AX Trader is a Forex software that trades on autopilot. The EA is coded based on a unique hybrid strategy that utilizes Fibonacci and Trend to place trades on 6 major currency pairs.

The software is sold through Leapfx, a platform that provides trading solutions such as automated trading, manual trading, and account management. According to its developers, the profit percentage the trader will make with the software depends on how the market moves, the lot size used, and the account size. They also acknowledge that not every month will be the same, but based on their experience, the robot can average a range of as low as 10% to as high as 46% profit a month with default settings.

AX Trader at a Glance

| Price | $297/year; $497/lifetime |

| Trading Platforms | MT4 |

| Currency Pairs | EURUSD, GBPUSD, AUDUSD, USDCAD, USDJPY, USDCHF |

| Timeframe | Any |

| Recommended Deposit | N/A |

| Recommended Leverage | N/A |

| Money Management | N/A |

AX Trader Functionality

- To use the software, the trader is required to install the software to the MT4 platform.

- Open the charts for EURUSD, GBPUSD, AUDUSD, USDCAD, USDJPY, and USDCHF.

- Attach the system to each chart and let trading starts.

- The developers state that the strategy used by this software performs well in a volatile market. They also recommend that the EA can be tested on a demo account or be used directly on a live account.

AX Trader Trading Strategy Tests

- This trading tool is designed to determine the direction of the overall trend while dynamically adjusting its entry points using data from Fibonacci calculations.

- The robot installs on the trader’s broker platform and once set up, it opens, manages, and closes trades automatically.

- It does not require adjustments while running.

There are no backtesting results for this EA provided. It’s a red flag for Ax Trader.

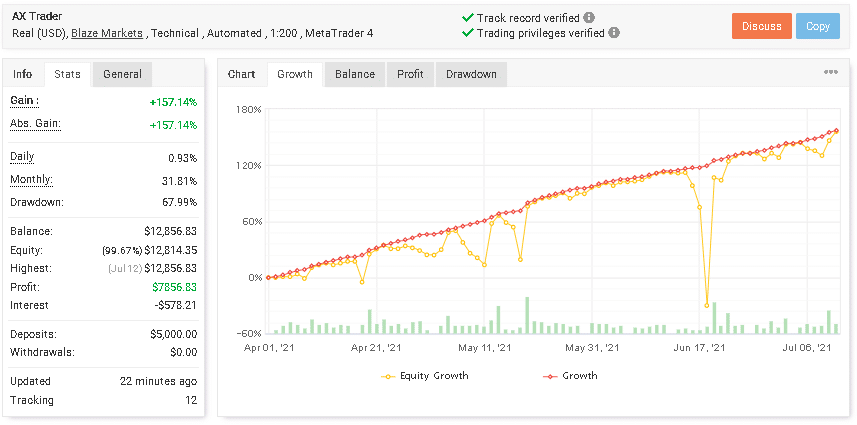

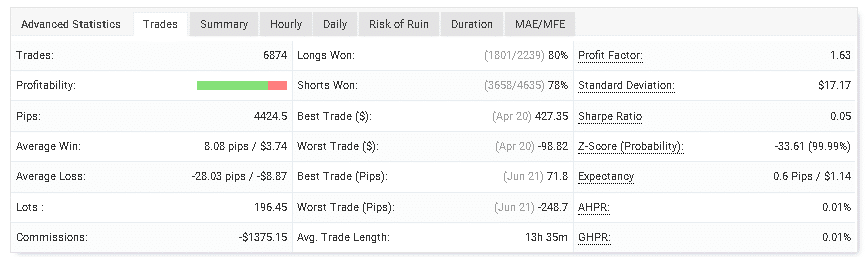

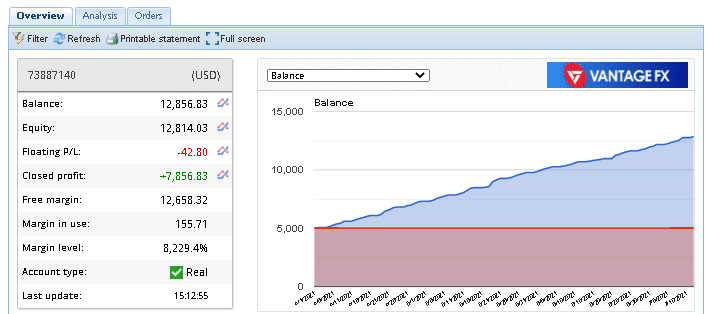

What about AX Trader Live Trading Results

When we look at the live trading results, we can see that the EA traded the account from April 1, 2021 to july 7, 2021. The software made a profit of $7856.83 in 6874 trades with a total lot size of 196.45. The initial deposit was $5000 and the current balance is $12,856.83.

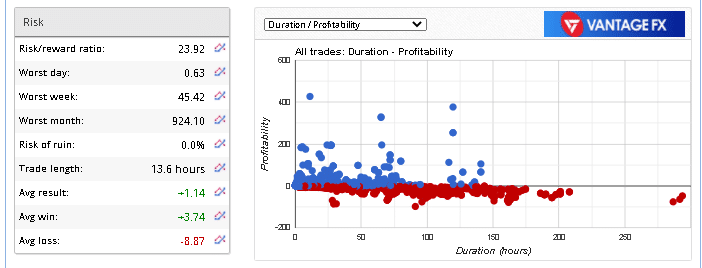

The average win and average loss are 8.08 pips ($3.74) and 28.03 pips (-$8.87) respectively. That shows a risk to reward ratio of 2:1 which should be the other way round.

The profit percentage is 79% while the maximum drawdown was 67.99%. This is a huge drawdown that indicates a lack of proper money management.

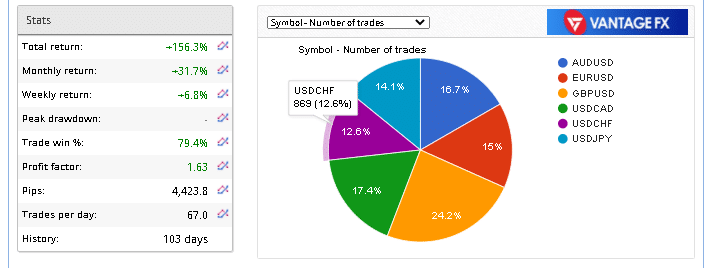

This is another live trading account attached to fxblue.com. on June 23, 2021. It has a profit gain of $7856.83 representing 156.3% of the initial deposit. It has a winning percentage of 79.4% and a profit factor of 1.63.

The risk to reward ratio is 23.92. Its worst day, week, and month are $0.63, $45.42, and 924.10 respectively.

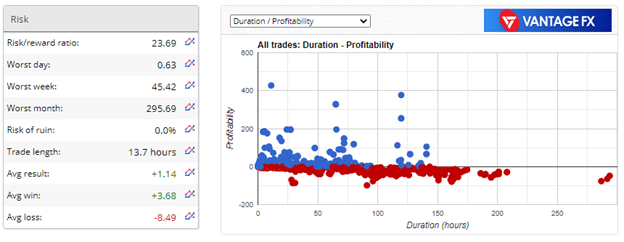

The most traded currency pair is GBPUSD while the least traded is USDCHF. The average trade length is 13,7 hours.

The average win is $3.68 while the average loss stands at $-8.49. This shows a poor risk to reward ratio where losing trades are closed with big losses.

User Reviews

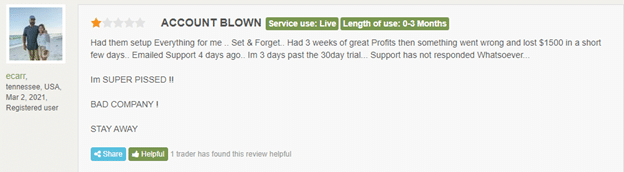

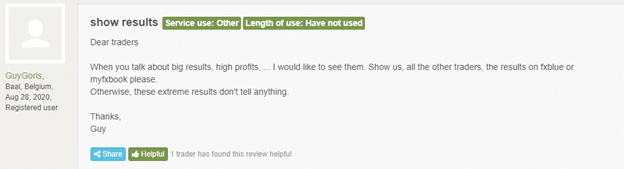

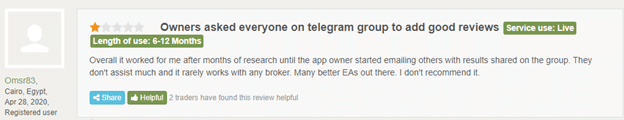

We have shared some of the customer reviews about this trading system below. Most of the customers are not satisfied with EA’s performance.

A customer by the name Eccar states that the system tends to deliver commendable results at the beginning then after sometime it starts to make losses. He continues to say that the robot made a big loss on his account in just a few days ending up blowing the account. He also confirms that the support doesn’t respond to customer’s concerns.

AX Trader Review Summary

AX Trader-

Functionality2/5 BadThe robot functions in a few simple steps.

-

Trading Strategy2/5 BadThe strategy the EA uses can work in both short-term and long-term trades.

-

Live Results4/5 GoodThe trading results provided on the third-party platform are for a real account.

-

Customer Support1/5 AwfullyNo channel provided on how the vendor can be reached.

-

User Reviews2/5 BadThere are negative reviews about the system that discredit its performance.

The Good

- Trading strategy explained

- Trades on small account

- Live trading results provided

The Bad

- Absence of backtesting results

- Vendor identity is hidden

- Limited to 6 currency pairs only

- Negative customer reviews