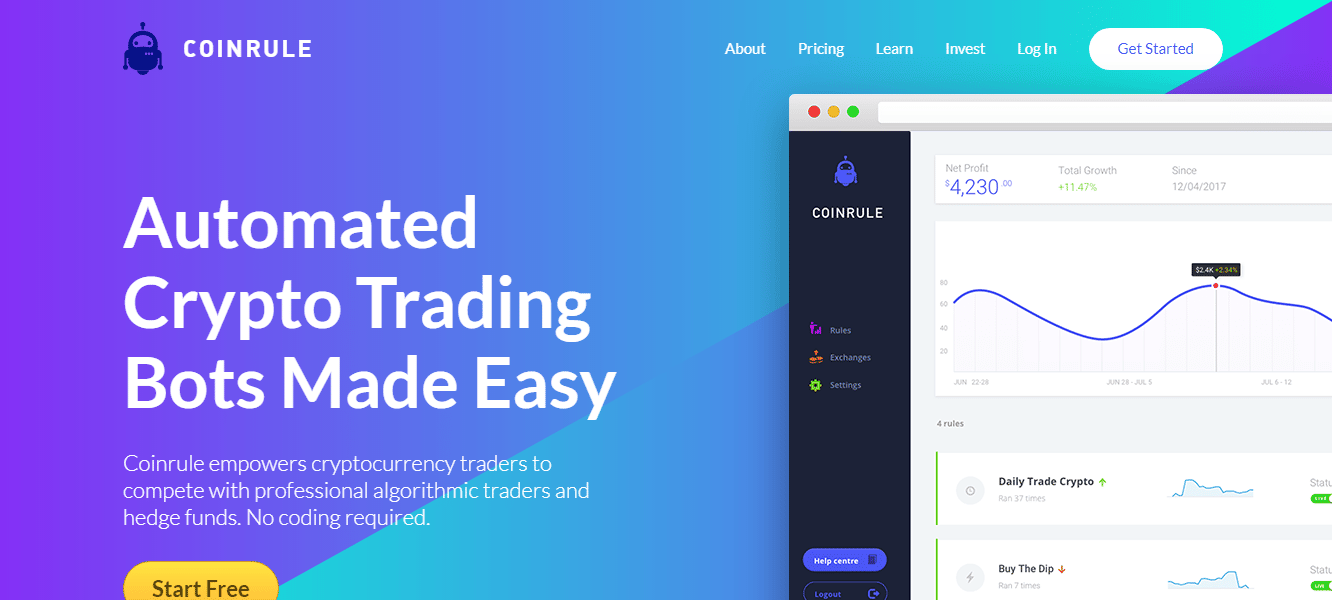

Coinrule is a fully automated cryptocurrency trading platform that provides a variety of bots for various market conditions. It lets you backtest your system with historical data and run your algorithms with a demo account. Binance, Kraken, Liquid, etc are some of the compatible exchanges. We’ll go over the platform in-depth, looking at its features, pricing, profitability, and more, so you can decide if it’s right for you.

What is Coinrule?

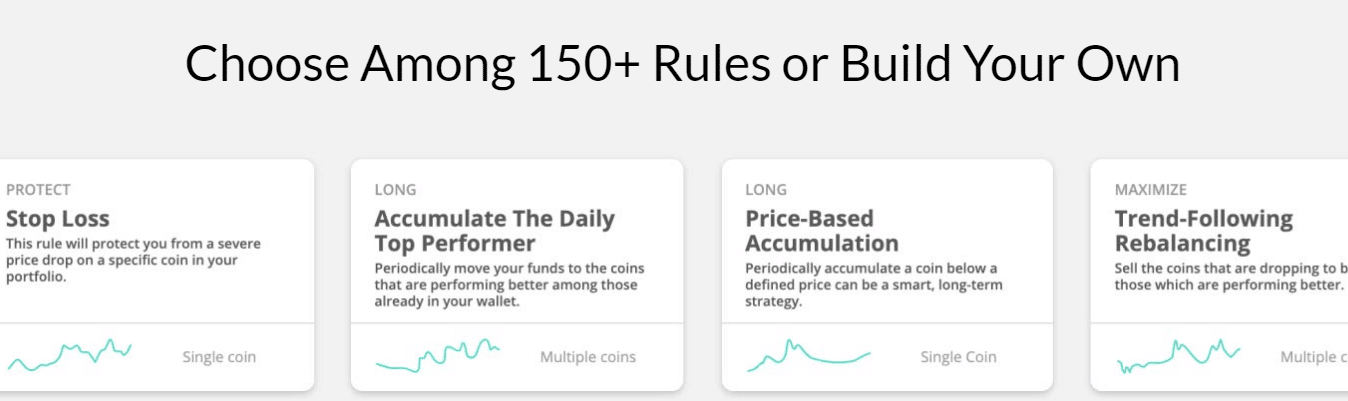

Coinrule claims to be a user-friendly platform that does not require any coding knowledge. Traders can use over 150 templates to develop automated strategies and receive free trading alerts. Users can sign up for a free demo or purchase one of the monthly options.

How does Coinrule help traders?

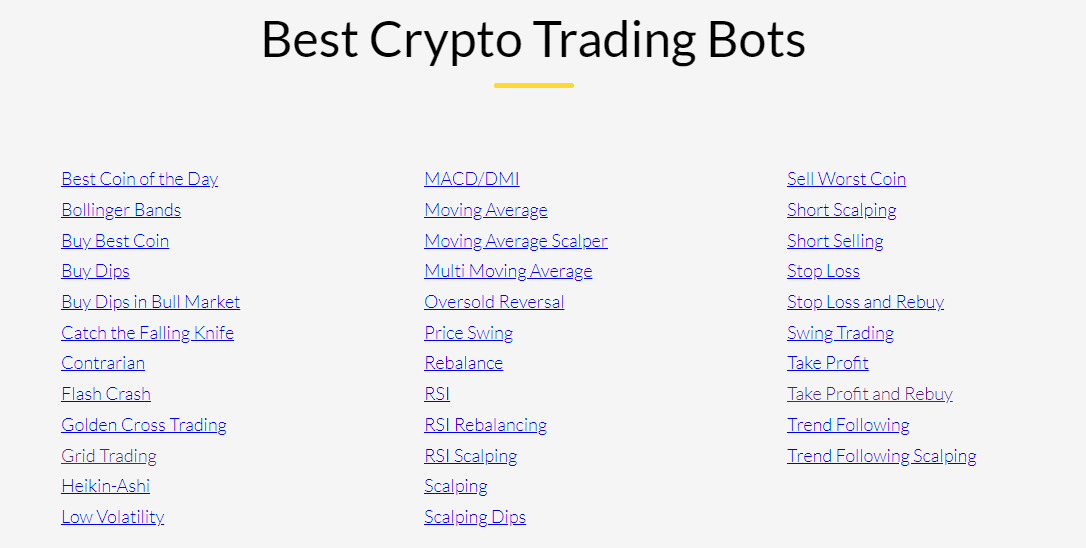

Coinrule helps traders design their trading strategy or use one from the built-in rules. They can use RSI, moving averages, contrarian, trend following, accumulation, risk management, and other trade approaches.

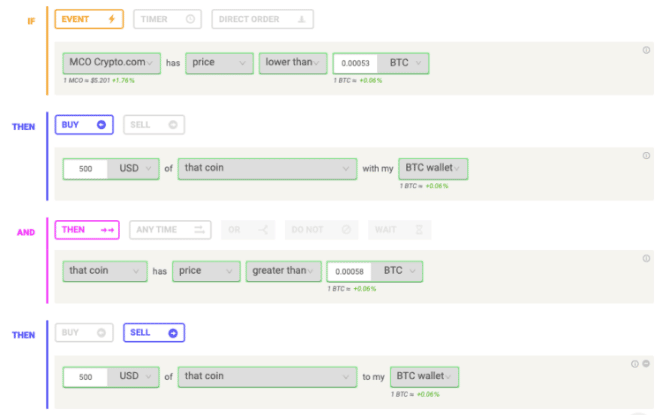

The platform employs a variety of IFTTT-based methods. The bots follow the pre-programmed parameters and place orders on the investor’s behalf. Numerous algorithms are available such as grid, MACD, short scalping, etc.

Coinrule main features

Following are the main features of Coinrule:

- It allows traders to create a customized trading strategy.

- The platform provides about 150 preset rules.

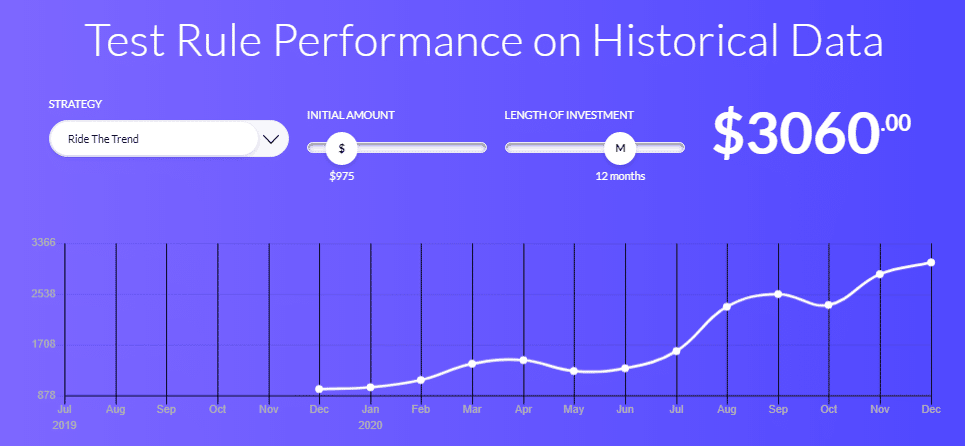

- You can test the performance of your algorithms on historical data.

- No coding skills are required as it uses simple if-this-then-that (IFTTT) methods.

- The webpage states to have military-grade security for accounts and funds.

Ease of use

The interface is average, including options for both novice and experienced traders. It gives tutorials on the platform functionality to avoid running into any major issues. Setting up the parameters does not require any programming knowledge. You can get started on the platform by selecting the exchange, template, trading pairs, and investment amount.

Settings

At Coinrule, traders can use the setting for their algorithm according to their needs. You can place your orders at certain time intervals or in response to specific market events. The platform requires users to configure parameters like condition (time to execute), action, operator (represents a logical relationship between various blocks within the same rule), etc.

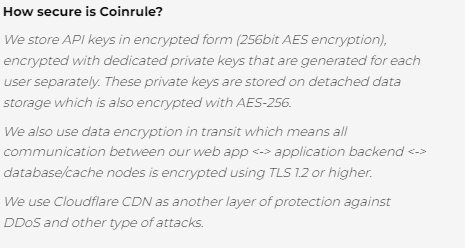

Safety and security

Coinrule takes several security measures to protect the funds and accounts of its user, such as:

- Encrypted API keys

- No withdrawal permission

- Cloudflare CDN against DDoS and hack attacks

- TLS 1.2 encrypts communication between the app, backend, and cache nodes

Customer support

Traders can contact the support team via email only. The website also mentions the address of the London office.

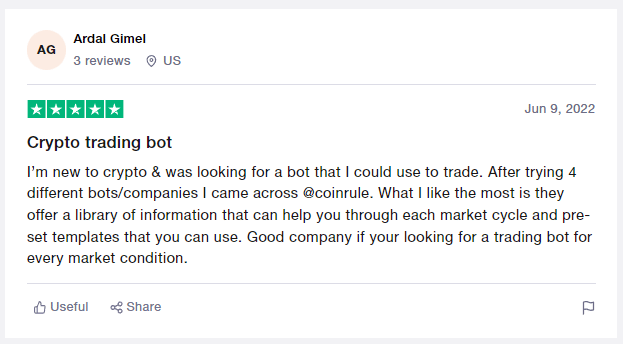

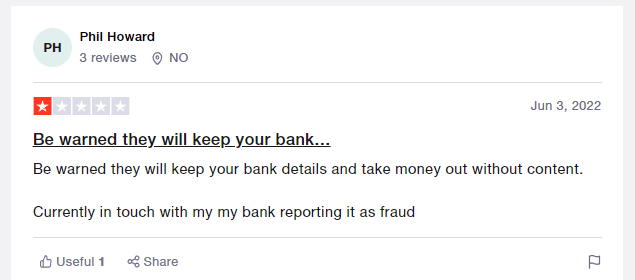

Public testimonials

Public reviews can be found on Trustpilot, a credible third-party website with 74 customer reviews and a 4.3/5 rating. According to one user, Coinrule provides predefined templates and good service, while another urges fellow traders not to submit bank data with the site since they will charge your account without your permission.

Profitability

Coinrule’s website lacks backtesting records that would allow us to assess its performance in historical data. The test tule performance is at hand with no real insights on drawdown and profit factor. There are also no live records available.

What does it cost to use Coinrule?

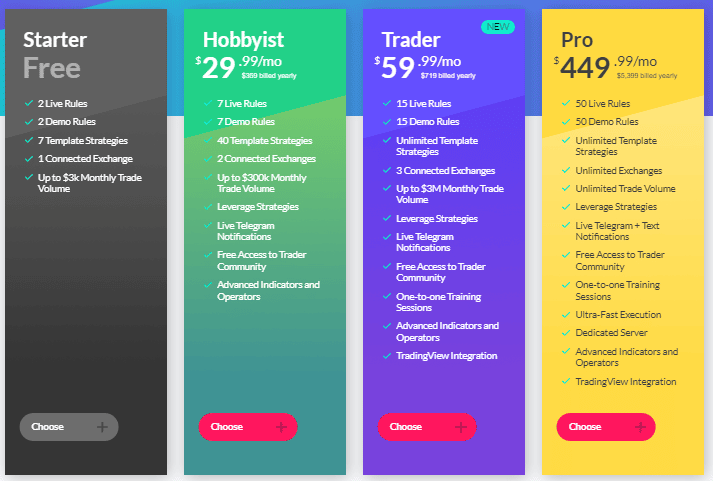

Following are the four subscription options available at Coinrule:

- Free plan: 7 template strategies, one exchange and $3k trading volume

- Basic subscription: Costs $29.99 a month and includes seven live and demo rules each, 40 templates, two connected exchanges, and other features.

- Trader plan: Costs $59.99 per month and $719 per year, up to $3 million in trading activity.

- Professional plan: $449.99/month, unlimited exchange support, 50 demo, and live rules

Other than these, Coinrule does not impose any further fees.

Coinrule supported exchanges

Coinrule supports trading cryptocurrencies on the following exchanges:

- Binance

- Coinbase Pro

- Okex

- HitBTC

- Bitstamp

- Bitpanda

- Kraken

- Poloniex

- Bitmex

- Liquid

Deposit & withdrawal requirements

The platform does not provide information on the minimum deposit or withdrawal policy.

How to get started on Coinrule?

The following are the steps to get started with Coinrule:

- Use your credentials to log in to the platform

- To test your rules, choose a cryptocurrency exchange or utilize a demo exchange

- Link the bot and exchange via API keys

- Select a trading strategy or use one of the built-in templates

- Set the bot’s conditions and actions

- Run the bot

The core team of Coinrule

Coinrule is an England-based company, and the board member includes:

- Gabriele Musella (CEO)

- Oleg Giberstein (COO)

- Zdenek Hofler(CTO)

According to the website, the company partners with over ten crypto platforms such as Kraken, NatWest, Daneel, fintech, crypto Mondays, and others.

Final verdict for Coinrule

Final verdict for CoinruleAdvantages

- A free plan with seven pre-built templates.

- You can trade simultaneously with 14 rules on the annual plans offer.

Disadvantages

- Technical indicators are available for some exchanges.

- The pricing plans are expensive.

- Lack of performance records.