Adaptive EA uses a neural network to learn as it trades on multiple instruments. The robot works on both MT 4 and MT 5 platforms and has 457 demos downloaded as of now. Traders have the option to adjust the stop loss and take profit and set the maximum slippage with the settings of the robot. To give more information to our readers, we will discuss the profitability, history record, strategy effectiveness, and key features of the robot.

Svetlana Visnepolschi is the robot’s owner and is residing in the USA. The author has an overall rating of 2.4 based on 7 reviews on the MQL5 marketplace and has an experience of 1 year on the Forex market. Two products are available in the vendor’s selling list i.e. Adaptive EA for MT4 and Adaptive EA for MT5. The author is not transparent on her portfolio as she does not provide any details regarding email address, other social media platform profiles, and market experience.

Adaptive EA at a glance

| Price | $185 |

| Trading Platforms | MT4, MT5 |

| Currency Pairs | Any |

| Strategy | Neural |

| Timeframe | N/A |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | Yes |

Adaptive EA functionality

The following steps should be followed to get the system ready:

- Click on the buy now option that is available on the MQL 5 website

- Login to MetaTrader 4/5 platform

- Take the algorithm to the expert directory and refresh the page

- Connect the robot with the chart, and be ready to go

The robot has the following key characteristics:

- It trades on multiple currency pairs.

- A free demo is available.

- It works on the MetaTrader 4/5 platform.

- The algorithm comes with different settings such as Lots size, Grid risk. Trailing stops etc.

- Traders can set a custom comment for each trade.

Adaptive EA trading strategy tests

The robot uses the take profit and stop-loss strategy and has maximum spread. The algorithm trades on multiple currency pairs, metals, oils, etc. It uses a self-learning mechanism to learn as it trades the markets.

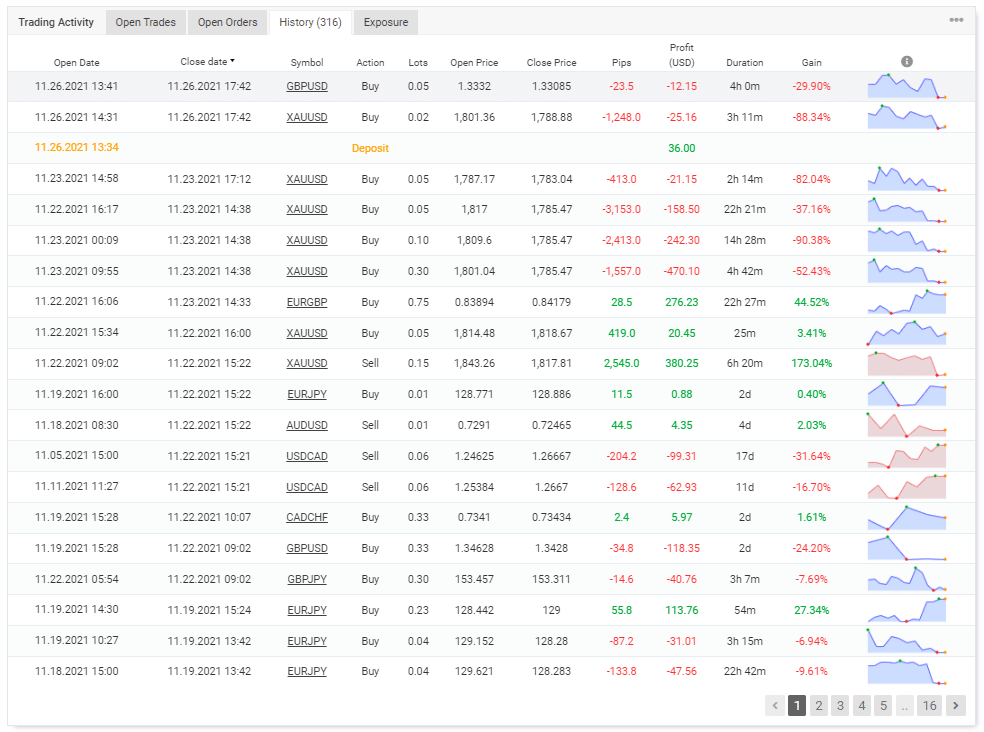

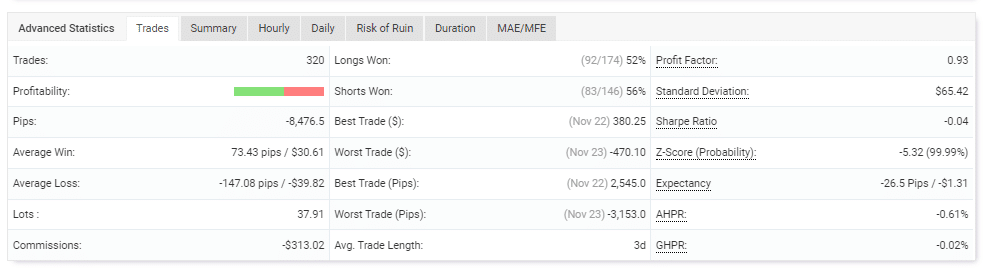

From Myfxbook history we observe that it uses grid/martingale with currency correlation techniques. An average trade length of 3 days justifies the use of swing trading.

The algorithm backtesting records are not available, which raises questions about its transparency. These stats tell us about the effectiveness of the trading strategy while trading on historical data.

What about Adaptive EA live trading results

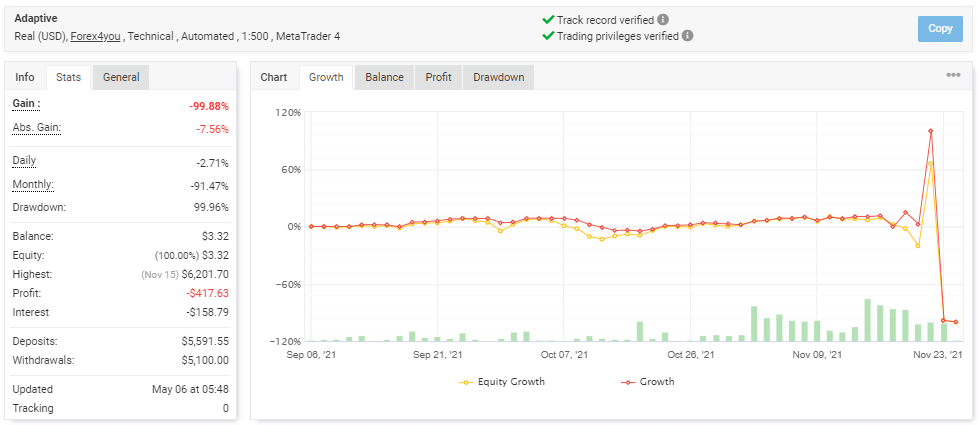

The live records on Myfxbook are available from September 05, 2021, till November 23, 2021 which shows that the algorithm caused a margin call on the portfolio. The overall gain of the account is horrendous at -99.88%.

The total deposit of $5591.55 was liquidated to $3.32 in a total of 320 trades. The winning rate of 55% with a profit factor of 0.92 justifies the poor performance of the system.

Customer reviews

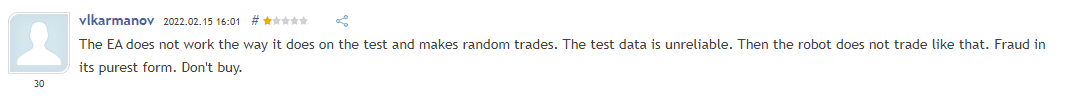

The algorithm has eight reviews and a rating of 2.43 on the MQL5 marketplace. One of the users comments that it is a scam and warns other users not to waste their money.

Another trader states that the EA does not work properly and has unreliable test data.

Adaptive EA Review Summary

Adaptive EA-

Strategy4/5 GoodUses a neural network to trade.

-

Features4/5 GoodMultiple settings can be configured within the robot.

-

Trading results2/5 BadUnsatisfactory live records on Myfxbook.

-

Reliability2/5 BadThe drawdown can be seen at 99%, showing complete liquidation of the account.

-

Pricing3/5 NeutralThe product's cost is average.

The Good

- The algorithm uses an advanced neural network

The Bad

- Poor live records

- There are no backtesting records present

- Poor customer support and reviews on the MQL5 website