Forexero is an online forex broker that offers traders access to numerous financial markets, including forex, indices, and commodities. The broker is known for providing competitive trading conditions, advanced trading platforms, and excellent customer support. In this review, we will take an in-depth look at Forexero’s features and services to help you determine if it is the right broker for your trading needs.

Features

Here are some of the main features offered by Forexero:

- Multiple Trading Platforms: Forexero offers its traders a choice of several advanced trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), as well as WebTrader and MobileTrader.

- Low Spreads and Commission Fees: Forexero provides traders with competitive trading conditions, including low spreads and commission fees for most asset classes.

- Wide Range of Financial Instruments: Forexero offers access to various financial markets, including forex, commodities, indices, and cryptocurrencies.

- Flexible Account Types: Forexero offers different account types that cater to the diverse needs of traders, including Standard, ECN, and Islamic accounts.

- Educational Resources: Forexero provides its traders with a range of educational resources, including webinars, tutorials, and market analysis, which can help traders improve their skills and knowledge.

- Excellent Customer Support: Forexero is known for its responsive and knowledgeable customer support team, which is available 24/5 via live chat, email, and phone.

- Regulatory Compliance: Forexero is a regulated broker, licensed by the International Financial Services Commission (IFSC) of Belize, ensuring that it operates in compliance with industry standards.

Overall, Forexero offers a comprehensive range of features designed to meet the needs of traders of all levels, making it a popular choice among traders worldwide.

Trading Platforms

Forexero offers its traders a choice of several advanced trading platforms, including:

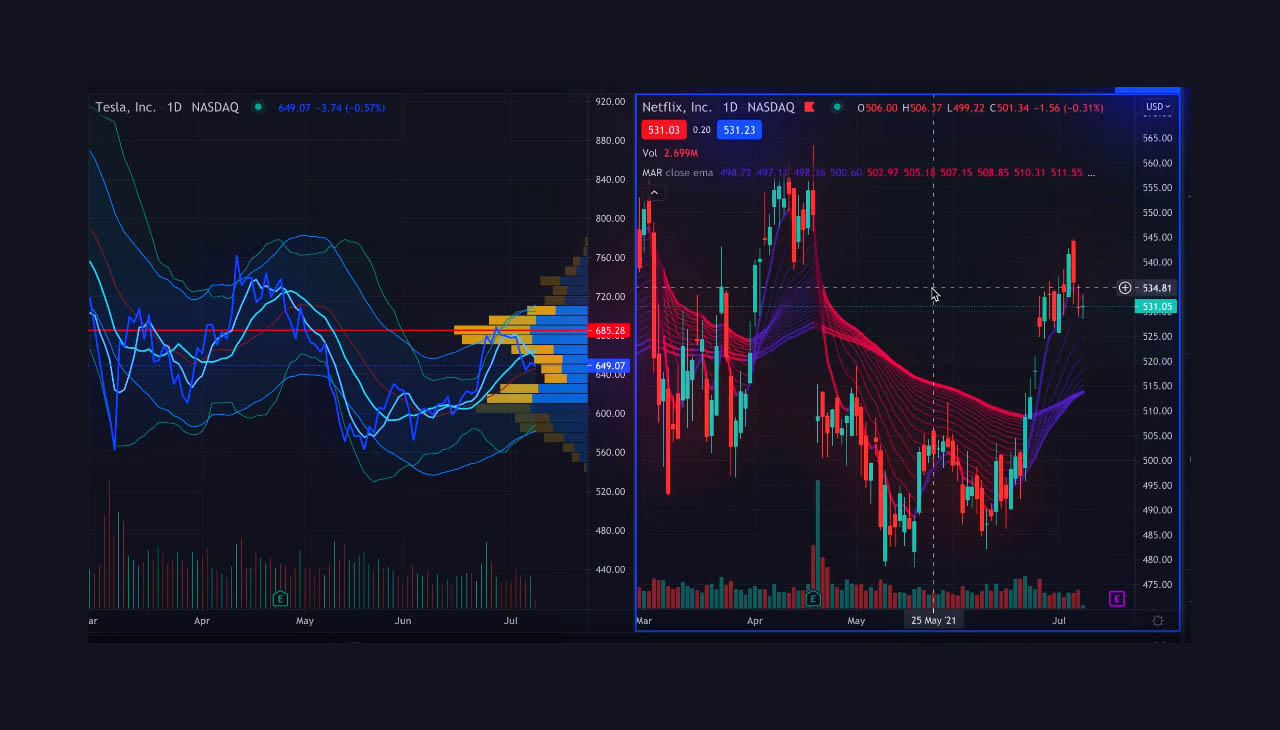

- MetaTrader 4 (MT4): MT4 is a widely-used platform that offers a range of features, including a user-friendly interface, customizable charts, and numerous technical indicators. It also allows for automated trading through the use of expert advisors (EAs).

- MetaTrader 5 (MT5): MT5 is the successor to MT4 and provides traders with enhanced functionality, including more advanced charting tools, depth of market, and the option to hedge positions.

- WebTrader: Forexero’s WebTrader platform enables traders to access their accounts and trade from any web-enabled device without downloading any software. It offers similar functionality to desktop platforms, including charting tools, technical indicators, and real-time quotes.

- MobileTrader: Forexero provides mobile versions of both the MT4 and MT5 platforms, allowing traders to manage their accounts and trade on the go using their smartphones or tablets.

Each platform has its unique advantages and disadvantages, so it is up to the individual trader to determine which platform best suits their trading needs. Overall, Forexero’s trading platforms are well-designed, and user-friendly, and offer traders a range of features designed to enhance their trading experience.

Trading Conditions

Forexero provides competitive trading conditions designed to suit the needs of traders of all levels. Here is an overview of Forexero’s trading conditions:

- Spreads: Forexero offers tight spreads on its forex and CFDs, with spreads starting from 0.0 pips for certain currency pairs.

- Leverage: Forexero offers flexible leverage options, ranging from 1:1 up to 1:1000, depending on the account type and the financial instrument being traded.

- Commission Fees: Forexero charges a commission fee for ECN accounts which varies depending on the asset class. For Standard accounts, there are no commissions, but the spreads may be slightly higher.

- Minimum Deposit: The minimum deposit required to open an account with Forexero depends on the account type chosen. The minimum deposit for the Standard account is $100, while for ECN and Islamic accounts, it is $500.

- Order Execution: Forexero ensures fast and reliable order execution through its advanced trading infrastructure, which includes state-of-the-art servers and data centers.

Overall, Forexero’s trading conditions are competitive when compared to other brokers in the market, making it an attractive option for traders who are looking for a broker that provides tight spreads, flexible leverage, and low commission fees.

Asset Classes

Forexero offers various asset classes for trading, including:

- Forex: Forexero offers access to over 45 currency pairs, including major, minor, and exotic pairs. The forex market is one of the largest and most liquid financial markets in the world, providing traders with ample opportunities to profit from fluctuations in exchange rates.

- Commodities: Forexero provides traders with the ability to trade on a range of commodities, including gold, silver, crude oil, and natural gas. These markets offer potential diversification benefits and can provide a hedge against inflation.

- Indices: Forexero allows traders to trade on some of the world’s most popular indices, including the S&P 500, NASDAQ, and the Dow Jones Industrial Average. These markets offer traders exposure to stocks of leading companies from different sectors and geographies.

- Cryptocurrencies: Forexero provides access to the cryptocurrency market, allowing traders to trade on Bitcoin, Ethereum, and several other cryptocurrencies. The cryptocurrency market is known for its high volatility, providing traders with high-risk, high-reward opportunities.

Overall, Forexero’s range of asset classes provides traders with ample opportunities to diversify their portfolios and trade on a range of financial instruments, depending on their risk appetite and trading style.

Account Types

Forexero offers traders a choice of three different account types, designed to cater to the diverse needs of traders. Here is an overview of each account type:

- Standard Account: The Standard account is the basic account type offered by Forexero and is suitable for novice traders who are just starting. This account has no commissions but slightly higher spreads.

- ECN Account: The ECN account is designed for advanced traders who require tighter spreads and faster execution speeds. In this account type, traders pay a commission fee on each trade, but they get access to raw interbank spreads from various liquidity providers.

- Islamic Account: The Islamic account is a swap-free account that is compliant with Sharia law. This account is suitable for Muslim traders who are not allowed to earn or pay interest on trades held overnight.

All of Forexero’s account types offer traders access to the same trading platforms and financial instruments. However, they differ in terms of the minimum deposit required, commissions, spreads, leverage, and other trading conditions. Therefore, it is important to choose an account type that best suits your trading needs

Educational Resources

Forexero provides its traders with a range of educational resources designed to help them improve their trading skills and knowledge. Here are some of the educational resources offered by Forexero:

- Webinars: Forexero regularly hosts webinars on various topics related to trading, including market analysis, trading strategies, and risk management.

- Tutorials: Forexero provides traders with tutorials on how to use the trading platforms offered by the broker, including MT4 and MT5.

- Market Analysis: Forexero provides daily market analysis, including technical and fundamental analysis, which can help traders identify potential trading opportunities.

- Trading Tools: Forexero offers a variety of trading tools, such as economic calendars, calculators, and charting software, which can help traders make informed trading decisions.

- E-books and Guides: Forexero provides traders with e-books and guides on various trading topics, including forex trading, CFDs, and risk management.

Overall, Forexero’s educational resources are comprehensive and designed to cater to traders of all levels, from beginners to advanced traders. These resources can help traders improve their trading skills and knowledge, which may ultimately lead to more profitable trading decisions.

Summary

Summary-

Regulation5/5 Amazing

-

Range of Assets4/5 Good

-

Trading Conditions4/5 Good

-

Account Types3/5 Neutral

-

Educational Resources4/5 Good

The Good

- Regulated broker

- Wide range of financial instruments, including forex, commodities, indices, and cryptocurrencies

- Competitive trading conditions with low spreads and flexible leverage

- Three different account types to choose from

- User-friendly trading platforms, including MT4/MT5, WebTrader, and MobileTrader

- Educational resources designed to help traders improve their trading skills and knowledge

The Bad

- Relatively high minimum deposit requirement for some account types

- Limited range of payment methods available

- Few extra features, such as social trading or copy trading tools