Alphi is a service that focuses on providing copy-trading services. For some reasons the devs decided to rebrand their Avia system to Alphi and add another trading account for it. Probably, it’s because Avia was not as good as claimed and traders didn’t want to invest in it. Let’s have a closer look at this trading tool.

Alphi at a glance

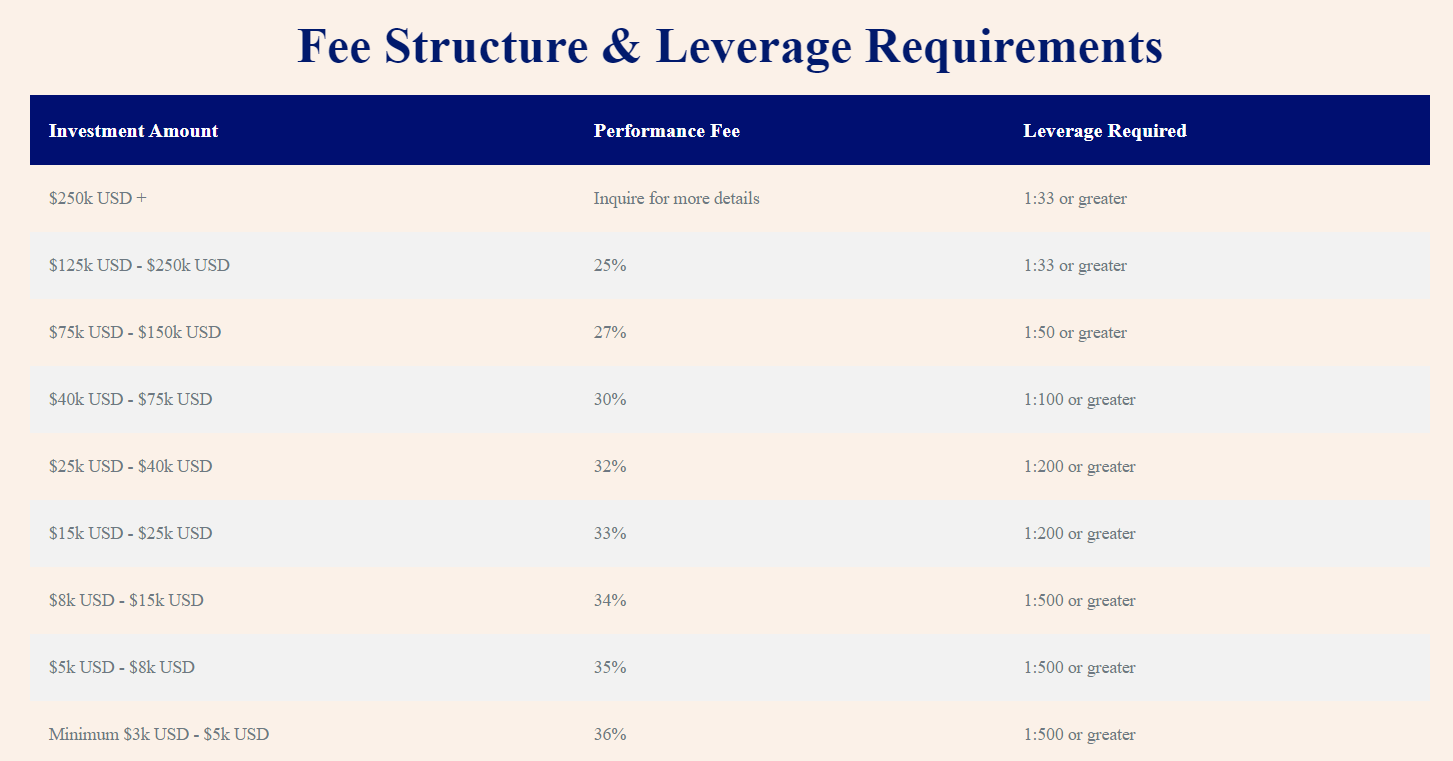

We would like you to take a look at the following sheet.

| Price | 25%-36% commissions |

| Trading Platforms | MT4 |

| Currency Pairs | Any |

| Strategy | N/A |

| Timeframe | N/A |

| Recommended Deposit | $3000 |

| Recommended Leverage | $25000 |

| Money Management | Yes |

Alphi functionality

We have united all details about the system in the following list. We had to come up with much to understand how the system works.

- There’s an algorithm that unites Artificial Intelligence with advisor and machine learning.

- We can decide what broker we want to work with.

- If we need, we can use a list of brokers provided by developers.

- They claimed that “their investment philosophy; Investment is a comprehensive trading arts, the core of it is to grasp the opportunity. As a strategic provider, we will execute trades under the premise of ensuring the safety of principal, in line with the principle of responsibility for customers.”

- They use fundamental and technical analysis for understanding the current market condition.

- All of this helps to avoid the rough market conditions and skip trading during high impact news.

- There’s a “zero risk trial” that allows us to open a demo account and let the company trade for us.

- An average monthly return is 9-12%.

- The annual profit can be up to 180%.

- There’s no lock period.

- Expected drawdowns are 10%.

- We can enjoy a recommended broker from a list: FBS, LMFX, or others.

- It trades all major cross pairs.

- The minimum deposit is $3000.

- The recommended investment is $25000.

- We have to pay commissions from winning trades monthly.

The commissions vary from 36% for $3000 accounts to 25% for accounts with over $125,000 on the balance.

Alphi trading strategy tests

The presentation isn’t featured with tests that could be executed to ensure that the system works stable and we can rely on it. It’s a con because we don’t know what broker was picked to test the system and what the quality of the tick data was.

What about Alphi live trading results

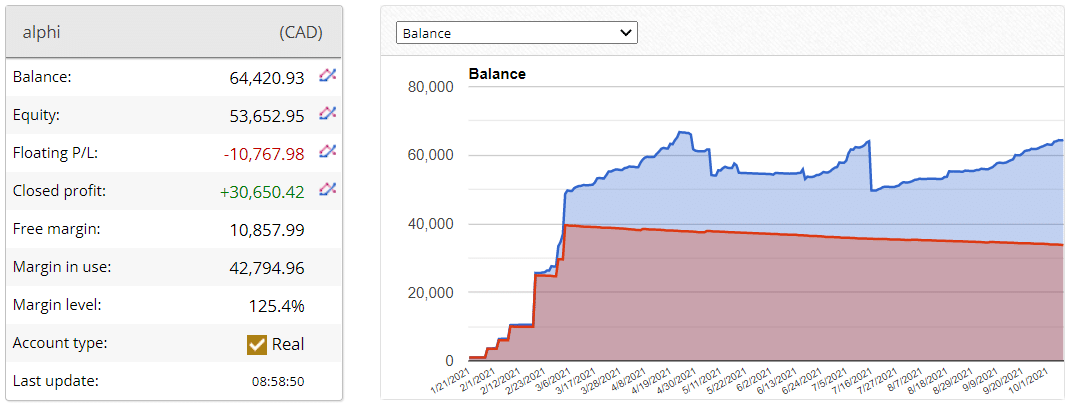

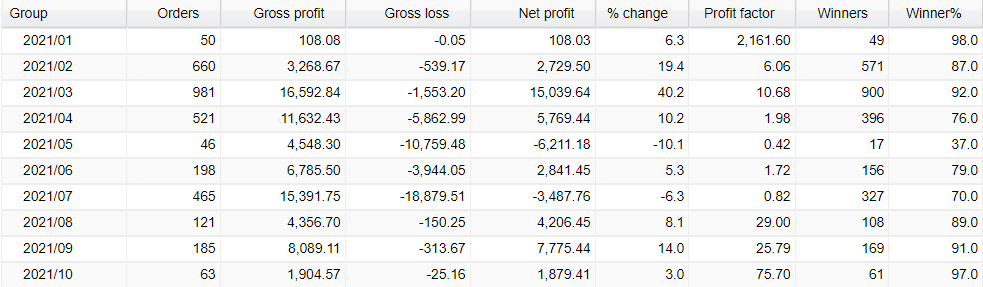

The system was set on January 01, 2021. It works on a real CAD account. The absolute gain is $30,650. There are some orders sitting in drawdowns, -$10,767. The margin level is low.

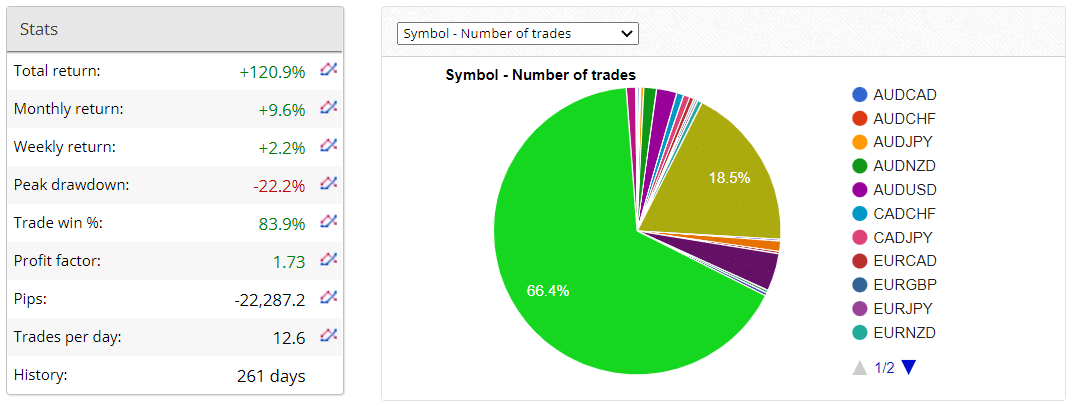

The system accumulated 130.9% of the total return. The monthly profit is 9.6%. The maximum drawdowns are -22.2%. The win rate is 83.9% when the profit factor is 1.73. Alphi has gained -22,287 pips. It means it survives because of Martingale. An average trade frequency is 12 deals daily.

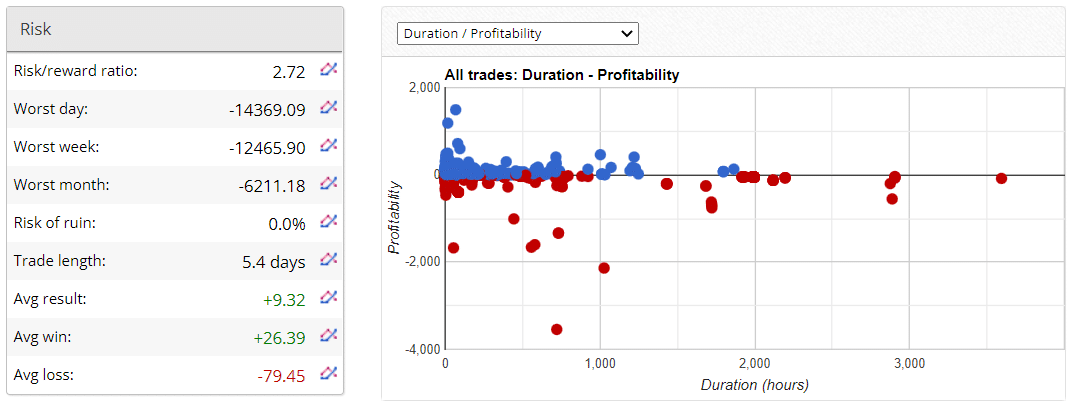

The ROI is 2.72. An average trade length is 5.4 days. An average result is $9.32. An average win is $26.39 when an average loss is three times deeper, -$79,45.

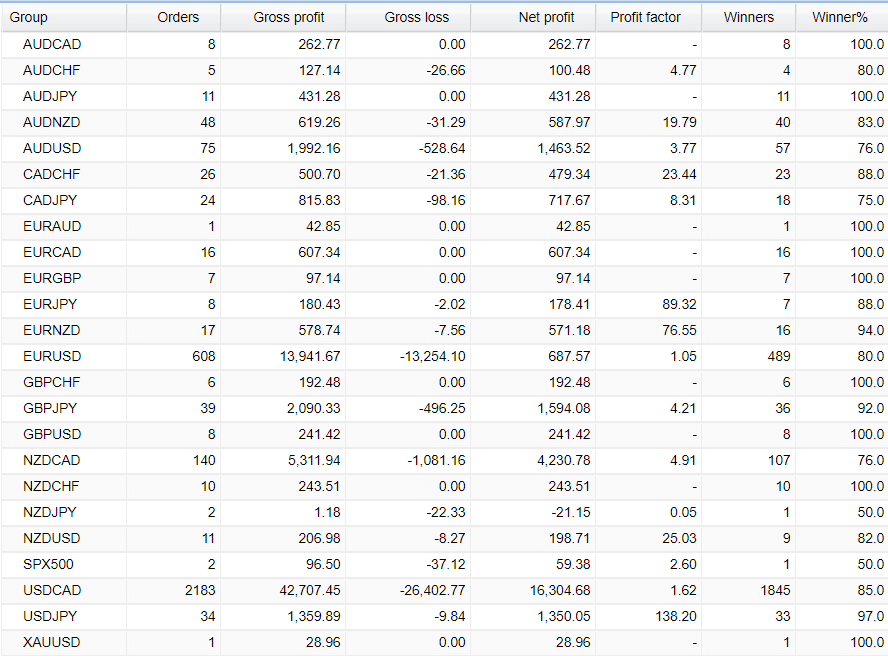

USDCAD is the most traded and profitable pit with 2184 orders and $16,304 profits.

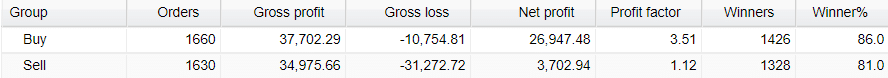

The robot trades directions equally by frequency when the Buy directions is eight times more profitable – $26,947.

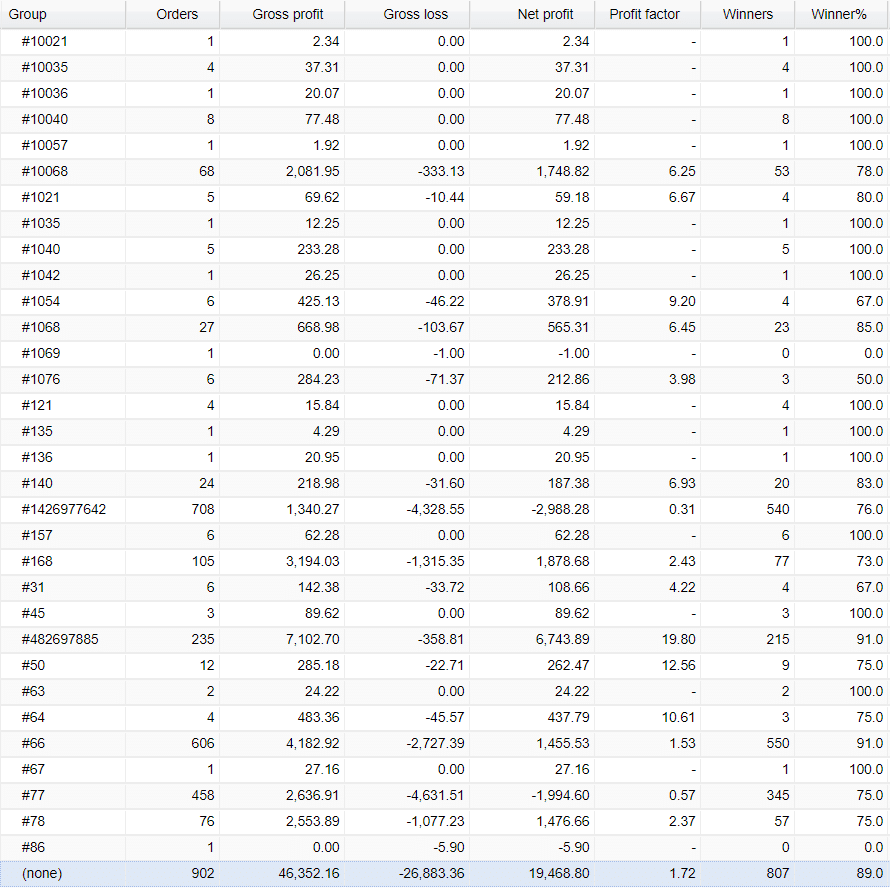

There are many magic numbers there. Over 900 orders were closed manually.

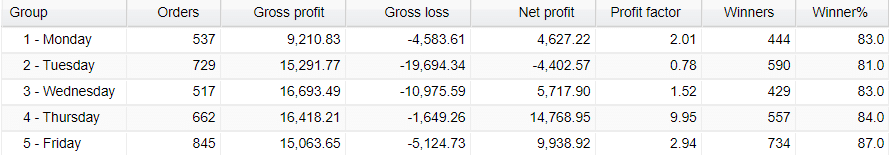

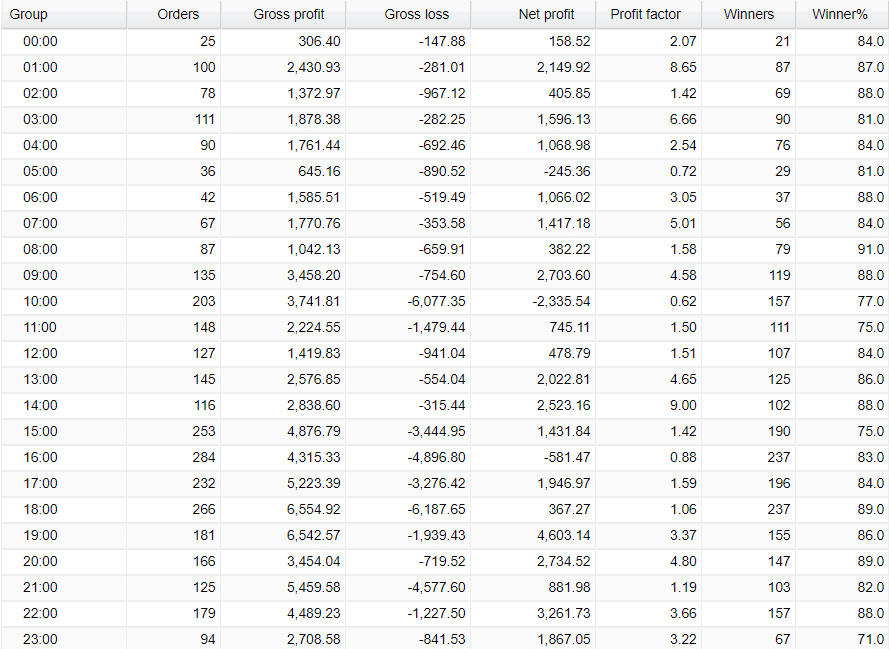

The system prefers trading on Friday – 845 orders were closed.

The advisor opens the most trades during. European and American sessions.

The advisor has been working unpredictable, losing several months in the past.

Other notes

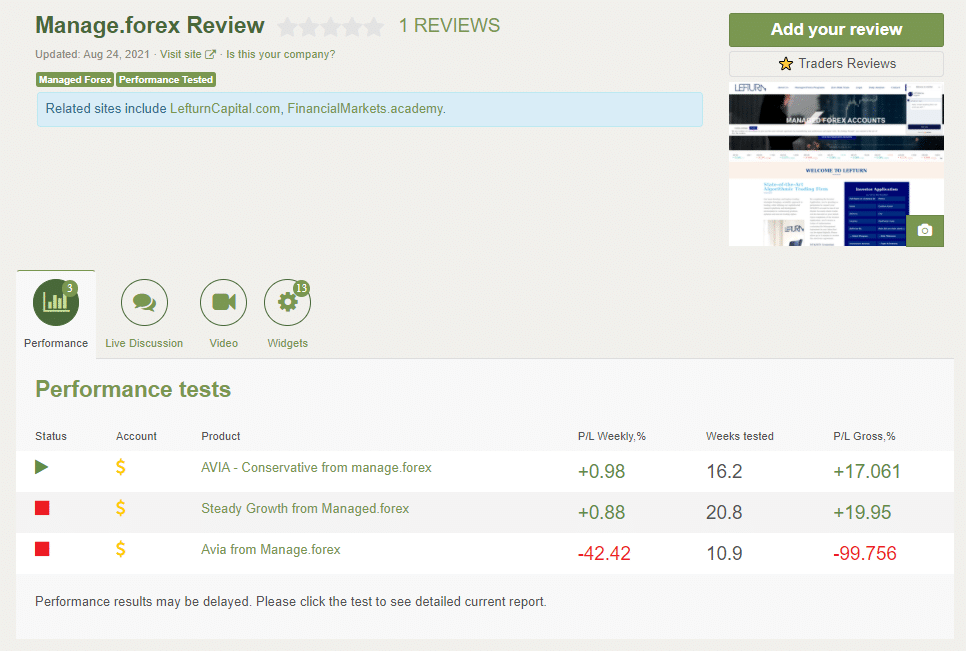

The Leafturn company has a page on Forex Peace Army. There are three accounts published where one of them was blown.

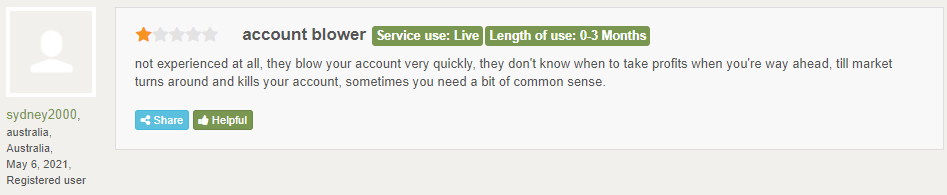

This person mentions that the Avia system is dangerous for our account. It might be one of the reasons the devs decided to rebrand their service.

Alphi Review Summary

Alphi-

Functionality2/5 BadThe system is risky.

-

Trading strategy2/5 BadMartingale is dangerous for our account.

-

Live results2/5 BadThe robot has lost two months not so far ago.

-

Customer support2/5 BadWe know nothing about their support.

-

User reviews2/5 BadSingle feedback mentioning that the system is dangerous.

The Good

- Affordable commissions

The Bad

- No risk advice given

- No backtest reports shared

- We have high-risk trading on the real account

- Martingale is on the board