Athena EA is a Forex robot that claims to generate a monthly profit of 8-25%. As per the vendor, this system is capable of providing explosive account growth on the MT4 trading platform. This expert advisor is supported by verified trading statistics and it gives you full control over your capital.

On the official website, the developer has shared some statistics related to the robot. They claim that it generates an average of 65% quarterly returns and 220% yearly returns based on past performance. Also, the drawdown is supposedly close to 30%.

The parent company behind this EA is known as Elite CurrenSea and it was founded in 2014 by Chris Svorcik and Nenad Kerkez. These two individuals serve as the CEO and the Head Trader, respectively. The third member of the team is Mykyta Barabanov, who acts as the CMO. This company is based in Tallinn, Estonia.

Athena EA at a glance

| Price | €999 |

| Trading Platforms | MT4 |

| Currency Pairs | EUR/USD |

| Strategy | Grid |

| Timeframe | Multiple |

| Recommended Deposit | $50–cent accounts, €4,000–rental, €400–PAMM |

| Recommended Leverage | 500:1 |

| Money Management | Yes |

Athena EA functionality

This is an EA that is only compatible with the EUR/USD pair. The system consists of two robots working simultaneously. One of them only conducts long trades while the other one deals with short trades.

You have the option of adding a VPS, or you can use the managed account option to let the system conduct trades on your behalf. Although the system is automated, you sometimes need to pause and restart it when there are high-impact events like FOMC or Non-Farm Payroll.

It is vital that you trade with an account having low spreads. Since it has a take profit of only 4 pips, the system is sensitive to spread. You must find a broker that allows hedging.

Athena EA trading strategy tests

The robot uses a grid trading strategy to trade price action and price swings. It implements a classical mathematical equation, but the vendor has not revealed what it is. For exits and profit targets, the robot uses oscillators and moving averages. Unfortunately, the vendor has not shared the backtesting results for this EA. Therefore, we can’t draw a comparison between the historical and live performances.

What about Athena EA live trading results

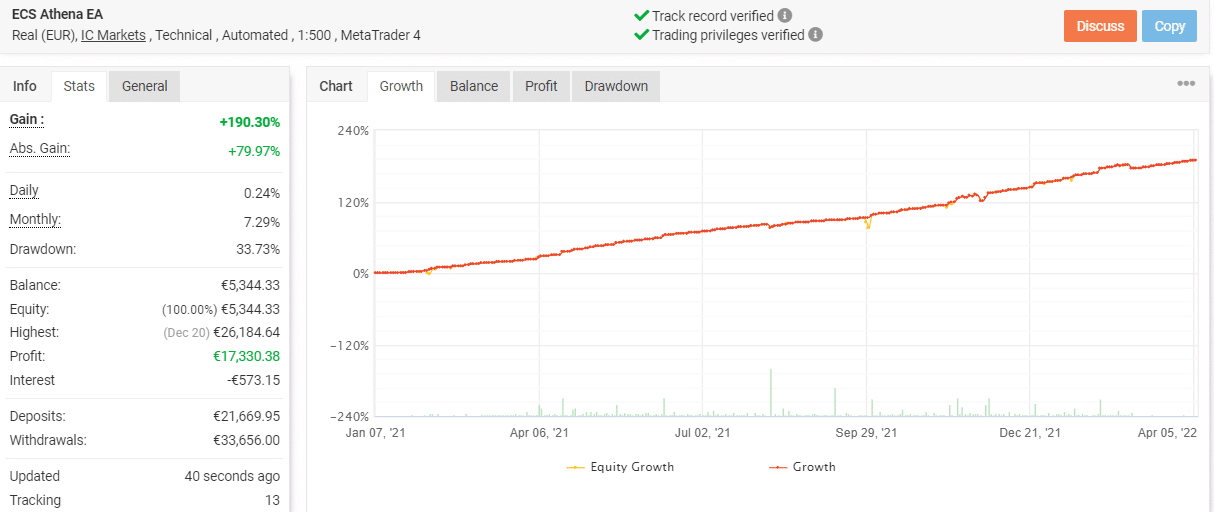

This live trading account on Myfxbook has been active since January 07, 2021. Since that time, the EA has conducted 21,719 trades, winning 72% of them and generating a total profit of €17,330.38. The win rate is quite impressive and so are the daily and monthly gains at 0.24% and 7.29%, respectively. However, the high drawdown of 33.73% tells us that the robot follows a high-risk strategy.

This account currently has a time-weighted return of 190.30%. It has a profit factor of 1.65, which can be considered good.

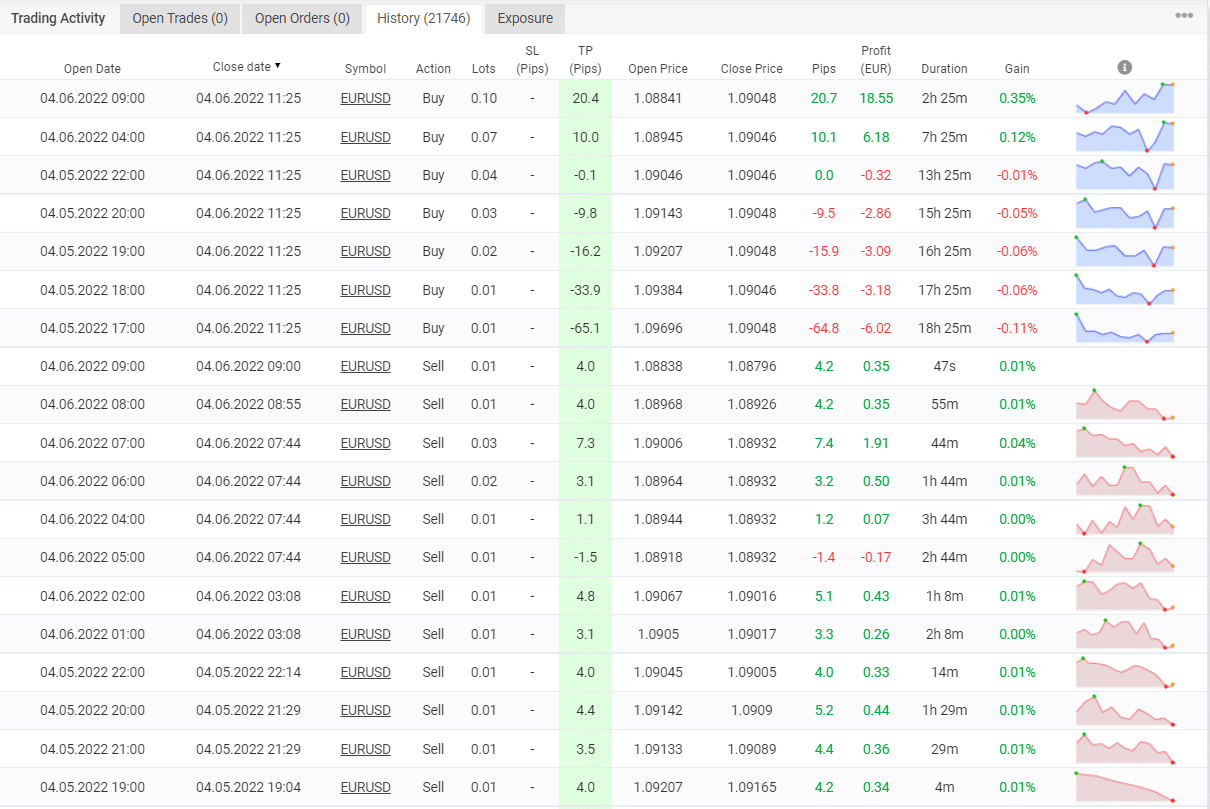

From recent trading history, it is obvious that the EA is capable of suffering consecutive losses. For the last 20 trades, it has used a lot size of 0.01 to 0.10. The average length of each order is 5 hours and 17 minutes, while the average win and loss are 6.43 pips/€2.82 and -18.02 pips/-€4.33, respectively.

Price

There are four pricing plans for this EA. The rental plan carries a recurring yearly fee of €799, while the lifetime plan is available for €999. There is a rental sponsored plan carrying a recurring yearly fee of €499, and a managed account plan with zero upfront fee but a profit share of 25-25%. None of the plans is cheap and offers a money refund.

Athena EA Review Summary

Athena EA-

Functionality3/5 NeutralThe vendor offers a managed account service as well as complimentary VPS and support.

-

Trading Strategy3/5 NeutralThe robot follows a grid strategy, so you don’t need to manually open and close positions.

-

Live Results4/5 GoodThe profit of over 17K EUR is decent and the peak drawdown (33%) is slightly higher than the dev claimed, but, nevertheless, is acceptable for trading.

-

Customer Support3/5 NeutralThere is a contact form on the website that you can use to get in touch with the support team.

-

User Reviews2/5 BadThere are no reviews for this EA on third-party websites.

The Good

- Verified trading results

The Bad

- High drawdown

- No refund policy

- Expensive pricing plans