The devs say that Volatility Factor 2.0 is based on numerous years of testing different market conditions, and therefore, they strongly believe that the robot can generate about 10+ pips from each trade. It is further alleged that the EA has a history of winning trades for 6 consecutive years, making it one of the most powerful EAs out there. We disagree. As you will see later in this review, the EA isn’t lucrative.

Volatility Factor 2.0 is one of the many creations of FXautomater. Unfortunately, the team behind the company is anonymous. From the numerous ineffective robots the devs have produced, it is very likely that their supposed 15 year trading experience has not been enough to polish their skills. So, we are reluctant to support their product.

Volatility Factor 2.0 at a glance

| Price | $237 |

| Trading platforms | MT4 |

| Currency pairs | GBPUSD, EURUSD, USDJPY and USDCHF |

| Strategy | Volatility-based market algorithm, price oscillations |

| Timeframe | M15 |

| Recommended deposit | $100-$500 |

| Recommended leverage | N/A |

| Money management | Yes |

Volatility Factor 2.0 functionality

Additional features of this EA include:

- Unique broker spy module

- Advanced money management system

- Three intelligent built-in protection systems

- Advanced high-impact news filter

- Trades micro, mini, and standard accounts

- Operates with any MT4 broker, ECN included

- Spread and slippage protection systems

- A 60-day money-back guarantee

- Customer support.

Volatility Factor 2.0 trading strategy tests

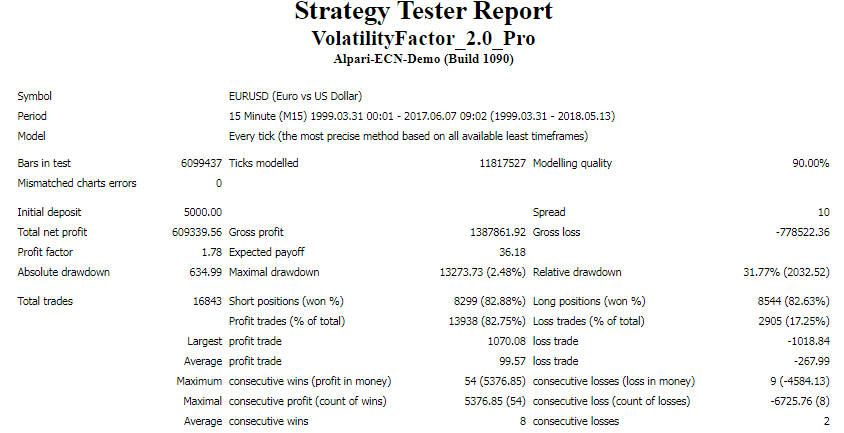

According to the vendor, this tool initiates trades when the market is volatile and follows the medium-term market impulse to try to make profits from it. Furthermore, the EA capitalizes on pricing oscillations around a prevailing price point. The backtest results below will tell us if the strategy is effective.

As per the data above, the system started its operations in March 1999 with a deposit of $5000, and by June 2017, it had generated a total net profit of $609339.56. This is after the system placed 16843 trades and won 82.88% of the short positions and 82.63% of the long ones. The profit factor of 1.78 meant that the EA had a low profitability rate. We had a drawdown of 2.48%. There were more losses than wins. This was illustrated by the average profit trade of $99.57 and an average loss of -$267.99.

What about Volatility Factor 2.0 live trading results

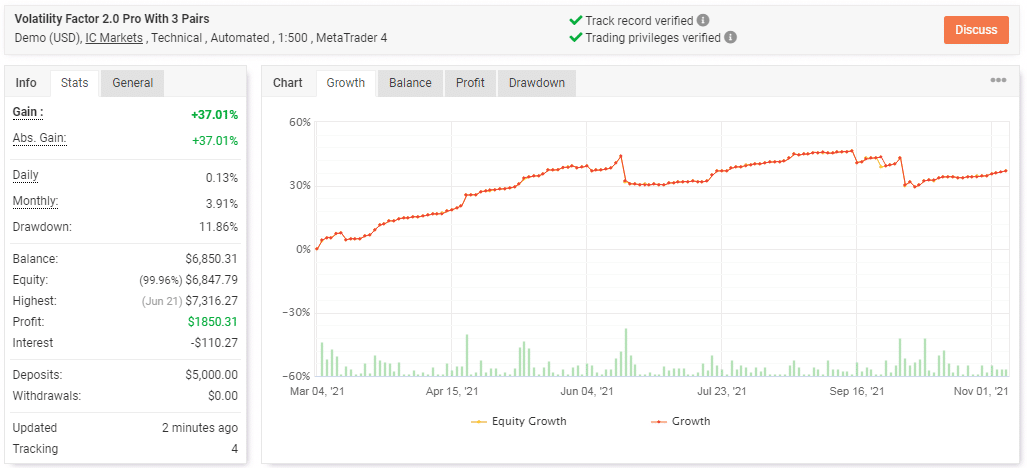

Currently, Volatility Factor 2.0 is running several demo accounts on Myfxbook.com. The vendor’s reluctance to open real accounts is rather suspicious. Perhaps the devs are not that confident about their strategy. Let’s see below how one of their accounts is doing:

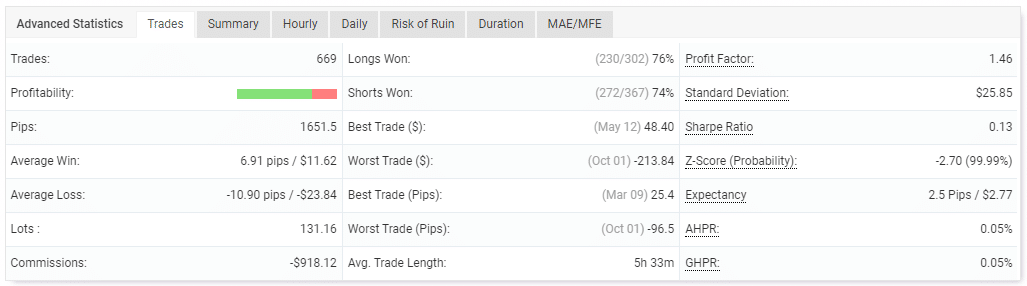

For the 8 months the account has been active, the EA has managed to only make a profit of $1850.31 from 669 trades. Therefore, the balance has increased from $5000 to $6850.31, representing a gain of 37.01%.

The trades completed are not that successful as we only have win rates of 76% for long positions and 74% for short ones. The average trade length is 5h 33m, and a huge amount of lots have been traded so far — 131.16. This can be risky for the account as it can become prone to losses. That’s why we are not surprised by the value of the average loss (-10.90 pips), which is almost twice higher than the average win (6.91 pips).

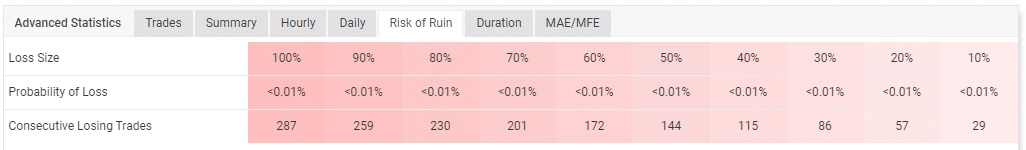

The account is not in any danger of being ruined at the moment.

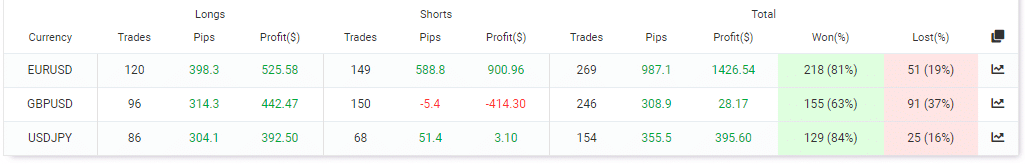

The EURUSD was the most traded pair with 269 trades. It was also the most profitable pair – $1426.54.

User reviews

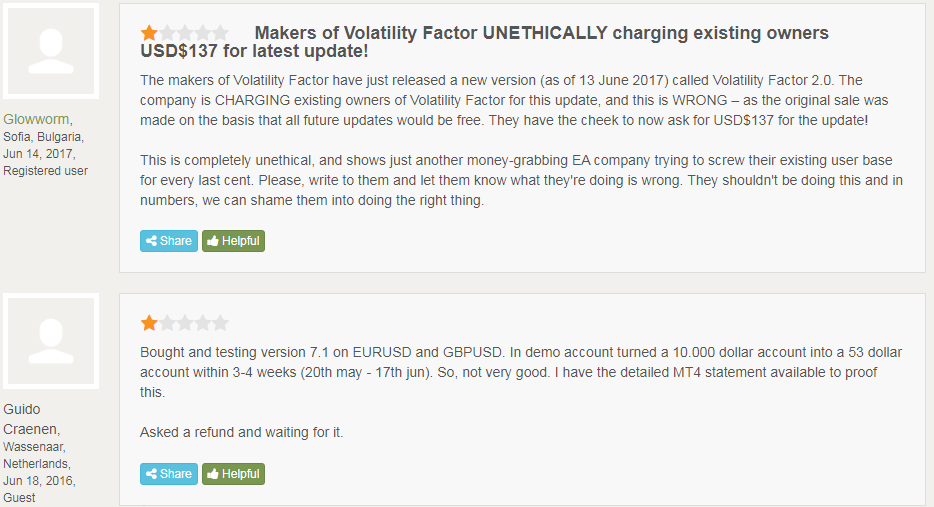

Volatility Factor 2.0 has been in this market for many years now. Therefore, it is disturbing that it only has 3 reviews on FPA. One of the disgruntled customers acknowledges the low profitability of the account. The other one is complaining about being charged extra money for updates.

Volatility Factor 2.0 Review Summary

Volatility Factor 2.0-

Functionality4/5 GoodThe EA has many useful features.

-

Trading strategy2/5 BadThe strategy used is not effective as it generates small profits.

-

Live results3/5 NeutralThe robot has a low profit factor and a high losing streak, signs that it doesn’t perform well in the market.

-

Customer support3/5 NeutralAlthough the vendor offers customer support, it is not clear how long the team takes to respond.

-

User reviews2/5 BadFrom the available reviews, it is evident that customers are not happy with the EA.

The Good

- A 60-day money-back guarantee is available

- Backtest results are present

The Bad

- Low profitability rate

- Inadequate vendor transparency

- Negative feedback from clients