Cairo was first published on MQL5 in January 2021. It is depicted as a fast and dynamic algorithm that has attained a 99% profitability rate on historical data after being backtested. However, the developer warns that past performance does not guarantee future results. So, before purchasing the EA, make sure you fully understand the risks involved in Forex trading.

Cairo was developed by a Switzerland-based developer known as Ruben Octavio Gonzalez Aviles. He has created two other systems, namely Kyoto and Berlin. There’s no more information about this developer, including his professional background, trading experience, etc.

Cairo at a glance

| Price | $399 or $249/month |

| Trading platforms | MT4, MT5 |

| Currency pairs | EURUSD |

| Strategy | N/A |

| Timeframe | Any |

| Recommended deposit | N/A |

| Recommended leverage | N/A |

| Money management | Yes |

Cairo functionality

Find below the other functionalities of the robot:

- It is fully automated.

- The recommended broker is Vantagefx.

- You are advised to set the Max Lot equal to the Dynamic Lot to utilize the EA with a fixed lot.

- Although the system works with a single currency pair, you can test and experiment with other instruments.

Cairo trading strategy tests

The vendor gives a generalized description of the system’s strategy, saying that it focuses on opening many trades weekly and closing them on the same day in most cases. He doesn’t reveal the exact criteria the robot employs while looking for entry points. A fixed take profit and stop loss are attached to every order. Although you are permitted to change the values, it is advisable to maintain the default values to optimize your performance. Apparently, no martingale, smart recovery, averaging, or grid trading are integrated into this program.

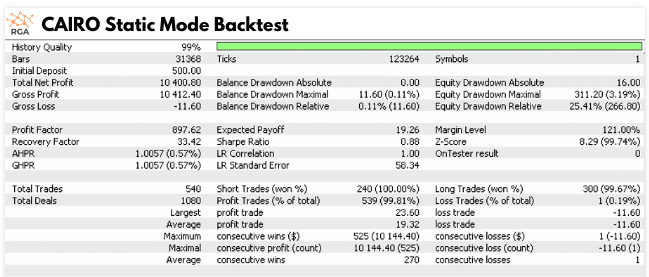

As per the backtest report above, Cairo was backtested with the static mode setting, between January 2016 and December 2020. The account started with a balance of $500, but by the end of the trading period, the system had increased it by $10400.80.

There were 540 completed trades, and the resulting win rates for the short and long trades were 100% and 99.67%, respectively. A small drawdown of 3.19% was generated, suggesting the robot worked with low risks to the balance. The profit factor (897.67) was impressive.

What about Cairo real trading results

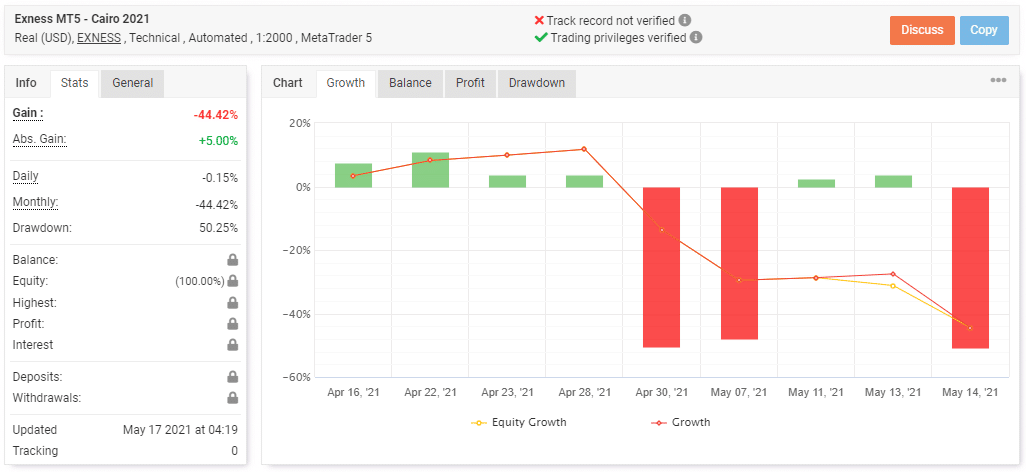

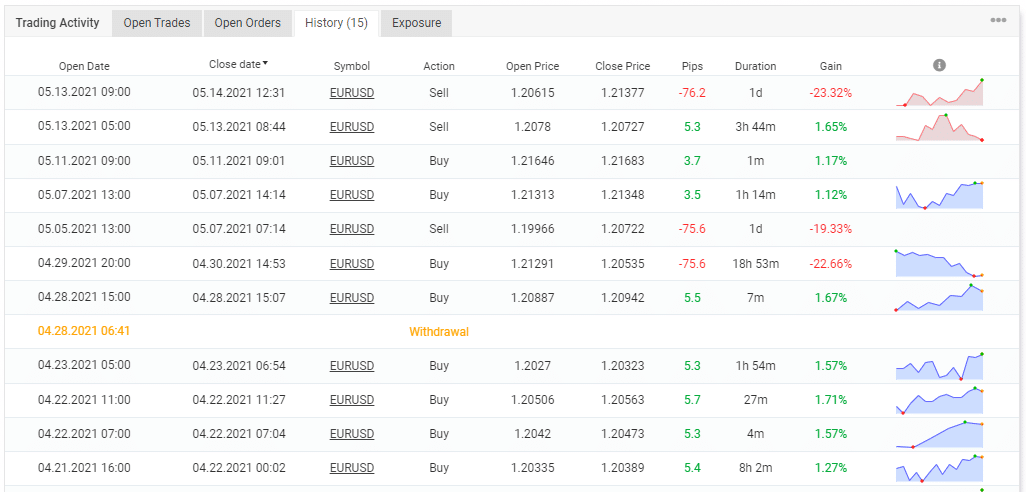

These live results hugely contrast with the ones we have seen in the backtest report. Clearly, Cairo struggles to make profits in the live market. The above account was launched in April 2021 and closed a month later. Within this period, the robot managed to decrease the account’s value by -44.42% after generating a huge drawdown of 50.25%. Other data values are not locked, possibly because they are not good.

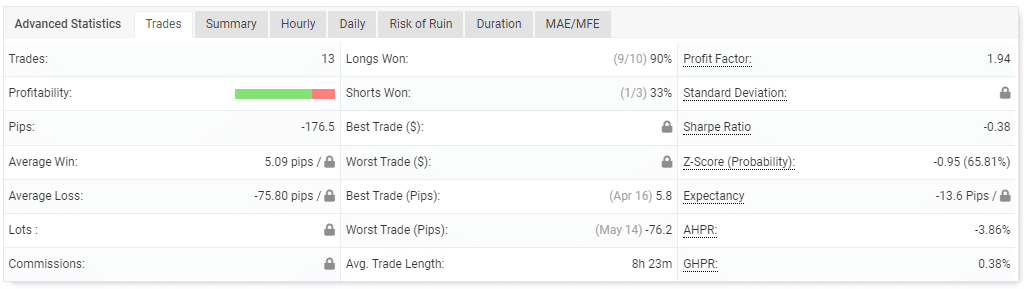

The system implemented a total of 13 trades, and won 90% of the long trades. The performance of short positions was poor at 33%. Comparisons of the average win (5.09 pips) and average loss (-75.80 pips) values show that the EA had a high losing streak. On average, the EA held a trade for 8 hours and 23 minutes.

The robot made a few wins and some large losses for the short period it operated on this account.

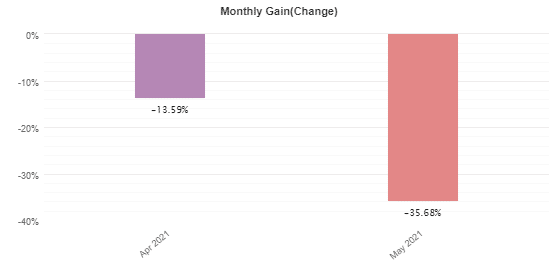

Huge losses were generated in April and May.

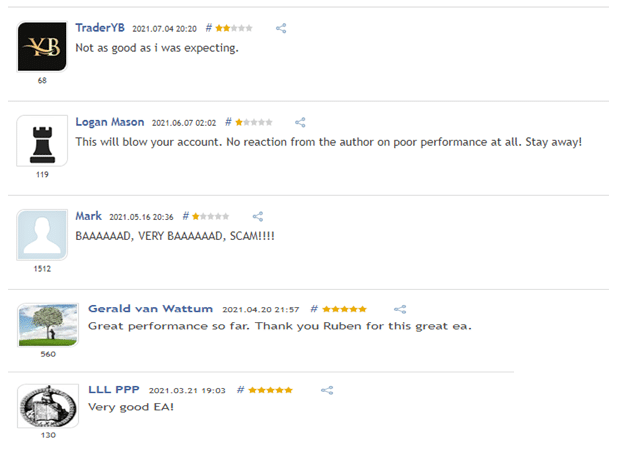

Customer reviews

Cairo has received mixed reviews on mql5, but most of them are negative. Some users are claiming that the EA is bad, has a poor performance, and can blow up your account. This coincides with our findings. A few of the satisfied clients disagree and say that the system demonstrates good performance.

Cairo Review Summary

Cairo-

Functionality3/5 NeutralAlthough the vendor highlights the features of the robot, he doesn’t disclose the minimum deposit or leverage it works with.

-

Trading strategy2/5 BadThe developer provides a vague description of the strategy used.

-

Live Results2/5 BadThe system makes small profits in the live market. The losses are uncomfortably higher.

-

Customer Support3/5 NeutralCustomer support is provided through a Telegram channel or the comments section on mql5.

-

Customer Reviews2/5 BadMost customers don’t have anything good to say about this product.

The Good

- Fully automated

- Provides backtest results

- Live trading stats are available on Myfxbook

The Bad

- Negative customer reviews

- Large drawdown

- No strategy insight

- Expensive