Champion trading robot comes at an asking price of $499 and works only on the MT4 and MT5 platform. The developer claims that the algorithm is not sensitive to slippage and spread and uses a magic number to control its trades. Traders only need to attach it on one chart to trade AUDCAD, NZDCAD, EURCAD, GBPCAD, and AUDNZD.

Evgenii Aksenov is the name of the author behind the system. He has 48 products published on the MQL 5 marketplace and has 22 signals for his services. The author has a total experience of more than three years, but there are no records or certificates that could verify this.

Champion EA at a glance

| Price | $499 |

| Trading Platforms | MT 5 |

| Currency Pairs | Multiple |

| Strategy | Martingale |

| Timeframe | H1 |

| Recommended Deposit | There’s no info on the recommended deposit. The minimum initial amount to trade 1 currency pair is $100 |

| Recommended Leverage | N/A |

| Money Management | Yes |

Champion EA functionality

The EA has the following features:

- It requires a hedging account for trading.

- The robot can work on multiple currency pairs.

- There is no need to attach it on various charts separately.

- The system is not sensitive to spread and slippage.

Champion EA trading strategy tests

The developers state that the EA trades on multiple currency pairs on the H1 chart and uses a news filter to avoid trading during volatile market conditions. From the history of the live records, we can see that it uses grid and martingale strategies. It uses a swing trading approach evident from the average trade duration of 5 days.

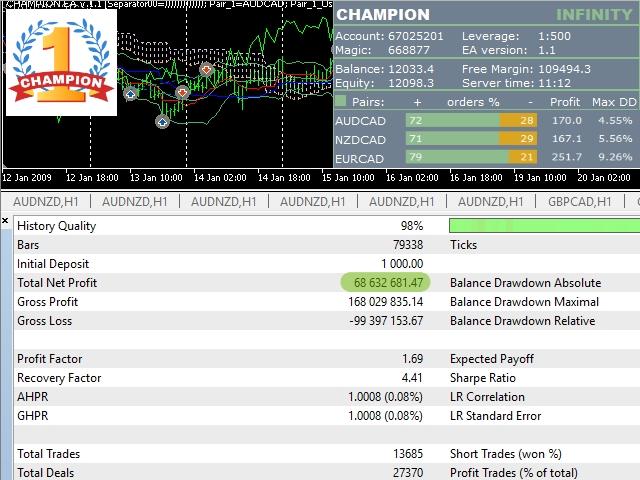

Backtesting results are available for unknown currency pairs with a modeling quality of 98%. For the duration, the robot had a maximum drawdown of 9.26% and turned an initial deposit of $1000 into $68632681.47. It had a profit factor of 1.69 and an AHPR of 1.0008 in a total of 13685.

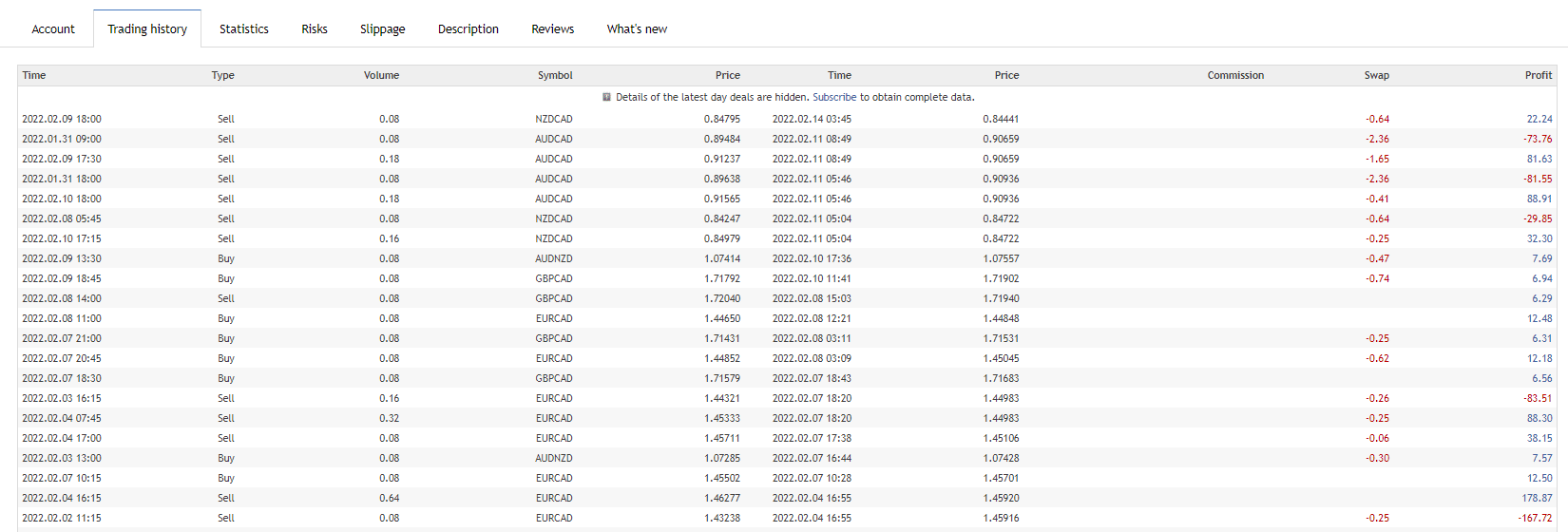

Champion EA real trading results

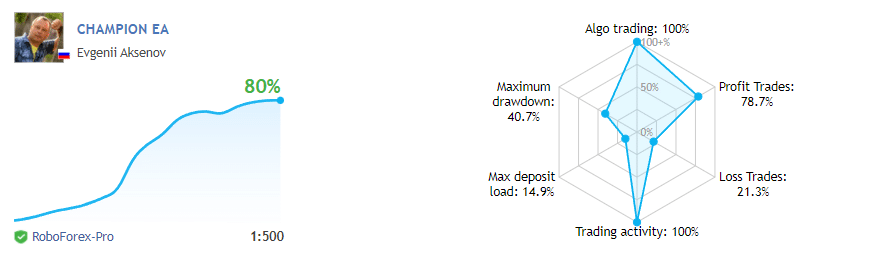

Verified trading records on MQL5 are available. We can see that the current floating gain is 80% at an account balance of $18013.55. The drawdown value is around 40.7%, with a winning rate of 78.7%, with a profit factor of 1.84. The drawdown amount is quite high which shows that the algorithm can cause a high loss on the account.

The best trade was $1624.47, while the worst was -$770.84 in a total of 647 trades. The system made an average monthly output of 6% during the period.

User reviews

There are 14 reviews present on the MQL5 marketplace, where the algorithm has a total rating of 5. One of the trades says they have purchased the robot and are currently testing it on their demo account. They will comment on the final results after two months.

Pricing

Traders can purchase the robot for an asking price of $499. The licenses are available for one real account where the trader logs in.

Champion EA Review Summary

Champion EA-

Functionality3/5 NeutralThe service works on MT 4 and 5 platform.

-

Trading strategy3/5 NeutralIt uses a grid and martingale trading approach.

-

Live Results2/5 BadLive results show a high drawdown.

-

Customer support4/5 GoodCustomer support is only available through the MQL5 marketplace.

-

User reviews4/5 GoodThere are a total of 14 reviews giving a 5-star rating.

The Good

- Live records available

The Bad

- Uses grid and martingale

- No transparency of backtesting

- No verified results on third party websites